Cheapest Auto Insurance With No Credit Check in 2025 (Top 8 Low-Cost Providers)

Geico, USAA, and Allstate provide the cheapest auto insurance with no credit check, starting at just $58 per month. These insurers offer a balance of low cost and extensive coverage, making them ideal for individuals seeking discounts and dependable protection for their peace of mind and assurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Commercial Lines Coverage Specialist

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Min. Coverage for No Credit Check

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for No Credit Check

A.M. Best Rating

Complaint Level

Pros & Cons

In conjunction with USAA and Allstate, they present economical and thorough options tailored specifically to meet the needs of peace of mind, such as auto insurance.

Our Top 8 Company Picks: Cheapest Auto Insurance With No Credit Check

Company Rank Monthly Rates Safe Driver Discount Best For Jump to Pros/Cons

#1 $58 22% Overall Value Geico

#2 $59 30% Military Families USAA

#3 $63 10% Pay-Per-Mile Insurance Allstate

#4 $67 20% Tech-Savvy Drivers Mile Auto

#5 $76 10% Good Drivers Root

#6 $87 20% Low-Mileage Drivers Metromile

#7 $89 15% Usage-Based Insurance Nationwide

#8 $119 15% Driving Record Focus Cure

- Geico provides competitive rates starting at $58 per month

- Leading insurance companies offer policies without credit checks

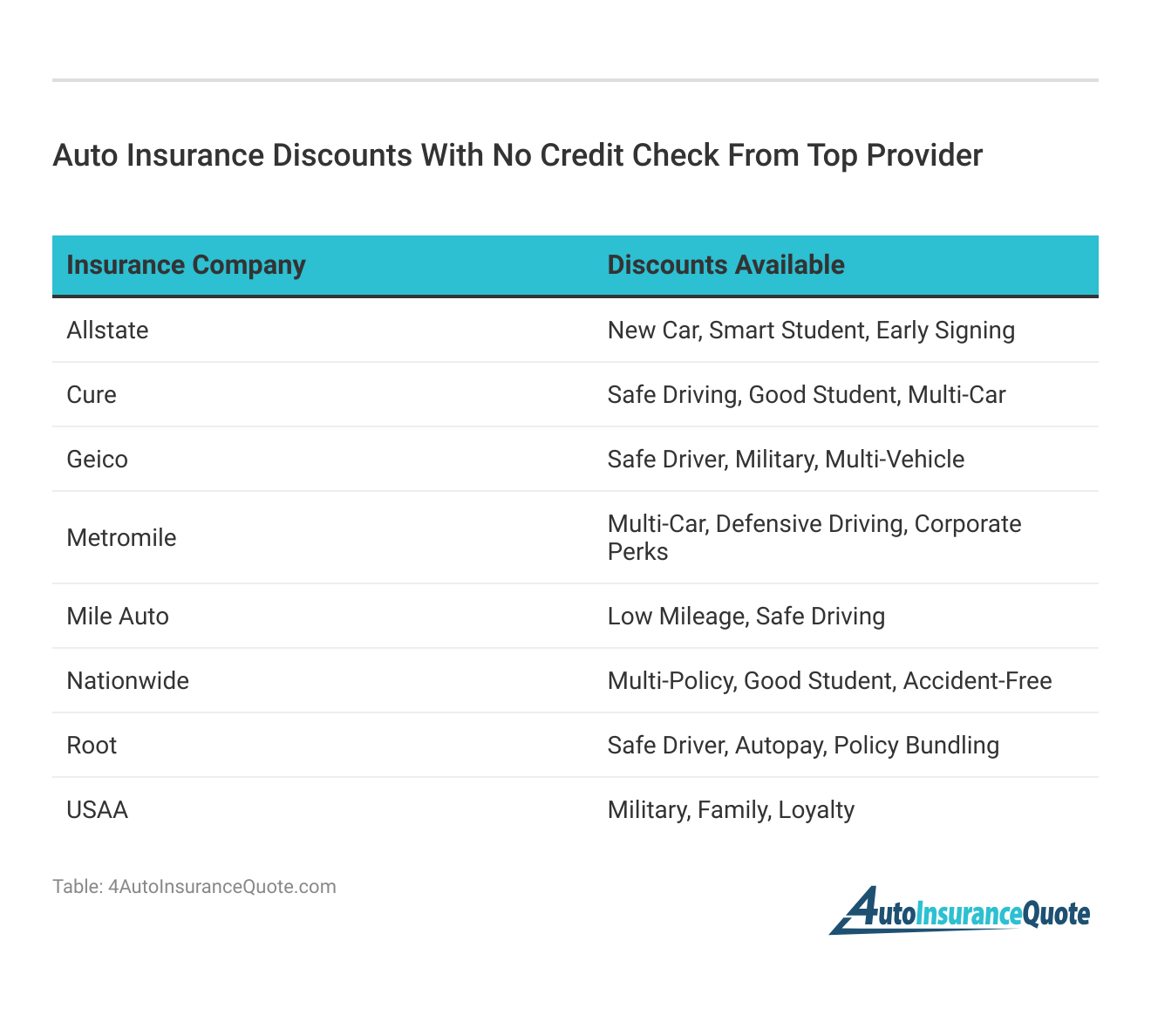

- Discounts are available for the auto insurance options without credit checks

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Competitive Rates: Geico offers competitive rates, making it an affordable option for many drivers.

- Wide Availability: Geico is available in all 50 states, providing accessibility to a broad range of customers.

- Online Tools: Geico offers user-friendly online tools and resources for managing policies, making it convenient for customers to handle their insurance needs.

Cons

- Customer Service: Some customers report mixed experiences with Geico’s customer service, citing issues with responsiveness and clarity. Read more in our Geico auto insurance review.

- Limited Discounts: Geico may offer fewer discounts compared to some other providers, potentially resulting in fewer opportunities for savings.

#2 – USAA: Best for Military Families

Pros

- Excellent Customer Service: USAA is well-known for its exceptional customer service, with high ratings for satisfaction and responsiveness. Use our USAA auto insurance review as your guide.

- Exclusive to Military Members and Families: USAA caters exclusively to military members and their families, offering specialized services and benefits tailored to their needs.

- Financial Stability: USAA boasts strong financial stability and reliability, providing peace of mind to policyholders.

Cons

- Membership Restrictions: USAA membership is limited to military personnel, veterans, and their families, excluding the general public from accessing its services.

- Limited Branch Locations: USAA operates primarily online and through phone services, which may be inconvenient for customers who prefer in-person interactions.

#3 – Allstate: Best for Pay-Per-Mile Insurance

Pros

- Range of Coverage Options: Allstate offers a wide range of coverage options and customizable policies to suit individual needs and preferences.

- Strong Financial Standing: Allstate has a solid financial reputation and stability, instilling confidence in its ability to fulfill claims and obligations.

- Innovative Features: Allstate provides innovative features such as Drivewise, which rewards safe driving behavior with discounts on premiums.

Cons

- Higher Premiums: Some customers may find Allstate’s premiums to be higher compared to other insurers, potentially impacting affordability. Use our Allstate auto insurance review as your guide.

- Mixed Customer Reviews: Allstate receives mixed reviews regarding customer service and claims handling, with some customers reporting dissatisfaction with their experiences.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Mile Auto: Best for Tech-Savvy Drivers

Pros

- Tech-Savvy Approach: Mile Auto utilizes technology to offer personalized and usage-based insurance, potentially leading to lower premiums for safe drivers. Read more through our Mile Auto insurance review.

- Flexible Coverage Options: Mile Auto provides flexible coverage options, allowing customers to pay based on their actual mileage and driving habits.

- Customizable Policies: Mile Auto allows policyholders to tailor their coverage to their specific needs, providing a personalized insurance experience.

Cons

- Limited Availability: Mile Auto may have limited availability in certain regions, restricting access to its services for some drivers.

- Limited Track Record: As a newer player in the insurance industry, Mile Auto may not have established the same level of trust and reliability as more established providers.

#5 – Root: Best for Good Drivers

Pros

- Usage-Based Insurance: Root offers usage-based insurance, which can lead to lower premiums for safe drivers who demonstrate responsible driving habits.

- Simplified Process: Root provides a streamlined and user-friendly process for obtaining quotes and managing policies through its mobile app. Follow us more using our Root auto insurance review.

- Transparency: Root’s usage-based model promotes transparency in insurance pricing, as premiums are based on actual driving behavior rather than statistical risk factors alone.

Cons

- Limited Coverage Options: Root’s coverage options may be more limited compared to traditional insurers, potentially leaving some customers with fewer choices.

- Phone Required for Telematics: Root’s usage-based insurance relies on smartphone technology for tracking driving behavior, which may not be suitable for all drivers or vehicles.

#6 – Metromile: Best for Low-Mileage Drivers

Pros

- Pay-Per-Mile Pricing: Metromile offers pay-per-mile pricing, which can result in significant savings for low-mileage drivers who don’t use their vehicles frequently.

- User-Friendly App: Metromile provides a convenient mobile app that allows customers to monitor their mileage, track trips, and manage policies with ease. Use our Metromile auto insurance review as your guidance.

- Customer Satisfaction: Metromile has a track record of high customer satisfaction, with positive reviews regarding its pricing model, customer service, and claims handling.

Cons

- Limited Coverage Area: Metromile may have limited coverage areas, restricting its availability to certain regions and states.

- Higher Base Rates: While pay-per-mile pricing can be advantageous for low-mileage drivers, Metromile’s base rates may be higher compared to traditional insurers for those who drive more frequently.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Usage-Based Insurance

Pros

- Variety of Coverage Options: Nationwide offers a wide range of coverage options, including standard policies as well as specialized coverage like usage-based insurance.

- Strong Financial Stability: Nationwide boasts strong financial stability and a long-standing reputation in the insurance industry, providing reassurance to policyholders.

- Discounts and Benefits: Nationwide offers various discounts and benefits to policyholders, including multi-policy discounts, safe driver discounts, and accident forgiveness programs.

Cons

- Mixed Customer Reviews: Nationwide receives mixed reviews regarding customer service and claims handling, with some customers reporting dissatisfaction with their experiences.

- Potentially Higher Premiums: Some customers may find Nationwide’s premiums to be higher compared to other insurers, impacting affordability for certain individuals. For further insight, read our Nationwide auto insurance review.

#8 – Cure: Best for Driving Record Focus

Pros

- Focus on Driving Record: Cure specializes in providing insurance options based on driving records, potentially offering competitive rates for safe drivers with clean records. (Read More: Clean Driving Record for Auto Insurance: Simply Explained)

- Accessibility: Cure may offer accessible options for individuals with past driving violations or accidents, providing opportunities for coverage when other insurers may decline.

- Community Engagement: Cure is actively involved in community initiatives and advocacy efforts, demonstrating a commitment to social responsibility and customer support beyond insurance services.

Cons

- Limited Availability: Cure’s services may be limited to certain regions or states, potentially restricting access for drivers outside of those areas.

- Less Diverse Coverage Options: Cure may have fewer coverage options compared to larger insurers, limiting choices for customers who require specialized coverage.

Auto Insurance and Credit Scores

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Cheapest Companies Based on Credit Scores

Finding Out Your Credit Score

No Credit Check Auto Insurance Quotes: The Bottom Line

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Frequently Asked Questions

Can I get auto insurance without a credit check?

Yes, some insurance companies offer no credit check auto insurance. Shop around to find companies that don’t use credit scores to determine rates.

Which insurance companies do not run credit checks for auto insurance?

Companies like Allstate and Progressive are known to not use credit checks in determining rates. However, it’s best to check with each company as their policies may change. Enter your ZIP code now to begin.

What should I do if I have bad credit and need auto insurance?

Why do insurance companies use credit scores for auto insurance?

Insurance companies use credit scores as an indicator of financial stability and credibility. Studies have shown a correlation between lower credit scores and increased likelihood of filing claims or committing fraud.

How can I improve my credit score to get better auto insurance rates?

Improving your credit score can help you secure cheaper auto insurance. Focus on paying bills on time, reducing debt, and maintaining a good credit history. Enter your ZIP code now to start.

How do Geico, USAA, and Allstate stand out in providing cheap auto insurance with no credit check?

What are some potential drawbacks associated with relying on credit scores for determining auto insurance rates?

The article discusses potential drawbacks associated with relying on credit scores for determining auto insurance rates, such as the impact on pricing, policy cancellations, or denial of coverage for individuals with low credit scores. It emphasizes the importance of finding insurers that offer no credit check options to mitigate these challenges.

What innovative features does Allstate offer to its customers?

Allstate offers innovative features such as Drivewise, which rewards safe driving behavior with discounts on premiums. This usage-based insurance program tracks driving habits using telematics devices or smartphone apps and provides personalized feedback to encourage safer driving practices. Enter your ZIP code now to start comparing.

How does Mile Auto differentiate itself in the insurance market?

What are some strategies suggested for improving credit scores to secure better auto insurance rates?

The article suggests several strategies for improving credit scores to secure better auto insurance rates, including paying bills on time, reducing debt, and maintaining a good credit history. It also advises consumers to obtain free annual credit reports from reputable agencies and to shop around for the best insurance deals despite credit challenges.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Commercial Lines Coverage Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.