Cheap Minnesota Auto Insurance in 2025 (Earn Savings With These 10 Companies)

Cheap Minnesota auto insurance starts at $27/month with our top providers like State Farm, Geico, and American Family, offering the best rates. These insurers excel in overall value, at the top for local agents, and in bundling policies. Compare these options to find affordable Minnesota insurance and save.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Min. Coverage in Minnesota

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage in Minnesota

A.M. Best Rating

Complaint Level

The best options for cheap Minnesota auto insurance are State Farm, Geico, and American Family, with rates starting as low as $27 per month.

With so many drivers on the road, it’s very important to be well-informed and properly insured. Understanding auto insurance is key to making sure you’re covered in Minnesota.

Our Top 10 Company Picks: Cheap Minnesota Auto Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $27 B Teen Discounts State Farm

#2 $37 A++ Cheap Rates Geico

#3 $38 A Loyalty Rewards American Family

#4 $39 A++ Coverage Options Travelers

#5 $41 A+ Competitive Rates Progressive

#6 $43 A+ Tailored Policies The Hartford

#7 $44 A Customizable Policies Farmers

#8 $54 A High-Risk Coverage The General

#9 $65 A+ Customer Service Allstate

#10 $153 A Multi-Policy Discounts Liberty Mutual

To find affordable Minnesota auto insurance right now, enter your ZIP code above.

You’ll get fast, free Minnesota auto insurance quotes from top companies.

- Minnesota auto insurance rates average $27/month

- Rates are higher in major cities like Minneapolis and Saint Paul

- Compare rates from different companies to find the best insurance deals

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Affordable Coverage: Provides some of the cheapest Minnesota auto insurance rates, with an average monthly rate of $27. This low cost makes State Farm a strong contender for budget-conscious drivers looking for economical insurance. Delve more through our State Farm insurance review.

- Teen Driver Discounts: Offers significant discounts for teen drivers, which contributes to affordable coverage for families. This helps make State Farm a practical choice for parents seeking cheap Minnesota auto insurance for young drivers.

- Comprehensive Coverage Options: Features a range of coverage options at competitive rates, ensuring you get thorough protection at an affordable price. Their extensive offerings contribute to making State Farm a reliable option for cheap Minnesota auto insurance.

Cons

- Higher Premiums for Young Drivers: Rates can be higher for younger drivers compared to some competitors, making it less ideal for families with teen drivers seeking cheap Minnesota auto insurance. Despite their overall affordability, young drivers might face increased costs.

- Limited Online Tools: Less advanced digital tools for managing policies and claims compared to some insurers, which could impact the ease of managing cheap Minnesota auto insurance online. This may be a drawback for those who prefer digital convenience.

#2 – Geico: Best for Cheap Rates

Pros

- Competitive Rates: Known for offering some of the lowest rates in the industry, making it a top choice for cheap Minnesota auto insurance. With an average monthly rate of $37, Geico provides budget-friendly coverage without sacrificing quality.

- Strong Mobile App: Offers a user-friendly app for managing policies and claims, which supports the convenience of cheap Minnesota auto insurance management on the go. The app facilitates easy access to policy information and claims processing.

- Discounts for Bundling: Provides substantial savings for bundling auto with other insurance types, which can further reduce the cost of cheap Minnesota auto insurance. This bundling option helps maximize overall savings. Read more through our Geico insurance review.

Cons

- Limited Personal Service: Fewer opportunities for personalized service and local agents, which may affect the level of customization for cheap Minnesota auto insurance. This lack of local presence could be a downside for those preferring face-to-face interactions.

- Average Customer Service: Mixed reviews on customer service quality can affect your experience, which may impact your satisfaction with cheap Minnesota auto insurance. Some users report less favorable experiences with support and claims handling.

#3 – American Family: Best for Loyalty Rewards

Pros

- Loyalty Rewards: Offers rewards and discounts for long-term customers, contributing to cheaper Minnesota auto insurance for those who stay with American Family. This program benefits loyal customers with lower premiums over time.

- Strong Coverage Options: Provides comprehensive coverage options at competitive rates, making it a solid choice for cheap Minnesota auto insurance. The variety of coverage ensures protection that fits various needs.

- High Customer Satisfaction: Praised for excellent customer service and claims handling, enhancing the overall experience with cheap Minnesota auto insurance. Their high ratings reflect their commitment to customer satisfaction. Learn more through our American Family auto insurance review.

Cons

- Higher Rates for High-Risk Drivers: Premiums can be higher for drivers with a poor history, making it less ideal for those seeking cheap Minnesota auto insurance with a high-risk profile. This could lead to increased costs for high-risk individuals.

- Limited Availability: Coverage might not be available in all states, which could be a limitation for those looking for cheap Minnesota auto insurance if relocating or traveling. This may restrict your options if you move outside their service areas.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Travelers: Best for Coverage Options

Pros

- Extensive Coverage Options: Offers a wide range of coverage options, ensuring you can find affordable protection that meets your needs for cheap Minnesota auto insurance. Their variety allows for comprehensive coverage at competitive rates.

- Discounts for Safety Features: Provides savings for vehicles equipped with advanced safety features, contributing to lower premiums for cheap Minnesota auto insurance. These discounts can reduce the cost of coverage for safer vehicles.

- Strong Financial Stability: High financial strength ratings, ensuring reliable claims payment and stability in providing cheap Minnesota auto insurance. This stability contributes to confidence in their ability to handle claims effectively. Look for more details through our Travelers insurance review.

Cons

- Customer Service Concerns: Some reports of slower response times and customer service issues may affect your experience with cheap Minnesota auto insurance. Service quality can vary, impacting overall satisfaction.

- Higher Rates for Certain Vehicles: Premiums can be higher for luxury or high-performance vehicles, which might not be ideal for those seeking cheap Minnesota auto insurance for such cars. This can result in increased costs for insuring high-value vehicles.

#5 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates: Known for offering highly competitive pricing, making it a strong choice for cheap Minnesota auto insurance. Their average monthly rate of $41 provides affordable options for various drivers. Find out more through our Progressive insurance review.

- Snapshot Program: Features a usage-based insurance program that can lower premiums based on your driving habits, helping to find cheap Minnesota auto insurance through safe driving. This program rewards cautious drivers with potential discounts.

- Strong Online Tools: Comprehensive online tools and resources for managing policies, supporting the convenience of cheap Minnesota auto insurance management. Their user-friendly website and mobile app enhance policy management and claims processing.

Cons

- Inconsistent Customer Service: Variable customer service reviews can impact your experience with cheap Minnesota auto insurance. Some users report issues with service quality, which may affect overall satisfaction.

- Complex Pricing Structure: The pricing structure can be complicated with numerous discounts and options, making it challenging to understand the final premium for cheap Minnesota auto insurance. This complexity may require additional effort to navigate.

#6 – The Hartford: Best for Tailored Policies

Pros

- Tailored Policies: Offers customizable policies to fit your needs, ensuring you get the best value for cheap Minnesota auto insurance. Their flexibility allows for a more personalized insurance experience at an affordable price.

- Great for AARP Members: Provides special discounts and benefits for AARP members, making it a top choice for cheap Minnesota auto insurance for eligible individuals. This focus on AARP members includes exclusive perks and savings.

- Strong Customer Service: High ratings for customer service and claims handling contribute to a positive experience with cheap Minnesota auto insurance. Their A+ rating from A.M. Best reflects their commitment to excellent service. Read more through our “How can I cancel my auto insurance policy with The Hartford“?

Cons

- Higher Rates for Young Drivers: Premiums can be higher for younger drivers, which may not be ideal for those seeking cheap Minnesota auto insurance for teen drivers. Families with young drivers might face increased costs.

- Limited Discounts: Fewer discount options compared to some competitors, which could limit potential savings for cheap Minnesota auto insurance. This could reduce opportunities for lowering your overall premiums.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – Farmers: Best for Customizable Policies

Pros

- Customizable Policies: Provides extensive options for tailoring policies, ensuring that you can find affordable coverage that suits your needs for cheap Minnesota auto insurance. This flexibility helps meet diverse insurance requirements.

- Good Claims Handling: High satisfaction with claims handling and customer service enhances the experience of obtaining cheap Minnesota auto insurance. Farmers’ A rating from A.M. Best supports their reputation for reliability.

- Multiple Discounts: Various discounts available, including for bundling and safety features, contribute to lower premiums for cheap Minnesota auto insurance. These discounts are designed to provide significant savings. Read more through our Farmers auto insurance review.

Cons

- Higher Premiums for High-Risk Drivers: Rates can be higher for drivers with a history of incidents, making it less ideal for those seeking cheap Minnesota auto insurance with a high-risk profile. This could lead to increased costs for high-risk individuals.

- Complex Policy Options: The range of policy options can be overwhelming, which may complicate finding the best cheap Minnesota auto insurance. The complexity of choices might require additional time and effort to understand.

#8 – The General: Best for High-Risk Coverage

Pros

- High-Risk Coverage: Specializes in providing coverage for high-risk drivers, making it a suitable option for cheap Minnesota auto insurance for those with challenging insurance histories. Their focus helps make coverage accessible for high-risk individuals.

- Flexible Payment Plans: Offers a variety of payment options to fit different financial situations, supporting the affordability of cheap Minnesota auto insurance. This flexibility helps manage your insurance expenses effectively.

- Simple Application Process: Features an easy and straightforward application process, which helps in obtaining cheap Minnesota auto insurance quickly. The simplicity of their process facilitates faster coverage. Read more through our “Affordable Instant Auto Insurance Quotes“.

Cons

- Limited Discounts: Offers fewer discounts compared to some competitors, which may limit potential savings for cheap Minnesota auto insurance. This could reduce opportunities to further lower premiums.

- Mixed Customer Reviews: Some customers report issues with service and claims handling, which might impact your experience with cheap Minnesota auto insurance. The mixed reviews could affect overall satisfaction.

#9 – Allstate: Best for Customer Service

Pros

- Comprehensive Coverage Options: Provides a range of coverage options tailored to different needs, ensuring you can find affordable protection with cheap Minnesota auto insurance. Their extensive offerings help meet various insurance requirements.

- Excellent Customer Service: Known for high-quality customer service and claims handling, which enhances the overall experience of obtaining cheap Minnesota auto insurance. Positive reviews reflect their commitment to customer satisfaction. Read more through our Allstate insurance review.

- Various Discounts Available: Offers multiple discounts, including those for safe driving and bundling, which help reduce premiums and make cheap Minnesota auto insurance more affordable. These discounts can contribute significantly to lowering your costs.

Cons

- Higher Premiums for Some Drivers: Rates can be higher for certain drivers, including those with less favorable driving histories, which may affect the affordability of cheap Minnesota auto insurance. This could result in increased costs for high-risk individuals.

- Complex Policy Options: The range of policy options and add-ons can be complex, making it challenging to determine the most cost-effective choice for cheap Minnesota auto insurance. This complexity might require extra effort to navigate.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Multi-Policy Discounts

Pros

- Multi-Policy Discounts: Offers significant savings when bundling auto insurance with other types of policies, contributing to cheaper Minnesota auto insurance for those with multiple insurance needs. This bundling option helps maximize overall savings.

- Customizable Coverage: Provides a variety of customizable coverage options, allowing you to tailor your policy to fit your needs while maintaining affordable rates for cheap Minnesota auto insurance. This flexibility ensures that you get the protection you need. Read more through our Liberty Mutual auto insurance review.

- Strong Financial Stability: High financial strength ratings ensure reliability and stability in handling claims, supporting the trustworthiness of cheap Minnesota auto insurance. This financial strength provides confidence in their ability to manage claims effectively.

Cons

- Higher Base Rates: Initial base rates can be higher compared to some competitors, which might impact the affordability of cheap Minnesota auto insurance if you don’t qualify for significant discounts. This could lead to increased costs for those without qualifying discounts.

- Limited Local Agents: Fewer local agents compared to some competitors might impact the level of personalized service and support, which can be a drawback for those seeking cheap Minnesota auto insurance with local assistance. This could affect the accessibility of tailored advice.

Minnesota Auto Insurance Requirements

When it comes to insurance, a state usually has to follow one of two systems, a tort system or a no-fault auto insurance system. The state of Minnesota has a no-fault system, which makes it so that any injury claims will be paid by your insurance company regardless of who was at fault.

Of course, the amount they pay is capped at a certain limit, but payments for injury claims will still be paid to their maximum limit. Because the state follows a no-fault system, it makes it harder for the person who wasn’t at fault to sue for more payments.

Minnesota Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $65 $160

American Family $38 $93

Farmers $44 $108

Geico $37 $90

Liberty Mutual $153 $375

Progressive $41 $101

State Farm $27 $67

The General $54 $232

The Hartford $43 $113

Travelers $39 $94

But even with a no-fault system, the state of Minnesota still has a set of minimum limits for liability. The first set of limits are minimum requirements for bodily injury liability and property damage liability. These liabilities are required by the state to cover for any damages to people in the other vehicle when you are at fault.

The minimum for bodily injury is $30,000 per person and $60,000 for all people injured in the accident.

The state also requests a minimum of $10,000 in coverage for property damage. This would cover any damages to the other person’s car in an accident where you are at fault. Once again, these listed values are minimum requirements, so they may not always be enough to cover everything you need.

With these liability limits, the state also requires all insured drivers to have personal injury protection insurance (PIP). This coverage helps to pay for any immediate medical expenses for you and your passengers regardless of fault. The minimum coverage required here is $40,000 total (20,000 for medical coverage and 20,000 for loss of income coverage).

Another important requirement is uninsured/underinsured motorist bodily injury. This coverage prevents you from paying out of pocket if you find yourself in a car accident with an uninsured driver or a driver who doesn’t have enough coverage. The minimum requirement for bodily injury is at least $25,000 per person and $50,000 per accident.

Auto Insurance Rates for Minnesota

Because Minnesota is a no-fault state, the insurance rates are a bit higher when compared to other states. This is partly because the insurance company always has to pay out on claims even if you’re not at fault. This extra pressure on the insurance company can raise the price of insurance, as can fraud, which is more common with no-fault insurance.

When looking at the prices of auto insurance from a distance, the premiums don’t seem too bad. The average rate in Minnesota is about $27, which is roughly $300 less than the national average and makes it easier to find affordable auto insurance.

This average rate also covers the rural areas, whereas a majority of Minnesota’s population is in the cities. In the cities, the insurance rates aren’t as pretty. In both major cities, Minneapolis and Saint Paul, the prices are about $27 each — about $300 more than the national average.

The way prices fluctuate between urban and rural areas is extreme, so it’s always a good idea to look deeper before making a snap call and canceling your auto insurance right away.

While many of these factors are simply based on your own driving record, two things that affect even the safest of drivers are age and gender. As with most states, males typically pay higher auto insurance rates than females. Enter your ZIP code now to begin comparing.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

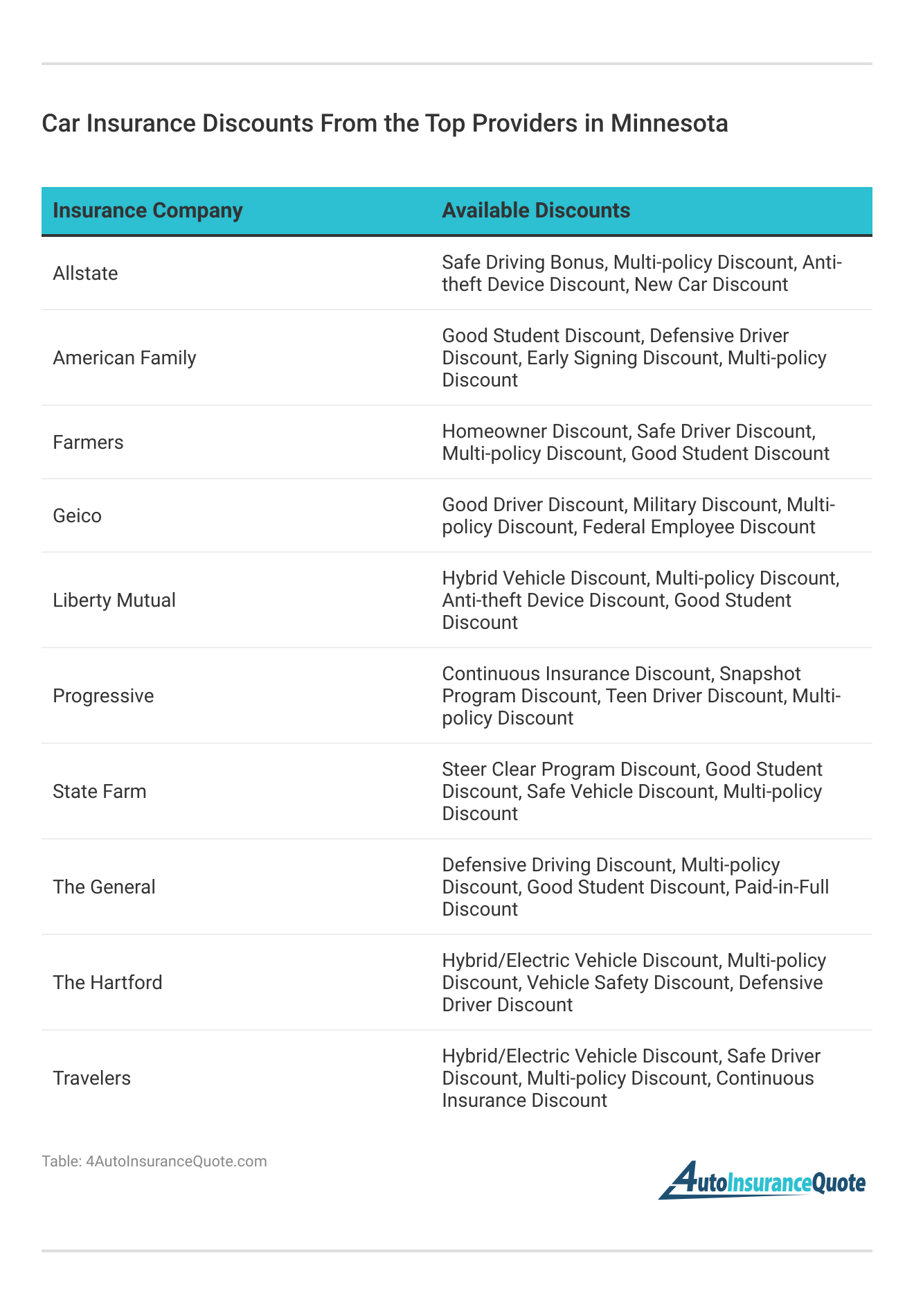

Minnesota Auto Insurance Companies

Most of the top auto insurance companies in the nation operate in Minnesota, offering a range of options for drivers. While the state generally boasts affordable auto insurance rates, the rates can differ significantly among the largest insurers.

By comparing quotes from these major companies, you can find the best Minnesota auto insurance rates tailored to your specific needs and preferences.

This comparison helps ensure you get the best coverage at the most competitive price. If you decide to switch providers, it’s also important to know how to cancel auto insurance with your current insurer properly to avoid any gaps in coverage or unnecessary charges.

Additional Minnesota Auto Insurance Information

There are a lot of factors that auto insurance companies take into consideration when determining your rates (read about how car insurance rates are calculated for more information).

Schimri Yoyo

Licensed Agent & Financial Advisor

Ready to find cheap Minnesota auto insurance rates? Just enter your ZIP code for free quotes from top Minnesota auto insurance companies.

Frequently Asked Questions

What are the minimum auto insurance requirements in Minnesota?

Minnesota requires drivers to have 30/60/10 liability coverage, which means a minimum of $30,000 bodily injury liability per person, $60,000 bodily injury liability per accident, and $10,000 property damage liability.

Is personal injury protection (PIP) coverage mandatory in Minnesota?

Yes, Minnesota requires drivers to carry personal injury protection (PIP) coverage. The minimum PIP coverage required is $40,000, which includes $20,000 for medical coverage and $20,000 for loss of income coverage. Enter your ZIP code now to begin.

What is uninsured/underinsured motorist coverage and is it required in Minnesota?

Are comprehensive and collision coverage required in Minnesota?

Comprehensive and collision coverage are not required by law in Minnesota. However, if you have a car loan or lease, your lender or leasing company may require you to carry these coverages.

What is the average cost of auto insurance in Minnesota per month?

The average auto insurance rate in Minnesota is around $96 per month, which is lower than the national average. However, rates can vary depending on factors such as your age, driving record, and the type of car you drive. Enter your ZIP code now to begin.

Is it illegal to not carry auto insurance in Minnesota?

Yes, you must have Minnesota’s required minimum auto insurance to drive legally. If you’re wondering how much auto insurance coverage do I need beyond the minimum, it’s essential to assess your personal needs and risks.

Higher coverage limits or additional types of coverage may offer better protection and peace of mind depending on your circumstances.

What makes State Farm a top choice for cheap Minnesota auto insurance?

State Farm is renowned for its affordable rates, starting as low as $27 per month, which is ideal for budget-conscious drivers. Additionally, its extensive network of local agents helps provide personalized service and teen driver discounts.

How does Geico’s rating affect its affordability for cheap Minnesota auto insurance?

Geico boasts an A++ rating for financial strength, which supports its ability to offer some of the cheapest rates, starting at $37 per month. This strong rating also indicates reliable claims handling and overall stability. Enter your ZIP code now to begin.

What benefits do American Family’s loyalty rewards offer for cheap Minnesota auto insurance?

American Family provides loyalty rewards that can lower premiums for long-term customers, making it a great option for those seeking cheap Minnesota auto insurance.

These rewards can include discounts and perks that reduce overall insurance costs. Additionally, their strong support in handling auto insurance claims can streamline the process and offer added peace of mind.

How do Travelers’ coverage options contribute to its ranking for cheap Minnesota auto insurance?

Travelers offers a wide range of coverage options, allowing customers to tailor their policies to fit their needs and budget. This flexibility can help ensure that drivers get affordable coverage that suits their specific requirements.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.