Cheap Utah Auto Insurance for 2025 (Save Money With These 10 Companies)

You can find the best cheap Utah auto insurance with USAA, Geico and Travelers, starting at a low price of $22 for minimum coverage. Utah is a no-fault insurance state, so to get the best deal, it's crucial to compare quotes to get the cheapest car insurance available.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in Utah

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage in Utah

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsWhen it comes to cheap Utah auto insurance, USAA, Geico, and Travelers insurance, offer affordable rates for your for your coverage, starting at $22/mo.

Understanding auto insurance can help you make sense of why Utah car insurance is more expensive, which is why affordable cheap auto insurance in Utah, is easier to find for some people than for others. We’ve got everything you need to know right here.

Our Top 10 Company Picks: Cheap Utah Auto Insurance

Company Rank Monthly Rate Good Driver Discount Best For Jump to Pros/Cons

#1 $22 10% Military Families USAA

#2 $33 25% Affordable Rates Geico

#3 $39 10% Discount Options Travelers

#4 $42 10% Multi-Policy Savings Nationwide

#5 $43 10% Budgeting Tools Progressive

#6 $46 15% Cheap Rates State Farm

#7 $47 15% Discount Availability American Family

#8 $51 15% Safe Drivers Farmers

#9 $52 20% Drivewise Program Allstate

#10 $53 12% Policy Options Liberty Mutual

Before you buy Utah auto insurance, make sure you have the best price by shopping around.

Enter your ZIP code for free to find cheap Utah car insurance quotes.

- Cheapest minimum coverage in Utah: USAA, Geico and Travelers

- Utah is a no-fault auto insurance state

- Compare rates to get cheap auto insurance in Utah

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#1 – USAA: Best for Military Families

Pros

- Competitive Rates: USAA offers competitive rates, especially for military members and their families based in Utah. They offer special discounts and benefits tailored for military personnel, including discounts for storing a vehicle during deployment for cheaper auto insurance rates.

- Excellent Customer Service: USAA consistently ranks high in customer satisfaction surveys, often praised for its helpful and responsive customer service, contributing to cheap auto insurance in Utah. If you want help in learning how to file a claim, read our guide “How to File an Auto Insurance Claim” for the information you need.

- Comprehensive Coverage Options: USAA offers a wide range of coverage options, including standard policies (liability, collision, comprehensive), and additional options like roadside assistance and rental reimbursement. These extras helped contribute to USAA being the top spot for cheap Utah auto insurance. Find out more with our USAA auto insurance review.

Cons

- Eligibility Restrictions: USAA membership is restricted to military members, veterans, and their families, so not everyone is eligible to join. The rates for non-military members can be higher when compared to other insurers, which can be a problem for those seeking cheaper auto insurance in Utah.

- Limited Availability: USAA is not available in every state, so those looking for cheap Utah auto insurance may find this as a drawback if you’re ever relocating outside the coverage area.

#2 – Geico: Best for Affordable Rates

Pros

- Competitive Rates: Geico is known for offering some of the most competitive rates in the car insurance industry, making it an attractive option for many drivers. Read Geico’s auto insurance review to see why they have cheap auto insurance not just in Utah, but in other states too.

- Discounts: Geico offers a variety of discounts, such as good driver, good student, multi-policy, and military discounts, which can help lower premiums, perfect for lowering auto insurance premiums in Utah.

- User-Friendly Online and Mobile Platforms: Geico provides robust online and mobile app services that allow customers to manage their policies, file claims, and access roadside assistance easily contributing to Utah’s cheaper than average car insurance premiums.

Cons

- Higher Rates for High-Risk Drivers: Geico can be less competitive in pricing for high-risk drivers compared to other insurers, which may result in higher premiums which can be a problem for some in the more congested areas of Utah.

- Customization of Policies: Some customers feel that Geico’s policies are less customizable compared to other insurers that offer more tailored options which may be a problem for getting cheap car insurance in Utah if the option is in another policy.

#3 – Travelers: Best for Discount Options

Pros

- Comprehensive Coverage Options: The wide range of coverage options that Traveler’s offer shows why they’re third for cheap auto insurance in Utah, offering standard policies and additional options like gap insurance, new car replacement, accident forgiveness, and roadside assistance. Be sure to read Travelers auto insurance review to find out more.

- Discounts: Travelers provides various discounts, such as safe driver, multi-policy, multi-car, good student, and hybrid/electric vehicle discounts, helping to reduce premiums. If you need help finding cheap Utah auto insurance, follow our guide; “Affordable Auto Insurance” to help you find quotes that fit your needs.

- Innovative Tools: Travelers offers tools like IntelliDrive, a usage-based insurance program that tracks driving behavior to potentially lower premiums for safe drivers, contributing to Traveler’s lower price for auto insurance in Utah.

Cons

- Higher Premiums: Some customers report that Travelers’ premiums can be higher than those of other insurers, especially for full coverage options, so depending on what vehicle you drive in Utah, your insurance premium may be larger than normal.

- Limited Availability of Discounts: Travelers may offer fewer discounts compared to other Utah based insurers, which might result in higher premiums for some policyholders.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Multi-Saving Policies

Pros

- Comprehensive Coverage Options: Nationwide offers a wide range of coverage options, including standard policies and additional options like gap insurance, new car replacement, and accident forgiveness, the last of which helps keep lower auto insurance for those based in Utah. Read our article on “What are the different types of auto insurance coverage?” to find more coverage options.

- Discounts: Nationwide provides various discounts, such as multi-policy, multi-car, safe driver, good student, anti-theft device, vanishing deductables, and paperless billing discounts, which can help lower Utah’s insurance premiums. They also offer SmartRide, a usage-based insurance program that tracks driving behavior and potentially lowers premiums for those driving in Utah.

- Strong Financial Ratings: Nationwide has strong financial ratings, indicating reliability in paying out claims and overall financial stability, which is perfect for Utah drivers seeking auto insurance, who may feel at risk. To know more about Nationwide, check our Nationwide auto insurance review.

- Customer Service: Generally, Nationwide receives positive reviews for its customer service, with representatives available to assist policyholders with their needs. The claims process at Nationwide is also considered to be smooth and streamlined with online and mobile claims reporting, making it easier for policyholders to file and track claims, this contributes to cheap auto insurance in Utah.

Cons

- Higher Premiums: Some customers report that Nationwide’s premiums can be higher than those of other insurers, especially for full coverage options. This can be problematic for those in Utah looking for a cheaper premium for bigger coverage.

- Mixed Reviews on Claims Satisfaction: While many customers are satisfied with Nationwide’s claims process, there are occasional complaints about claim denials or lower-than-expected payouts, but this all depends on the make and model of your car within Utah, as well as the accident involved.

- Specialized Coverage: Nationwide may lack some specialized coverage options or endorsements that other insurers provide, such as rideshare coverage or classic car insurance, this can be a drawback for some drivers in Utah looking for specific auto insurance.

#5 – Progressive: Best for Budgeting Tools

Pros

- Competitive Rates with Coverage Options: Progressive is known for offering competitive rates with its wide range of coverage options, including gap insurance, rideshare cover, and custom parts and equipment coverage, often lower than many other major Utah based auto insurers.

- Snapshot Program: Progressive’s Snapshot program can offer discounts based on your actual driving habits, potentially lowering your premiums in Utah.

- Bundling Discounts: Progressive offers discounts for bundling car insurance with other types of insurance within their company. So if you’re already a customer of Progressive for other types of insurance, you can find cheaper auto insurance Utah to go with it.

- Customer Service: Generally positive reviews for customer service and claims handling, contributing to their cheap Utah auto insurance prices. Our Progressive auto insurance review discusses their fantastic customer service and more.

Cons

- Rates Can Vary: While generally competitive, rates can sometimes be higher depending on individual circumstances such as location within Utah and driving history.

- Potential Rate Increases: Some customers have reported significant rate increases upon renewal of their auto insurance, even without any claims or changes in driving history.

- Limited Local Agents: Progressive primarily operates online and over the phone, which might be a drawback for those who prefer face-to-face interaction with an agent when discussing auto insurance within Utah.

#6 – State Farm: Best for Cheap Rates

Pros

- Strong Local Presence: State Farm has a large network of local agents, offering personalized service and face-to-face interactions which is perfect for those in Utah who prefer to visit their agent for auto insurance.

- Excellent Customer Service: Generally high ratings for customer service and claims handling, especially with their user-friendly app for mobile, this can be used for managing policies, filing claims, and accessing ID cards. Look into our State Farm auto insurance review, here you’ll be able to read about their customer service and how it contributes to auto insurance based in Utah.

- Financial Strength: State Farm is one of the largest and most financially stable insurance companies, ensuring reliability in paying claims, so those in Utah who are worried their auto insurance premiums won’t pay out, need not worry.

Cons

- Premiums Can Be Higher: Some customers find that State Farm’s premiums are higher compared to other Utah based auto insurers. To learn more about auto insurance premiums, read our “What are auto insurance premiums?”

- Rate Increases: Reports of rate increases upon renewal, which can be frustrating for auto insurance policyholders within Utah with no change in their driving history.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – American Family: Best for Discount Availability

Pros

- Personalized Service: American Family offers a strong network of local agents within Utah, providing personalized customer service for their cheap auto insurance. Read American Family auto insurance reviews for their positive reviews on customer service and claims handling.

- Comprehensive Coverage Options: Wide range of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist, and more, so if you’re working commercially or just driving leisurely around Utah, American family has the right cheap auto insurance for your needs.

- Discounts: Offers various discounts, such as multi-policy, good student, safe driver, loyalty discounts, and usage-based insurance programs like KnowYourDrive which can help save on cheap auto insurance premiums in Utah.

Cons

- Premium Rates: Auto insurance premiums can be higher compared to some competitors in Utah, depending on individual circumstances.

- Discount Limitations: Not all customers may qualify for the available discounts, which can limit potential savings for auto insurance within Utah.

#8 – Farmers: Best for Safe Drivers

Pros

- Local Agents: Farmers has a robust network of local agents, find out more with our Farmers auto insurance review about the personalized service and support that contribute to cheap auto insurance in Utah.

- Comprehensive Coverage Options: Offers a wide range of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist, and specialty options like rideshare and new car replacement coverage, which covers different circumstances for various lifestyles for Utah based customers looking for cheap auto insurance.

- Discounts: Farmers provide various discounts, such as multi-policy, good student, safe driver, and affinity group discounts contributing to cheap Utah auto insurance.

- Customizable Policies: Offers highly customizable policies to fit individual needs and preferences for Utah’s auto insurance.

Cons

- Premiums Can Be Higher: Some customers find that Farmers’ premiums are higher compared to other auto insurers within Utah.

- Discount Availability: Not all discounts are available to every customer due to location or driving history, which can limit potential savings for cheaper auto insurance if based in Utah.

- Potential Rate Increases: Some Utah based policyholders report significant rate increases to their auto insurance upon renewal, even without claims or changes in driving history.

#9 – Allstate: Best for Drivewise Program

Pros

- Local Agents and Digital Tools: Allstate has a strong network of local agents within Utah, who can provide personalized service, support, and claims handling for their chap auto insurance. But for more flexibility, they also offer a robust mobile app and online tools for managing policies, filing claims, and accessing insurance ID cards for their auto insurance policies.

- Comprehensive Coverage Options: Offers a wide range of cheap auto insurance coverage options within Utah, including liability, collision, comprehensive, uninsured/underinsured motorist, and specialty coverages like rideshare insurance.

- Discounts: Provides various discounts, such as multi-policy, good student, safe driver, new car, and anti-theft device discounts. If you want to read more, check the Allstate auto insurance review for a wide range of discounts available in Utah for cheaper auto insurance.

- Drivewise Program: The Drivewise program can help safe drivers save money by monitoring driving habits and offering discounts based on safe driving within Utah and lowering their auto insurance premiums.

Cons

- Premiums Can Be Higher: Some customers find Allstate’s premiums to be higher compared to other Utah auto insurers.

- Rate Increases: Some policyholders report significant rate increases with their Utah auto insurance upon renewal, even without any claims or changes in driving history.

- Coverage Limits: Some specialty coverages may have limitations or restrictions within Utah that could impact overall auto insurance coverage.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Policy Options

Pros

- Comprehensive Coverage Options: Offers a wide range of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist, and specialty coverages like accident forgiveness, new car replacement, and better car replacement. This variety of coverage can satisfy the policy needed for your cheap auto insurance in Utah.

- Discounts: Provides various discounts, such as multi-policy, safe driver, good student, as well as bundling instance discounts, which can give a large drop in Utah based auto insurance premiums.

- Customizable Policies: Highly customizable policies to fit individual needs and preferences in different locations within Utah for its affordable auto insurance.

- Online Tools and Mobile App: Offers a user-friendly website and mobile app for managing policies, 24/7 assistance for customer service and filing auto insurance claims within Utah, and accessing auto insurance ID cards.

Cons

- Premiums Can Be Higher: Some customers find Liberty Mutual’s premiums to be much higher compared to other Utah based auto insurers. Read into our Liberty Mutual auto insurance review to see how this could affect your cheap auto insurance premiums in Utah.

- Rate Increases: Some policyholders report significant rate increases upon renewal, even without any claims or changes in driving history, this can be problematic after the first year of Utah based auto insurance with Liberty Mutual.

- Discount Availability: Not all discounts are available to every customer, which can limit potential savings contributing to higher auto insurance premiums in Utah.

Getting Cheap Utah Auto Insurance

One of the main reasons that Utah auto insurance rates are higher than the national average is due to no-fault auto insurance. Utah is a no-fault auto insurance state. No-fault insurance means that a driver who is involved in an accident is reimbursed for their costs by their own insurance company regardless of fault.

Utah Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $52 $117

American Family $47 $105

Farmers $51 $115

Geico $33 $73

Liberty Mutual $53 $119

Nationwide $42 $93

Progressive $43 $95

State Farm $46 $103

Travelers $39 $88

USAA $22 $50

However, to drive your car in Utah, you must have the required state liability coverage minimums:

- Bodily Injury Liability: $25,000 per person and $65,000 per accident

- Property Damage Liability: $15,000 per accident

Utah auto insurance requires 25/65/15 of liability insurance coverage. This amount of coverage is the minimum amount that is required by the state of Utah and can be increased by the policyholder. Many policyholders choose to increase the amount of coverage that they have to protect themselves from further liability.

The $25,000 minimum coverage amount applies to liability insurance per person for a bodily injury. When an accident occurs, each individual would be covered by $25,000 in liability insurance from the accident. The other driver and passengers in both vehicles are covered by this policy. $65,000 in maximum coverage is allowed for bodily injury in each accident.

So, if you require auto insurance, be sure to compare different insurance companies along with their coverage options, the prices will vary greatly depending on what your vehicle is used for, be it personal or commercial. Be sure to enter your ZIP code down below to find quotes swiftly so you can get on the road just as swiftly. Now let’s compare Utah with the surrounding states.

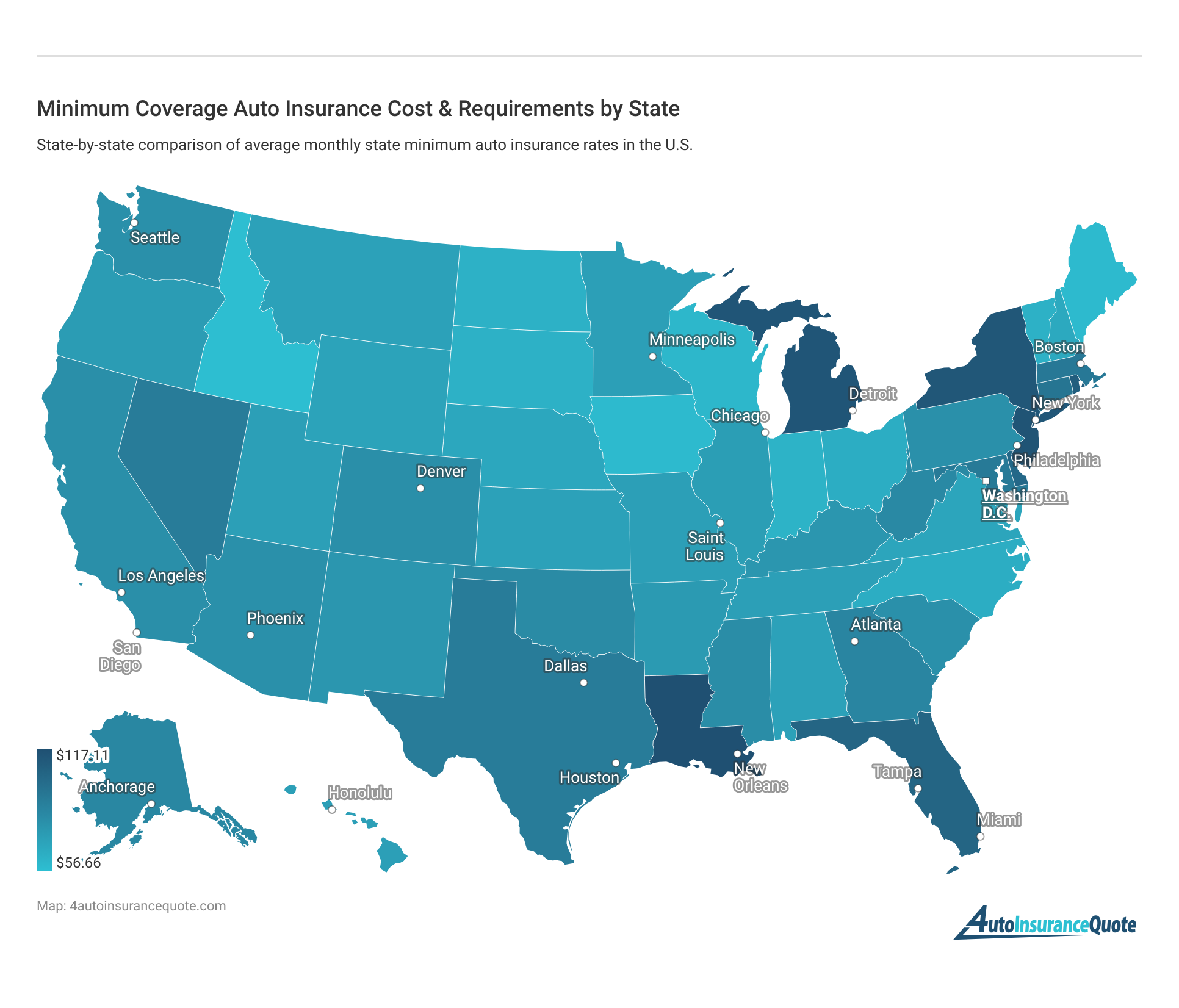

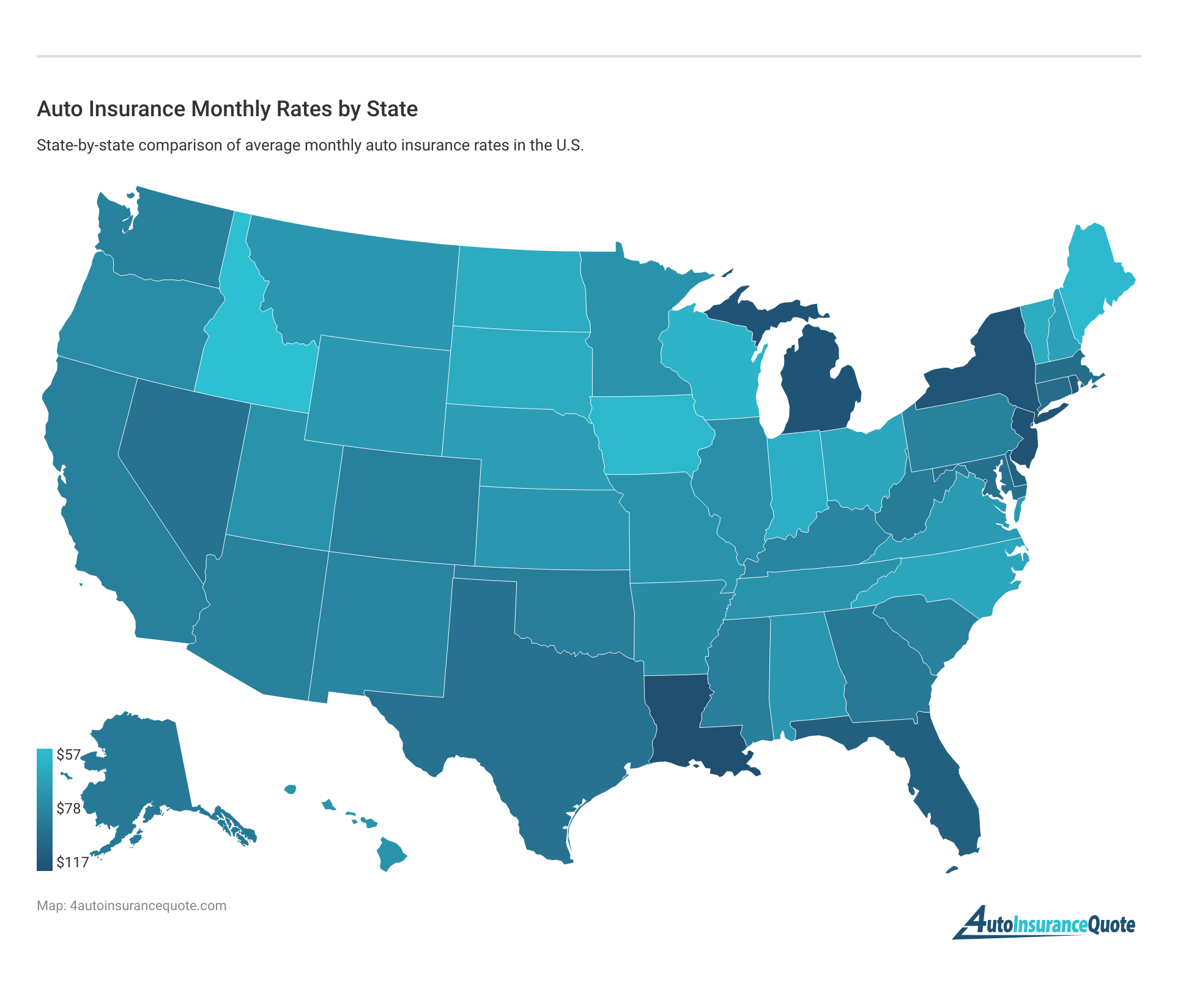

Although Utah has higher than-normal averages for auto insurance when compared to the surrounding states, only Idaho and Wyoming have lower monthly rates for minimum coverage.

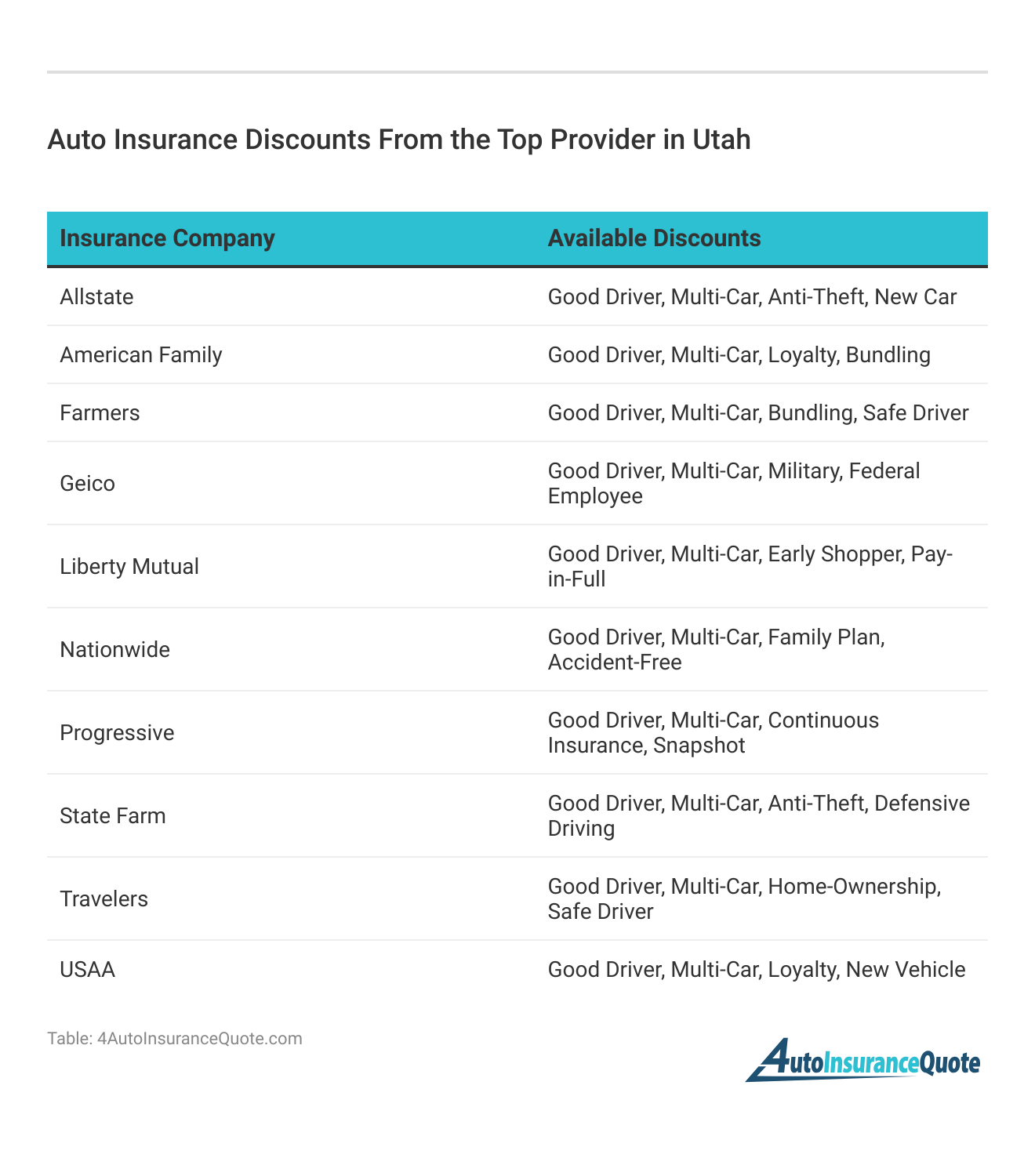

Discounts Can Lead to Cheaper Utah Car Insurance

When you’re shopping around for quotes to get cheap car insurance in Utah, insurance providers will look into many factors including the make and model of your car, your age, driving history, and additional extras. Read our “How Age Affects your Auto Insurance Rates” to see how this could affect your auto insurance in Utah.

To combat that, insurance providers offer a variety of discounts, such as those for bundling policies, having safety features installed in your vehicle, or maintaining a good driving record. Failing to take advantage of these discounts means potentially paying more for your car insurance.

By having anti-theft devices installed, such as an alarm system or vehicle recovery system, can qualify you for discounts. Some insurers also offer discounts for parking your vehicle in a secure location, like a locked garage. Additionally, safe driving courses or defensive driving classes can sometimes lead to discounts.

It’s worth noting that the availability of these discounts may vary among different insurance providers, so be sure to inquire about potential savings opportunities when obtaining quotes. Be sure to use our comparison tool below to compare different insurance providers to find the right discounts that apply to your car insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

How to Determine the Right Level of Coverage For Your Insurance Premiums in Utah

This is the maximum amount that an insurance company will pay out for all claims unless the limit is raised. $15,000 in property damage is covered by the state minimum insurance. This applies to damage done to the property of others when you are at fault for an accident.

Just taking the minimum coverage may seem good for your finances in the short term, but it only covers a small amount. You need more coverage to cover all bases.Tracey L. Wells Licensed Insurance Agent & Agency Owner

Drivers should strongly consider raising their coverage from the state auto insurance requirements. The limits that are in place in the state of Utah are adequate for a minor accident but could leave a driver without recourse for large accidents. Drivers who even have a minor accident may exceed the minimum amount of coverage that the state requires.

Another minimum requirement that the state of Utah enforces is personal injury protection insurance or PIP. This policy requires all insured drivers in the state of Utah to have $3,000 in medical coverage. This policy will cover the medical costs of a driver who is involved in an accident. Drivers often increase this coverage to $10,000 or $25,000 to ensure that all of their medical costs are covered.

Uninsured/underinsured motorist insurance is also available from automobile insurance companies in the state of Utah. This coverage will allow drivers who are involved in an accident with a driver who does not have valid insurance or doesn’t have enough coverage to receive compensation for their losses.

This is a coverage that every driver should consider because it only requires a few extra dollars per month but can save tens of thousands of dollars if a driver were involved in an accident.

Drivers who have a fairly new vehicle or a vehicle that is on a lease/loan may be required by their finance company to take out collision coverage. A collision coverage policy covers a driver in case their vehicle is involved in an accident with another vehicle, object, or rolls over. Replacing parts after a crash can cost thousands of dollars for drivers who are not insured by collision coverage.

Comprehensive coverage is also available for drivers who want to be covered for numerous reasons. This coverage protects a vehicle against theft, vandalism, arson, glass damage (read our “Affordable Full Glass Auto Insurance Coverage” for more information), and numerous other incidents. Drivers who have a vehicle that is on a lease or financed by a bank may want to purchase this coverage.

When you’re searching for the right coverage, be sure to enter your ZIP code below, to find quotes as quickly as a click of a button, you’ll find different providers for your needs.

Utah Auto Insurance Rates State Comparison

When looking into Utah car insurance, as mentioned before, its insurance is slightly above the normal average across the country. However, the insurance rates in Utah are still much cheaper in comparison to the other states in the nation.

We can also take a closer look at the ZIP codes within the state to see how rates changed based on different areas. Unsurprisingly, rates increase as we get to the larger cities of Salt Lake City and Ogden. This can be due to many factors such as more risk for accidents in the more congested areas.

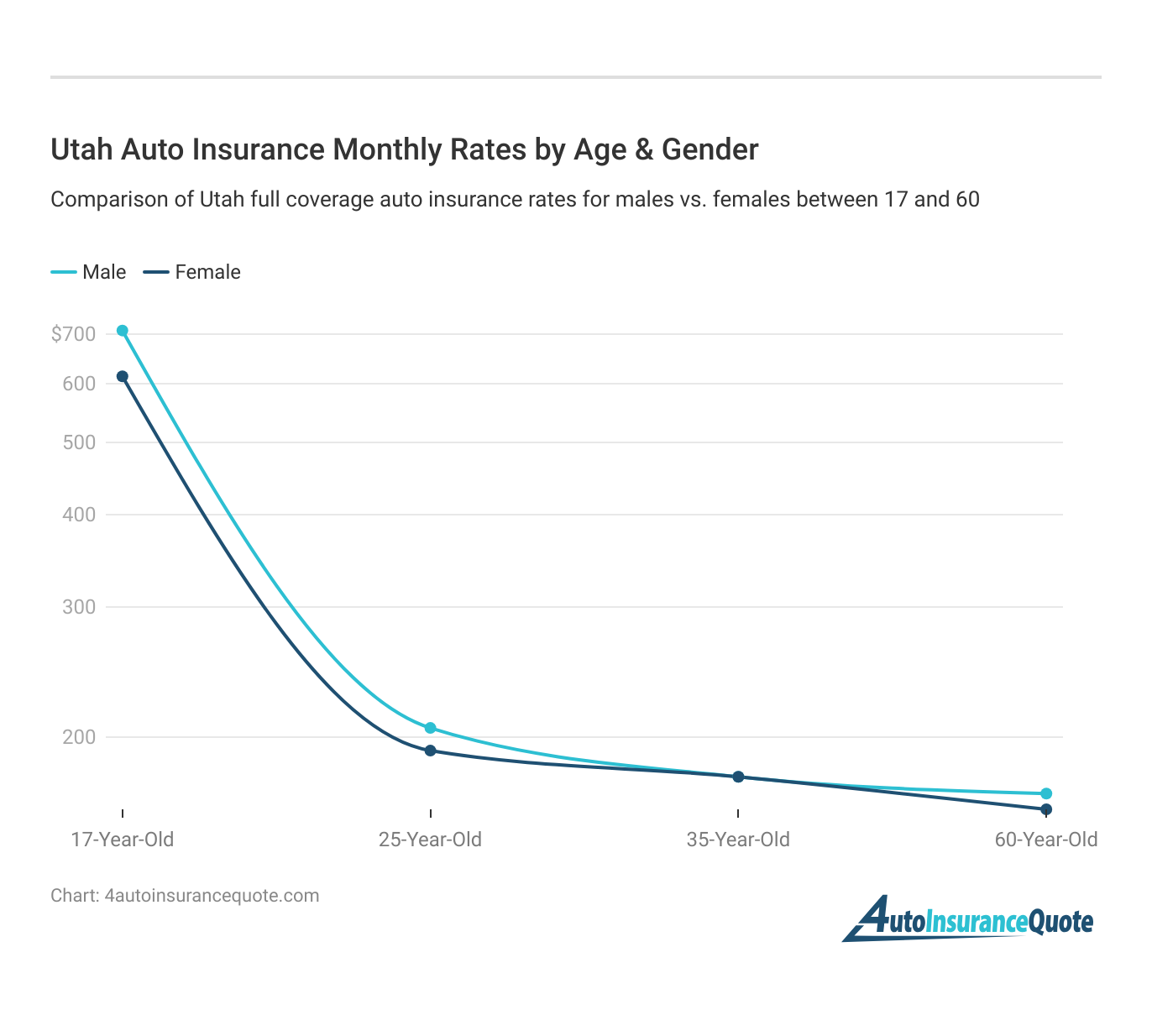

There are a lot of factors that auto insurance companies take into consideration when determining your rates. Take a look at our overview here. While many of these factors are simply based on your driving record, two things that affect even the safest of drivers are age and gender.

As with most states, males typically pay higher auto insurance rates than females. Read up on our guide for “Affordable Auto Insurance quotes for Women” to learn how insurance rates work for women.

If you’re still looking for Utah car insurance quotes, just use our comparison tool down below to find insurance quotes nearly instantly, to find the right insurance premiums for your situation.

Now It’s Your Turn to Get Cheap Auto Insurance in Utah

A driver who is caught without valid auto insurance can be convicted and have to pay a large fine. While Utah does require no-fault insurance, several auto insurance companies provide competitive rates for this type of insurance. Take a read on the “10 Best Auto Insurance Companies” for more details on the best company for your car insurance.

Remember, peace of mind comes with the right auto insurance if you’re ever caught in an accident. Always stay ahead, and if you are a Utah driver, start getting quotes to insure your automobile, simply enter your ZIP code to begin. Find the cheapest auto insurance today.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Frequently Asked Questions

What are the minimum auto insurance requirements in Utah?

In Utah, the state liability insurance coverage minimums are 25/65/15, which means you must have at least $25,000 bodily injury coverage per person, $65,000 bodily injury coverage per accident, and $15,000 property damage coverage per accident.

What is personal injury protection (PIP) coverage?

Personal injury protection (PIP) coverage is a requirement in Utah. It provides coverage for your medical expenses and related costs, regardless of who is at fault in an accident. The minimum PIP coverage required in Utah is $3,000, but drivers often choose to increase this coverage.

Do I need uninsured/underinsured motorist insurance in Utah?

Uninsured/underinsured motorist insurance is not mandatory in Utah, but it is strongly recommended. This coverage protects you if you are involved in an accident with a driver who doesn’t have insurance or doesn’t have enough coverage to compensate you for your losses.

Is collision coverage required in Utah?

Collision coverage is not required by law in Utah. However, if you have a fairly new vehicle or a vehicle that is leased or financed, your finance company may require you to carry collision coverage.

Do I need comprehensive coverage in Utah?

Comprehensive coverage is optional but highly recommended, especially if you have a vehicle that is leased or financed. It protects your vehicle against theft, vandalism, fire, and other non-collision incidents. Comprehensive coverage is not mandated by Utah law.

What is the cheapest car insurance in Midvale, Utah?

Midvale has more expensive insurance than the surrounding areas.. The cheapest car insurance quotes can vary greatly compared to the rest of Utah. Sun Coast insurance has a $60/mo for liability coverage for a Honda CR-V. You can also get similar price quotes with Safeco and Progressive. If you’re looking for more detail, read our affordable Midvale auto insurance quotes.

What is the cheapest insurance in Utah?

The cheapest is the liability insurance policy, however, it is the bare minimum, and you can avail of our cheapest recommendations from USAA, Geico, and Travelers Insurance. If you’re looking for other quotes, be sure to enter your ZIP code below to find insurance quotes in your area in Utah.

What are the best insurance rates in Utah?

For the best insurance rates, in Utah, you’ll have to shop around. But we recommend USAA if you’re a military veteran, otherwise, you should avail Geico for their rates. If you’re unsatisfied with your current car insurance in Utah, be sure to read our guide on canceling your auto insurance before you decide to get a new quote.

What factors are involved with auto insurance?

Numerous factors will affect your insurance premiums; age, driving history, gender, location, the make and model of the car, how often it’s used as well as what it is used for. Be sure to take advantage of different insurance companies with various discounts offered.

What is no-fault insurance?

No-fault insurance is when an accident occurs, no one is at fault. The insurers will be paying out from their own company to pay for their own damages.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.