Captive vs. Independent Auto Insurance Agents in 2025 (Differences Explained)

Captive vs. independent auto insurance agents differ in options and expertise. Captive agents work for one company, offering specialized advice and an 85 to 90% customer satisfaction rate. Independent agents compare policies from multiple companies, and their satisfaction rates typically range from 80 to 90%.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Jan 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

It’s important to understand the key differences between captive vs. independent auto insurance agents. Captive agents work for just one insurance company. They can offer deep knowledge of that company’s options and with customer satisfaction rates between 85%-90%.

On the other hand, independent agents can work with multiple insurance companies, giving you more choices to find the best rate and coverage, with customer satisfaction between 80%-90%. While captive agents specialize in one company’s policies, independent agents can help you compare quotes from different auto insurance companies for better rates.

Choosing the right agent comes down to whether you want expert advice or the flexibility to shop around for the best deal. Keep reading to learn the answer to this interesting question and the benefits of working with each.

Enter your ZIP code to compare quotes instantly and find the cheapest insurance available.

- Captive agents offer advice from one company with limited options

- Independent agents provide multiple options from various companies

- Captive agents have more knowledge about the insurer’s products

The Difference Between Captive vs. Independent Auto Insurance Agents

When deciding between a captive vs. independent agent for auto insurance, it’s important to understand the difference. A captive insurance agent works for one insurance company, offering specialized advice but limited choices.

Captive agents work with one insurance company, while independent agents offer policies from multiple providers, giving more options and flexibility.Maria Hanson Insurance and Finance Writer

On the other hand, an independent agent can offer policies from multiple companies, giving you more options to compare. Knowing the captive agent definition helps you pick the best option for your needs. Both agents can advise you on the different types of auto insurance coverage and other important aspects of your auto policy.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Captive Auto Insurance Agent: Explained

A captive auto insurance agent, also known as an exclusive insurance agent, works for just one insurance company. These agents are contracted by the company and can only sell policies from that company. The captive agent meaning in auto insurance is that they are limited to offering only one insurer’s coverage options.

Captive agents work closely with their company to offer detailed information and support for that provider’s products. For example, a captive insurance agent is an agent who exclusively sells policies from a single company, such as State Farm or Allstate.

Comparison of Captive vs. Independent Auto Insurance Agents: Data, Rates, and Features| Feature | Captive Agents | Independent Agents |

|---|---|---|

| Definition | Represent one insurance company | Represent multiple insurance companies |

| Insurance Options | Limited to one insurer's policies | Wide variety of insurer policies |

| Flexibility in Rates | Rates fixed by the insurer | Shop around for best rates |

| Customer Service | Expert in one insurer's products | Personalized service with options |

| Commission Structure | Higher commissions, limited choices | Commissions from multiple insurers |

| Policy Bundling | Bundled packages with one insurer | Bundling with various insurers available |

| Product Knowledge | Deep knowledge of one insurer’s products | Knowledge of multiple insurers’ products |

| Price Variability | Prices are fixed by insurer | Flexible, competitive pricing options |

| Claims Handling | Direct support from insurer | Claims handled by chosen insurer |

| Customer Loyalty | Loyal to one insurer’s products | Loyal to best coverage options |

| Suitability for Consumers | Ideal for simple, single insurer needs | Best for comparing multiple options |

| Typical Discounts | Company-specific discounts available | Discount options from various insurers |

| Premium Rates | $200/month | $150/month |

| Top Providers | State Farm, Allstate, Farmers, GEICO, Nationwide | Progressive, Liberty Mutual, Travelers, Safeco, The Hartford |

| Customer Experience | Consistent, one-company experience | Personalized, variety of coverage |

A captive insurance agency represents one insurance provider, so clients may get specialized services but fewer choices compared to an independent agent.

Read about auto insurance agents vs. brokers to understand the differences and discover how choosing the right option can help you find the best coverage for your needs.

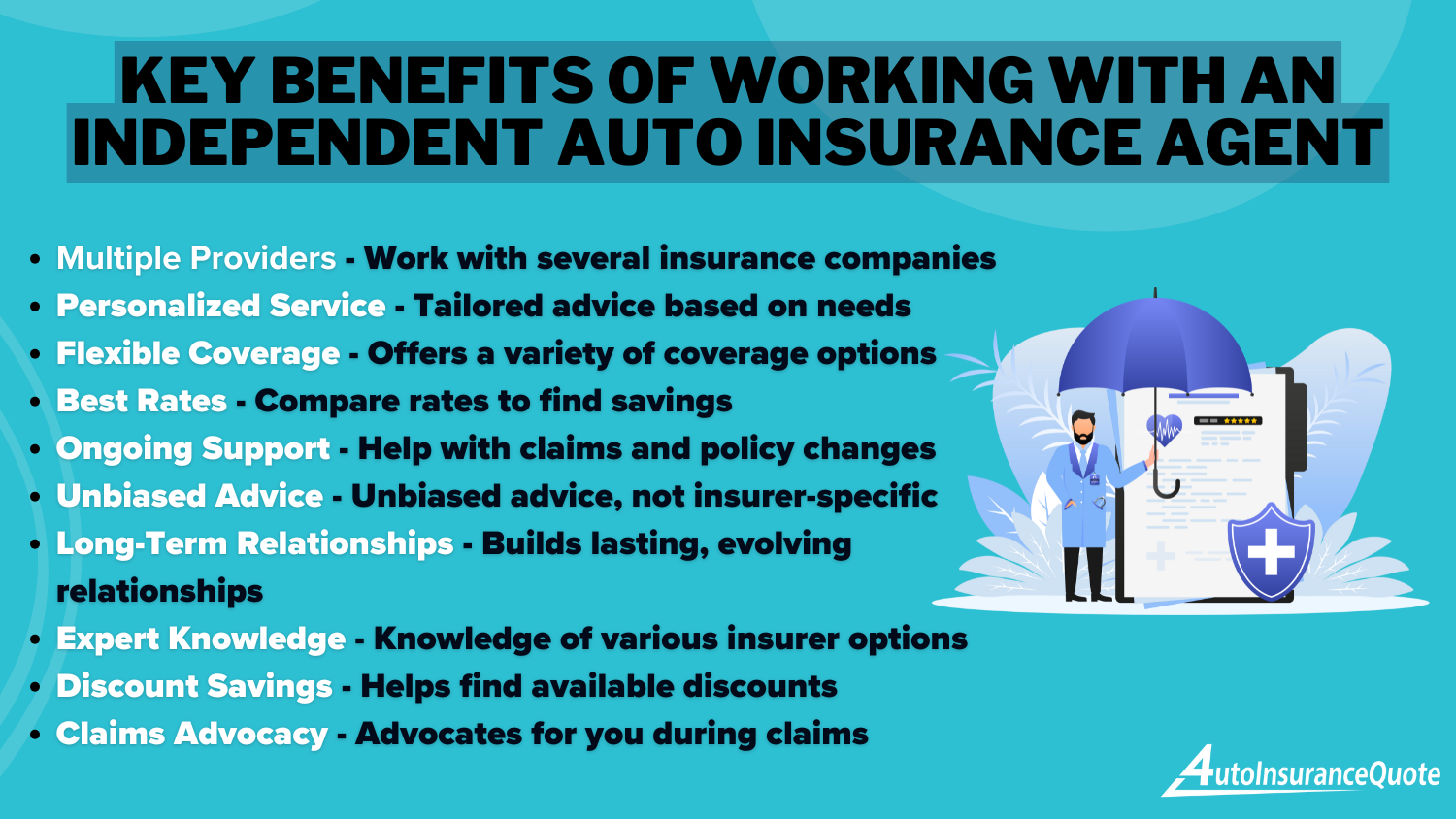

Independent Auto Insurance Agent: Explained

An independent auto insurance agent can sell policies from several different insurance companies like Geico or State Farm, unlike a captive agent who only works with one company. These agents aren’t tied to one insurer, so they can offer a variety of policies and rates.

One of the pros and cons of independent insurance agents is that they can give you more options to compare, helping you find the best deal. However, they might not know the details of one company’s policies as well as a captive agent would.

Independent agents work with well-known companies like Progressive, Geico, and Allstate, which gives you more flexibility to choose the right coverage for your needs. Learn how to find affordable instant car insurance quotes.

Benefits of Working With Captive vs. Independent Auto Insurance Agents

When deciding between a captive and an independent auto insurance agent, it’s important to know the benefits of each. A captive insurance agent works for only one company, so they know that company’s policies well.

This means they can give you clear answers to questions like “How much auto insurance coverage do I need?” and offer helpful advice. On the other hand, when you look at the captive vs. non-captive insurance agent difference, independent agents can get quotes from several companies, giving you more options and the chance to find better rates.

If you’re trying to lower your insurance costs, an independent agent can help. Plus, a captive insurance agent’s salary is usually based on a set salary and commissions, while independent agents may earn more through commissions from a variety of insurance providers.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Captive vs. Independent Auto Insurance Agents: Disadvantages

If you’re comparing a captive vs. independent auto insurance agent, there are a few downsides to think about. One disadvantage of working with a captive agent vs. an independent agent is that you’ll only get information about the policies from one company.

While a captive agent in insurance is very familiar with their company’s options, you won’t be able to compare them with rates from other companies unless you do it yourself.

The Insurance Influencer

Adam Robinson of Retention recently shared something about the next generation of $1M/year SaaS Account Executives (AEs), and I couldn’t help but think about how this plays out in the independent insurance agency (IIA) space.

The agency that capitalizes… pic.twitter.com/k86Eg49hW2

— Brandon Dendas (@BrandonDendas) January 22, 2025

On the other hand, the downside of working with an independent agent is that although they can provide quotes from multiple companies, they may not have the same level of detailed knowledge about each company’s policies.

Understanding what a captive insurance agent is can help you figure out which type of agent best fits your needs, whether you want more choices or a deeper knowledge of one insurer.

Read more: Auto Insurance Quotes by Vehicle

Choosing Between Captive and Independent Auto Insurance Agents: Key Considerations

When you’re deciding between a captive vs. independent auto insurance agent, it’s all about what fits your needs. Here are some things to think about:

- Personal Referrals: If a friend or family member recommends a specific agent and you are happy with their knowledge and rates, a captive agent could be a good option.

- Shopping Flexibility: If you value comparing quotes from various insurance providers, an independent agent offers more options.

- Expertise: Captive agents typically represent one company, so they have deep knowledge of their policies. However, the pros and cons of a captive insurance agent include limited options compared to an independent agent.

- Range of Options: The difference between captive and independent insurance agents is that independent agents can offer a wider selection of policies.

Ultimately, the choice depends on whether you prioritize a personal, specialized approach or prefer to shop around for the best deal.

Read more: Auto Insurance Discounts for Affordable Coverage

Captive vs. Independent Auto Insurance Agents: Which One is Right for You

When you’re choosing between a captive vs. independent auto insurance agent, it’s all about what fits your needs. A captive agent works with only one insurance company, so they can offer you in-depth knowledge of that company’s policies. But you’re limited to just their options.

On the other hand, an independent agent works with multiple companies, meaning they can show you a range of options and help you compare quotes. While this gives you more choices, independent agents may not know the ins and outs of each policy, as well as a captive agent.

Ultimately, whether you choose a captive or independent agent depends on whether you value a specialized, personal touch or the ability to shop around for the best price.

Check out how to get auto insurance to learn the steps for securing the right coverage and finding the best options to suit your needs and budget.

Don’t let expensive insurance rates hold you back. Enter your ZIP code and shop for affordable premiums from the top companies.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Frequently Asked Questions

What is the difference between captive agents and independent agents?

Insurance agents be either captive agents or independent agents. Captive agents work for only one insurance company, but an independent agent does not work for one insurance company. Instead, they can sell policies from a variety of companies.

What is the difference between a captive and a non-captive agent?

Captive insurance agents are contracted to work for one insurance company. Non-captive agents are contracted to work with several insurance companies and can sell policies from various insurance agencies. No matter how much coverage you need, you can find the lowest rates by entering your ZIP code into our free comparison tool.

What are the pros of a captive insurance agent?

The benefits of working as a captive agent include that the insurance company usually supports their agents and offers office space and support staff.

Read more: Cheap Toyota Auto Insurance

How to become a captive insurance agent?

To become a captive insurance agent, complete the required licensing courses, apply to an insurance company, undergo training, and start selling policies exclusively for that company.

How does an independent agent earn money?

Independent agents typically earn commissions from the policies they sell across different insurance providers, allowing them to potentially earn more than captive agents, who often have a salary and commission structure tied to a single company.

Are captive agents able to provide more specialized advice?

Yes, because captive agents only sell one company’s policies, they tend to have a deeper understanding of that company’s offerings and can provide specialized advice tailored to their specific policies.

Read more: Your Credit Score and Auto Insurance Quotes

Can an independent agent offer better pricing than a captive agent?

Independent agents may offer better pricing because they have access to quotes from several companies. This allows you to compare different rates and find the best deal for your needs, while a captive agent can only offer rates from their company.

What kind of support do captive agents have compared to independent agents?

Captive agents often receive more support from their company, including office space, marketing, training, and customer service staff. Independent agents, on the other hand, must handle much of the administrative and business support themselves.

Can I get quotes from several insurance providers through a captive agent?

No, since captive agents represent only one company, they can only provide quotes from that particular insurance provider.

Read more: Affordable Public Auto Insurance

Are there any drawbacks to working with an independent insurance agent?

One disadvantage is that independent agents may not have as much in-depth knowledge of each insurance company’s specific policies compared to a captive agent. This can sometimes lead to less specialized advice.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.