Cheap Tennessee Auto Insurance in 2025 (Lower Your Rates With These 10 Top Companies!)

USAA, State Farm, and Geico are the top providers for cheap Tennessee auto insurance with starting rates $18 monthly. These companies offer competitive pricing, excellent customer service, and various discounts tailored for young drivers, making them the top choices for affordable coverage.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage in Tennessee

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in Tennessee

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsUSAA, State Farm, and Geico are excellent choices for cheap Tennessee auto insurance in providing both competitive rates and extensive coverage.

Luckily, understanding cheap Tennessee auto insurance is not hard when it’s broken down. Knowing the difference between comprehensive vs. collision coverage is key to securing the best rates. Being informed can help you get the most value from your insurance policy.

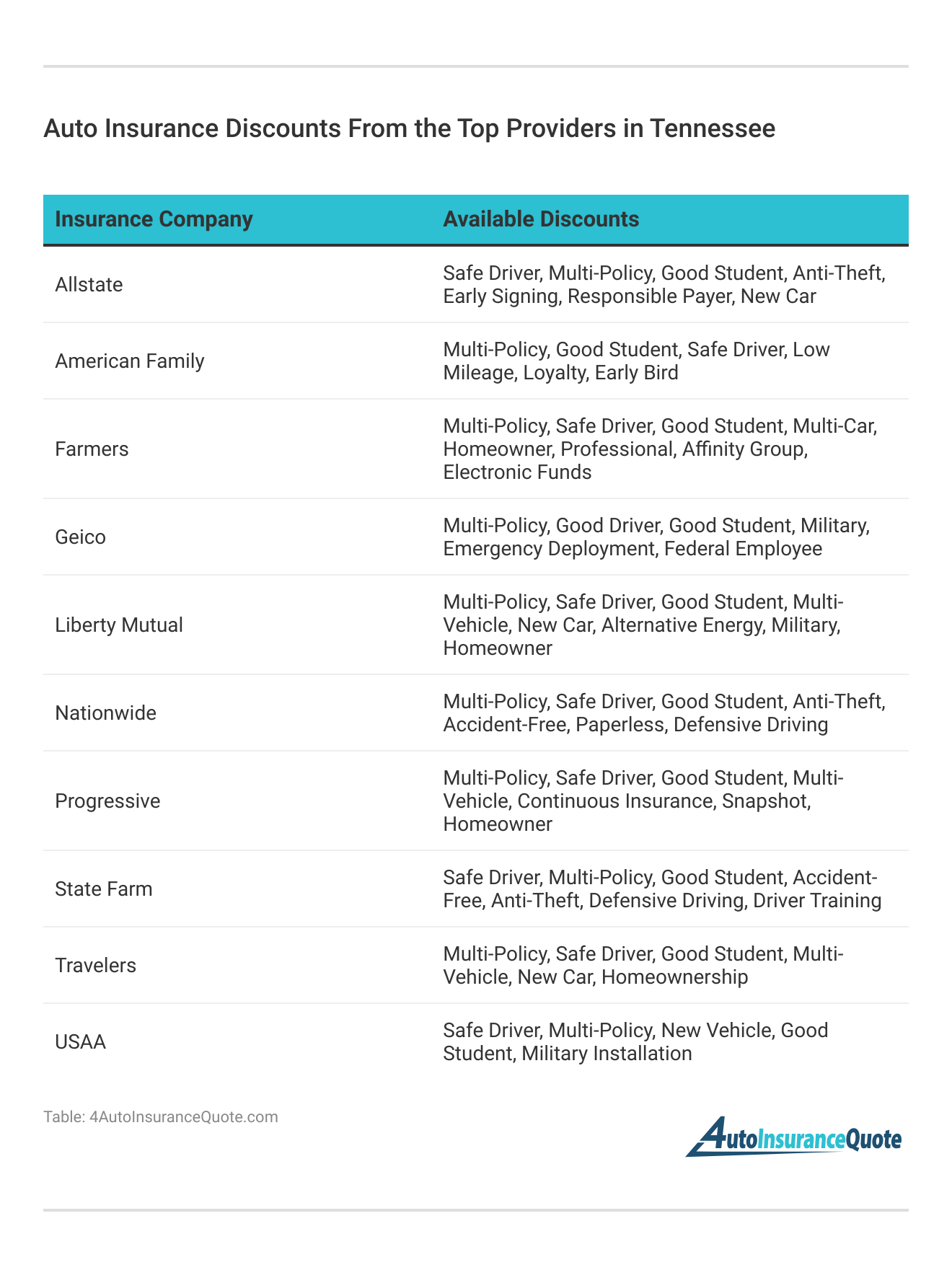

Our Top 10 Company Picks: Cheap Tennessee Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $18 | A+ | Military Members | USAA | |

| #2 | $22 | B | Reliable Claims | State Farm | |

| #3 | $24 | A++ | Affordable Rates | Geico | |

| #4 | $26 | A | Experienced Agents | Farmers | |

| #5 | $27 | A++ | Comprehensive Coverage | Travelers | |

| #6 | $29 | A+ | Online Tools | Progressive | |

| #7 | $32 | A | Customer Satisfaction | American Family | |

| #8 | $33 | A | Custom Policies | Liberty Mutual |

| #9 | $37 | A+ | Diverse Options | Nationwide |

| #10 | $45 | A++ | Personal Service | Allstate |

Before you buy Tennessee auto insurance, make sure you have compared rates. Enter your ZIP code now for the best Tennessee auto insurance quotes.

- Cheap Tennessee Auto Insurance

- cheap Tennessee auto insurance with an average rate of $18/mo

- Tennessee auto insurance requirements are 25/50/15

- Tennessee auto insurance rates can change based on your location

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#1 – USAA: Top Overall Pick

Pros

- Exclusive Benefits: Tailored services and discounts for military families, offering specialized options like deployment discounts, making it an excellent choice for military members seeking cheap Tennessee auto insurance.

- Comprehensive Coverage Options: Offers a wide range of coverage, including roadside assistance and rental reimbursement, allowing customers to customize their policies to fit their needs.

- Competitive Pricing: Offers some of the lowest premiums in the industry, making it an attractive option for those looking for cheap Tennessee auto insurance without sacrificing quality. Discover additional insights on Allstate vs. USAA.

Cons

- Limited Eligibility: Only available to military members and their families, restricting access for the general public.

- Fewer Local Agents: Limited physical office locations compared to other insurers, which can be inconvenient for those preferring in-person service.

#2 – State Farm: Best for Reliable Claims

Pros

- Reliable Claims Process: Known for smooth and efficient claims handling, ensuring quick and fair settlements in case of an accident.

- Multiple Discounts: Offers a variety of discounts, including multi-policy and safe driver discounts, helping customers save on premiums.

- Technology Integration: User-friendly mobile app and online tools for policy management, making it easy to access and manage insurance details. Learn more on State Farm auto insurance review.

Cons

- Higher Premiums: Often more expensive than some competitors, which may not align with the search for cheap Tennessee auto insurance.

- Coverage Limitations: Some coverage options may not be available in all areas, potentially limiting choices for specific needs.

#3 – Geico: Best for Affordable Rates

Pros

- Low Premiums: Offers some of the lowest rates, especially for good drivers, making it a go-to choice for cheap Tennessee auto insurance.

- Extensive Discounts: Wide range of discounts, including for safety features and good grades, providing additional savings opportunities.

- 24/7 Customer Service: Round-the-clock customer service availability ensures assistance whenever needed. Discover on Geico auto insurance review.

Cons:

- Limited Local Presence: Fewer local agents for in-person assistance, which might be a drawback for those who prefer face-to-face interaction.

- Mixed Reviews on Claims: Some customers report issues with the claims process, which could impact satisfaction.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Farmers: Best for Experienced Agents

Pros

- Personalized Service: Knowledgeable and experienced agents provide personalized advice, helping customers tailor their coverage to find cheap Tennessee auto insurance.

- Strong Financial Stability: Highly rated for financial strength and reliability, ensuring that claims will be paid promptly.

- Innovative Programs: Unique programs like “Signal,” which rewards safe driving, provide additional benefits and savings. Learn more through our “Farmers Auto Insurance Review.”

Cons

- Higher Costs: Generally, more expensive than budget-friendly competitors, which might not be ideal for those strictly looking for cheap Tennessee auto insurance.

- Limited Online Features: Somewhat less advanced online and mobile tools compared to competitors, potentially affecting ease of use.

#5 – Travelers: Best for Comprehensive Coverage

Pros

- Strong Customer Service: Highly rated for customer service and support, ensuring a positive experience from policy purchase to claims handling. Discover more on Travelers auto insurance review.

- Discounts for Hybrid Vehicles: Special discounts for eco-friendly and hybrid vehicles, promoting green driving and savings.

- Optional Add-ons: Various add-ons available, such as accident forgiveness and new car replacement, providing extra protection and peace of mind.

Cons

- Average Premiums: Rates can be higher than some low-cost providers, potentially conflicting with the goal of finding cheap Tennessee auto insurance.

- Less Accessible: Limited availability of local agents in some regions, which could be inconvenient for some customers.

#6 – Progressive: Best for Online Tools

Pros

- Snapshot Program: Usage-based insurance program that rewards safe driving, potentially lowering rates for cautious drivers looking for cheap Tennessee auto insurance.

- Comprehensive Online Tools: Strong online and mobile app for policy management and claims, making it easy for tech-savvy customers to manage their insurance.

- Price Comparison: Offers tools to compare their rates with competitors, helping customers find the best deal. Read more on Progressive auto insurance review.

Cons

- Mixed Customer Service Reviews: Some variability in customer service experiences, which could impact satisfaction.

- Higher Rates for High-Risk Drivers: Can be expensive for drivers with a poor driving record, which may not align with the search for cheap Tennessee auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – American Family: Best for Customer Satisfaction

Pros

- High Customer Satisfaction: Strong ratings for customer satisfaction and support, ensuring a positive and supportive experience.

- Family-Oriented Discounts: Special discounts for families, such as multi-vehicle and young driver discounts, making it a good choice for households.

- Safe Driving Programs: Offers programs like “KnowYourDrive” to encourage safe driving, potentially reducing premiums.

- Financial Stability: Highly rated for financial stability and claim payments, ensuring reliability. To find more visit American Family auto insurance review.

Cons

- Limited Availability: Not available in all states, including some parts of Tennessee, which could limit access.

- Higher Premiums for New Drivers: Can be more expensive for inexperienced drivers, which may not be ideal for those looking for cheap Tennessee auto insurance.

#8 – Liberty Mutual: Best for Custom Policies

Pros

- Customizable Coverage: Highly customizable policies to fit individual needs, offering flexibility to find cheap Tennessee auto insurance that covers specific requirements.

- New Car Replacement: Offers unique features like new car replacement and better car replacement, providing valuable benefits.

- Strong Financial Ratings: Solid financial stability and strong backing, ensuring reliable service. Learn more on our “Liberty Mutual Auto Insurance Review.”

Cons

- Mixed Reviews on Claims: Some customers report inconsistent claims experiences, which could affect satisfaction.

- Average Customer Service: Customer service can vary depending on the region, potentially impacting overall experience.

#9 – Nationwide: Best for Diverse Options

Pros

- Wide Range of Coverage: Offers extensive coverage options, including vanishing deductible and accident forgiveness, providing comprehensive protection.

- On Your Side Review: Annual review service to help customers optimize coverage and find savings, ideal for those seeking cheap Tennessee auto insurance.

- Strong Financial Ratings: Known for financial strength and reliability, ensuring secure and dependable coverage. Read more about it through Nationwide auto insurance review.

Cons

- Higher Premiums: Often more expensive than other providers, particularly for full coverage, which might not align with budget constraints.

- Mixed Digital Experience: Some users find the online and mobile experience less intuitive, which could affect ease of use.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – Allstate: Best for Personal Service

Pros

- Local Agents: Strong network of local agents for personalized service and support, helping customers navigate options for cheap Tennessee auto insurance.

- Drivewise Program: Usage-based insurance program that rewards safe driving, providing potential discounts for responsible drivers. Discover more on Allstate auto insurance review.

- Financial Stability: Strong ratings for financial stability and claim satisfaction, ensuring dependable service.

Cons

- Higher Premiums: Typically, higher rates compared to other insurers, which may not suit those strictly looking for cheap Tennessee auto insurance.

- Mixed Customer Reviews: Customer satisfaction can vary by location and agent, potentially affecting overall experience.

Tennessee Auto Insurance Requirements

First of all, many states require you to have a minimum amount of different types of auto insurance coverage to be financially responsible for an accident. These areas include bodily injury liability and property damage.

Tennessee Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $45 | $144 |

| American Family | $32 | $102 |

| Farmers | $26 | $86 |

| Geico | $24 | $78 |

| Liberty Mutual | $33 | $184 |

| Nationwide | $37 | $118 |

| Progressive | $29 | $92 |

| State Farm | $22 | $72 |

| Travelers | $27 | $88 |

| USAA | $18 | $58 |

All insurance providers have to comply with the state’s set minimums on the amount of coverage required for these three categories.

Bodily injury pays for injuries to the other driver, passengers, and pedestrians when you are at fault in an accident. For the state of Tennessee, the minimum for bodily injury per person is $25,000 and $50,000 per accident.

The other category of coverage is property damage liability insurance. This category covers all the expenses needed to repair or replace the other driver’s car or other property after an accident where you are at fault. The minimum set for this is $15,000.

Tennessee Auto Insurance Rates

The price for insurance varies greatly in Tennessee, however. Depending on where you’re located, the price can vary from $18 to $1,600.

On monthly, the price for auto insurance in Tennessee is about $18.

It’s shocking how the price fluctuates between rural Tennessee and major cities; major metropolitan areas like Memphis will have monthly insurance premiums of about $133, while other cities such as Nashville will offer the same insurance at about $100.

There are a lot of affordable instant auto insurance companies take into consideration when determining your rates. Take a look at our overview here. Enter your ZIP code today.

While many of these factors are simply based on your own driving record, two things that affect even the safest of drivers are age and gender. As with most states, males typically pay higher auto insurance rates than females.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Tennessee Driving Statistics

It’s important to remember that driving is oftentimes very dangerous and that you have to take great precautions on the road. From 2003 to 2007, a total of 675,545 people have been involved in some kind of auto accident.

In that same course of time, 48,000 people suffered from injuries, and more than 5,000 people were killed.

Even though you should be covered by some insurance policy, it’s very important to remember to be your safest on the road because of the high rates of incidents and keep anti-theft recovery systems on your vehicle.

Tennessee Auto Insurance Quotes

Looking for a place to get an insurance quote can oftentimes be difficult, so here at 4AutoInsuranceQuote.com we try to make things as simple as possible for you.

We can easily help you find the best auto insurance rates in Tennessee.Ty Stewart Licensed Insurance Agent

If you’re interested in getting a compare auto insurance quote for cheap Texas insurance policies in your area, just enter your ZIP code to begin.

Frequently Asked Questions

What are the minimum auto insurance requirements in Tennessee?

In Tennessee, the state’s minimum liability coverage requirements are 25/50/15. This means you must have at least $25,000 in bodily injury liability coverage per person, $50,000 in bodily injury liability coverage per accident, and $15,000 in property damage liability coverage.

Why is it important to compare quotes from multiple insurance companies?

Comparing quotes from multiple insurance companies allows you to find the best rates for your Tennessee auto insurance coverage.

Rates can vary significantly between companies, and by shopping around, you increase your chances of finding affordable insurance that meets your needs.

Should I only get the minimum required coverage?

While the state sets minimum coverage requirements, it’s not always recommended to only get the minimum. The cost of a serious accident can be high, so it’s advisable to purchase as much coverage as you can afford to adequately protect your assets and potential liabilities.

Check out more by comparaing auto insurance quotes by state for more information.

What factors affect auto insurance rates in Tennessee?

Several factors can affect your auto insurance rates in Tennessee, including your driving record, age, gender, location, type of vehicle, credit history, and the coverage options you choose. Insurance companies consider these factors when calculating your premium.

How do auto insurance rates vary in Tennessee?

Auto insurance rates in Tennessee can vary significantly depending on your location. On average, the price for auto insurance in Tennessee is about $1,000 per year.

However, rates can range from $900 to $1,600 depending on where you live, with major metropolitan areas generally having higher premiums. Enter your ZIP code now.

Does Tennessee have high auto insurance rates?

The average rate for auto insurance in Tennessee is $83/mo, which is on the lower side.

Know more insights on how to find your car’s make and model.

Is it illegal to not have auto insurance in Tennessee?

Yes, all drivers must have Tennessee auto insurance coverage.

Is Tennessee a no-fault state?

No, Tennessee is an at-fault state.

Stop overpaying for auto insurance. Enter your ZIP code below to find out if you can get a better deal.

What factors contribute to finding cheap Tennessee auto insurance?

Factors include age, gender, driving history, location, vehicle type, credit score, and available discounts. Comparing quotes from multiple providers can also help find the best rates.

Know more insights on how to find your car’s make and model.

Is it advisable to only purchase the minimum required coverage for cheap Tennessee auto insurance?

While it lowers premiums, minimum coverage may not be enough in serious accidents. It’s often wise to consider additional coverage for better protection.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.