Cheap Texas Auto Insurance in 2024 (Unlock Big Savings From These 10 Companies!)

Secure cheap Texas auto insurance starting at $22/month from leading providers such as USAA, Geico, and Travelers. These companies offer exceptional customer service, diverse coverage options, and significant discounts. Discover how these top providers can save you money on your Texas auto insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in Texas

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 1,731 reviews

1,731 reviewsCompany Facts

Min. Coverage in Texas

A.M. Best Rating

Complaint Level

Pros & Cons

1,731 reviews

1,731 reviewsThe top picks for cheap Texas auto insurance are USAA, Geico, and Travelers, with rates starting at $22/month.

These companies excel by providing outstanding customer service, a wide range of coverage options, and substantial discounts, ensuring you get the best value and protection for your needs. To gain further insights, consult our comprehensive guide titled, “Different Types of Auto Insurance Coverage.”

Our Top 10 Company Picks: Cheap Texas Auto Insurance

| Company | Rank | Monthly Rates | Good Driver Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $22 | 10% | Military Savings | USAA | |

| #2 | $33 | 25% | Cheap Rates | Geico | |

| #3 | $40 | 10% | Bundling Policies | Travelers | |

| #4 | $42 | 10% | Deductible Savings | Nationwide |

| #5 | $43 | 10% | Qualifying Coverage | Progressive | |

| #6 | $46 | 15% | Financial Strength | State Farm | |

| #7 | $47 | 15% | Loyalty Rewards | American Family | |

| #8 | $51 | 15% | Safe Drivers | Farmers | |

| #9 | $52 | 20% | UBI Discount | Allstate | |

| #10 | $53 | 12% | 24/7 Support | Liberty Mutual |

Finding affordable auto insurance is easy with our top 10 picks for Texas. Compare rates, discounts, and benefits to choose the best coverage for you and start saving today. Start saving on your auto insurance by entering your ZIP code above and comparing quotes.

- USAA has the best rates for cheap Texas auto insurance, starting at $20/mo

- Compare quotes from Geico and Travelers for affordable coverage

- Explore various quotes to find the best deals on Texas auto insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#1 – USAA: Top Overall Pick

Pros:

- Exclusive Discounts for Military Members: USAA offers cheap Texas auto insurance for military personnel and their families, providing significant savings.

- Affordable Comprehensive Coverage: USAA provides military members with cheap Texas auto insurance that includes comprehensive coverage at lower rates.

- Consistent Rate Reductions: USAA offers consistent rate reductions for military personnel, making it a top choice for cheap Texas auto insurance. To delve deeper, refer to resource titled, “Affordable Auto Insurance Discounts.”

Cons:

- Eligibility Restrictions: USAA’s cheap Texas auto insurance is exclusively available to military members and their families.

- Limited Local Branches: USAA’s limited local branches in Texas may impact the convenience of accessing their cheap Texas auto insurance services.

#2 – Geico: Best for Cheap Rates

Pros:

- Competitive Pricing: Geico consistently offers some of the lowest rates for cheap Texas auto insurance, making it a popular choice. For additional details, explore our comprehensive resource titled, “Geico Auto Insurance Review.”

- Variety of Discounts: Geico offers multiple discounts, such as for good drivers and multi-policy holders, to lower the cost of cheap Texas auto insurance.

- User-Friendly Online Tools: Geico’s online tools make it easy to compare quotes and find cheap Texas auto insurance rates quickly.

Cons:

- Service Variability: Customer service experiences can vary, potentially affecting the overall satisfaction with their cheap Texas auto insurance.

- Limited Coverage Options: Geico offers cheap Texas auto insurance but with less comprehensive coverage compared to some competitors.

#3 – Travelers: Best for Bundling Policies

Pros:

- Bundling Discounts: Travelers offers significant savings on cheap Texas auto insurance when you bundle multiple policies, such as home and auto.

- Customizable Coverage: With Travelers, you can customize your cheap Texas auto insurance policy to include only what you need, saving money.

- Stable Premiums: Bundling with Travelers can lead to more stable, affordable premiums over time. To broaden your understanding, explore our coverage titled, “Combining Insurance Policies.”

Cons:

- Higher Initial Quotes: Initial quotes for Travelers’ Texas auto insurance may be higher before bundling discounts are applied.

- Complex Policy Management: Managing multiple policies can complicate things and reduce the convenience of cheap Texas auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Deductible Savings

Pros:

- Vanishing Deductible: Nationwide’s vanishing deductible program makes their cheap Texas auto insurance even more affordable over time. To expand your knowledge, refer to our handbook titled, “Nationwide Auto Insurance Review.”

- Accident Forgiveness: With accident forgiveness, your rates for cheap Texas auto insurance won’t increase after your first at-fault accident.

- SmartRide Discounts: The SmartRide program provides discounts based on safe driving behavior, lowering the cost of cheap Texas auto insurance.

Cons:

- Strict Eligibility for Discounts: Eligibility requirements for some of Nationwide’s cheap Texas auto insurance discounts can be strict.

- Higher Rates for High-Risk Drivers: Nationwide may not offer the cheapest Texas auto insurance rates for high-risk drivers.

#5 – Progressive: Best for Qualifying Coverage

Pros:

- Snapshot Program: Progressive’s Snapshot program rewards safe driving with discounts, making cheap Texas auto insurance more accessible.

- Wide Range of Coverage Options: Progressive provides various coverage options, letting you customize a cheap Texas auto insurance policy to fit your needs.

- Multi-Car Discounts: Bundling multiple vehicles with Progressive can result in significant savings on cheap Texas auto insurance.

Cons:

- Inconsistent Savings: Savings through the Snapshot program for cheap Texas auto insurance can vary greatly based on driving habits. To enhance your understanding, explore our resource titled, “Progressive Auto Insurance Review.”

- Higher Premiums for Poor Driving Records: Drivers with poor records might not find the cheapest Texas auto insurance rates with Progressive.

#6 – State Farm: Best for Financial Strength

Pros:

- Stable and Reliable: State Farm’s financial strength ensures they can provide cheap Texas auto insurance while maintaining reliable service.

- Steady Premiums: Customers enjoy stable and predictable premiums with cheap Texas auto insurance. To gain in-depth knowledge, consult our comprehensive resource titled, “State Farm Auto Insurance Review.”

- Extensive Agent Network: State Farm’s extensive network of agents makes accessing cheap Texas auto insurance easy and convenient.

Cons:

- Higher Initial Rates: Initial rates for State Farm’s cheap Texas auto insurance may be higher compared to some competitors.

- Discount Eligibility: State Farm’s discounts for cheap Texas auto insurance may have strict eligibility requirements.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – American Family: Best for Loyalty Rewards

Pros:

- Loyalty Discounts: American Family rewards long-term customers with discounts, making their cheap Texas auto insurance even more affordable over time.

- Generous Customer Service: American Family is known for its exceptional customer service, enhancing the overall value of their cheap Texas auto insurance.

- Multiple Policy Discounts: Combining different policies can lead to significant savings on cheap Texas auto insurance. For additional details, explore our resource titled, “American Family Insurance Auto Insurance Review.”

Cons:

- Limited Availability: American Family’s cheap auto insurance may not be available in all areas of Texas.

- Fewer Online Tools: The company’s online tools for managing Texas auto insurance are less extensive than some competitors.

#8 – Farmers: Best for Safe Drivers

Pros:

- Safe Driver Discounts: Farmers offers substantial discounts for safe drivers, making cheap Texas auto insurance more attainable. For detailed information, refer to our comprehensive report titled, “Farmers Auto Insurance Review.”

- Signal App Savings: The Signal app tracks driving behavior for extra discounts, further lowering your Texas auto insurance costs.

- Accident Forgiveness: Accident forgiveness helps safe drivers keep low rates for Texas auto insurance, even after an accident.

Cons:

- Complex Discount Structure: Understanding and accessing all available discounts for cheap Texas auto insurance can be complex with Farmers.

- High Rates for Riskier Drivers: Farmers may not offer the cheapest Texas auto insurance rates for drivers with less-than-perfect records.

#9 – All State: Best for UBI Discount

Pros:

- Drivewise Program: Allstate’s Drivewise program provides usage-based discounts, making it easier to find cheap Texas auto insurance. For a comprehensive analysis, refer to our detailed guide titled, “Allstate Auto Insurance Review.”

- Multi-Policy Savings: Bundling different policies with Allstate can lead to additional savings on cheap Texas auto insurance.

- New Car Discount: Allstate offers discounts for new car owners, making cheap Texas auto insurance more accessible.

Cons:

- Usage-Based Discounts May Vary: Usage-based discounts can vary and affect the overall cost of Texas auto insurance.

- High Base Rates: Allstate’s base rates for cheap Texas auto insurance may be higher before applying discounts.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for 24/7 Support

Pros:

- Around-the-Clock Service: Liberty Mutual provides 24/7 support, ensuring customers always have access to their cheap Texas auto insurance services.

- Accident Forgiveness: Liberty Mutual offers accident forgiveness, helping maintain low rates for cheap Texas auto insurance. To gain in-depth knowledge, consult our comprehensive resource titled, “Liberty Mutual Auto Insurance Review.”

- Customizable Coverage Options: Customers can customize their coverage, ensuring they get the cheap Texas auto insurance that fits their needs.

Cons:

- Potentially Higher Premiums: Liberty Mutual’s premiums for cheap Texas auto insurance may be higher than those of other providers.

- Service Quality Variability: The quality of customer service for Liberty Mutual’s cheap Texas auto insurance can vary based on location.

Texas Auto Insurance: Monthly Rates by Coverage Level & Provider

When it comes to finding the right auto insurance in Texas, understanding the cost variations across different providers and coverage levels is crucial. Monthly insurance rates can significantly impact your budget, so it’s important to compare costs to find the best deal.

USAA offers the most affordable auto insurance rates in Texas, providing exceptional value for both minimum and full coverage.Daniel Walker Licensed Insurance Agent

In Texas, auto insurance rates vary based on the type of coverage—minimum or full—offered by various providers. For those seeking basic protection, minimum coverage rates start as low as $22 per month with USAA, while full coverage options can reach up to $201 per month with Allstate.

Texas Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $52 | $201 |

| American Family | $47 | $176 |

| Farmers | $51 | $137 |

| Geico | $33 | $105 |

| Liberty Mutual | $53 | $178 |

| Nationwide | $42 | $154 |

| Progressive | $43 | $121 |

| State Farm | $46 | $90 |

| Travelers | $39 | $101 |

| USAA | $22 | $62 |

This overview shows cost differences between providers, helping you choose the best insurance plan for your budget. This also highlights the significant differences in pricing among top insurers in the state.

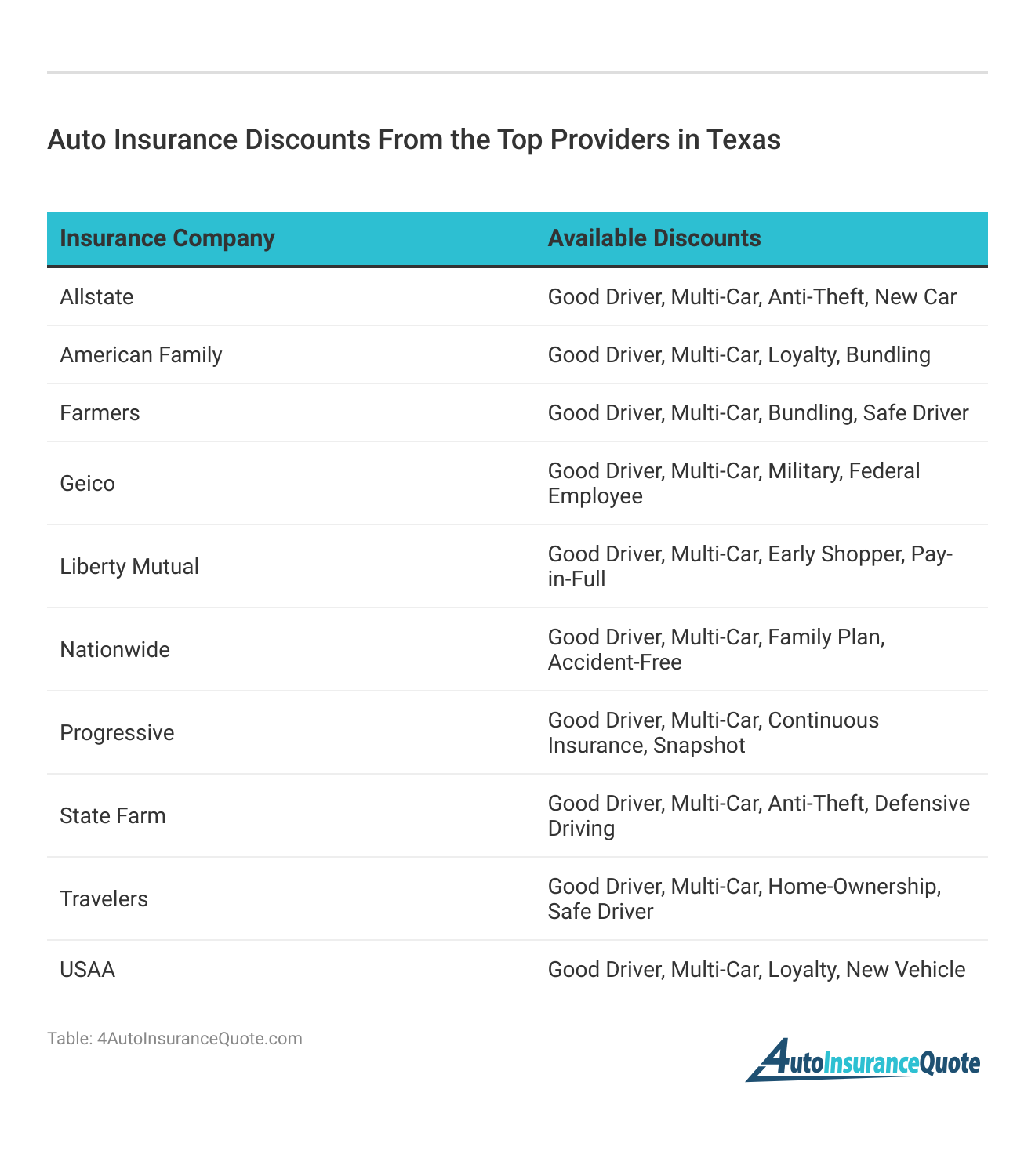

This table lists the available auto insurance discounts from leading Texas providers, including options like Good Driver, Multi-Car, and Safe Driver discounts. Each company offers unique benefits, with USAA and Geico featuring specialized discounts for military and federal employees, respectively.

It is important to have Texas auto insurance that meets the state’s requirements but is also affordable. Understanding auto insurance and what rate is the best can be daunting, but we have gathered the basics of what you need to know about finding the best Texas auto insurance. Let’s take a look at how Texas auto insurance works and what you can expect to pay for Texas auto insurance coverage.

Before you buy Texas auto insurance, make sure you have taken the time to shop around. Enter your ZIP code above for free Texas auto insurance quotes.

Texas Auto Insurance Requirements And Laws

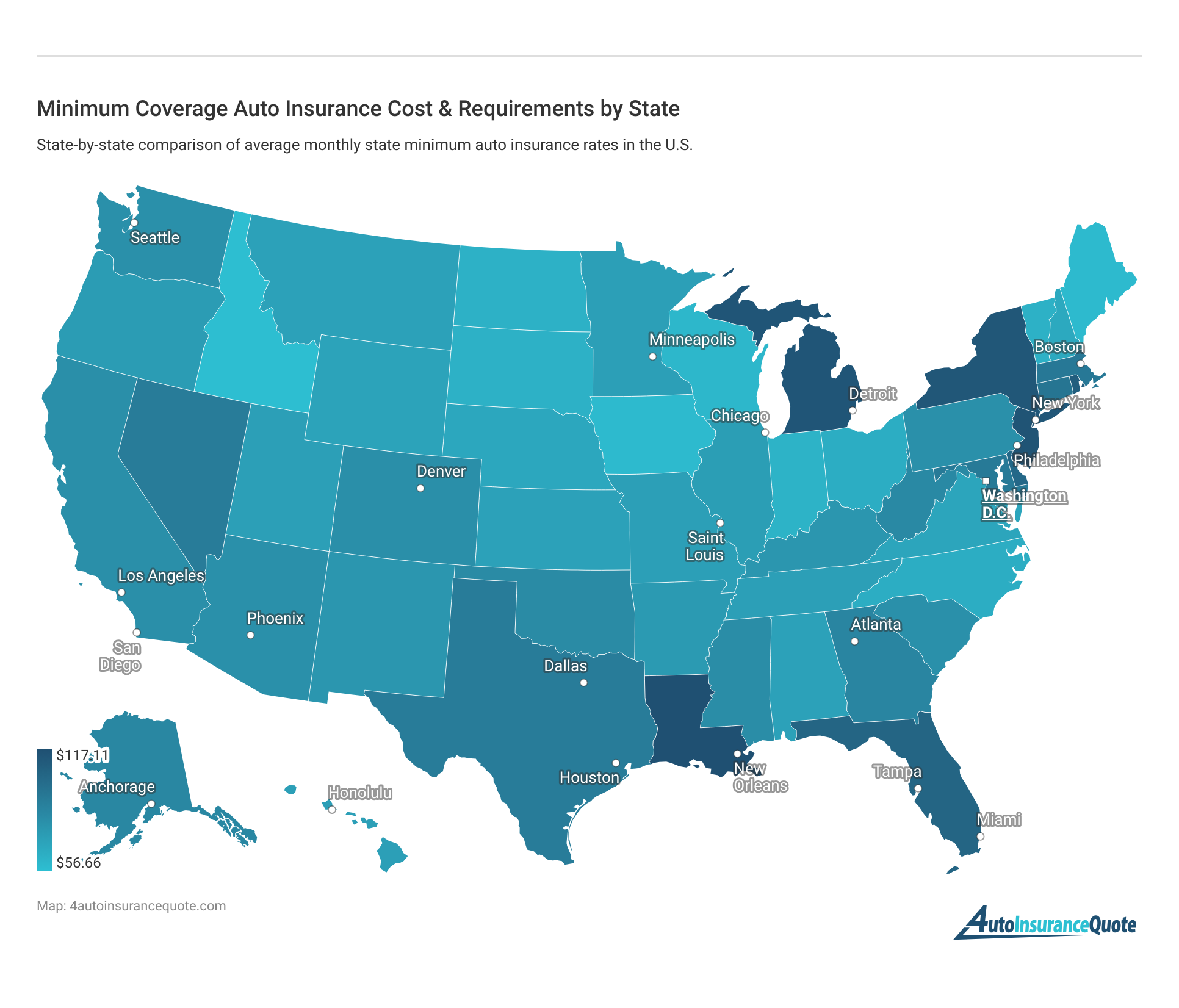

In Texas, there are different types of auto insurance coverage where minimums must be obtained and comply by the drivers. These are the mandatory liability coverage minimums commonly referred to as “30/60/25”, which you may have heard an auto insurance agent refer to.

- Bodily Injury Liability: $30,000 per person and $60,000 per accident

- Property Damage Liability: $25,000 per accident

These minimums are designed to ensure coverage in case of an accident and to comply with state laws. To gain a clearer picture, it’s helpful to see how Texas’ coverage requirements compare with those of neighboring states. Take a look at how Texas’ minimum rates compare with surrounding states.

In addition to the mandatory liability insurance, Texas drivers have several optional coverage choices to enhance their protection. These optional coverages can be tailored to your needs, offering additional peace of mind and protection on the road.

- Uninsured/Underinsured Motorist Coverage: Provides protection for accidents with drivers who lack adequate insurance. It ensures you’re covered even if the at-fault driver is underinsured or uninsured.

- Collision Auto Insurance Coverage: Covers damage to your vehicle resulting from a collision. It helps repair or replace your car after an accident.

- Roadside Assistance Coverage: Offers help in case of breakdowns, including towing and minor repairs. It ensures you’re covered when your vehicle encounters issues on the road.

- Comprehensive Coverage: Protects against damage caused by a natural disaster and theft. It provides broader coverage beyond accidents.

On January 1, 2011, the State of Texas joined the vast majority of state governments in requiring citizens to provide proof of their ability to cover minimum liability limits while on the road. This is primarily done through the purchasing of an auto insurance policy that covers the driver, passengers, and car.

Proof of coverage laws are now strictly enforced by police and other officials. The new “TexasSure” system implemented by the state allows police, vehicle inspectors, and tax officials to verify whether or not a vehicle is insured almost instantly through an online system.

It was initially created to fight insurance fraud, but it also helps police quickly identify uninsured drivers. If caught without valid insurance, you could face fines with higher penalties for repeat offenses. Penalties increase with subsequent convictions, so it’s important to understand why you should never use a fake insurance card.

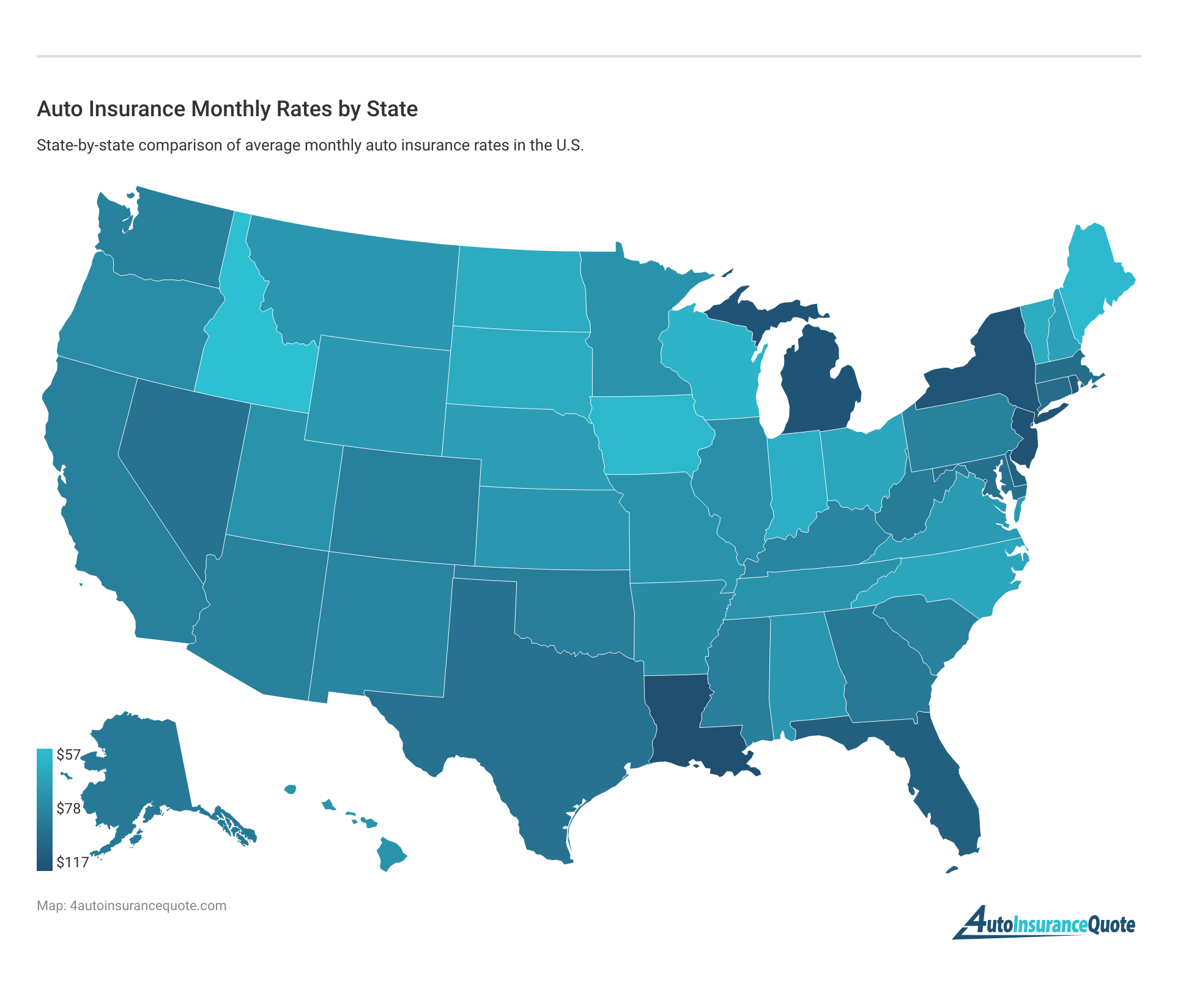

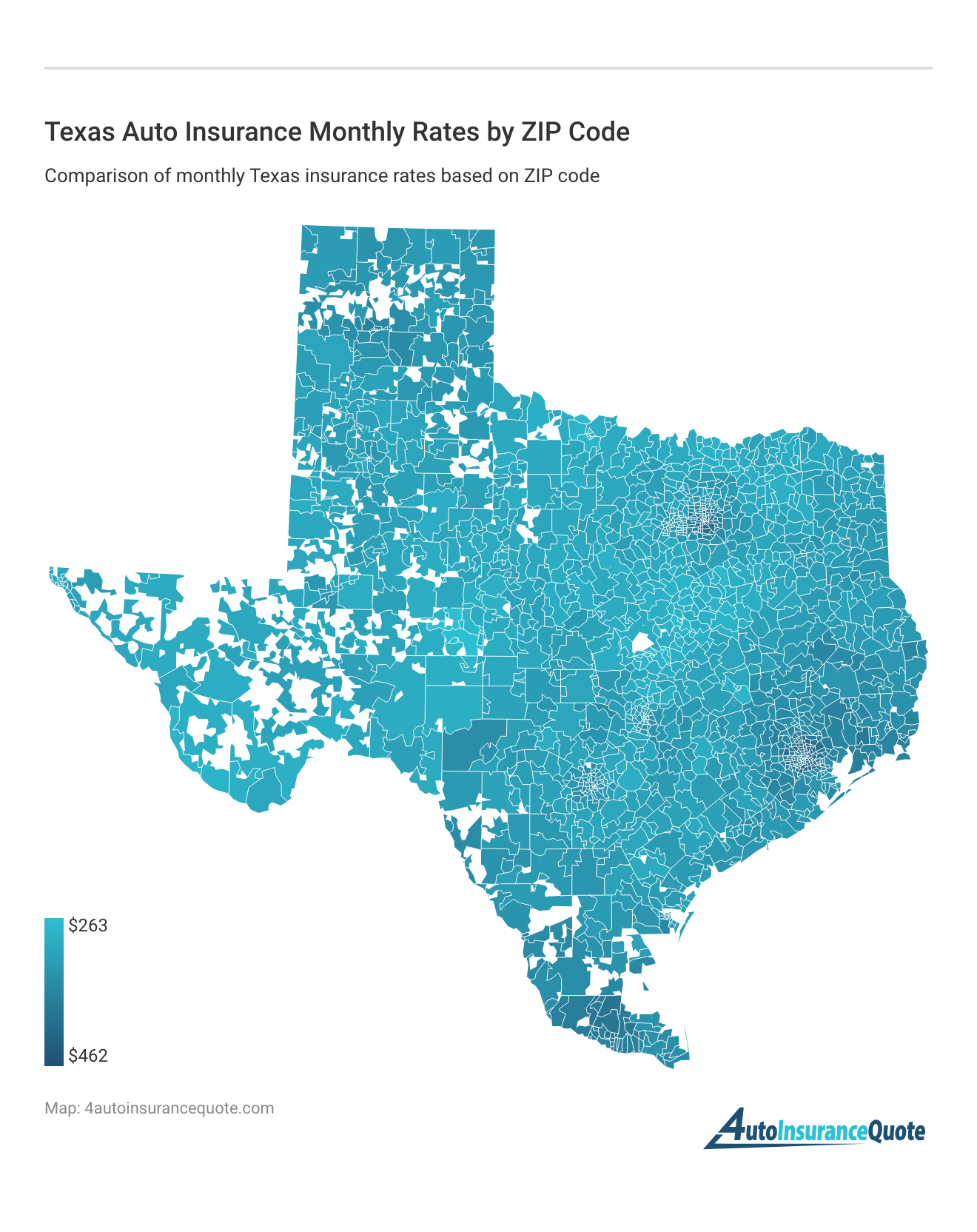

Texas auto insurance rates are generally aligned with the national average, offering a balanced approach to coverage costs. However, insurance premiums can vary significantly within the state based on specific ZIP codes.

We can also take a closer look at the ZIP codes within the state to see how rates changed based on different areas. Examining these regional differences provides a clearer understanding of how location impacts insurance rates, helping you make more informed decisions about your coverage.

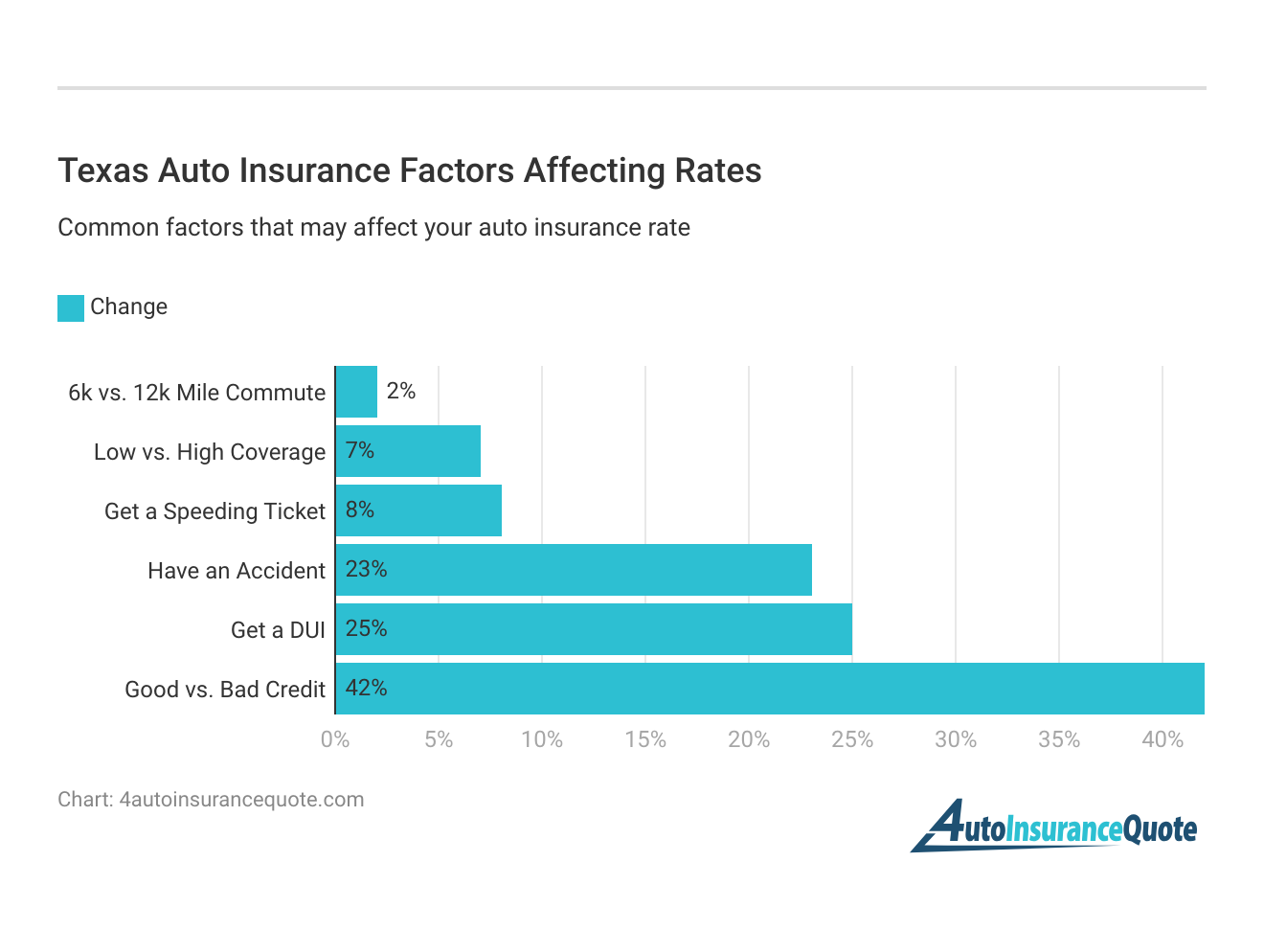

There are a lot of key factors influencing your insurance rates. These include your driving record, coverage levels, commute distance, and credit score. For instance, having a DUI or multiple accidents can significantly increase your rates, while opting for higher coverage or having poor credit can also lead to higher premiums. Take a look at our overview here.

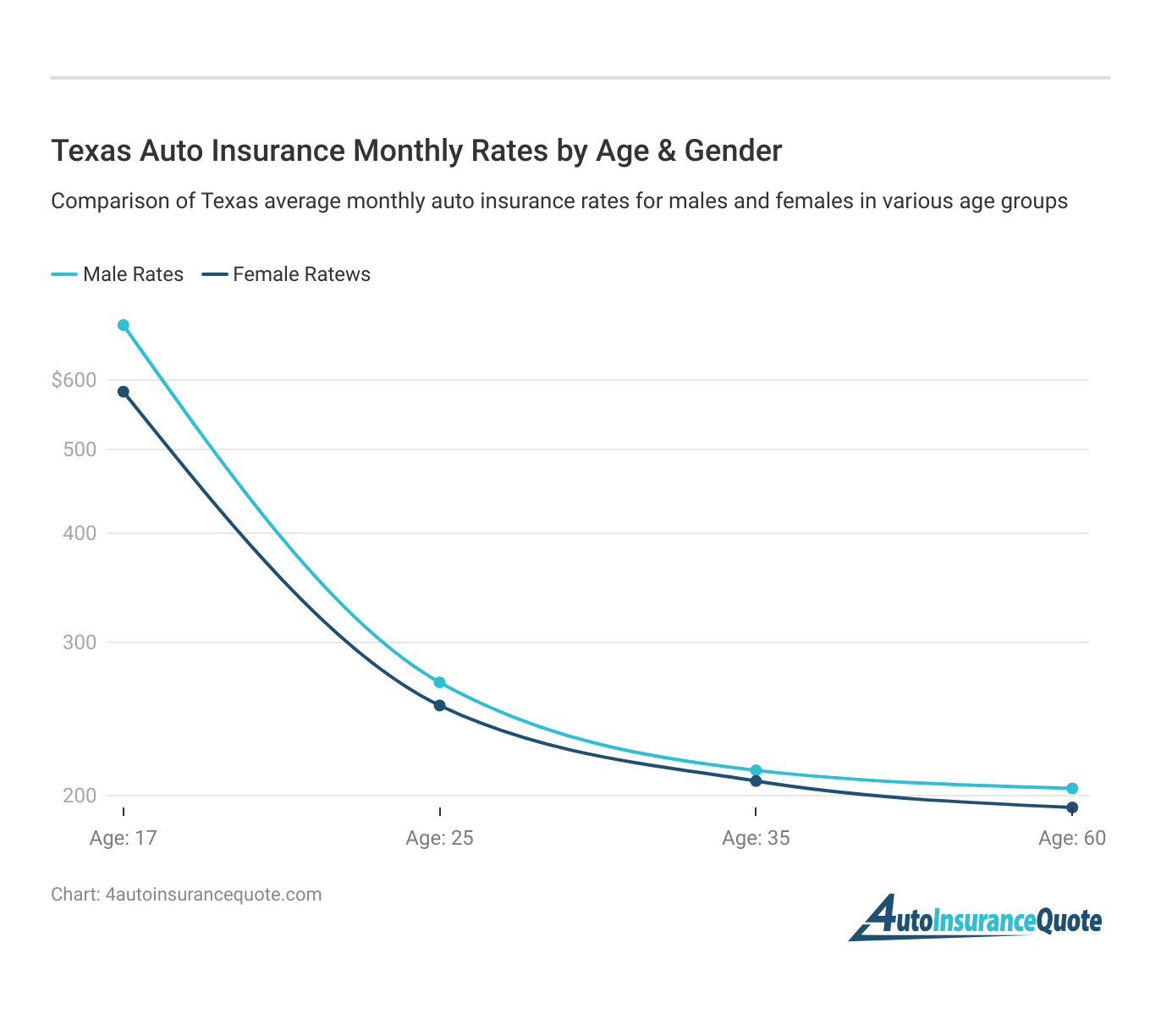

While many of these factors are simply based on your own driving record, two things that affect even the safest of drivers are age and gender. As with most states, males typically pay higher auto insurance rates than females.

Compare Texas auto insurance rates by age and gender with this chart, which reveals how costs differ for 17-year-olds, 25-year-olds, 35-year-olds, and 60-year-olds, broken down by male and female. This overview helps you understand how demographic factors influence insurance pricing.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

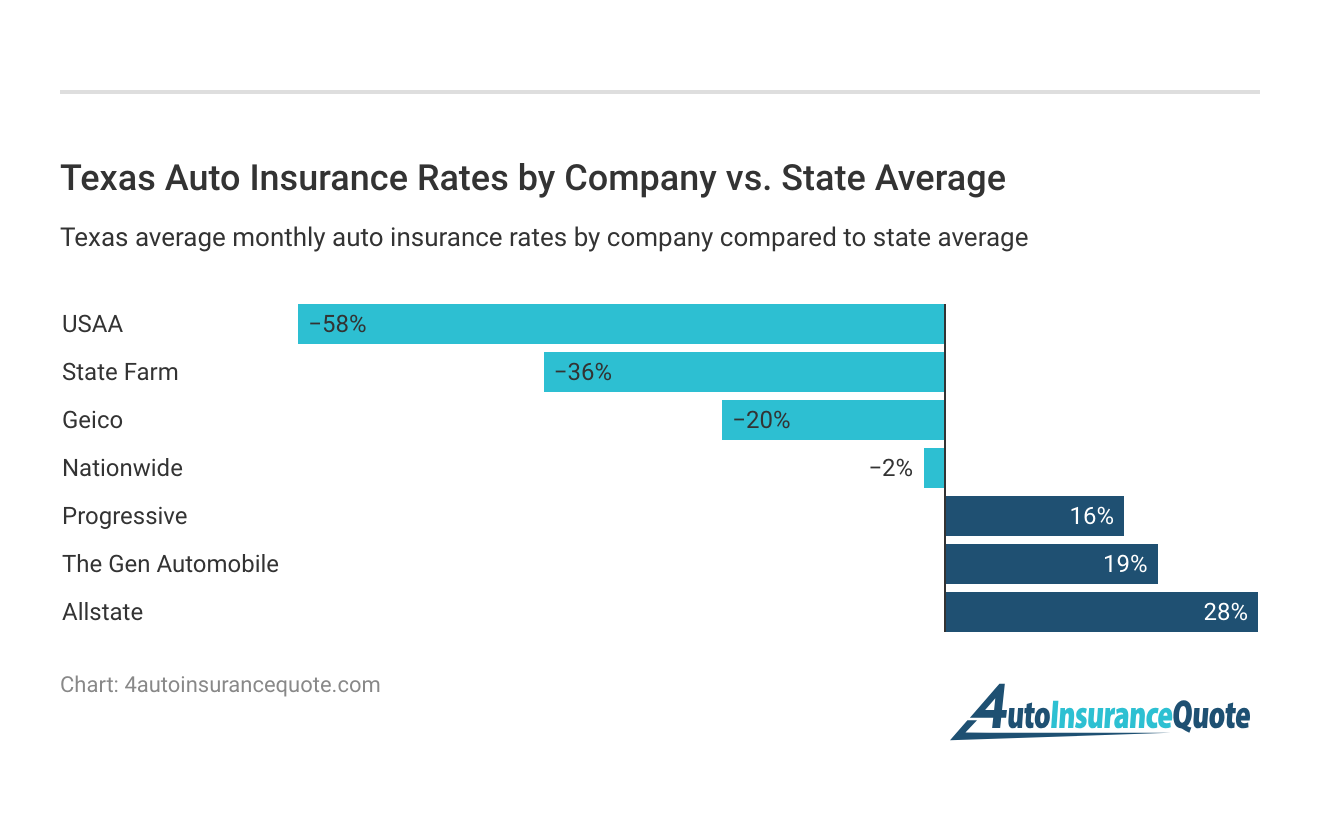

Texas Auto Insurance Rates by Company

Texas is known for its affordable auto insurance rates, but the cost can vary significantly among different providers. To help you navigate these differences, we’ll explore how rates differ across some of the largest companies operating in the state.

Understanding these variations can assist you in finding the best value for your auto insurance needs. USAA offers rates 58% lower than the average, while Allstate is 28% higher. See how providers like State Farm, Geico, and Progressive stack up in our chart.

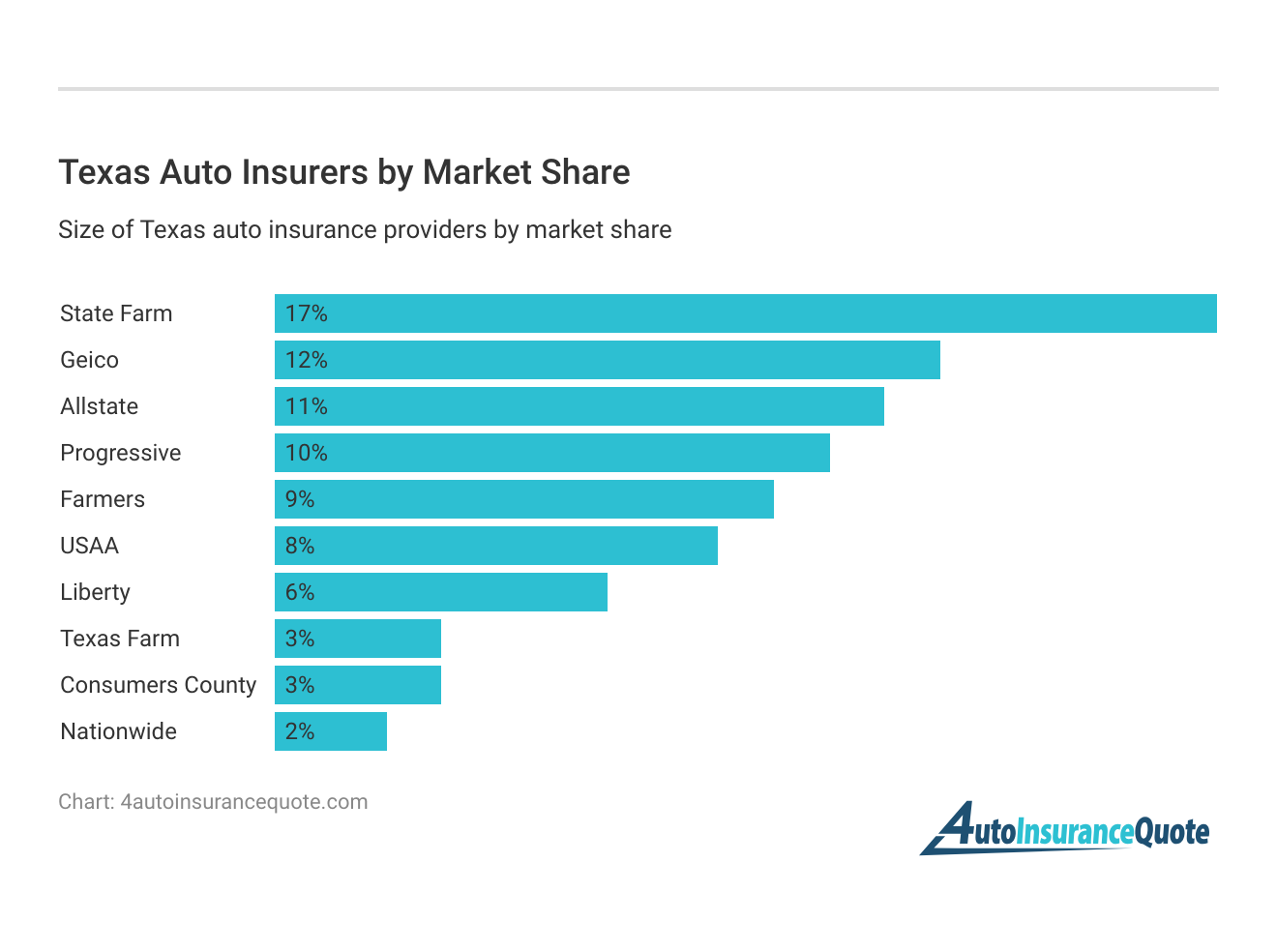

View the market share of top Texas auto insurers, with State Farm at 17%, Geico at 12%, and Allstate at 11%. This chart illustrates the competitive landscape of Texas auto insurance, allowing consumers to make informed choices about their coverage based on the presence and stability of these major players.

Texas Car And Driving Statistics

Theft is another component of insurance – and the news isn’t great for Texans when it comes to auto theft. According to 2008 statistics (the most recent year available), Texas ranks second in the total number of vehicles stolen across the country, and third in the total number of motorcycle thefts.

On the plus side, the 2008 total of 85,411 vehicles stolen was a drop of more than ten percent from 2007, reflecting the strong effort that Texas law enforcement has put towards stamping out auto theft. This total works out to an auto theft rate of about 350 vehicles stolen per 100,000 Texans.

View this post on Instagram

Laredo, TX, ranks among the top ten U.S. cities for auto theft, with 827 vehicles stolen per 100,000 residents. This highlights the importance of ensuring your auto insurance adequately covers theft and does not lead to excessive rate increases. Drivers will also benefit from anti-theft recovery systems on their vehicles.

The news is much better in regard to accident risk while driving Texan roads and highways. The state experienced a decrease of eleven percent in regard to automobile fatalities in 2009, dropping to just over 3,000 fatalities recorded. State officials attributed this improvement to stricter enforcement of laws against intoxicated driving, cell phone use, and increased driver caution.

Additional Texas Automobile Insurance Resources

To help you navigate the complexities of auto insurance in Texas, several valuable resources are available. Here are some essential websites and tools to help you make informed decisions and stay compliant with state regulations:

- Texas Department of Insurance: Offers guidance and resources for agents and consumers on insurance matters.

- Texas Department of Insurance (Auto Insurance): Provides specific information and resources for auto insurance.

- Texas Department of Motor Vehicles: Assists with vehicle registration and other DMV-related services.

- Texas Highway Safety Laws: Outlines key safety laws that impact driving in Texas.

These resources equip consumers with the knowledge and tools needed to navigate the Texas auto insurance landscape effectively. These resources provide essential information on insurance regulations, vehicle registration, and safety laws, helping to ensure that you are informed about what auto insurance companies don’t tell you and remain compliant with state requirements.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Find Auto Insurance Agents in Texas

Explore auto insurance options across various cities in Texas, including Atascocita, San Antonio, and The Woodlands, to find the best coverage for your needs. From small towns like Cisco and Bandera to larger cities like San Antonio and Kyle, compare rates and services from local agents to secure the most suitable insurance policy.

The table offers a detailed list of Texas cities where auto insurance agents are located, making it a valuable resource for finding insurance assistance throughout the state. It serves as a practical guide to help you easily locate and connect with agents in your area.

Cheap Auto Insurance In Texas

Having proper auto insurance really is a no-brainer, and yet many Texans choose to take to the road without having an adequate policy to cover themselves should they end up in an accident. If you’re in the market for insurance, spend the time to do some research and find out what an auto insurance policy looks like, and the right coverage suit your needs and budget.

While using insurance is not something anyone desires, having the best Texas auto insurance coverage is essential when the need arises. To find affordable coverage, it’s advisable to compare quotes from various insurance providers, ensuring you select the option that offers the best value and protection for your needs.

Get the best auto insurance rates possible by entering your ZIP code below into our free comparison tool today.

Frequently Asked Questions

Who is known for the cheapest car insurance?

USAA is often recognized for offering the cheapest car insurance rates, especially for military members and their families. To gain profound insights, consult our extensive guide titled, “Affordable Full Coverage Auto Insurance.”

How much is car insurance in Texas per month?

Monthly car insurance rates in Texas vary widely by provider and coverage level, with costs ranging from as low as $22 to over $200 depending on your choice of insurance company and the type of coverage you select.

Does Texas require car insurance?

Yes, Texas law requires all drivers to carry a minimum level of car insurance to legally operate a vehicle on public roads.

Can I get Texas car insurance without a Texas license?

Generally, you need a valid Texas driver’s license to purchase car insurance in Texas, although some providers may offer coverage with a valid out-of-state license under certain conditions.

What is the best bundle insurance in Texas?

The best bundle insurance in Texas often involves combining auto and home coverage with providers like State Farm or Progressive for comprehensive protection and discounts.

For a thorough understanding, refer to our detailed analysis titled, “Affordable Comprehensive Auto Insurance Coverage.”

Can I use my Texas car insurance in another state?

Yes, Texas car insurance usually covers you in other states, but verify with your provider to ensure you’re fully covered.

Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

Why is Texas insurance so high?

Car insurance rates in Texas can be higher due to factors such as high population density, frequent accidents, and high repair costs, among others.

What is the cheapest full coverage car insurance in Texas?

USAA offers some of the lowest rates for full coverage car insurance in Texas, making it a cost-effective choice for those who qualify.

Can I self-insure my car in Texas?

Yes, Texas allows self-insurance for vehicles if you can demonstrate financial responsibility by meeting specific requirements, such as having a substantial cash deposit or surety bond.

For a comprehensive overview, explore our detailed resource titled, “Self-Insured Auto Insurance: An Affordable Alternative.”

Do I need comprehensive and collision insurance in Texas?

Comprehensive and collision insurance aren’t legally required in Texas but are recommended for extra protection against damage from accidents, theft, or natural disasters.

Get the best auto insurance rates possible by entering your ZIP code below into our free comparison tool today.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.