Cheap New York Auto Insurance in 2025 (Lower Your Rates With These 10 Top Companies!)

For cheap New York auto insurance, Geico, USAA, and Progressive stand out as the top choices, offering monthly rates as low as $40. These top providers excel in affordability and customer satisfaction, making them the top choices for drivers seeking budget-friendly coverage in New York.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage in New York

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage in New York

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe top picks for cheap New York auto insurance are Geico, USAA, and Progressive, offering competitive rates starting at just $40 per month.

Geico is the standout choice overall, combining affordability with comprehensive coverage that suits a wide range of drivers. USAA excels in providing exceptional benefits tailored to military members, making it a top choice for those eligible. Progressive offers significant savings through its Snapshot program, rewarding safe driving behaviors with lower premiums.

Our Top 10 Company Picks: Cheap New York Auto Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $40 A++ Competitive Rates Geico

#2 $44 A++ Military Benefits USAA

#3 $50 A+ Snapshot Discounts Progressive

#4 $60 A+ High Satisfaction Amica

#5 $71 B Excellent Service State Farm

#6 $76 A+ Comprehensive Options Allstate

#7 $85 A+ Vanishing Deductible Nationwide

#8 $86 A Extensive Network Farmers

#9 $90 A++ Solid Reputation Travelers

#10 $104 A Flexible Policies Liberty Mutual

- Cheap New York Auto Insurance

- Get Affordable Valatie, NY Auto Insurance Quotes (2025)

- Get Affordable Sherburne, NY Auto Insurance Quotes (2025)

- Get Affordable Roscoe, NY Auto Insurance Quotes (2025)

- Get Affordable Otto, NY Auto Insurance Quotes (2025)

- Get Affordable North Valley Stream, NY Auto Insurance Quotes (2025)

- Get Affordable North Babylon, NY Auto Insurance Quotes (2025)

- Get Affordable New Windsor, NY Auto Insurance Quotes (2025)

- Get Affordable Mina, NY Auto Insurance Quotes (2025)

- Get Affordable Milo, NY Auto Insurance Quotes (2025)

- Get Affordable Melville, NY Auto Insurance Quotes (2025)

- Get Affordable Medina, NY Auto Insurance Quotes (2025)

- Get Affordable Lake Mohegan, NY Auto Insurance Quotes (2025)

- Get Affordable Kingston, NY Auto Insurance Quotes (2025)

- Get Affordable Jamaica, NY Auto Insurance Quotes (2025)

- Get Affordable Ithaca, NY Auto Insurance Quotes (2025)

- Get Affordable Glasco, NY Auto Insurance Quotes (2025)

- Get Affordable Fort Drum, NY Auto Insurance Quotes (2025)

- Get Affordable Evans Mills, NY Auto Insurance Quotes (2025)

- Get Affordable Eastport, NY Auto Insurance Quotes (2025)

- Get Affordable Cortlandt Manor, NY Auto Insurance Quotes (2025)

- Get Affordable Bayside, NY Auto Insurance Quotes (2025)

- Get Affordable Bainbridge, NY Auto Insurance Quotes (2025)

- Get Affordable Ashford, NY Auto Insurance Quotes (2025)

For a comprehensive understanding, consult our article titled “Affordable Public Auto Insurance.” Need the cheapest car insurance possible? Enter your ZIP code above into our free comparison tool to find the most affordable rates for your vehicle.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

Pros

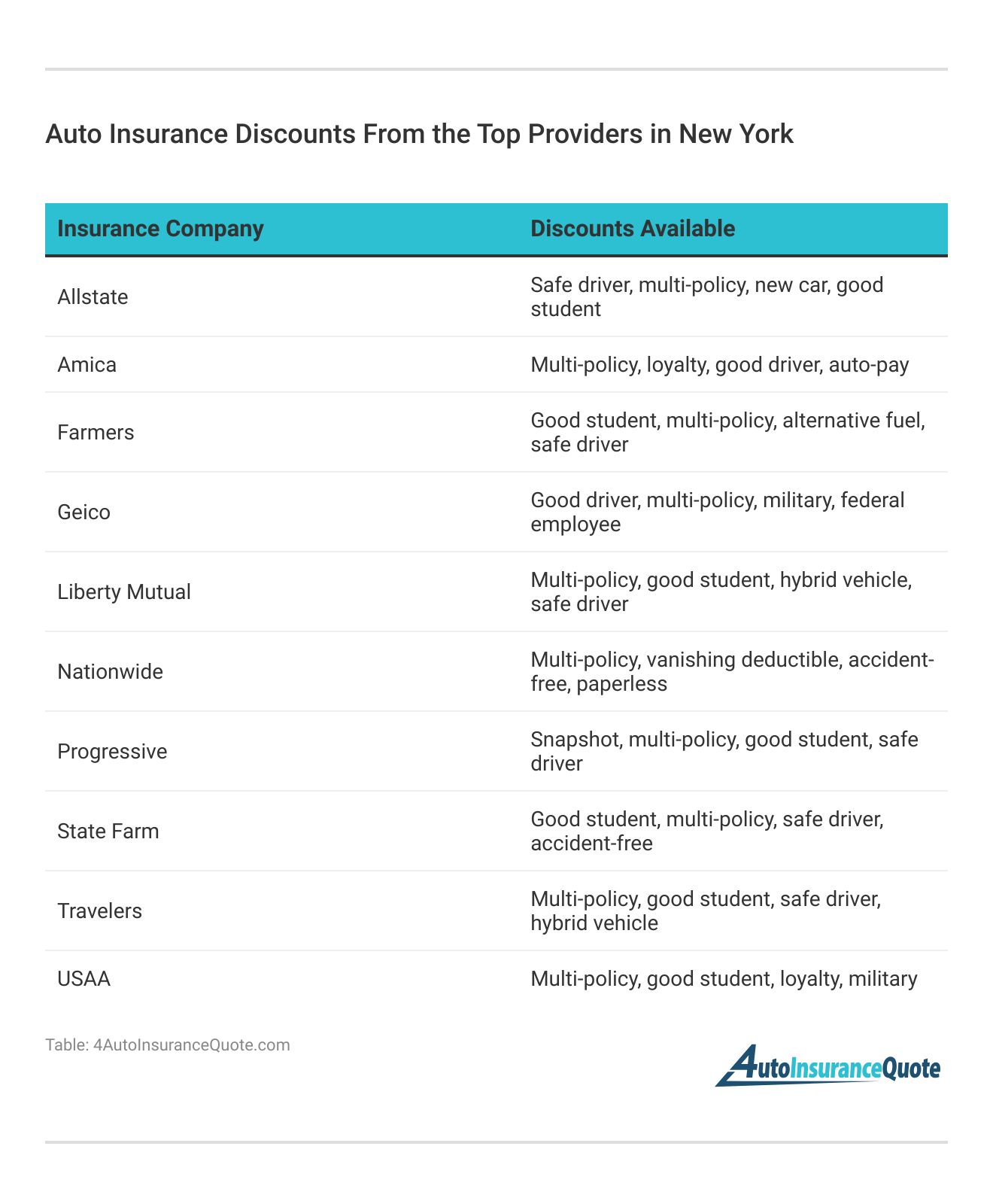

- Low Rates: Geico offers competitive New York insurance rates starting at $40 per month, making it one of the most affordable options for New York drivers seeking budget-friendly coverage.

- Strong Financial Stability: With an A++ rating from A.M. Best, Geico is highly reliable financially, providing peace of mind for New York policyholders who want secure and stable insurance.

- Wide Range of Discounts: Geico provides various discounts, including safe driver and multi-policy discounts, which can significantly benefit New York drivers by lowering their overall insurance costs.

- User-Friendly Online Tools: The Geico app and website offer intuitive tools for managing your New York insurance policy and filing claims, making it convenient for New York owners to handle their coverage.

Cons

- Customer Service Concerns: Some users report less personalized customer service experiences, which can be a drawback for New York policyholders seeking more tailored support. Read more through our Geico insurance review.

- Limited Coverage Options: Geico’s coverage options may not be as extensive as other companies, potentially limiting choices for New York drivers who need more specialized coverage.

- High Premiums for High-Risk Drivers: Geico may charge higher rates for drivers with a poor driving record, impacting New York enthusiasts with less-than-perfect driving histories who might face higher premiums.

#2 – USAA: Best for Military Benefits

Pros

Pros

- Military Benefits: USAA offers military members and their families benefits at competitive rates, starting at $44 per month, which is highly advantageous for New York policyholders with military affiliations who seek tailored coverage.

- Excellent Customer Service: USAA consistently ranks high in customer satisfaction, providing top-notch service to New York drivers who value exceptional support and care. Find our more through our Allstate vs. USAA insurance review.

- Comprehensive Coverage Options: USAA provides a wide range of coverage options tailored to military life, benefiting New York owners who need specialized insurance solutions for their unique situations.

- Strong Financial Stability: With an A++ rating from A.M. Best, USAA is highly reliable financially, ensuring security for New York enthusiasts who prioritize financial stability in their insurance provider.

Cons

- Eligibility Restrictions: USAA is only available to military members, veterans, and their families, limiting access for other New York drivers who may not qualify for their services.

- Limited Physical Locations: USAA operates mainly online, with fewer physical branches compared to other insurers, which may be less convenient for New York policyholders who prefer in-person interactions.

- Average Claims Processing: Some customers have noted that claims processing can take longer than expected, potentially leading to delays for New York insurance holders during crucial times.

#3 – Progressive: Best for Snapshot Discounts

Pros

Pros

- Snapshot Discounts: Progressive’s Snapshot program offers significant discounts, with monthly rates starting at $50, rewarding safe driving habits for New York drivers who want to lower their insurance costs.

- Customizable Coverage: Progressive allows for a high degree of customization in its coverage options, providing New York owners with the flexibility to tailor their insurance to their specific needs.

- Strong Financial Rating: Progressive holds an A+ rating with A.M. Best, indicating solid financial health and reliability for New York policyholders seeking a stable insurance provider.

- Extensive Online Resources: Progressive provides numerous tools and resources for policy management online, making it easy for New York enthusiasts to manage their coverage and access support.

Cons

- Higher Rates for High-Risk Drivers: Progressive’s rates can be higher for those with poor driving records, which may impact New York drivers with less-than-ideal driving histories.

- Inconsistent Customer Service: Customer service experiences can vary widely depending on the representative, potentially leading to mixed experiences for New York policyholders.

- Potential for Rate Increases: Some customers report unexpected rate increases after the first policy term, which could affect New York insurance rates in the long run. Find out more through our Progressive insurance review.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Amica: Best for High Satisfaction

Pros

Pros

- High Customer Satisfaction: Amica is known for excellent customer service and satisfaction, with rates starting at $60 per month, making it a top choice for New York drivers who value high-quality support.

- Comprehensive Coverage Options: Amica provides a wide range of coverage options, including some unique add-ons, benefiting New York owners who need tailored and extensive insurance solutions.

- Strong Financial Rating: Amica holds an A+ rating from A.M. Best, reflecting its financial stability and reliability for New York policyholders seeking a dependable insurance provider.

- Flexible Payment Options: Amica offers flexible payment plans that can be tailored to your budget, helping New York enthusiasts manage their insurance costs more effectively.

Cons

- Fewer Discounts: Compared to other insurers, Amica offers fewer discount opportunities, potentially limiting savings for New York policyholders. For additional insights, refer to our “What are the different types of auto insurance coverage?“

- No Online Quote Tool: Unlike other companies, Amica doesn’t offer an online quote tool, which can make the process less convenient for New York drivers who prefer to get quotes online.

- Higher Premiums for Younger Drivers: Younger drivers may find Amica’s rates higher compared to other insurers, which could be a disadvantage for New York enthusiasts who are just starting out.

#5 – State Farm: Best for Excellent Service

Pros

Pros

- Excellent Service: State Farm is known for providing high-quality service, with rates starting at $71 per month, making it a reliable choice for New York drivers who value strong customer support.

- Wide Network of Agents: With a large network of agents, State Farm offers personalized service to New York policyholders across the state. Delve more through our State Farm insurance review.

- Comprehensive Coverage Options: State Farm provides a variety of coverage options to meet diverse needs, benefiting New York owners who require customizable insurance solutions.

- User-Friendly Mobile App: State Farm’s mobile app offers convenient features for managing your policy and filing claims, making it easier for New York enthusiasts to stay on top of their insurance.

Cons

- Higher Rates for Some Drivers: State Farm’s rates may be higher for certain drivers, which could impact New York insurance costs for those with specific risk factors.

- Less Competitive Discounts: Compared to other insurers, State Farm may offer fewer discount opportunities, limiting savings for New York policyholders.

- Varied Customer Service: Experiences with customer service can vary depending on the local agent, which may lead to inconsistent support for New York owners.

#6 – Allstate: Best for Comprehensive Options

Pros

Pros

- Comprehensive Coverage Options: Allstate provides a wide range of coverage options, with rates starting at $76 per month, catering to various needs for New York drivers.

- Strong Financial Rating: Allstate holds an A+ rating with A.M. Best, reflecting its financial stability and reliability for New York policyholders.

- Extensive Network of Agents: Allstate offers access to a large network of agents, providing personalized support to New York owners. Read more through our Allstate insurance review.

- Numerous Discounts: Allstate offers various discounts, including safe driver and multi-policy discounts, helping New York enthusiasts save on their insurance premiums.

Cons

- Higher Average Rates: Allstate’s average rates may be higher compared to some competitors, impacting affordability for New York drivers.

- Customer Service Inconsistencies: Customer service experiences can vary depending on the agent, potentially leading to mixed experiences for New York policyholders.

- Complex Policies: Policy details can be complex and hard to navigate, which could be challenging for New York insurance enthusiasts.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Vanishing Deductible

Pros

Pros

- Vanishing Deductible: Nationwide offers a vanishing deductible program, which reduces your deductible over time, with rates starting at $85 per month for New York drivers.

- Comprehensive Coverage Options: Nationwide provides a wide range of coverage options, benefiting New York owners with diverse insurance needs.

- Strong Financial Stability: With an A+ rating from A.M. Best, Nationwide offers solid financial reliability for New York policyholders.

- Excellent Customer Service: Nationwide is known for providing good customer service, ensuring support for New York enthusiasts.

Cons

- Higher Rates for Some Drivers: Nationwide’s rates may be higher for certain drivers, potentially affecting New York insurance costs. Find out more through our Nationwide insurance review.

- Limited Discount Options: Compared to other insurers, Nationwide may offer fewer discount opportunities, which could limit savings for New York policyholders.

- Claims Processing Can Be Slow: Some customers have reported slower claims processing times, which may be inconvenient for New York drivers.

#8 – Farmers: Best for Extensive Network

Pros

Pros

- Extensive Network of Agents: Farmers boasts a large network of agents, providing personalized support and service to New York policyholders, with rates starting at $86 per month.

- Customizable Coverage Options: Farmers offers a variety of customizable coverage options, catering to the unique needs of New York drivers.

- Strong Financial Stability: With an A rating from A.M. Best, Farmers provides financial stability and reliability for New York enthusiasts.

- Numerous Discounts Available: Farmers offers a range of discounts, including multi-policy and safe driver discounts, helping New York owners save on their insurance premiums.

Cons

- Higher Average Premiums: Farmers’ average premiums may be higher compared to some competitors, impacting affordability for New York drivers.

- Inconsistent Customer Service: Customer service experiences can vary depending on the local agent, potentially leading to mixed experiences for New York policyholders.

- Complex Policies: Policy details can be complex and hard to navigate, which could be challenging for New York insurance enthusiasts. Read more through our Farmers auto insurance review.

#9 – Travelers: Best for Solid Reputation

Pros

Pros

- Solid Reputation: Travelers is known for its strong reputation in the industry, with rates starting at $90 per month, making it a reliable choice for New York drivers.

- Comprehensive Coverage Options: Travelers offers a wide range of coverage options to meet diverse needs, benefiting New York owners who require tailored insurance solutions.

- Strong Financial Stability: With an A++ rating from A.M. Best, Travelers provides robust financial stability for New York policyholders.

- User-Friendly Online Resources: Travelers offers a range of online tools and resources for managing your insurance, making it convenient for New York enthusiasts to handle their coverage.

Cons

- Higher Rates for Some Drivers: Travelers’ rates may be higher for certain drivers, which could impact affordability for New York insurance seekers.

- Limited Discount Opportunities: Travelers may offer fewer discount opportunities compared to some competitors, potentially limiting savings for New York drivers.

- Inconsistent Customer Service: Experiences with customer service can vary, potentially leading to mixed support for New York owners. Look for more details through our Travelers insurance review.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Flexible Policies

Pros

Pros

- Flexible Policies: Liberty Mutual offers a variety of flexible policy options, with rates starting at $104 per month, catering to the diverse needs of New York drivers.

- Customizable Coverage: Liberty Mutual provides customizable coverage options, allowing New York policyholders to tailor their insurance to their specific requirements.

- Strong Financial Rating: With an A rating from A.M. Best, Liberty Mutual ensures financial reliability for New York enthusiasts seeking dependable insurance coverage.

- Variety of Discounts: Liberty Mutual offers numerous discounts, including those for bundling and safe driving, helping New York owners save on their premiums.

Cons

- Higher Premiums: Liberty Mutual’s premiums can be higher compared to other insurers, which may impact affordability for New York drivers. Read more through our Liberty Mutual auto insurance review.

- Customer Service Inconsistencies: Customer service experiences can vary widely, potentially leading to mixed support for New York policyholders.

- Limited Local Agents: Liberty Mutual’s network of local agents may be smaller compared to other insurers, which can affect personalized service for New York owners.

New York Auto Insurance Quotes

Finding the best New York auto insurance requires careful research. Start by evaluating insurance companies to compare their offerings and rates. Consider different coverage levels and how they fit your needs and budget. For instance, check if you qualify for an air bag auto insurance discount, which many insurers offer.

Understanding the coverage options available helps in making an informed decision. Look for policies that provide comprehensive protection within your financial constraints to ensure you get the best value.

New York Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $76 | $147 |

| Amica | $60 | $145 |

| Farmers | $86 | $165 |

| Geico | $40 | $78 |

| Liberty Mutual | $104 | $200 |

| Nationwide | $85 | $164 |

| Progressive | $50 | $96 |

| State Farm | $71 | $137 |

| Travelers | $90 | $175 |

| USAA | $44 | $85 |

Consulting with an auto insurance agent can also be beneficial. They offer personalized advice and highlight potential savings opportunities you might overlook. This can streamline the process and help you find the most suitable insurance.

By exploring your options and seeking expert guidance, you’ll be well-equipped to secure the best auto insurance policy for your needs in New York. Enter your ZIP code below to get personalized insurance quotes tailored to your needs and budget.

New York Auto Insurance Rates by Company

Auto insurance rates in New York are known for being high, so it’s crucial to shop around to find the best rates. Comparing various providers can help you find affordable instant auto insurance quotes that suit your needs.

Among the largest insurers in the region, State Farm, Geico, and Progressive are the top companies with significant market share. Understanding which companies dominate the market can guide you in making an informed decision.

View this post on Instagram

These leading insurers offer competitive rates and comprehensive coverage options, which can be beneficial in finding the best value for your auto insurance in New York. Enter your ZIP code below to start comparing premiums from highly-rated insurers in your area.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

New York Auto Insurance Laws and Requirements

Uninsured/underinsured motorist coverage is required, providing $25,000 per person and $50,000 per accident for bodily injury when the at-fault driver lacks sufficient insurance. Personal injury protection insurance (PIP) is required with a minimum of $50,000 per person, covering medical expenses, lost wages, and including a $2,000 death benefit.

Optional coverages include Comprehensive, Collision, Medical Payments, Rental Car Reimbursement, Roadside Assistance/Towing, and Funeral Services Coverage. While auto insurance state minimum rates nationwide determine the minimum required coverage, these optional coverages provide additional protection.

Insurance rates in New York vary by location and personal factors like age and gender, with males generally paying higher premiums. Additionally, personal injury protection coverage can impact your overall costs. For accurate rates and policy options, consult an auto insurance agent.

New York Driving Statistics

Insurance serves to safeguard against accidents and theft, so understanding the associated risks in New York is essential. In recent times, New York has seen a reduction in both traffic accidents and fatalities. The state reported fewer accidents and a significant drop in fatalities, thanks to stricter law enforcement and increased driver vigilance.

Geico is the top choice for New York drivers, delivering exceptional value with comprehensive coverage starting at just $40 per month.Kristen Gryglik Licensed Insurance Agent

New York has one of the lowest vehicle theft rates in the country, significantly lower than California, Texas, and Florida. For auto insurance quotes in Bayside, NY, or car insurance quotes in Bayside, NY, the low theft rate may lead to lower insurance rates.

Remarkably, more vehicles were stolen in San Diego, CA, than in the entire state of New York. Despite the overall number being high, it has decreased considerably over recent years, with a notable reduction in auto theft rates. Find out more by reading our article titled “San Diego, CA auto insurance.“

Additional New York Auto Insurance Resources

Navigating auto insurance in New York can be complex, but having the right resources at your disposal can make the process easier. Whether you’re looking to understand your coverage options, stay compliant with state regulations, or manage your vehicle’s paperwork, accessing reliable information is crucial.

- Visit the New York Department of Insurance: Access information on automobile insurance for consumers, including regulations and coverage options.

- Review New York Highway Safety Laws: Learn about key highway safety laws in New York to stay informed about legal requirements and safety practices.

- Check the New York State Department of Motor Vehicles: Use the official DMV website for services related to vehicle registration, driver licensing, and other motor vehicle needs.

For more guidance on managing your auto insurance and staying compliant with state laws, these resources will provide the support you need. Make sure to consult these sites regularly to stay updated on any changes or new information. Explore further with our article entitled “How do I file an auto insurance claim with Geico?”

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Summary: Cheap New York Auto Insurance

Drivers looking for cheap New York auto insurance can find competitive rates with Geico, USAA, and Progressive, offering premiums as low as $40 per month. Geico is a top choice for its affordability and coverage, USAA excels with benefits for military members, and Progressive’s Snapshot program rewards safe drivers.

To get the best rates and understand what auto insurance premiums are, compare quotes and review New York’s insurance requirements. Explore further in our article titled “What are auto insurance premiums?” Enter your ZIP code below to compare rates from the top providers near you.

Frequently Asked Questions

Can I drive in New York without auto insurance?

No, it is illegal to drive in New York without auto insurance. Proof of insurance must be presented when registering a vehicle, and failure to maintain insurance can result in fines, license suspension, and other penalties. Explore further in our article titled “Cheap New York Auto Insurance.“

How can I lower my auto insurance costs in New York?

To reduce costs, select only the mandatory coverages and compare rates from different insurers to find the best deal for New York’s minimum requirements. Use our free quote comparison tool below to find the cheapest coverage in your area.

How can I lower my auto insurance premiums in New York?

There are several ways to potentially lower your auto insurance premiums in New York. These include maintaining a clean driving record, opting for a higher deductible, bundling your auto insurance with other policies, and taking advantage of available discounts, such as safe driver discounts or discounts for installing safety features in your vehicle.

What is the average cost of auto insurance in New York per month?

The average cost of auto insurance in New York is approximately $113 per month. However, it’s important to note that individual rates can vary depending on factors such as age, driving history, and the type of vehicle you drive. Delve into the specifics in our article called “Is auto insurance paid in advance?“

How often should I review and update my auto insurance policy?

It is recommended to review and update your auto insurance policy annually or whenever there are significant changes in your circumstances. Examples of changes that may warrant a policy update include purchasing a new vehicle, moving to a different location, or adding or removing drivers from your policy.

Can I use my auto insurance policy to cover rental cars in New York?

In most cases, your auto insurance policy will extend coverage to rental cars within the United States. However, it’s important to check with your insurance provider to confirm the specific details of your coverage and any limitations that may apply.

Can my auto insurance rates be affected by my credit history in New York?

Yes, in New York, insurance companies may consider your credit history as one of the factors when determining your auto insurance rates. Maintaining good credit can help you secure lower insurance premiums. For additional insights, refer to our “Affordable No-Down-Payment Auto Insurance.“

Which optional coverages raise New York auto insurance costs?

Optional coverages such as comprehensive, collision, and rental car reimbursement can increase the cost of auto insurance in New York. You can find the cheapest insurance coverage tailored to your needs by entering your ZIP code below.

What are New York’s minimum auto insurance requirements?

The minimum coverage for cheap auto insurance in New York includes $25,000 per person and $50,000 per accident for bodily injury liability, and $10,000 per accident for property damage liability. Explore further with our article entitled “What information do I need to file an auto insurance claim with Geico?“

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros