Cheap Wisconsin Auto Insurance in 2025 (Save Big With These 10 Companies!)

USAA, State Farm, and Geico are the top picks for cheap Wisconsin auto insurance with rates starting at $16 monthly. These companies offer extensive coverage, excellent customer service, and customizable policies, making them excellent options for Wisconsin drivers looking for dependable and affordable insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Min. Coverage in Wisconsin

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage in Wisconsin

A.M. Best Rating

Complaint Level

Pros & Cons

USAA, State Farm, and Geico are the leading choices for cheap Wisconsin auto insurance, providing customizable policies and excellent full coverage auto insurance.

Wisconsin auto insurance is required by law, as it protects everyone on the road. If understanding auto insurance in Wisconsin is confusing for you, you’re not alone. We’ll cover what you need to know about auto insurance in Wisconsin, from what coverages you need to how to find the cheapest auto insurance in Wisconsin.

Our Top 10 Company Picks: Cheap Wisconsin Auto Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $16 A+ Military Discounts USAA

#2 $20 B Large Network State Farm

#3 $21 A++ Online Efficiency Geico

#4 $22 A Customer Loyalty American Family

#5 $26 A++ Bundling Options Travelers

#6 $30 A Flexible Coverage Liberty Mutual

#7 $33 A+ Snapshot Program Progressive

#8 $38 A Competitive Pricing Farmers

#9 $43 A++ Safe Driver Allstate

#10 $80 A+ SmartRide Program Nationwide

If you want to find affordable Wisconsin auto insurance right now, just enter your ZIP code for free Wisconsin auto insurance quotes.

- Cheap Wisconsin Auto Insurance

- Get Affordable New London, WI Auto Insurance Quotes (2025)

- Get Affordable Wausau, WI Auto Insurance Quotes (2025)

- Get Affordable Onalaska, WI Auto Insurance Quotes (2025)

- Get Affordable Loyal, WI Auto Insurance Quotes (2025)

- Get Affordable Kenosha, WI Auto Insurance Quotes (2025)

- Get Affordable Cobb, WI Auto Insurance Quotes (2025)

- 25/50/10 liability insurance required in Wisconsin

- Full coverage averages $92/month

- At-fault state; proper coverage is crucial

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#1 – USAA: Top Overall Pick

Pros

- Exceptional Customer Service: USAA is renowned for its outstanding customer service, especially in claims processing, making it a top choice for those seeking cheap Wisconsin auto insurance with reliable support. Their J.D. Power rating is among the highest, reflecting their commitment to customer care.

- Low Rates: USAA offers some of the lowest rates available, especially for military personnel. With an average premium of $983 per year, it’s an excellent option for drivers seeking cheap Wisconsin auto insurance without compromising on quality.

- Comprehensive Coverage Options: USAA provides a wide array of coverage options, including rare offerings like rideshare insurance and vehicle replacement assistance, making it a versatile choice for those looking for cheap Wisconsin auto insurance with extensive coverage.

Cons

- Eligibility Restrictions: USAA is exclusively available to military members and their families, limiting access for those seeking cheap Wisconsin auto insurance but who do not meet the eligibility criteria. Read more through our Allstate vs. USAA Insurance Review.

- Limited Local Presence: While USAA offers great online services, its lack of local offices may be a drawback for Wisconsin drivers who prefer in-person service when securing cheap Wisconsin auto insurance.

#2 – State Farm: Best for Large Network

Pros

- Extensive Agent Network: State Farm’s vast network of local agents offers personalized service, making it easier to find cheap Wisconsin auto insurance with tailored advice. Their agents are well-versed in Wisconsin-specific insurance needs.

- Strong Reputation: State Farm is a well-known and trusted brand across the U.S., giving customers confidence when choosing their cheap Wisconsin auto insurance. Their strong market presence ensures stability and reliability.

- Discount Opportunities: State Farm offers various discounts, such as multi-policy and safe driving, which can significantly lower premiums, making it a popular choice for those seeking cheap Wisconsin auto insurance. Find out in our State Farm Company Review.

Cons

- Higher Base Rates: State Farm’s rates may be higher compared to some competitors, making it less appealing for those strictly focused on cheap Wisconsin auto insurance. However, discounts can mitigate this to some extent.

- Limited Customization: While State Farm offers solid coverage options, their policies are less customizable compared to other providers, which might be a downside for drivers looking for cheap Wisconsin auto insurance with specific coverage needs.

#3 – Geico: Best for Online Efficiency

Pros

- User-Friendly Online Platform: Geico’s website and mobile app are among the best in the industry, making it easy to manage your cheap Wisconsin auto insurance policy online, from getting quotes to filing claims. To find out more, visit our Geico auto insurance review.

- Competitive Rates: Geico is known for its affordability, with rates starting as low as $16 per month, making it a top contender for cheap Wisconsin auto insurance. Their pricing is especially attractive for budget-conscious drivers.

- Multiple Discount Options: Geico offers a variety of discounts, including for good drivers, military personnel, and federal employees, helping to further reduce the cost of cheap Wisconsin auto insurance.

Cons

- Limited Local Agent Presence: Geico’s focus on online services means fewer local agents, which could be a disadvantage for Wisconsin drivers who prefer face-to-face interactions when managing their cheap Wisconsin auto insurance.

- Mid-Tier Claims Satisfaction: While Geico’s claims service is generally good, it doesn’t rank as high as some competitors, which could be a concern for those seeking cheap Wisconsin auto insurance with top-notch claims support.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – American Family: Best for Customer Loyalty

Pros

- Loyalty Discounts: American Family offers significant discounts for long-term customers, making it a great option for those looking for cheap Wisconsin auto insurance while being rewarded for their loyalty. Their customer retention rate is one of the highest in the industry.

- Strong Local Presence: With a robust network of local agents in Wisconsin, American Family provides personalized service, making it easier for drivers to find cheap Wisconsin auto insurance that meets their specific needs. Find out more about American Family in our American Family review.

- Comprehensive Coverage Options: American Family offers a wide range of coverage options, including unique add-ons like accidental death coverage, making it a versatile choice for those seeking cheap Wisconsin auto insurance with more protection.

Cons

- Higher Rates for New Customers: American Family’s rates may be less competitive for new customers, which could be a drawback for those seeking immediate savings on cheap Wisconsin auto insurance. Loyalty discounts may take time to accrue.

- Average Online Experience: While American Family offers online services, their digital platform isn’t as advanced as some competitors, which could be a downside for tech-savvy drivers seeking cheap Wisconsin auto insurance with easy online management.

#5 – Travelers: Best for Bundling Options

Pros

- Excellent Bundling Discounts: Travelers offers significant savings for customers who bundle multiple policies, such as home and auto, making it an attractive choice for those seeking cheap Wisconsin auto insurance with added value. Bundling can lead to substantial overall savings.

- Customizable Coverage Options: Travelers allows you to tailor your policy with a variety of coverage options, making it a flexible choice for drivers who want cheap Wisconsin auto insurance that fits their unique needs. Options like accident forgiveness add to the customization.

- Strong Financial Backing: With an A.M. Best rating of A++, Travelers is financially stable, ensuring that your cheap Wisconsin auto insurance is secure even in times of widespread claims. This stability is crucial for long-term policyholders. Read more in our detailed Travelers auto insurance review.

Cons

- Mid-Range Customer Satisfaction: Travelers has received mixed reviews for customer service, which could be a concern for those seeking cheap Wisconsin auto insurance with top-tier support. Their claims process, in particular, has room for improvement.

- Higher Premiums Without Bundles: While Travelers offers great discounts for bundling, their standalone auto insurance rates can be higher, which may deter those looking for strictly cheap Wisconsin auto insurance without additional policies.

#6 – Liberty Mutual: Best for Flexible Coverage

Pros

- Highly Customizable Policies: Liberty Mutual offers a wide array of customization options, allowing you to build a cheap Wisconsin auto insurance policy that fits your exact needs. This flexibility is ideal for drivers with specific coverage requirements.

- Various Discounts Available: Liberty Mutual provides numerous discounts, including for safe driving, multi-car, and military personnel, making it easier to secure cheap Wisconsin auto insurance that doesn’t break the bank. Their RightTrack program offers additional savings.

- Accident Forgiveness: Liberty Mutual’s accident forgiveness program ensures that your rates won’t increase after your first accident, making it a great option for drivers seeking cheap Wisconsin auto insurance with long-term savings in mind. To see monthly premiums and honest rankings, read our Liberty Mutual auto insurance review.

Cons

- Higher Base Rates: Liberty Mutual’s base rates can be higher compared to some competitors, which may be a drawback for those focused solely on finding cheap Wisconsin auto insurance. However, their discounts can help offset this cost.

- Average Claims Satisfaction: While Liberty Mutual’s claims process is generally reliable, it doesn’t always receive top marks, which could be a concern for drivers seeking cheap Wisconsin auto insurance with superior claims support.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: Progressive’s Snapshot program rewards safe driving habits with discounts, making it a great option for those seeking cheap Wisconsin auto insurance with personalized savings based on their driving behavior. This telematics option offers potential for substantial savings.

- Competitive Rates: Progressive is known for offering competitive rates, making it a strong contender for cheap Wisconsin auto insurance. Their average annual premium is often lower than many other national insurers, making them a budget-friendly choice. Our complete Progressive auto insurance review goes over this in more detail

- Wide Range of Discounts: Progressive offers numerous discounts, such as for bundling, good students, and multi-car policies, which can further reduce the cost of cheap Wisconsin auto insurance. Their Name Your Price tool adds flexibility to finding the right coverage.

Cons

- Mixed Customer Service Reviews: Progressive’s customer service and claims satisfaction have received varied reviews, which might be a drawback for those seeking cheap Wisconsin auto insurance with consistent support. Some customers report issues with responsiveness.

- Rates Can Vary Significantly: Progressive’s rates can vary widely depending on factors like driving history and location, which may make it challenging to predict the cost of cheap Wisconsin auto insurance. Their Snapshot program may also not be ideal for all drivers.

#8 – Farmers: Best for Competitive Pricing

Pros

- Extensive Coverage Options: Farmers offers a broad range of coverage options, including unique add-ons like new car replacement and loss of use, making it an excellent choice for those seeking cheap Wisconsin auto insurance with comprehensive protection. Their policies can be highly tailored.

- Solid Customer Service: Farmers is known for good customer service, particularly in claims handling, which is a significant advantage for those looking for cheap Wisconsin auto insurance with dependable support. Their agents are well-regarded for their personalized service.

- Discounts for Various Needs: Farmers provides discounts for a wide array of circumstances, including safe drivers, homeowners, and military personnel, helping to reduce the overall cost of cheap Wisconsin auto insurance. Their Signal app offers additional savings for safe driving. Take a look at our Farmers auto insurance review to learn more.

Cons

- Higher Rates for Basic Coverage: Farmers’ base rates can be higher than some competitors, which may be a downside for those looking for strictly cheap Wisconsin auto insurance without the need for extensive add-ons. However, discounts can help mitigate this.

- Limited Online Tools: While Farmers offers some online services, their digital platform isn’t as advanced as some competitors, which could be a disadvantage for tech-savvy drivers seeking cheap Wisconsin auto insurance with easy online management.

#9 – Allstate: Best for Safe Driver

Pros

- New Car Replacement: Allstate offers a new car replacement option that ensures your vehicle is replaced with a new one if totaled within the first two model years, making it a top choice for new car owners seeking cheap Wisconsin auto insurance with added protection.

- Extensive Agent Network: Allstate has a large network of local agents, providing personalized service that helps drivers find cheap Wisconsin auto insurance tailored to their specific needs. Their agents are well-versed in local insurance requirements.

- Discount Opportunities: Allstate offers a variety of discounts, including for safe driving, multi-policy, and anti-theft devices, making it easier to secure cheap Wisconsin auto insurance that fits your budget. Their Drivewise program offers additional savings.

Cons

- Higher Premiums: Allstate’s premiums can be higher compared to some competitors, which may be a drawback for those strictly focused on finding cheap Wisconsin auto insurance. However, their discounts and new car replacement option may justify the cost for some.

- Average Claims Satisfaction: While Allstate’s claims process is generally reliable, it doesn’t always receive the highest marks, which could be a concern for drivers seeking cheap Wisconsin auto insurance with superior claims handling. Read more about this provider in our Allstate auto insurance review.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

10 – Nationwide: Best for SmartRide Program

Pros

- Highly Customizable Policies: Nationwide offers extensive customization options, allowing you to build a cheap Wisconsin auto insurance policy that fits your exact needs. Their Vanishing Deductible program rewards safe driving with lower deductibles.

- SmartRide Program: Nationwide’s SmartRide program offers discounts based on your driving habits, making it an excellent option for those seeking cheap Wisconsin auto insurance with the potential for personalized savings. This telematics option promotes safe driving.

- Strong Financial Stability: With a solid A.M. Best rating, Nationwide ensures that your cheap Wisconsin auto insurance is backed by a financially secure company, providing peace of mind that your claims will be covered. Learn from our Nationwide auto insurance review about their financial stability.

Cons

- Higher Base Rates: Nationwide’s base rates can be higher compared to some competitors, which may be a downside for those focused strictly on finding cheap Wisconsin auto insurance. However, their discounts and SmartRide program can help offset this.

- Average Customer Service: While Nationwide offers solid coverage and customization, their customer service ratings are average, which might be a drawback for drivers seeking cheap Wisconsin auto insurance with top-tier support.

Wisconsin Auto Insurance Requirements

In Wisconsin, a tort system is in place that makes it so that one of the drivers involved in the accident must be labeled as the person at fault. Whoever is at fault for the accident must pay for the damages through his or her insurance. Along with this system, all drivers licensed under the Wisconsin Department of Motor Vehicles must have insurance that satisfies the minimum requirements for auto insurance coverage.

Wisconsin Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $43 $123

American Family $22 $63

Farmers $38 $109

Geico $21 $62

Liberty Mutual $30 $84

Nationwide $80 $226

Progressive $33 $94

State Farm $20 $58

Travelers $26 $72

USAA $16 $47

When you are found to be at fault, Wisconsin auto insurance laws require your mandatory coverages to pay for the damages. Bodily injury liability insurance and property damage liability insurance are both required. The minimum coverage required for BIL in Wisconsin is $50,000 per person and $100,000 per individual accident.

These coverages pay for any medical bills that need to be paid as a result of the accident. Property damage liability, on the other hand, covers the costs associated with damages to the other person’s vehicle during the accident. This would cover things like auto body damage and internal circuitry damage.

The minimum requirement of coverage for this is $15,000, but more should be purchased if you feel that you would ever find yourself in a situation where you inflict more than $15,000 worth of damage, such as totaling a luxury vehicle.

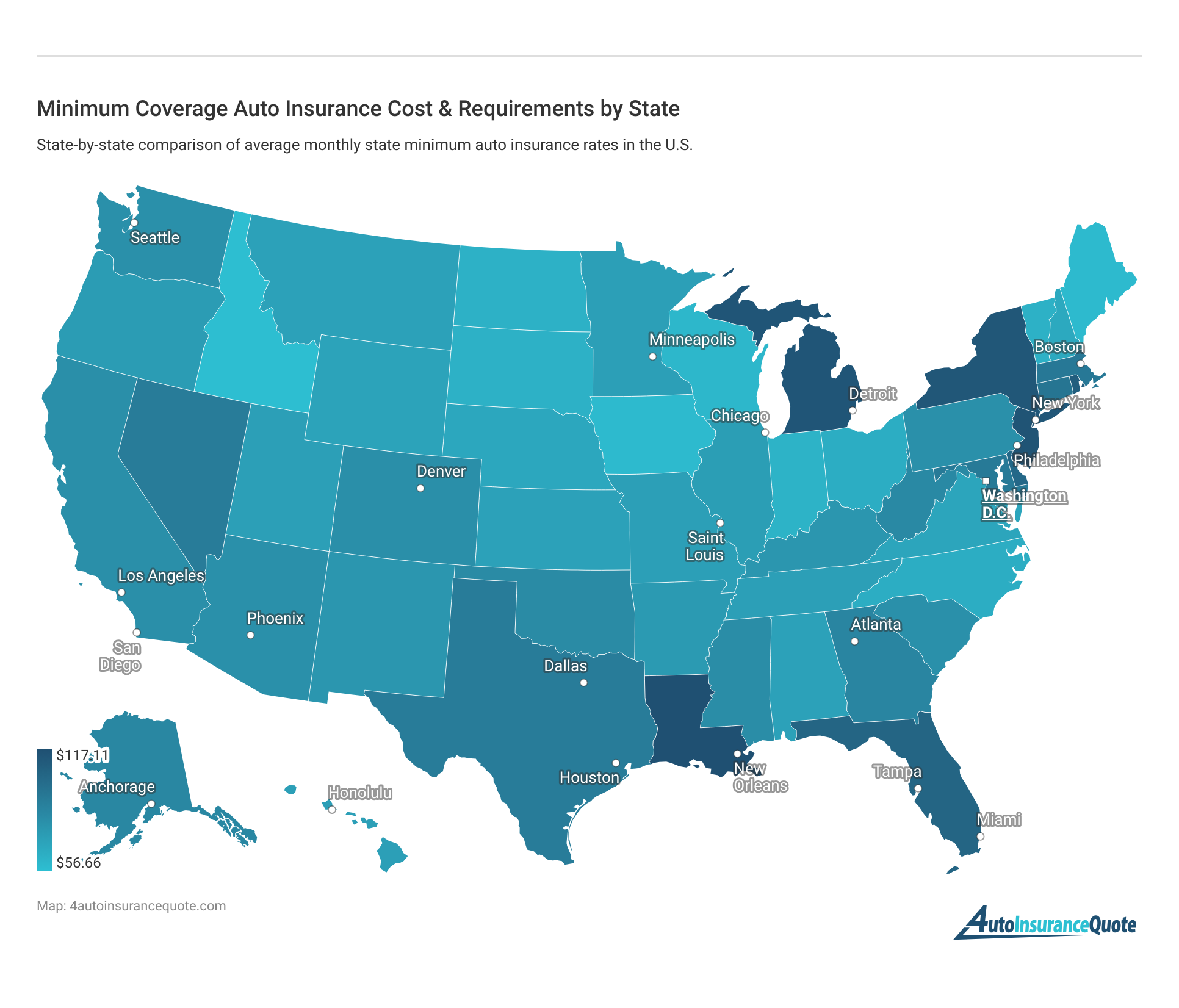

Take a look at how Wisconsin’s minimum rates compare with surrounding states.

Wisconsin also requires that you purchase some insurance to cover yourself in case the other motorist doesn’t have insurance of his own when he or she is at fault. This type of coverage, known as uninsured motorist coverage, primarily covers bodily injury. The state requires a $100,000 minimum per person up to a total of $300,000 total per accident in coverage for you and your family.

Wisconsin Auto Insurance Rates

The statewide average for auto insurance is just under $1,100 per year, which is less than $100 a month. Compared to the national average, this rate is more than $300 less. What’s even better is that the rate doesn’t change much when going from an average rural area to a big city.

While many of these factors are simply based on your own driving record, two things that affect even the safest of drivers are age and gender . As with most states, males typically pay higher auto insurance rates than females.

While this may seem biased, it’s also important to realize that as people get older, their rates begin to go down dramatically, and the gap between genders shrinks. The reason for this is simply that younger drivers have less experience behind the wheel, and are therefore a higher-risk demographic to insure.

Read more about how age affects auto insurance rates. Get started by entering your ZIP code below to receive free quotes from top auto insurance companies and find the most affordable options.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Wisconsin Car And Driving Statistics

A decreasing trend in Wisconsin is the number of crashes among motorists. The total amount of accidents in the state has decreased from 125,174 in 2005 to 108,808 in 2010. Of the 108,808 accidents in 2010, only 29,380 (about 30%) of them caused any type of injury, and of those 517 were fatal.

Wisconsin comes out to be one of the safest states when it comes to the amount of injuries/deaths per accident.

Ways to track the progress of your auto insurance include keeping an eye on auto theft rates. In Wisconsin, the amount of reported stolen vehicles has been decreasing since 1992, which is great news for drivers.

In 2009, Wisconsin saw its lowest number of auto thefts in one year since 1982, with only 8,926 report thefts compared to 11,539 the year before. This works out to be only 157.8 stolen vehicles per 100,000 vehicles, one of the lowest theft rates in the nation.

Learn about anti-theft recovery systems you can install in your car to reduce your risk of theft.

Wisconsin Auto Insurance Agents

The auto insurance rates for major cities in Wisconsin are about $1,350 in Milwaukee and a little more than $1,000 in Madison. These are still noticeably less expensive than the national average, so it’s very affordable to be properly insured in Wisconsin. Find more through our expert guide titled “Compare Auto Insurance Quotes.“

Tim Bain

Licensed Insurance Agent

Ready to buy the best Wisconsin auto insurance? Get started by entering your ZIP code below to receive free quotes from top auto insurance companies and find the most affordable options.

Frequently Asked Questions

What is the minimum auto insurance coverage required in Wisconsin?

Wisconsin requires drivers to have 25/50/10 coverage, which means $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, and $10,000 property damage liability per accident.

What additional coverages can I get in Wisconsin?

Optional coverages include collision, comprehensive, medical payments, and uninsured/underinsured motorist coverage. To start your quote, Enter your ZIP code here.

How does fault work in Wisconsin?

Wisconsin operates under a tort system where the at-fault driver pays for damages. You must have insurance to cover the minimum requirements. Learn how to find your car make and model in our guide.

What is the average cost of auto insurance in Wisconsin per month?

The average rate is around $91.67 per month or under $1,100 per year, which is lower than the national average.

Is it illegal to drive without auto insurance in Wisconsin?

Yes, all Wisconsin drivers must carry the required auto insurance in Wisconsin to drive legally. To start your quote, Enter your ZIP code here.

Is auto insurance more expensive in Wisconsin?

No, Wisconsin auto insurance is actually cheaper than the national average. Full coverage only costs an average of $92 per month in Wisconsin. You can find auto insurance quotes online, compare rates, and discover the most affordable coverage in your area.

Do I need auto insurance to buy a car in Wisconsin?

Yes, you will need to have auto insurance in order to buy a car in Wisconsin.

What type of coverage is required in Wisconsin for drivers involved in accidents with uninsured motorists?

Wisconsin requires uninsured motorist coverage to protect drivers if they are involved in an accident with someone who does not have insurance. The minimum coverage required is $100,000 per person and $300,000 per accident for bodily injury. To start your quote, Enter your ZIP code here.

Which auto insurance provider is noted for its extensive network and large number of local agents?

State Farm is recognized for its extensive network and large number of local agents. This widespread network provides personalized service and helps Wisconsin drivers find affordable auto insurance options. For additional details, explore our comprehensive resource titled “What are the different types of auto insurance coverage?” for more information.

How does Wisconsin’s average auto insurance rate compare to the national average?

Wisconsin’s average auto insurance rate is approximately $1,100 per year, which is significantly lower than the national average. This makes Wisconsin’s auto insurance rates more affordable compared to most other states.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.