How much do Liberty Mutual auto insurance rates increase after an accident? (2025)

Liberty Mutual auto insurance rates may increase by around 52% after an accident, depending on fault and severity. Accident forgiveness can help drivers avoid a Liberty Mutual rate increase if their policy stays claim-free for five years. Learn how Liberty Mutual accident forgiveness works to keep rates low here.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Jan 3, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 3, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Expect your Liberty Mutual auto insurance rates to increase by around 52% after an accident, though it depends on fault, severity, and driving history.

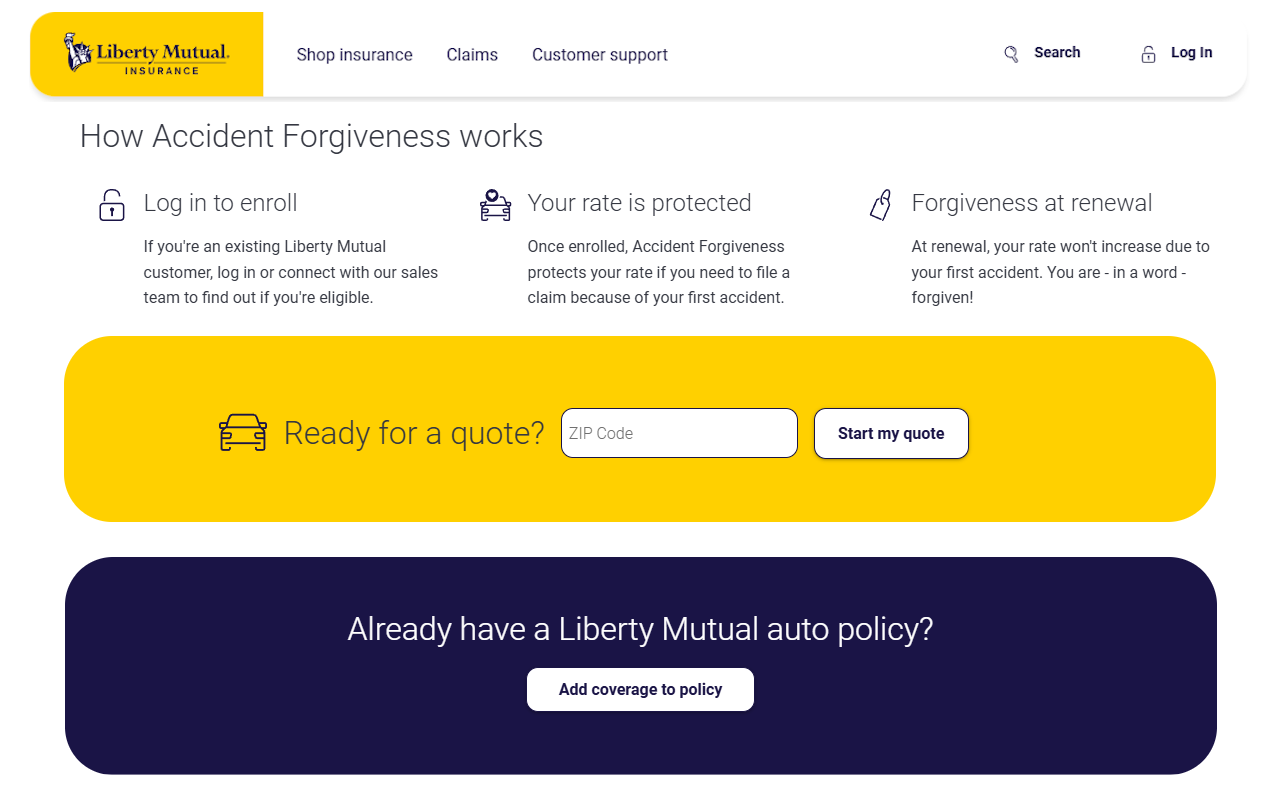

Liberty Mutual’s accident forgiveness program helps certain people with their insurance avoid higher costs after having one accident, as long as they do not make any claims for five years. Check out the full Liberty Mutual auto insurance review today.

Without accident forgiveness, even small claims or accidents that not your fault can still make your rate go up. Stop overpaying for auto insurance. Enter your ZIP code to find out if you can get a better deal.

- Claims may increase Liberty Mutual rates by up to 52%

- Accident forgiveness prevents hikes for claim-free policies

- Non-fault claims can still impact your auto insurance rate

Liberty Mutual Rates Can Go Up Over 50% After an Accident

Your Liberty Mutual insurance cost may increase by up to 52%, depending on accident severity, fault, and driving history. However, Liberty Mutual offers accident forgiveness to drivers with a claim-free record for five years, helping prevent rate hikes after their first accident.

It is important to note that this applies to the policy, not the driver, so if one driver on a shared policy caused an accident in the past five years, then accident forgiveness will not be available for other named drivers.

Auto Insurance Monthly Rates by Driving Record & Provider| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $195 | $240 | $290 | $450 | |

| $180 | $220 | $270 | $420 | |

| $170 | $210 | $260 | $400 | |

| $130 | $160 | $200 | $350 | |

| $210 | $260 | $320 | $480 |

| $145 | $180 | $230 | $390 |

| $155 | $190 | $240 | $400 | |

| $140 | $170 | $220 | $370 | |

| $165 | $200 | $250 | $410 | |

| $115 | $145 | $175 | $290 |

Without accident forgiveness, the exact amount that your rate might increase depends on whether you were at fault, how much damage was caused, your history as a driver, and whether you are a repeat offender. Even if you are making a claim for a minor accident or for an accident where you were not at fault, your rate might be affected — though less than it would be if you were at fault.

How long does it take for an accident to get off your record? Generally, you are looking at between three and seven years, depending on where you live and who your insurance company is. For Liberty Mutual, your rates will stay elevated for three to five years.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Comparing Liberty Mutual Claims Processing Efficiency

The table shows top auto insurance companies’ average days to process claims. This helps people understand how fast each insurer works when handling a claim, which is essential during emergencies. With this information, drivers can choose an insurance company that processes claims quickly and efficiently.

Auto Insurance Average Claims Length by Provider| Insurance Provider | Average Claims Length (Days) |

|---|---|

| 25 | |

| 21 | |

| 22 | |

| 14 | |

| 30 |

| 19 |

| 20 | |

| 18 | |

| 24 | |

| 10 |

USAA is the quickest way to process claims, taking only 10 days. Next in line is Geico, with a 14-day average. Liberty Mutual takes around 30 days on average to process claims, making it one of the slower choices. Companies such as State Farm and Nationwide are in the middle range, with processing times usually taking 18 to 25 days.

Liberty Mutual’s claims process typically resolves faster than the average 30-day industry timeline. However, it all depends on the complexity and severity of your case.Daniel Walker Licensed Insurance Agent

The table shows six ways to keep track of your claim. These include using the online portal and mobile app, which let you log in quickly to see updates. You can also get notifications by email and text for instant alerts about your claim status.

Ways to Track Your Liberty Mutual Auto Insurance Claim| Tracking Method | Details |

|---|---|

| Online Portal | Log in to your account on the Liberty Mutual website |

| Mobile App | Use the app to check status and upload documents |

| Email Notifications | Get real-time updates via email |

| Phone Support | Call 1-800-2CLAIMS for assistance |

| Assigned Claims Adjuster | Contact your claims adjuster for updates |

| Text Notifications | Sign up for alerts sent to your phone |

For people who like personal help, calling Liberty Mutual’s phone support or talking to your claims adjuster directly is a good way. These ways make sure you stay updated and manage your claim more efficiently.

Read more: How to Check the Status of an Auto Insurance Claim

Switching Providers After a Liberty Mutual Claim

When facing a hefty rate increase after an accident with Liberty Mutual, it might be tempting to ask if you can switch auto insurance companies after an accident. The short answer is yes. However, before making the switch, it’s important to:

- Settle Open Claims: If you have an open car insurance claim with Liberty Mutual, continue working with your adjuster until it’s fully processed to avoid issues. Check out our guide titled, “What is a claims adjuster’s role in the auto insurance claims process?” to better understand the claims process.

- Get New Coverage Before Canceling: Don’t cancel your Liberty Mutual policy until you’ve secured a new one to avoid a coverage lapse. Read our step-by-step guide, titled, “How to Cancel Your Auto Insurance,” to learn the best way to switch policies without a gap in coverage.

You are still likely to have an increase in your monthly rate after an accident, even if you move to a new insurer.

You have to tell your insurer about old car accidents, and the new company will take this information into account when calculating your rate. It’s illegal to lie about past accident history.

Rate Increases After an Accident Claim With Liberty Mutual

After an accident, your rate is likely to increase if you file a claim with Liberty Mutual unless you qualify for accident forgiveness. If the accident is your fault, you do not qualify for accident forgiveness, and you are a repeat offender, you are looking at an increase of up to 52% for up to five years.

If you are not at fault, your rate might still be affected but will increase as dramatically as it would if the accident was your fault. Discover what happens if fault can’t be determined after a car accident. Explore your auto insurance options by entering your ZIP code into our free comparison tool today.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Frequently Asked Questions

Is Liberty Mutual good at paying claims?

Liberty Mutual is known for its efficient auto insurance claims process, often resolving claims faster than many competitors while maintaining clear communication.

Is Liberty Mutual insurance high?

Liberty Mutual’s insurance rates vary based on factors like your driving history and location, but they are competitive with industry averages.

How long does Liberty Mutual take to process claims?

Liberty Mutual typically processes claims within 7-21 days, depending on the claim’s complexity and documentation provided. Avoid expensive auto insurance premiums by entering your ZIP code to see the cheapest rates for you.

What is cheaper than Liberty Mutual?

Companies like Geico or Progressive may offer lower monthly rates for drivers with clean records, but it depends on individual circumstances.

Who owns Liberty Mutual insurance?

Liberty Mutual is a mutual company owned by its policyholders rather than public shareholders. Gain clarity by understanding how auto insurance works effectively.

What is the Liberty Mutual insurance rating?

Liberty Mutual holds strong financial ratings, such as an “A” rating from A.M. Best, reflecting its reliability and stability.

What is the claim settlement ratio for Liberty insurance?

Liberty Mutual has a high claim settlement ratio, resolving most claims efficiently and fairly.

How to claim Liberty insurance?

To file a claim, use the Liberty Mutual mobile app or online portal or call 1-800-2CLAIMS for quick assistance.

Who is Liberty Mutual’s biggest competitor?

Major competitors include Geico, State Farm, and Progressive, offering similar coverage and rates. Explore our guide to the cheapest auto insurance companies today.

Who is Liberty Mutual’s sister company?

Liberty Mutual operates subsidiaries like Safeco Insurance, which provides personal auto and homeowners policies.

Do I need to pay the excess if it is not my fault in Liberty Mutual insurance?

If you’re not at fault and the other party is liable, Liberty Mutual typically waives the excess fee, depending on your policy terms.

What factor affects Liberty Mutual insurance premiums the most?

Your driving history impacts Liberty Mutual insurance premiums, location, vehicle type, and chosen coverage.

How do you calculate the Liberty Mutual insurance premium formula?

Liberty Mutual calculates premiums based on risk factors such as your age, driving record, vehicle value, and coverage options. Find out how the auto insurance company determines my premium accurately.

What is Liberty Mutual’s application rate?

Liberty Mutual offers competitive monthly rates based on individual risk factors and selected coverage levels.

What is the waiting period for claims in Liberty Mutual?

Liberty Mutual typically begins processing claims immediately, most settled within 7-21 days.

What is the deductible for Liberty Mutual insurance?

The deductible for Liberty Mutual insurance varies by policy, typically ranging from $500 to $1,000, depending on your chosen coverage.

Will your Liberty Mutual insurance go up if I have protected no claims?

With protected no claims, your Liberty Mutual insurance rate generally won’t increase after an accident, provided you meet eligibility requirements. See how the best claims-free auto insurance discounts can save you money.

Does claiming on travel insurance affect future premiums in Liberty Mutual?

Filing a travel insurance claim with Liberty Mutual doesn’t usually impact auto or home insurance premiums but may affect future travel coverage costs.

Should I file a claim if it’s not my fault in Liberty Mutual?

Yes, you should file a claim with Liberty Mutual to ensure proper coverage, but the other party’s insurer will typically handle the costs.

Is it better to have high or low excess under Liberty Mutual?

A high excess lowers monthly premiums, while a low excess reduces out-of-pocket costs during claims; choose based on your financial preferences. Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.