Cheap Virginia Auto Insurance in 2025 (Save Big With These 10 Providers!)

USAA, Progressive, and State Farm are the top choices for the cheap Virginia auto insurance with rates as low as $18 per month, these providers deliver great value. Known for their extensive coverage, excellent customer service and competitive pricing that is ideal for Virginia drivers seeking reliable insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Min. Coverage in Virginia

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage in Virginia

A.M. Best Rating

Complaint Level

Pros & Cons

USAA leads the way as the top choice for cheap Virginia auto insurance, offering competitive rates beginning at just $18 per month for comprehensive coverage, excellent customer service and competitive pricing.

Like most states, Virginia requires that drivers carry auto insurance. Fortunately, rates are low, making it easy to get affordable Virginia auto insurance quotes.

Our Top 10 Company Picks: Cheap Virginia Auto Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $18 A++ Military Families USAA

#2 $26 A+ Competitive Rates Progressive

#3 $27 B Local Agents State Farm

#4 $29 A++ Competitive Rates Geico

#5 $31 A++ Discount Opportunities Travelers

#6 $36 A+ Coverage Options Nationwide

#7 $42 A Customizable Policies Farmers

#8 $43 A+ Online Tools Allstate

#9 $44 A+ Customer Satisfaction Erie

#10 $54 A Flexible Coverage Liberty Mutual

Virginia minimum auto insurance requirements include liability and uninsured/underinsured motorist coverage. However, many drivers may need additional coverage and higher limits to be better protected.

Understanding auto insurance can be hard but we have everything you need to know to buy Virginia auto insurance with confidence.

- Cheap Virginia Auto Insurance

- Get Affordable Buckingham, VA Auto Insurance Quotes (2025)

- Get Affordable Wytheville, VA Auto Insurance Quotes (2025)

- Get Affordable Ridgeway, VA Auto Insurance Quotes (2025)

- Get Affordable Raven, VA Auto Insurance Quotes (2025)

- Get Affordable Madison Heights, VA Auto Insurance Quotes (2025)

- Get Affordable Lovettsville, VA Auto Insurance Quotes (2025)

- Get Affordable Independence, VA Auto Insurance Quotes (2025)

- Get Affordable Earlysville, VA Auto Insurance Quotes (2025)

- Get Affordable Brookneal, VA Auto Insurance Quotes (2025)

To find affordable Virginia auto insurance rates right now, enter your ZIP code above.

- Average Virginia auto insurance rates are $92 per month

- Required liability coverage: 25/50/20

- Uninsured/underinsured motorist coverage: 25/50/20

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

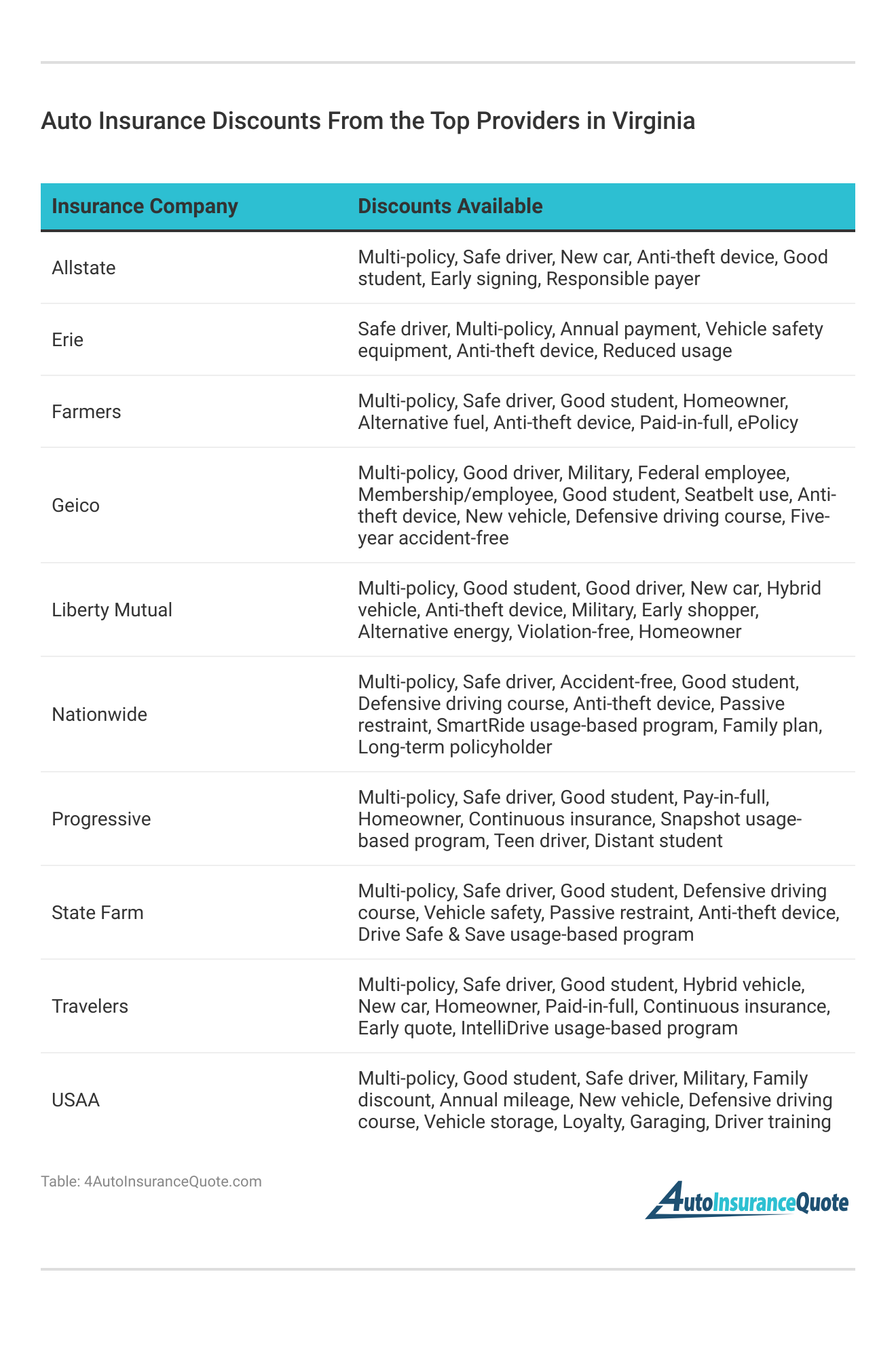

#1 – USAA: Top Overall Pick

Pros

- Exceptional Value for Military Families in Virginia: USAA offers some of the lowest rates for Virginia drivers, with premiums starting at $18 per month, making it an excellent choice for military families residing in the state.

- Comprehensive Coverage Tailored for Virginians: Provides extensive coverage options including unique benefits for military members, such as deployment coverage and rental car reimbursement, ensuring comprehensive protection for Virginia drivers.

- High Customer Satisfaction in Virginia: USAA is highly rated for customer service, which is crucial for Virginia owners looking for reliable and responsive support in their auto insurance needs. Find our more through our Allstate vs. USAA insurance review.

Cons

- Eligibility Limitations for Virginia Drivers: USAA’s services are restricted to military members and their families, which excludes many Virginia drivers from accessing these low rates and extensive coverage options.

- Limited Physical Locations in Virginia: Fewer local offices can be a drawback for Virginia policyholders who prefer in-person interactions for managing their auto insurance policies and resolving issues.

#2 – Progressive: Best for Competitive Rates

Pros

- Affordable Rates for Virginia Drivers: Progressive offers competitive rates starting at $26 per month, making it a cost-effective option for Virginia drivers looking for cheap auto insurance. Find out more through our Progressive insurance review.

- Snapshot Program Benefits for Virginians: The Snapshot app allows Virginia drivers to potentially lower their rates by demonstrating safe driving habits, offering additional savings based on individual driving behavior.

- Wide Coverage Options for Virginia Enthusiasts: Provides a variety of coverage types and add-ons, including gap insurance and new car replacement, catering to the diverse needs of Virginia auto enthusiasts.

Cons

- Customer Service Variability for Virginia Drivers: Some Virginia customers report issues with customer service and claims handling, which can affect the overall satisfaction of drivers seeking reliable support.

- Complex Policy Details for Virginians: The extensive range of options and add-ons might be overwhelming for some Virginia drivers, requiring careful review to ensure they select the right coverage.

#3 – State Farm: Best for Local Agents

Pros

- Local Agents for Virginia Drivers: With a strong network of local agents, State Farm provides personalized service and support, which is ideal for Virginia drivers who prefer face-to-face interactions for their auto insurance needs.

- Discount Opportunities for Virginians: Offers various discounts, including those for safe driving and bundling, helping Virginia drivers reduce their premiums and find affordable auto insurance.

- High Customer Satisfaction in Virginia: State Farm consistently receives positive reviews for customer service, making it a reliable choice for Virginia drivers seeking high-quality support. Delve more through our State Farm insurance review.

Cons

- Higher Premiums for Some Virginians: Without applying discounts, State Farm’s rates may be higher compared to other providers, which could be a consideration for budget-conscious Virginia drivers.

- Limited Digital Features for Virginia Enthusiasts: The online experience and app functionalities may be less advanced compared to competitors, potentially impacting Virginia drivers who prefer managing their policies online.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Geico: Best for Competitive Rates

Pros

- Low Rates for Virginia Drivers: Geico offers competitive premiums starting at $29 per month, providing affordable auto insurance options for Virginia drivers. Read more through our Geico insurance review.

- Strong Online Tools for Virginians: Geico’s user-friendly website and mobile app facilitate easy management of policies, making it convenient for Virginia drivers to handle their insurance needs online.

- Various Discounts Available for Virginia Owners: Geico provides multiple discounts, including for safe driving and military service, which can help Virginia drivers save even more on their insurance premiums.

Cons

- Customer Service Challenges for Virginia Drivers: Some Virginia customers report difficulties with claims processing and customer service, which can affect overall satisfaction with Geico’s services.

- Limited Personal Interaction for Virginians: Primarily operates online, which might be less appealing to Virginia drivers who prefer in-person service for managing their auto insurance policies.

#5 – Travelers: Best for Discount opportunities

Pros

- Discount Opportunities for Virginia Drivers: Travelers offers various discounts, including those for safe driving and bundling, helping Virginia drivers find affordable auto insurance and reduce their premiums.

- Customizable Policies for Virginians: Provides flexible policy options and add-ons, allowing Virginia drivers to tailor their coverage according to their specific needs and preferences. Look for more details through our Travelers insurance review.

- Strong Financial Stability for Virginia Owners: With an A++ rating from A.M. Best, Travelers ensures reliable financial backing, giving Virginia drivers confidence in their insurance coverage.

Cons

- Complex Policy Options for Virginia Drivers: The extensive range of options and add-ons can be overwhelming for some, requiring careful review and understanding to select the best coverage for Virginia drivers.

- Customer Service Variability in Virginia: Service quality can vary based on location, leading to inconsistent customer support experiences for Virginia drivers.

#6 – Nationwide: Best for Coverage Options

Pros

- Diverse Coverage Options for Virginia Drivers: Nationwide offers a broad range of coverage types and add-ons, including accident forgiveness and vanishing deductibles, catering to the varied needs of Virginia drivers.

- Discount Programs for Virginians: Provides discounts for safe driving, bundling, and more, helping Virginia drivers reduce their premiums and make auto insurance more affordable. Find out more through our Nationwide insurance review.

- Positive Customer Service Feedback in Virginia: Generally receives favorable reviews for customer service, reflecting Nationwide’s commitment to supporting Virginia drivers effectively.

Cons

- Higher Premiums for Some Virginians: Premiums can be on the higher side compared to other providers, especially if discounts are not applied, which may impact budget-conscious Virginia drivers.

- Less Intuitive Online Experience: The website and app functionality may be less user-friendly compared to competitors, potentially affecting the ease of managing policies and claims for Virginia drivers.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – Farmers: Best for Customizable Policies

Pros

- Customizable Policies for Virginia Drivers: Farmers offers highly customizable policies, allowing Virginia drivers to tailor their coverage extensively to meet their specific needs and preferences.

- Wide Range of Discounts for Virginians: Includes discounts for safe driving, bundling, and more, helping Virginia drivers reduce their premiums and save on auto insurance.

- Comprehensive Coverage Options: Provides a broad range of coverage types and add-ons, ensuring that Virginia drivers can find protection that suits their diverse needs. Read more through our Farmers auto insurance review.

Cons

- Potentially Higher Rates for Virginians: Premiums can be higher, especially for new drivers or those without multiple discounts, which may be a consideration for cost-sensitive Virginia drivers.

- Complex Policy Information: The detailed policy options and add-ons can be confusing, requiring Virginia drivers to carefully review their choices to ensure appropriate coverage.

#8 – Allstate: Best for Online Tools

Pros

- Excellent Online Tools for Virginia Drivers: Allstate offers a robust website and app for managing policies, tracking claims, and accessing digital ID cards, providing convenience for Virginia drivers. Read more through our Allstate insurance review.

- Good Discount Opportunities for Virginians: Includes various discounts for safe driving, bundling, and more, allowing Virginia drivers to lower their premiums and find affordable insurance.

- Comprehensive Coverage Options: Offers a wide range of coverage types and add-ons, including features like accident forgiveness and new car replacement, catering to Virginia drivers’ diverse needs.

Cons

- Higher Premiums for Some Virginians: Rates may be higher compared to some other providers, which could impact affordability for Virginia drivers looking for the lowest premiums.

- Mixed Customer Service Feedback: Some customers report issues with customer service and claims processing, potentially affecting overall satisfaction for Virginia drivers.

#9 – Erie: Best for Customer Satisfaction

Pros

- High Customer Satisfaction for Virginia Drivers: Erie consistently receives positive reviews for customer service, indicating strong support and satisfaction among Virginia drivers.

- Affordable Rates for Virginians: Offers competitive premiums starting at $44 per month, providing cost-effective insurance options for Virginia drivers. Learn more through our Erie auto insurance review.

- Good Discount Options: Provides various discounts, including for safe driving and bundling, helping Virginia drivers reduce their insurance costs and find affordable coverage.

Cons

- Limited Availability in Virginia: Erie is not available in all states, which could limit access for some Virginia drivers interested in their coverage options.

- Complex Policies: The range of options and discounts may be complex, making it challenging for Virginia drivers to select the most suitable coverage without careful consideration.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Flexible Coverage

Pros

- Flexible Coverage Options for Virginia Drivers: Liberty Mutual offers a range of customizable policies and coverage options, including features like accident forgiveness and new car replacement, ideal for Virginia drivers.

- Strong Financial Stability: With an A rating from A.M. Best, Liberty Mutual’s financial stability ensures that Virginia drivers can rely on the company to meet its obligations and handle claims effectively.

- Variety of Coverage Options: Offers diverse coverage options and add-ons, catering to the specific needs and preferences of Virginia drivers and enthusiasts. Read more through our Liberty Mutual auto insurance review.

Cons

- Higher Premiums Compared to Some Providers: Rates may be higher than other options, which could be a consideration for Virginia drivers seeking the most budget-friendly insurance.

- Customer Service Variability: Service quality can vary, potentially affecting the overall experience for Virginia drivers who may encounter inconsistent support.

Virginia Auto Insurance Laws and Requirements

Drivers in Virginia are governed under what is known as a tort insurance system, which means that when an accident occurs, one of the drivers involved will be held responsible, or at fault.

Virginia Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $43 $103

Erie $44 $118

Farmers $42 $100

Geico $29 $70

Liberty Mutual $54 $129

Nationwide $36 $86

Progressive $26 $61

State Farm $27 $63

Travelers $31 $73

USAA $18 $43

State law also directs drivers to establish financial responsibility in the form of minimum requirements for auto insurance coverage. There are four main areas that drivers need to purchase auto insurance, and minimum rates for each are involved.

The first two mandatory auto insurance liability policies cover instances when you are found to be at fault for the accident. Bodily injury liability or BIL insurance covers the medical costs for the parties in the other vehicles that sustain injuries due to your actions.

The minimum coverage for BIL is $25,000 per person for a single accident and $50,000 for all parties in a single accident. Property damage liability or PDL insurance covers the costs associated with damage that you cause to another person’s property in an accident that you are found at fault for, such as auto body damage.

The minimum coverage required for PDL is $20,000. The next two legally required coverages are for instances when you are in an accident with an uninsured motorist, and the accident is their fault. Since the other driver doesn’t have insurance, it’s best if you have some form of coverage to take care of you.

The legally required amount of uninsured motorist BIL coverage is the same $25,000 per person in a single accident and $50,000 for all parties. If you typically drive with your entire family in the car – you may consider investing in higher coverage just in case.

The uninsured motorist PDL minimum coverage requirement is $20,000 – you can determine based on the value of your car if this is going to be adequate for you.

Virginia Auto Insurance Rates

Average insurance rates in Virginia are cause enough for drivers to jump for joy when compared to those in the rest of the nation. The statewide average for auto insurance premiums is just $1,100 per year, which works out to under $100 per month.

This is about $300 less per year than the national average, which ranks Virginia as one of the least expensive states to insure your automobile. Unlike other major metropolitan areas, the situation doesn’t get much worse in Virginia’s major cities.

There are a lot of factors that impact how car insurance rates are calculated.

While many of these factors are simply based on your own driving record, two things that affect even the safest of drivers are age and gender. As with most states, males typically pay higher auto insurance rates than females.

To get the cheapest Virginia car insurance, avoid infractions on your driving record, and improve your credit score. Read more in our expert guide titled “Get Affordable Washington D.C. Auto Insurance Quotes.”

Ready to compare Virginia auto insurance quotes? Enter your ZIP code to see rates from top Virginia auto insurance companies.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Virginia Car and Driving Statistics

Over the past couple of years, Virginia drivers have seen some slight decreases in auto crashes and injuries related to crashes on the state’s roads. In 2010, Virginia drivers took part in 116,386 traffic accidents, which was a decrease of less than half of a percentage point over 2009 – a very small decrease.

However, the total of 61,418 injuries was down 2.5%, and the 740 fatalities suffered as a result of traffic accidents was a drop of 2.1% from 2009’s total. Virginia was of the few states to have a relatively flat crash rate over the past couple of years, and drivers in the state will need to work a bit harder if they want to see that total come down in the future.

Auto theft statistics, on the other hand, look positively golden for Virginians. The state saw just 11,419 instances of vehicle theft in 2009, which is down about 40% from the beginning of the decade and down about 14% from 2008’s total.

This works out to a rate of just 144 vehicle thefts per 100,000 residents, which is quite low considering the size of Virginia’s population and places the state in the top 10 for the lowest vehicle theft rates in the nation.

These low auto theft rates are attributed to a combination of law enforcement initiatives as well as much greater use of anti-theft recovery systems taken by vehicle owners to secure their vehicles.

Cheap Auto Insurance in Virginia

Virginians can take satisfaction in their auto insurance landscape, as they enjoy lower average payments compared to residents of similarly populated states. This is attributed to a lower risk of accidents and auto theft in the state. Experience the benefits of affordable coverage with cheap West Virginia Auto insurance.

If you would like to get an auto insurance quote for your Virginia vehicle, enter your zip code in the box above and fill out our brief form. After entering some basic information about you and your vehicle, you will be given the most competitive rates in the state of Virginia.

Drive safely and secure your vehicle to lower auto insurance rates in Virginia.Tracey Wells Licensed Insurance Agent

Ready to compare Virginia auto insurance quotes? Enter your ZIP code to see rates from top Virginia auto insurance companies.

Frequently Asked Questions

What are the auto insurance requirements in Virginia?

In Virginia, the state requires a minimum liability coverage of 25/50/20 for bodily injury and property damage. This means you need at least $25,000 coverage per person injured, $50,000 coverage for all persons injured, and $20,000 coverage for property damage.

Are there any additional coverage options required in Virginia?

Virginia also requires uninsured/underinsured motorist coverage with minimum limits of 25/50 for bodily injury. To get started, Enter your ZIP code here.

How can I find the best Virginia auto insurance plans?

To find the best Virginia auto insurance plans, it’s recommended to shop around and compare quotes from multiple Virginia auto insurance companies. This allows you to compare coverage options and rates to make an informed decision about affordable auto insurance.

What factors should I consider when comparing Virginia auto insurance quotes?

When comparing Virginia auto insurance quotes, consider factors such as coverage limits, deductibles, discounts, customer reviews, and the financial stability of the insurance company.

What are the average auto insurance rates in Virginia?

On average, auto insurance rates in Virginia are around $91.67 per month or $1,100 per year. These rates are lower compared to the national average. To get started, Enter your ZIP code here.

Who are the insurance feature writer and the licensed insurance agent mentioned in the article?

The insurance feature writer, Rachel Bodine, who graduated with a BA in English, has extensive knowledge of insurance laws and rates, particularly when it comes to combining insurance policies. The licensed insurance agent, Jimmy McMillan, founder of HeartLifeInsurance.com, specializes in insurance for people with heart problems.

What is the purpose of the free quote tool mentioned in the article?

he free quote tool is designed to help users compare quotes from multiple auto insurance companies to find the most competitive rates. By entering their ZIP code, users can access personalized quotes and make informed decisions.

Which provider is noted for offering the best discount opportunities?

Travelers is highlighted as the provider offering the best discount opportunities for auto insurance in Virginia. They provide various discounts that can help reduce the overall cost of coverage. To get started, Enter your ZIP code here.

What factors are suggested to consider when comparing Virginia auto insurance quotes?

When comparing Virginia auto insurance quotes, it is recommended to consider coverage limits, deductibles, discounts, customer reviews, and the financial stability of the insurance company. Additionally, understanding the differences between comprehensive vs. collision coverage in car insurance is crucial. These factors ensure you get the best value and reliable coverage.

How has the auto theft rate in Virginia changed over the past decade according to the article?

The auto theft rate in Virginia has decreased significantly, with a reduction of about 40% from the beginning of the decade. In 2009, the state saw just 11,419 instances of vehicle theft, placing it in the top 10 for the lowest vehicle theft rates in the nation.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.