How to Customize Your Travelers Auto Insurance in 2025 (4 Easy Steps)

If you want to learn how to customize your Travelers auto insurance and save around $30 a month, we’ve got your back. We’ll guide you through easy steps like figuring out your coverage needs, choosing add-ons that fit, finding discounts, and using the MyTravelers app to keep everything in check.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Maria Hanson

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life i...

Insurance and Finance Writer

UPDATED: Nov 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

If you want to customize your Travelers auto insurance and save around $30 a month, you’re in the right place. This article will help you assess your coverage needs and choose the right add-ons to fit your lifestyle, all while understanding how auto insurance works.

It will also disclose valuable discounts that can make a real difference in your premiums and highlight how the MyTravelers app can make managing your policy a breeze, putting everything you need at your fingertips.

Type in your ZIP code above to explore quotes and see how much you can save.

- Step #1: Know Your Needs – Identify the coverage you want

- Step #2: Pick Extras – Choose optional coverages

- Step #3: Look for Discounts – Find savings opportunities

- Step #4: Use the App – Manage your policy with MyTravelers

4 Steps to Customize Your Traveler’s Auto Insurance

Customizing your Travelers auto insurance policy doesn’t have to be a hassle. Just a few easy steps, and you can have coverage that fits exactly what you need—and even save some money in the process.

Step #1: Know Your Needs

Comparing auto insurance rates can be simple. Companies like Geico, Allstate, and American Family offer affordable full coverage auto insurance.

Auto Insurance Monthly Rates by Provider & Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $48 | $145 | |

| $42 | $130 | |

| $40 | $125 | |

| $30 | $100 | |

| $52 | $150 |

| $46 | $140 |

| $35 | $120 | |

| $44 | $135 | |

| $50 | $148 | |

| $32 | $110 |

Look at their monthly rates to help you choose the best fit. Auto insurance doesn’t need to be complicated. You can find the coverage that works for you with the right provider and rate.

Step #2: Pick Extras

Before picking optional coverages, it’s important to lay a solid foundation. Take a moment to think about what you need. This is crucial in building an insurance plan that truly fits you.

- Evaluate Driving Habits: Consider how often you’re on the road and where you typically drive.

- Assess Vehicle Value: Take a minute to consider what your vehicle is worth. Does going for affordable comprehensive auto insurance coverage make sense, or is primary liability sufficient for your situation? This choice can significantly affect your premiums.

- Set Your Budget: Be sure your coverage aligns with what you can comfortably spend each month. Finding that balance is critical—you want to be protected without feeling the financial strain.

By following these points, you can ensure that your auto insurance premiums genuinely reflect your needs. It’s all about finding the right balance between coverage and cost.

When you take the time to assess your driving habits, vehicle value, and budget, you can protect yourself solidly without overspending.

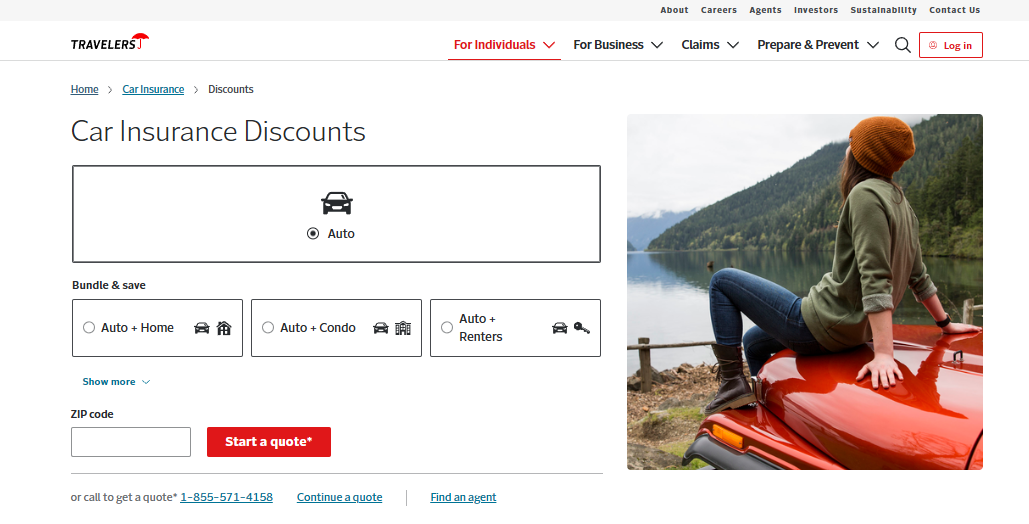

Step #3: Look for Discounts

Travelers have many ways to help you save on auto insurance, ensuring you get the best deal possible. They offer discounts like:

- Savings for insuring multiple cars

- A discount for homeowners, even if your home isn’t insured with Travelers

- A safe driver discount

- Discounts for electric or hybrid vehicles

Saving money can be simple! Pay on time, set up automatic payments, or go for payroll deductions. And check the hybrid vehicle auto insurance discount to save money and keep more cash in your pocket.

Once you start using these discounts, you’ll see those savings add up, giving you a little extra room in your budget for the things that matter to you.

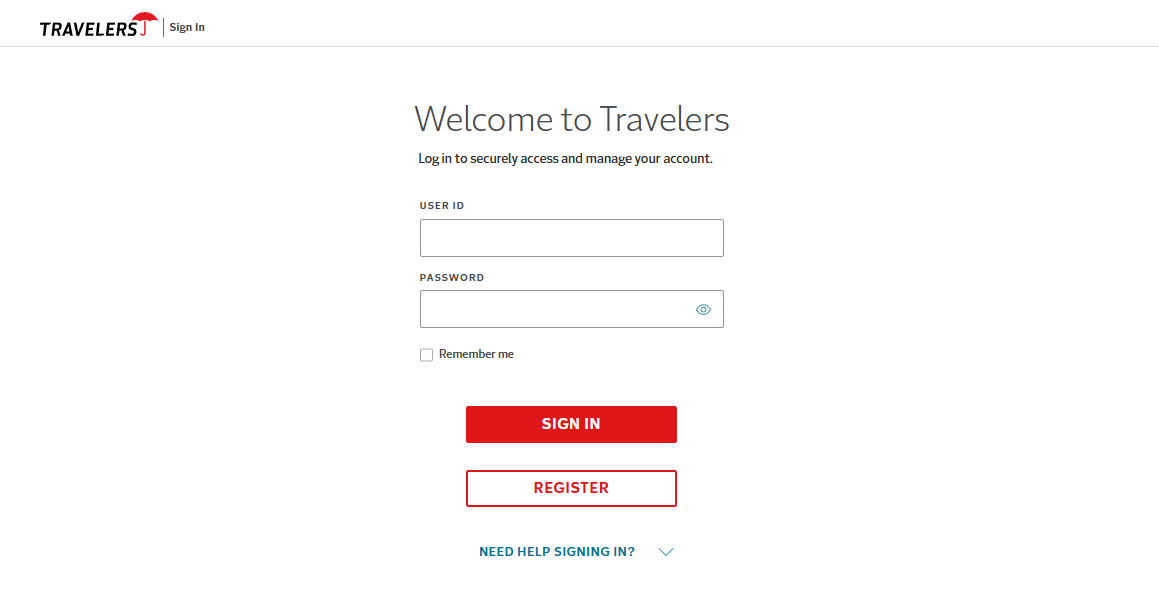

Step #4: Use the App

Managing your policy is a breeze with the MyTravelers app; everything you need is right there, whether you want to check your coverages, make a payment, or handle auto insurance claims.

Simply open the app, and you can take care of your insurance anytime and anywhere you want. It even helps you keep track of your discounts and sets reminders for important tasks, so you’re always up to date.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Factors to Consider When Customizing Your Traveler Auto Insurance Policy

When customizing your Travelers auto insurance policy, consider a few key points. Start by considering your driving history and habits; how you drive really affects the coverage that makes sense for you.

When looking into auto insurance, understanding what are the different types of auto insurance coverage is essential. The car you drive can make a big difference in the kind of insurance you need. For example, if you’re driving a brand-new luxury car, you’ll probably want more coverage than an older, well-used model.

Optimizing Your Traveler Auto Insurance Experience

Customizing your Travelers auto insurance is an intelligent way to get the coverage you want without spending more than necessary. Take a moment to consider what’s important to you—like specific add-ons or discounts that could lower your auto insurance premiums.

Travelers offers customizable auto insurance that balances comprehensive coverage with affordability, making it a top choice for smart drivers.Scott W. Johnson Licensed Insurance Agent

You might be surprised at how much you can save! And the MyTravelers app? It makes everything so easy. You can check your coverages, make payments, and even file claims from your phone. It’s all about making your insurance work for you so you can focus on the things that really matter in your life.

Find affordable auto insurance rates from leading providers by entering your ZIP code below.

Frequently Asked Questions

What are the four parts of an auto policy, and what are the four parts of an insurance policy?

Traveler’s auto insurance has four essential parts: liability, collision, comprehensive coverage, and coverage for uninsured motorists. And if you think about any insurance policy, they usually include a declaration page, the insuring agreement, exclusions, and conditions.

How can I modify my Travelers auto insurance policy?

If you want to tweak your Travelers auto insurance policy, call up your agent or their customer service. They’ll help you determine what changes you can make and guide you through the process.

Trying to cut down on your auto insurance costs? Just pop your ZIP code into our free quote tool below and see how your current rate stacks up against the big-name insurers.

What does travel insurance cover, and what are the main types of insurance?

Travel insurance covers trip cancellations, medical emergencies, lost luggage, and delays. When considering insurance options, look at health, auto (like Travelers), home, and life insurance. To save money, check out the best companies for bundling home and auto insurance for great discounts.

What is a modified insurance policy?

A modified insurance policy from Travelers is tailored to your specific needs. Instead of a standard plan, it comes with terms and conditions that work best for you.

Do you have to activate travel insurance?

Travel insurance usually activates automatically on the start date you choose when purchasing. However, check your policy, as some benefits may need pre-trip registration or notification.

How do I create an insurance policy that meets my needs?

To create an insurance policy that fits your needs, start by figuring out what coverage you need, including asking yourself, What is the minimum auto insurance coverage that I have to sign up for? Then, chat with a Travelers auto insurance agent—they’re great at customizing a policy that works for your situation.

Can I edit my Travelers auto insurance policy limits?

You can adjust your policy limits with Travelers. Call them to discuss what you want to change and how it might affect your rates.

What should be included in travel insurance?

Travel insurance should ideally cover trip cancellations, medical emergencies, lost belongings, and delays. The coverage you need will depend on your trip’s total cost and comfort level.

What are the parts of an insurance policy contract?

An insurance policy contract usually has four parts: declarations, the insuring agreement, exclusions, and conditions. To gain further insights, consult our comprehensive guide: What does auto insurance do?

What risks does travel insurance cover, and how do I assign an insurance policy?

Travel insurance typically covers risks like trip cancellations and medical emergencies. If you need to assign an insurance policy, contact your Travelers auto insurance company; they’ll help you with the necessary steps.

Thinking about finding better auto insurance rates? Just enter your ZIP code into the comparison tool below, and we’ll show you what options are available in your area.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Maria Hanson

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life i...

Insurance and Finance Writer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.