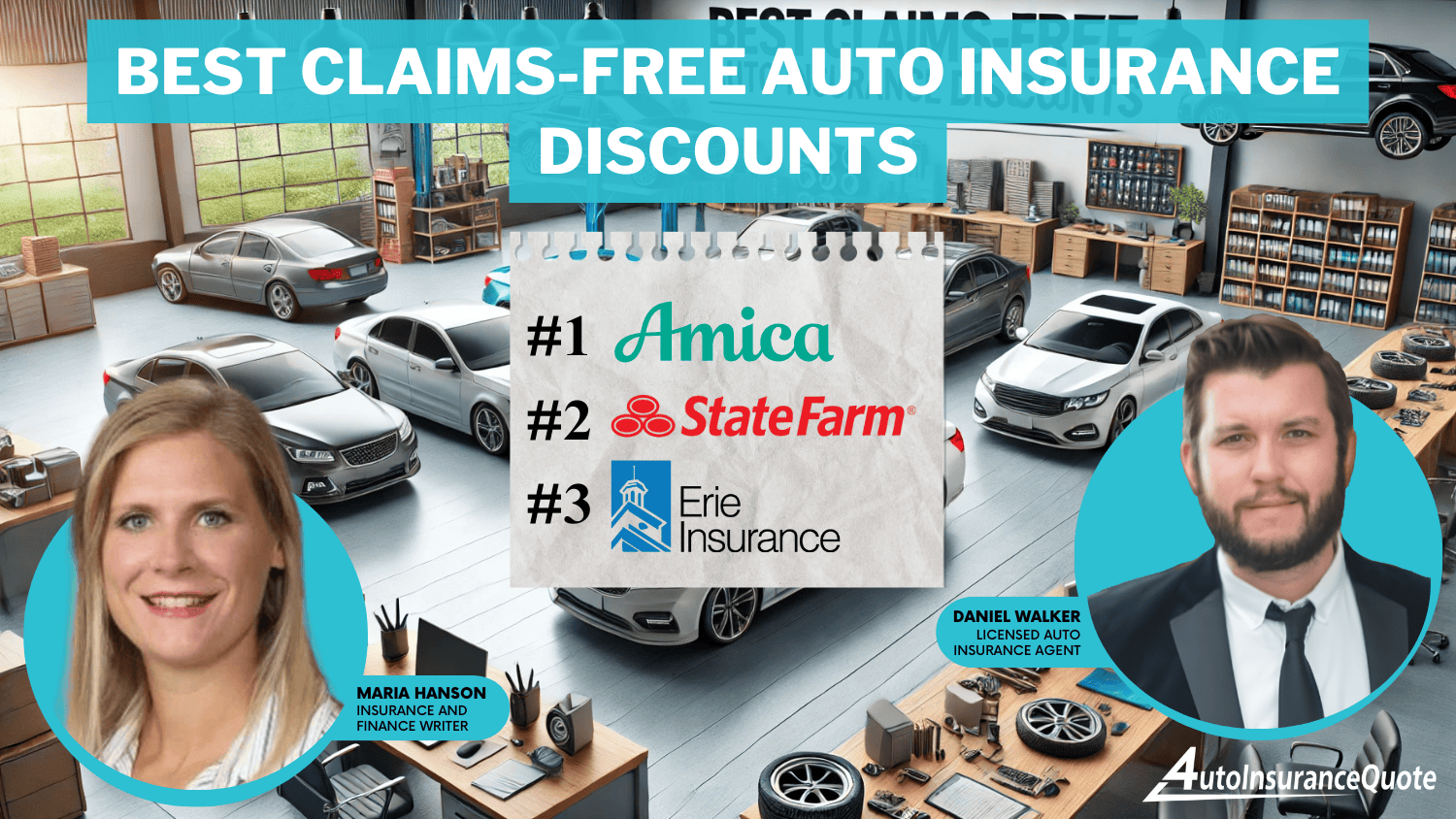

Best Claims-Free Auto Insurance Discounts in 2025 (Save up to 25% With These Companies)

The best claims-free auto insurance discounts allow drivers to save up to 25% on premiums. Top providers like Amica, State Farm, and Erie offer significant savings provider-specific discounts for good driving. Be sure to inquire with your insurer about this claim-free discount to reduce the cost for you further.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Dec 14, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 14, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

The best claims-free auto insurance discounts can save drivers up to 25% on premiums, with top providers like Amica, State Farm, and Erie offering substantial savings. These discounts reward drivers with a clean claims history, typically for five years or more.

Rates and availability vary by state and insurer, but qualifying for a claim-free discount can significantly reduce your insurance costs. It’s a good idea to check with your provider to determine if you qualify for these savings, especially when learning how to compare auto insurance quotes.

Our Top 10 Company Picks: Best Low-Mileage Auto Insurance Discounts

Company Rank Savings Potential A.M. Best Mileage Range

#1 25% A+ 5,000 Miles

#2 20% B 7,500 Miles

#3 15% A+ 6,000 Miles

#4 15% A+ 7,500 Miles

#5 15% A++ 6,000 Miles

#6 15% A+ 7,500 Miles

#7 15% A 8,000 Miles

#8 15% A++ 7,500 Miles

#9 12% A++ 8,000 Miles

#10 10% A+ 10,000 Miles

- The best claims-free auto insurance discounts reward clean claims histories

- Qualifying for an accident-free discount can lead to significant savings

- Drivers can save up to 25% on their monthly premiums with these discounts

Understanding the Claims-Free Discount

If you have never made a claim, then you are probably the best customer for your car insurance company. You have brought the company minimum, pure profit by delivering on your promise and paying your premium monthly without requiring them to pay for car repairs, ship replacements, or shattered windshields.

Therefore, many car insurance companies offer discounts to those who have not made any claims. It is also possible for you to receive a lower premium due to bonuses when the practice of driving is fought against using your insurance or compensation. This is important to understand when considering how to file an auto insurance claim, as it highlights the benefits of maintaining a clean driving record.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

How a Claims-Free Discount Works

Claims-free discounts vary between car insurance companies and states. Some car insurance companies offer claims-free discounts in some states but not others.

Esurance, for example, offers a claims-free discount in Arizona, Georgia, Illinois, Maryland, Ohio, Pennsylvania, Tennessee, Texas, Virginia, and Washington, but no other states. The discount gives drivers up to 20% off car insurance premiums if they have not claimed within the last five years. It’s one of the most substantial discounts offered by the company.

Other car insurance companies offer similar types of claims-free discounts. Generally, claims-free discounts require you to have no claims within the last 5 years. Some companies, however, provide a claims-free discount in as little as 3 years. Others require you to have 7 years of clean driving.

Some companies give you a claims-free discount that increases every year you go without making a claim. You might get 5% off after going one year without making a claim, for example, with an additional 5% discount every year after, up to a maximum of 4 years or a 20% discount.

Understanding What Constitutes a Claim

What exactly does it mean to be ‘claims-free’? Rules vary between car insurance companies. In some states, comprehensive claims under $1,000, glass-only claims, and emergency road service claims won’t disqualify you from the claims-free discount, for example. Some states forbid insurance companies from taking away a driver’s claims-free discount for these claims.

Similarly, you may be able to maintain your claims-free discount after an accident where you were not at fault. In this situation, the other driver’s car insurance would pay – not yours, which means you didn’t cost your car insurance company money.

In other states and with different insurance companies, your claims-free discount could be removed for any claim, regardless of the amount or type.

Generally, however, you’ll qualify for a claims-free discount if you meet the following requirements:

- All drivers on your car insurance policy have gone at least 60 months (5 years) without an at-fault accident claim, a DUI/DWI conviction, or a similar central claim.

- At least one person on your policy has 5-plus years of driving experience.

- You have at least five years of continuous insured driving history.

How to Get a Claims-Free Discount

Most car insurance companies will automatically apply the claims-free discount to your account once you meet the above requirements.

If you believe you meet the above requirements but have not qualified for a claims-free discount, then contact your car insurance company. Some customers might slip through the cracks. Or, some car insurance companies only apply the claims-free discount if customers specifically request it.

Maximize Your Savings with Claims-Free Discounts on Car Insurance

Have you gone at least five years (60 months) without claiming your car insurance policy? If nobody listed on your car insurance policy has claimed within the last five years, then you may qualify for a claims-free discount. Typically, a claims-free discount gives you 15% to 30% off car insurance premiums until you get into an accident.

Amica offers some of the most competitive claims-free auto insurance discounts, rewarding safe drivers with significant savings on their premiums.

With most car insurance companies, claims-free discounts are among the most significant discounts available. Car insurance companies have different claims-free discount policies. Additionally, some car insurance companies offer claims-free discounts in some states but not others. Talk to your car insurance company to determine if you qualify for a claims-free discount.

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code into our comparison tool today.

Frequently Asked Questions

What is a claims-free discount?

How does a claims-free discount work?

The specifics of a claims-free discount can vary between car insurance companies and states. Generally, if you have not claimed within a certain period (typically 3 to 5 years), you may qualify for a discount on your car insurance premiums. The discount amount and eligibility criteria depend on the insurance provider and state regulations.

What counts as a ‘claim’ for the claims-free discount?

A ‘claim’ definition can vary among car insurance companies and states. In some cases, certain types of claims, such as glass-only or emergency road service claims, may not disqualify you from the claims-free discount. However, it’s essential to check with your specific insurance company to understand their policy regarding claims and the impact on your discount.

Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

How can I qualify for a claims-free discount?

To qualify for a claims-free discount, you must maintain a clean claims history for a specific period, usually 3 to 5 years. If you meet this requirement, most insurance companies will automatically apply the discount to your policy. However, if you believe you qualify but haven’t received the discount, contacting your insurance company for clarification is recommended.

Are claims-free discounts available in all states?

No, claims-free discounts may not be available in all states. Insurance companies may have different policies and regulations based on the state.

How much is State Farm’s accident-free discount?

State Farm typically offers an accident-free discount ranging from 10% to 25% on premiums, depending on how long you’ve maintained a claims-free status. The amount can vary based on circumstances, such as your driving record and state regulations.

What does a no-claims discount mean?

A no-claims discount refers to a reduction in insurance premiums for policyholders who have not made any claims during a specified period. This discount rewards safe driving behavior and helps lower the cost of insurance.

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code in our free quote comparison tool.

What is a no-claim bonus car insurance?

A no-claim bonus (NCB) is a reward given to policyholders who do not make any claims during their policy term. This bonus usually translates into a percentage discount on the premium for the next policy renewal, encouraging safe driving.

Can I combine a claims-free discount with other discounts?

Do I need to provide documentation for my claims-free history?

Generally, you do not need to provide documentation for your claims-free history, as insurance companies can verify this information through their records. However, it may be beneficial to have proof if you’re switching providers or if your history isn’t accurately reflected in their system.

Can my claims-free discount apply to multiple vehicles?

Yes, a claims-free discount can often apply to multiple vehicles if they are insured under the same policy or with the same provider. You should confirm with your insurer to ensure that all vehicles qualify for the discount.

How to get discounts on auto insurance?

To get discounts on auto insurance, consider the following strategies:

- Maintain a clean driving record: Avoid accidents and traffic violations.

- Bundle policies: Combine auto insurance with home or renters insurance.

- Take advantage of safety features: Install safety devices in your vehicle.

- Complete driver education courses: Some insurers offer discounts for completing a defensive driving course.

- Shop around: Compare quotes from multiple insurance providers.

What does claim-free driving mean?

Claim-free driving means a driver has not made any claims on their auto insurance policy during a specified period. This status can lead to discounts on premiums as it reflects safe driving behavior.

How to get free car insurance?

While entirely free car insurance is not typically available, you can reduce costs significantly by taking advantage of discounts, such as claims-free discounts, low-mileage discounts, or participating in referral programs. Some non-profit organizations may assist low-income individuals with insurance costs, but these options are limited and vary by location.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.