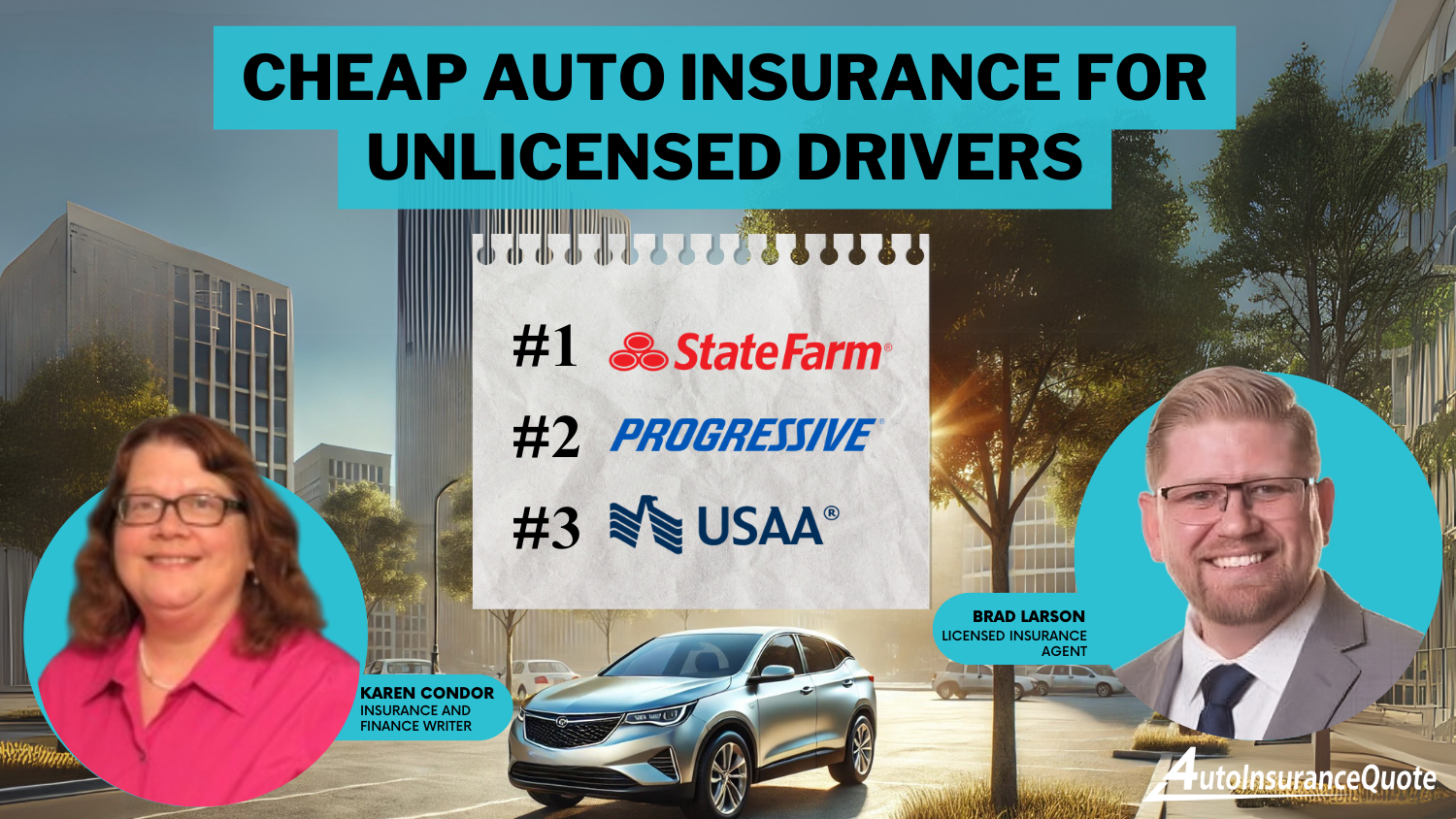

Cheap Auto Insurance for Unlicensed Drivers in 2025 (10 Most Affordable Providers)

State Farm, Progressive, and USAA are the top providers of cheap auto insurance for unlicensed drivers, starting at $40 per month. These top providers ensure unlicensed drivers can find affordable and reliable coverage options, making them the best choices for maintaining necessary insurance without a valid license.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Jan 20, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 20, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,128 reviews

13,128 reviewsCompany Facts

Min. Coverage for Unlicensed Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

13,128 reviews

13,128 reviews 6,435 reviews

6,435 reviewsCompany Facts

Min. Coverage for Unlicensed Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

6,435 reviews

6,435 reviewsThe cheap auto insurance for unlicensed drivers is offered by the top providers State Farm, Progressive, and USAA. These top providers offer comprehensive coverage with rates starting at $40 per month. State Farm stands out as the best overall for its affordable rates and reliable service.

Progressive and USAA also offer excellent options, with discounts and flexible coverage plans tailored for unlicensed drivers. Whether you need coverage for a suspended license, a vintage car, or someone else driving your vehicle, these companies provide the best options to ensure your car is protected.

Our Top 10 Company Picks: Cheap Auto Insurance for Unlicensed Drivers| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $40 | A++ | Solid Reputation | State Farm | |

| #2 | $45 | A++ | Military Discount | Progressive | |

| #3 | $50 | A+ | Flexible Options | USAA | |

| #4 | $52 | A | Roadside Assistance | Nationwide |

| #5 | $53 | A+ | Multiple Discounts | The Hartford |

| #6 | $55 | A+ | Claims Process | AAA |

| #7 | $58 | A | Personalized Service | Farmers | |

| #8 | $60 | A | Customized Policies | Liberty Mutual |

| #9 | $62 | A+ | Online Convenience | Allstate | |

| #10 | $65 | A | Financial Strength | Metlife |

To find the best auto insurance companies in your area that offer coverage to people without a driver’s license, you should shop online and compare quotes. Doing so will help you determine which company provides the coverage you want for the best price.

The best way to get the cheapest auto insurance coverage is to get multiple quotes to compare. Use our free tool to get multiple temporary car insurance quotes.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: State Farm provides a substantial discount for low-mileage usage.

- Wide Coverage: State Farm offers various coverage options tailored for different business needs. Learn more in our State Farm auto insurance review.

Cons

- Limited Multi-Policy Discount: The multi-policy discount of State Farm is not as high compared to some competitors.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels.

#2 – Progressive: Best for Military Discount

Pros

- Competitive Rates: Progressive offers some of the most competitive rates for unlicensed drivers. Read up on the Progressive auto insurance review for more information.

- Snapshot Program: Drivers can save with Progressive’s Snapshot program that tracks driving habits.

- Extensive Online Tools: Progressive provides a range of online tools to help manage policies and claims.

Cons

- Customer Service: Some customers report mixed experiences with Progressive’s customer service.

- High Premiums for High-Risk Drivers: Progressive’s rates can be high for drivers considered high-risk.

#3 – USAA: Best for Flexible Options

Pros

- Member-Only Benefits: USAA offers exclusive benefits to military members and their families.

- Exceptional Customer Service: USAA is known for its high customer satisfaction ratings. See more details on what information do I need to provide when filing an auto insurance claim with USAA.

- Flexible Payment Options: USAA provides flexible payment options to accommodate various financial situations.

Cons

- Limited Availability: USAA is only available to military members and their families.

- Higher Premiums: Premiums can be higher compared to other providers for non-military drivers.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Roadside Assistance

Pros

- Roadside Assistance: Nationwide offers comprehensive roadside assistance services. Learn more on how do I file an auto insurance claim with Nationwide.

- Vanishing Deductible: Drivers can benefit from a vanishing deductible program that rewards safe driving.

- Wide Range of Discounts: Nationwide provides various discounts that can help reduce premiums.

Cons

- Limited Local Agents: Availability of local agents may be limited in some areas.

- Digital Experience: Some users report that Nationwide’s digital tools and online experience are less robust than competitors.

#5 – The Hartford: Best for Multiple Discounts

Pros

- Multiple Discounts: The Hartford offers a wide range of discounts for different circumstances.

- AARP Benefits: Special benefits and discounts are available for AARP members.

- Strong Customer Service: Known for strong customer service and claims support. Check out this guide titled “Affordable Auto Insurance Companies With Great Customer Service“

Cons

- Age Restrictions: Some of The Hartford’s best rates are restricted to older drivers.

- High Premiums for Younger Drivers: Younger drivers may find The Hartford’s premiums to be higher.

#6 – AAA: Best for Claims Process

Pros

- Streamlined Claims Process: AAA Auto insurance review has known for its efficient and customer-friendly claims process.

- Membership Perks: AAA members receive additional benefits and discounts.

- Wide Range of Coverage: AAA offers extensive coverage options for different needs.

Cons

- Membership Requirement: To get the best rates, a AAA membership is required.

- Average Rates: Premium rates are average compared to other top providers.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – Farmers: Best for Personalized Service

Pros

- Personalized Service: Farmers is known for its personalized customer service approach.

- Discounts for Good Students: Special discounts are available for good students. Discover more about offerings in our Farmers auto insurance review.

- Extensive Agent Network: Farmers has a large network of local agents for in-person assistance.

Cons

- High Premiums: Premium rates can be higher than average.

- Limited Online Tools: The online experience and tools may not be as comprehensive as competitors.

#8 – Liberty Mutual: Best for Customized Policies

Pros

- Customized Policies: Liberty Mutual offers highly customizable policy options. Check out insurance savings in our complete Liberty Mutual auto insurance review.

- Accident Forgiveness: Liberty Mutual includes accident forgiveness in their policies.

- Multiple Vehicle Discounts: Discounts are available for insuring multiple vehicles.

Cons

- Price Variability: Premiums can vary significantly based on location and driving history.

- Customer Service: Customer service experiences can be inconsistent.

#9 – Allstate: Best for Online Convenience

Pros

- Digital Tools: Allstate offers robust online tools and a user-friendly app for managing policies.

- New Car Replacement: Allstate’s new car replacement coverage is a valuable benefit.

- Safe Driving Bonuses: Discounts and bonuses are available for safe drivers. More information is available about this provider in our “Allstate vs. USAA: Which Offers More Affordable Auto Insurance Quotes.”

Cons

- Higher Premiums: Allstate’s premiums can be higher than some competitors.

- Mixed Customer Reviews: Customer service reviews are mixed, with some reporting issues.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – MetLife: Best for Financial Strength

Pros

- Strong Financial Stability: MetLife has a strong financial standing and reliability.

- Comprehensive Coverage Options: Offers a wide range of coverage options to suit different needs.

- Discounts for Safety Features: Discounts are available for vehicles with advanced safety features.

Cons

- Limited Availability: MetLife’s auto insurance may not be available in all states.

- Customer Service: Some customers report less satisfactory experiences with MetLife’s customer service.

Getting Car Insurance Without a License

You can get auto insurance without a license, though why you’re without a license may determine whether you’re eligible for coverage with most insurance providers.

Still, finding auto insurance without a driver’s license is possible with certain companies. Having proper insurance on your vehicle does not mean you’re allowed to drive. You won’t be able to drive an insured car until you have a valid, U.S.-issued driver’s license.

Securing Car Insurance Without a License

Because many companies won’t offer affordable non-owner SR-22 auto insurance, you will probably have to research to find a good company willing to cover you. However, there are a few things you can do to find out how to get auto insurance coverage quickly.

Read more: Can I buy auto insurance without a driver’s license?

Ask About SR-22 Coverage

If you have a suspended driver’s license, you may be required to file for SR-22 auto insurance with your state to prove financial responsibility. You can search for a company in your area that provides SR-22 filings and purchase coverage with that company.

Your state should eventually reinstate your license, and you should be able to drive with the insurance coverage you have on your vehicle. However, remember that your rates will likely be higher than average because you’re considered high-risk, and how much high-risk auto insurance costs is generally high.

Read more: Affordable Non-Owner SR-22 Insurance

List Someone Else As the Driver

If you own a vehicle, but someone else drives you around, you may be able to list that person as the primary driver on the policy.

Most companies require that a primary driver lives in the same household as the car owner. Still, you can speak with a representative from any insurance provider you’re considering to learn more about that company’s rules and regulations.

List Yourself As an Excluded Driver

An excluded driver is someone who is not covered by an insurance policy. So if you have an insurance policy and someone else is listed on the policy with you, speak with your provider to see if you can exclude yourself from coverage and keep the same policy.

This could help you avoid shopping for a new policy without having a driver’s license.

Add A Co-Owner

If you run into issues purchasing a car insurance policy without a driver’s license, you may be able to add a co-owner to the policy. If that person has a driver’s license, it could make finding and purchasing car insurance a lot easier.

Companies have different co-owner rules, so you’ll need to research which companies in your area allow you to list a co-owner.

Get Parked Car Coverage

If you plan to garage your vehicle, you can purchase coverage for your parked car. Storage coverage is a lot like comprehensive car insurance coverage, and it covers your vehicle with regard to non-driving-related incidents, such as:

- Flooding

- Theft

- Vandalism

- Fire

- Damage from rodents

- Damage from wild animals

- Damage from falling objects

You may find it easier to purchase storage coverage if you don’t have a driver’s license, but you’ll still have to shop and compare quotes to see which companies offer what you’re looking for.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Insurance Companies That Insure Without a License

Many insurance companies will not consider covering you if you don’t have a valid driver’s license.

Some of the companies that are known for offering coverage to people without a driver’s license and have received positive ratings and reviews include:

- AAA auto insurance review

- Freeway auto insurance

- Geico auto insurance review

- The Hartford auto insurance

- Travelers auto insurance

- State Farm auto insurance review

Other companies may be willing to offer coverage to you if you don’t have a license, but you’ll have to research your options and speak with representatives from each company to learn more.

The Cost of Car Insurance Without a License

Finding car insurance can be difficult if you don’t have a driver’s license. But if you do, you can expect to pay higher-than-average rates for coverage.

Auto Insurance Monthly Rates for Unlicensed Drivers by Coverage Level & Provider| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $55 | $125 |

| Allstate | $62 | $132 |

| Farmers | $58 | $128 |

| Liberty Mutual | $60 | $130 |

| MetLife | $65 | $135 |

| Nationwide | $52 | $122 |

| Progressive | $45 | $115 |

| State Farm | $40 | $110 |

| The Hartford | $53 | $123 |

| USAA | $50 | $120 |

Below is a table including the monthly rates from the top insurers comparing minimum coverage versus full coverage car insurance.

Shopping online could help you find cheap car insurance near you. Through research, uncover affordable auto insurance options tailored to their needs and budget. This proactive approach empowers individuals to make informed decisions and potentially save significant amounts on their premiums.

The Reasons to Buy Car Insurance Without a License

You may think it sounds silly to purchase car insurance if you don’t have a driver’s license. But if you have a car, you should have insurance on the vehicle. There are a few reasons why a person may want to consider buying a car insurance policy without a driver’s license.

Your Health Prevents You From Driving

If your health is a temporary reason why you cannot drive your vehicle, you should try to maintain a car insurance policy on the vehicle. However, in many cases, once your health stabilizes and you get a driver’s license again, finding a new, affordable policy can be challenging if you have a lapse in coverage. That is one of the dangers of letting your auto insurance lapse.

Sometimes, it’s best to keep your policy and continue paying the premiums even when you’re not driving.

Someone Drives You Around

If you don’t have a license, but someone else drives you around in your vehicle, you should consider purchasing coverage on the car.

Since auto insurance follows the car rather than the owner, the vehicle would not have proper insurance coverage when a caregiver drives you around to run errands or make it to specific appointments.

Maintain at least your state’s minimum auto insurance coverage required on any vehicle someone else uses on your behalf.

You’re a Young Driver

If you drive a vehicle with a restricted license, you still need auto insurance on the car you drive.

This coverage usually comes through your parents or guardians, but you may want to check with the insurance company to see if you should be listed on the policy.

You Have a Student Driver in Your Home

If you don’t drive a car, but your student driver does, you need proper coverage on your vehicle. Otherwise, you will have to pay for all damages and repairs if your child gets into an accident.

You may also end up with a hefty fine and even more severe consequences.

You Own a Classic or Vintage Car

You should have at least comprehensive coverage if you own a car that is considered a classic car. If you don’t drive your vehicle around, it could still incur damage from falling debris, inclement weather, and vandalism.

A parked car insurance policy could protect your vintage car.

Your License Is Suspended

If you own a car but have a suspended license, you should try to maintain coverage on your vehicle. You may be required to file an SR-22 with your state. If that’s the case, you will need to find an insurance provider that will provide adequate coverage for you while you cannot drive your car. Just remember that there are consequences for driving with an expired license.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Obtaining Online Quotes for Unlicensed Drivers

Finding car insurance without a driver’s license can be challenging, but obtaining online quotes makes the process easier. Here’s how you can efficiently get quotes tailored to your situation:

- Use Comparison Tools: Utilize online platforms that allow you to compare quotes from multiple insurers simultaneously.

- Enter Accurate Information: Provide detailed and accurate information about your vehicle and driving situation to get precise quotes.

- Specify Your Status: Clearly indicate that you are seeking insurance without a license, and explore options like SR-22 filings if applicable.

- Include Primary Driver Details: If another person will be driving your car, include their information as the primary driver.

- Check for Discounts: Look for available discounts that might apply to your specific circumstances, such as safe driver or multi-policy discounts.

Obtaining online quotes for car insurance without a license is a straightforward process that can help you find affordable and suitable coverage. Check out this guide “Affordable Instant Auto Insurance Quotes”

By using comparison tools and providing accurate information, you can ensure your vehicle is protected even if you don’t hold a driver’s license.

Case Studies: Success Stories with Cheap Auto Insurance for Unlicensed Drivers

Securing affordable auto insurance without a license is possible with the right provider. These case studies showcase how unlicensed drivers successfully obtained coverage, ensuring their vehicles are protected.

- Case Study #1– Solution With State Farm: John, a classic car owner with a suspended license, secured comprehensive coverage from State Farm at $40 per month, protecting his investment with reliable service.

- Case Study #2– Flexible Plan With Progressive: Maria, unable to drive due to health issues, found a flexible plan with Progressive that listed her caregiver as the primary driver, maintaining necessary coverage affordably.

- Case Study #3– Discounts With USAA: David, a military veteran without a valid license, benefited from USAA’s affordable plan, which included military discounts, providing essential coverage at a low cost.

These case studies demonstrate that unlicensed drivers can find affordable and comprehensive auto insurance solutions. To find out more, explore our guide titled “Auto Insurance Quotes by Vehicle.”

State Farm offers the best rates and most reliable service for unlicensed drivers seeking affordable coverage.Daniel Walker Licensed Insurance Agent

Providers like State Farm, Progressive, and USAA offer tailored plans that address unique circumstances, ensuring that everyone can maintain essential coverage without a valid driver’s license.

Car Insurance for Unlicensed Drivers: The Bottom Line

If you don’t have a license, you may think you don’t need insurance. But anyone who owns a car should have coverage on the vehicle.

Speak with your insurance provider to see what kind of coverage you need based on your unique circumstances. If the rates for coverage seem too expensive, shop online and compare quotes to find good driver discount and auto insurance that works with your budget. Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Frequently Asked Questions

Do I need insurance if I have a car but don’t have a license?

Yes, if you own a vehicle, it is still recommended to have insurance coverage, even if you don’t have a driver’s license. Insurance protects your car from various risks, including damage from non-driving-related incidents.

For additional details, explore our comprehensive resource titled “Auto Insurance Discounts for Affordable Coverage.”

How can I get car insurance without a license?

Finding car insurance without a license can be challenging, but options include filing for SR-22 insurance if your license is suspended, listing someone else as the primary driver, excluding yourself from coverage, adding a co-owner with a valid license, or getting parked car coverage to protect against non-driving-related incidents.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Can I add a driver to my car insurance policy if they have a suspended license?

The ability to add a driver with a suspended license to your car insurance policy depends on the policies of the insurance company. It’s best to contact your insurer for specific information regarding their guidelines.

Is it advisable to have car insurance without a license?

Yes, it is advisable to have car insurance without a license for various reasons, such as health issues, having someone drive you, being a young driver, owning a classic car or vintage, or having a suspended license.

How much is car insurance without a license?

The cost of car insurance without a license can vary depending on factors such as the insurer, coverage type, and your specific circumstances. Rates are generally higher for individuals without a license.

Access comprehensive insights into our guide titled “Average Cost of Auto Insurance: Find Affordable Quotes.”

What is SR-22 insurance, and do I need it?

SR-22 insurance is a certificate of financial responsibility required for high-risk drivers, often due to a suspended license. It proves that you carry the minimum required auto insurance. Check with your state’s requirements to see if you need SR-22 insurance.

Can I insure a car that I don’t drive?

Yes, you can insure a car that you don’t drive by getting parked car coverage or comprehensive coverage. This type of insurance protects your vehicle from non-driving-related incidents like theft, vandalism, and weather damage.

How can I find the best car insurance rates without a license?

To find the best car insurance rates without a license, shop online and compare quotes from multiple providers. Look for companies that offer coverage to unlicensed drivers and check for discounts that may apply to your situation.

To find out more, explore our guide titled “Can I buy auto insurance online?“

Can I insure a classic or vintage car without a license?

Yes, you can insure a classic or vintage car without a license. It is advisable to get comprehensive coverage to protect against damage from non-driving-related incidents. Some insurers specialize in classic car insurance.

What should I do if my health prevents me from driving temporarily?

If your health temporarily prevents you from driving, maintain your car insurance to avoid a lapse in coverage. Consider listing another driver on your policy or getting parked car coverage to keep your vehicle insured.

Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.