Cheap Maine Auto Insurance in 2025 (Unlock Big Savings From These 10 Companies!)

Get affordable Maine auto insurance starting at $15/month from top providers like Geico, Travelers, and American Family. These insurers provide outstanding customer service, variety of coverage options, and discounts. Learn how these leading companies can help you save on your Maine auto insurance needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage in Maryland

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 2,235 reviews

2,235 reviewsCompany Facts

Min. Coverage in Maryland

A.M. Best Rating

Complaint Level

2,235 reviews

2,235 reviewsUnderstanding auto insurance is the key to getting the best coverage, so read on to learn what you need to know about finding cheap Maine auto insurance.

Auto insurance rates in Maine are nearly 40% below the national average, partly due to the state’s low crash and vehicle theft rates, which we’ll explore further in this article.

Our Top 10 Company Picks: Cheap Maine Auto Insurance| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $15 | A++ | Good Drivers | Geico | |

| #2 | $25 | A++ | Bundling Policies | Travelers | |

| #3 | $34 | A | Claims Service | American Family | |

| #4 | $38 | A+ | Online Management | Progressive | |

| #5 | $43 | A+ | Small Businesses | The Hartford |

| #6 | $44 | A+ | UBI Discount | Allstate | |

| #7 | $47 | A | Customizable Policies | Farmers | |

| #8 | $48 | A | Policy Options | Liberty Mutual |

| #9 | $54 | A | High-Risk Coverage | The General | |

| #10 | $57 | B | Local Agents | State Farm |

Finding affordable Maine auto insurance is easy. Just enter your ZIP code above and compare Maine auto insurance quotes right now for free.

- Cheap Maine auto insurance starts at $15/month

- Compare quotes from Geico and Travelers for affordable coverage

- Explore various quotes to find the best deals on Maine auto insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Competitive Rates: Offers some of the cheapest Maine auto insurance rates with minimum coverage starting at $15 and full coverage at $37, ideal for those seeking affordable options.

- User-Friendly App: The app facilitates easy management of policies and claims, streamlining the process of finding and maintaining cheap Maine auto insurance.

- Excellent Customer Service: 24/7 support ensures help is available whenever needed, assisting with any issues related to cheap Maine auto insurance. Read more through our Geico insurance review.

Cons

- Limited Coverage for High-Risk Drivers: Fewer options available for high-risk profiles, which may restrict access to cheap Maine auto insurance for drivers with poor credit or driving history.

- Inconsistent Customer Service: Some reports of inconsistent service during claims processing could affect your experience with cheap Maine auto insurance.

#2 – Travelers: Best for Bundling Policies

Pros

- Customizable Coverage: Wide range of coverage options and customization, with full coverage rates at $61, allowing for tailored cheap Maine auto insurance solutions. Look for more details through our Travelers insurance review.

- Discount Opportunities: Offers good discounts, including for hybrid vehicles, helping reduce the cost of cheap Maine auto insurance.

- Strong Financial Ratings: Reliable and financially stable, ensuring long-term security and trustworthiness in cheap Maine auto insurance.

Cons

- Higher Rates for Risky Drivers: Rates can be higher for those with a history of accidents, which might make cheap Maine auto insurance less affordable.

- Mixed Service Reviews: Inconsistent feedback on customer service could affect your overall experience with cheap Maine auto insurance.

#3 – American Family: Best for Claims Service

Pros

- Wide Range of Coverage: Extensive coverage options and endorsements, with full coverage starting at $84, catering to various needs and providing affordable cheap Maine auto insurance.

- Focus on Customer Service: Strong emphasis on service and community enhances overall satisfaction with cheap Maine auto insurance. Learn more through our American Family auto insurance review.

- Comprehensive Online Tools: Robust tools for managing policies and claims provide a seamless experience for maintaining cheap Maine auto insurance.

Cons

- Limited Availability: Not available in all states, which may restrict access for some potential customers looking for cheap Maine auto insurance.

- Rate Increases: Premiums may increase significantly after claims or violations, potentially affecting the affordability of cheap Maine auto insurance over time.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Progressive: Best for Online Management

Pros

- Flexible Budgeting Tools: Features like the Name Your Price® tool assist in managing insurance costs effectively, helping to secure cheap Maine auto insurance within your budget.

- Competitive Rates: Offers good rates for high-risk drivers, with full coverage starting at $94, providing affordable options for cheap Maine auto insurance.

- Strong Online Presence: An easy-to-use website and app simplify managing policies, making it easier to handle cheap Maine auto insurance online. Find out more through our Progressive insurance review.

Cons

- Mixed Customer Service Reviews: Some inconsistencies in customer service, particularly during claims, may affect your overall experience with cheap Maine auto insurance.

- Higher Rates for Risky Drivers: Premiums can be higher for drivers with a history of accidents, potentially making it less affordable to find cheap Maine auto insurance.

#5 – The Hartford: Best for Small Businesses

Pros

- Comprehensive Coverage Options: Offers a wide range of coverage, including unique benefits like new car replacement, with full coverage rates at $113, ensuring comprehensive cheap Maine auto insurance.

- Excellent Customer Service: High ratings for customer service and support enhance your overall experience with cheap Maine auto insurance.

- Flexible Payment Options: Multiple payment plans available, making it easier to manage costs and find cheap Maine auto insurance that fits your budget. Read more on auto insurance policy with The Hartford.

Cons

- Higher Rates for Some Drivers: Premiums may be higher for certain demographics or driving records, potentially impacting the affordability of cheap Maine auto insurance.

- Limited Availability: Not available in all states, which might restrict access for some individuals seeking cheap Maine auto insurance.

#6 – Allstate: Best for UBI Discount

Pros

- Varied Coverage Options: Extensive coverage and add-on options, with full coverage rates at $108, provide a range of choices for cheap Maine auto insurance.

- Strong Customer Service: Reliable local agents and online support improve overall satisfaction with cheap Maine auto insurance services.

- Discounts for Bundling: Savings for multi-policy holders reduce the overall cost, making it easier to find and maintain cheap Maine auto insurance. Read more through our Allstate insurance review.

Cons

- Higher Premiums: Rates can be more expensive compared to other major insurers, with full coverage at $108, which might impact the affordability of cheap Maine auto insurance.

- Slow Claims Processing: Complaints about delays in claims processing could lead to longer wait times, affecting your experience with cheap Maine auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – Farmers: Best for Customizable Policies

Pros

- Variety of Coverage Options: Wide range of coverage and add-ons, with full coverage rates at $117, catering to different needs and offering affordable options for cheap Maine auto insurance. Read more through our Farmers auto insurance review.

- Bundling Discounts: Savings for bundling policies reduce overall insurance expenses, making it easier to find cheap Maine auto insurance.

- Innovative Programs: Features like the Farmers Signal® app for tracking driving behavior offer additional tools for managing cheap Maine auto insurance.

Cons

- Higher Premiums: Rates can be higher compared to some competitors, with full coverage starting at $117, potentially impacting the affordability of cheap Maine auto insurance.

- Slow Claims Processing: Reports of delays in processing claims may result in extended resolution times, affecting your experience with cheap Maine auto insurance.

#8 – Liberty Mutual: Best for Policy Options

Pros

- Customizable Policies: A wide range of coverage options, with full coverage rates at $120, allows for personalized insurance solutions, including cheap Maine auto insurance. Read more through our Liberty Mutual auto insurance review.

- Competitive Rates: Offers good rates with various discount opportunities, though premiums may vary based on coverage levels, helping you find cheap Maine auto insurance.

- User-Friendly App: Easy management of policies and claims through the app enhances the convenience of maintaining cheap Maine auto insurance.

Cons

- Mixed Customer Service Reviews: Some inconsistency in customer service, especially with claims, which could affect the overall experience of cheap Maine auto insurance.

- Potential Rate Increases: Premiums can rise significantly after incidents, which might lead to higher long-term costs and impact the affordability of cheap Maine auto insurance.

#9 – The General: Best for High-Risk Coverage

Pros

- Specializes in High-Risk Drivers: Offers coverage options for drivers with poor credit or previous infractions, accommodating those who need cheap Maine auto insurance despite high-risk profiles.

- Quick Quote Process: Fast online quoting system makes it easier to compare and find cheap Maine auto insurance quickly.

- User-Friendly Website: Simplified website for managing policies and claims makes it accessible and convenient for those seeking cheap Maine auto insurance.

Cons

- Limited Coverage Options: Fewer add-ons and custom coverage options compared to major insurers may limit flexibility for cheap Maine auto insurance.

- Higher Premiums: Rates can be higher for drivers with less-than-ideal driving histories, with full coverage significantly more expensive, which may affect the affordability of cheap Maine auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – State Farm: Best for Local Agents

Pros

- Local Agents: A large network of local agents offers personalized service, making it easier to find cheap Maine auto insurance tailored to your specific needs. Delve more through our State Farm insurance review.

- Wide Coverage Options: Extensive range of coverage and add-ons, with full coverage rates at $59, allowing for flexible choices in cheap Maine auto insurance.

- High Customer Satisfaction: Strong ratings for customer service and satisfaction reflect positive experiences, enhancing the search for cheap Maine auto insurance.

Cons

- Higher Rates: Rates may be higher compared to some competitors, with minimum coverage at $57, potentially impacting the affordability of cheap Maine auto insurance.

- Less Transparent Quote Process: The online quote process can lack transparency, making it harder to compare and find the best cheap Maine auto insurance options.

Maine Auto Insurance Requirements

Maine uses the tort system for auto insurance, meaning the at-fault driver and their insurance are responsible for covering treatment costs and damages in an accident.

Maine Auto Insurance Monthly Rates by Coverage Level & Provider| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $44 | $108 |

| American Family | $34 | $84 |

| Farmers | $47 | $117 |

| Geico | $15 | $37 |

| Liberty Mutual | $48 | $120 |

| Progressive | $38 | $94 |

| State Farm | $57 | $59 |

| The General | $54 | $232 |

| The Hartford | $43 | $113 |

| Travelers | $25 | $61 |

To ensure that all drivers are financially able to cover themselves in the event of a crash, state law requires that drivers purchase a minimum amount of coverage. There are four coverages required by law.

Bodily injury liability insurance covers injury-related costs for the other driver, passengers, or pedestrians when the policyholder is at fault in an accident.

Drivers in Maine must purchase a minimum coverage of $50,000 per person, per accident, and $100,000 for all parties in a single accident.

Uninsured motorist bodily injury insurance acts much like the BIL insurance explained above, except in this case the policyholder and their passengers are protected when in a crash caused by a driver who has no insurance (or who is underinsured).

Maryland Auto Insurance Monthly Rates by Coverage Level & Provider| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $107 | $201 |

| American Family | $62 | $116 |

| Auto-Owners | $63 | $120 |

| Farmers | $74 | $140 |

| Geico | $72 | $135 |

| Liberty Mutual | $96 | $181 |

| Progressive | $64 | $121 |

| State Farm | $57 | $107 |

| The Hartford | $70 | $138 |

| Travelers | $55 | $103 |

For example, if Driver A causes an accident with Driver B and Driver A has no insurance, Driver B’s Uninsured Motorist BIL insurance will cover their own medical treatment and other injury costs.

Maine Auto Insurance Rates

Another factor contributing to these lower rates is the cost of property damage liability coverage in Maine, which tends to be more affordable compared to other states.

Looking statewide, drivers in Maine can expect to pay about $86 for a month’s worth of auto insurance and quite a bit lower than the national monthly auto insurance rate of $120.

This lower car insurance premium reflects the state’s favorable driving conditions and low incidence of accidents and vehicle theft.

Those in Maine’s major cities may end up paying a bit more or a bit less, depending on where they live. Residents of the largest city, Portland, pay monthly of $87 for auto insurance; those in Lewiston are looking at around $96

While many of these factors are simply based on your own driving record, two things that affect even the safest of drivers are age and gender. As with most states, males typically pay higher auto insurance rates than females.

Let’s take a closer look at the ZIP codes within the state to see how rates changed based on different areas. Enter your ZIP code now.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Maine Driving Statistics

Maine’s Department of Transportation has put in a lot of work with state law enforcement officers and highway patrols to reduce the number of crashes in the state – and it seems to be working. In 2009, Maine saw a total of 28,692 crashes reported, with 159 fatalities.

These numbers are well below the five-year adjusted averages of 31,784 crashes and 171 fatalities, respectively.

As long as these totals continue their downward trend, drivers will continue to see reductions in the cost of Maine auto insurance. Additionally, the affordability of medical payments insurance in Maine further contributes to the overall lower insurance costs for drivers in the state.

As with the crash totals, continued downward pressure on the theft numbers will bring further reductions to Maine auto insurance premiums.

Additional Maine Auto Insurance Information Links

As anticipated, due to its welcoming population and relatively remote location in the northeastern corner of the country, Maine has some of the lowest auto theft rates in the nation. In 2009, only 1,021 vehicles were stolen, resulting in a rate of 77.4 thefts per 100,000 residents.

Over the past decade, Maine’s auto thefts have steadily declined from 1,671 in 2001, thanks to more anti-theft devices and vigilant policing. This trend is expected to continue.

This reduction in thefts positively impacts the various types of auto insurance coverage available, potentially leading to lower premiums for comprehensive coverage, which includes theft protection.

Schimri Yoyo Licensed Agent & Financial Advisor

Ready to find cheap auto insurance in Maine? Enter your ZIP code below to get started on finding the best Maine auto insurance for your needs.

Frequently Asked Questions

What is the minimum liability auto insurance required in Maine?

Maine requires a minimum of 50/100/25 liability coverage for bodily injury and property damage.

What additional coverage options can I choose?

You can add collision, comprehensive, uninsured/underinsured motorist, and medical payments coverage to your policy. Enter your ZIP code now.

How much does auto insurance cost in Maine?

On average, auto insurance rates in Maine are around $90 per month or $1,050 per year. This makes it a great place to find affordable full coverage auto insurance, as the rates are relatively low compared to many other states.

Which companies are popular for auto insurance in Maine?

State Farm, Progressive, Geico, and Allstate are among the popular auto insurance companies in Maine.

How can I find affordable auto insurance in Maine?

Compare quotes from multiple insurance companies to find the best coverage at competitive rates. Enter your ZIP code now to compare.

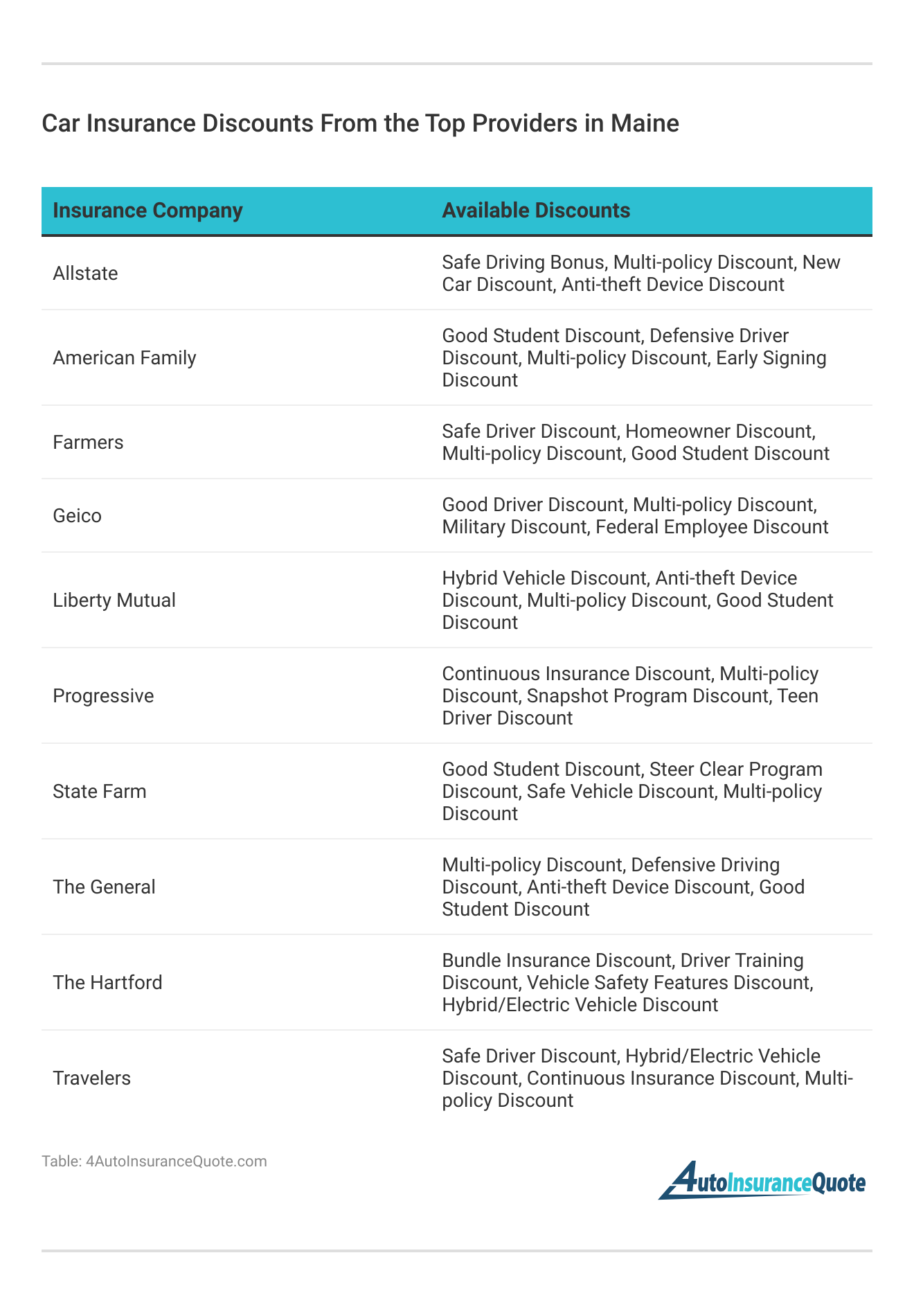

What specific discounts or savings opportunities does each insurance provider offer for maintaining a clean driving record?

This question helps identify which providers offer rewards or lower rates for safe driving, potentially reducing the cost of cheap Maine auto insurance.

Additionally, a good credit rating can further influence the cost, as many insurers consider it when determining premiums.

Is Maine a no fault state?

No, Maine is not a no fault state.

How does each provider handle customer service and claims during high-demand periods, such as after major accidents or natural disasters?

Understanding how providers manage claims and customer service during peak times can give insights into their reliability and responsiveness. Enter your ZIP code now to compare rates.

What are the differences in coverage options for drivers with high-mileage vehicles or those who use their car for business purposes?

This question focuses on finding the best coverage options for drivers with specific needs or higher risk profiles.

Additionally, understanding how different providers handle an auto insurance claim can help you choose a company that will efficiently manage and support you through the claims process.

How does each provider’s policy renewal process work, and what factors could lead to significant changes in premiums upon renewal?

Knowing how premiums might change at renewal and what factors affect these changes can help in planning and budgeting for long-term cheap Maine auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.