Cheap Honda Auto Insurance in 2025 (Get Low-Cost Coverage With These 10 Companies)

Get cheap Honda auto insurance starting at just $40/month from top providers like Geico, Auto-Owners, and Erie. These companies provide excellent customer service, a wide range of coverage options, and substantial discounts. Learn how these leading insurers can help you save on your Honda auto insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

563 reviews

563 reviewsCompany Facts

Min. Coverage for Honda

A.M. Best Rating

Complaint Level

563 reviews

563 reviews 1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage for Honda

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviewsThe top picks for cheap Honda auto insurance are Geico, Auto-Owners, and Erie, with rates starting at $40/month.

Most Hondas have very affordable auto insurance rates, no matter what model you own, making it easier to find affordable Honda auto insurance rates.

While insurance for a new Honda Civic will cost more than for an older, cheaper model, the model and age of a Honda won’t cause huge leaps in rates.

Our Top 10 Company Picks: Cheap Honda Auto Insurance| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $40 | A++ | Competitive Rates | Geico | |

| #2 | $42 | A++ | Comprehensive Coverage | Auto-Owners | |

| #3 | $44 | A+ | Customer Satisfaction | Erie |

| #4 | $45 | B | Extensive Discounts | State Farm | |

| #5 | $46 | A | Reliable Service | Farmers | |

| #6 | $47 | A+ | Innovative Programs | Nationwide |

| #7 | $48 | A++ | Customizable Policies | Travelers | |

| #8 | $50 | A+ | Technology Integration | Progressive | |

| #9 | $52 | A | Loyalty Rewards | American Family | |

| #10 | $55 | A | Diverse Options | Liberty Mutual |

Read on to learn all about what will affect your Honda auto insurance quotes, from which auto insurance coverages you pick to which Honda model you own. Enter your ZIP code to begin.

- The Honda Civic has the highest insurance rates but the difference is small

- Honda insurance rates will also depend on a driver’s age and driving record

- Drivers who is good has the cheapest Honda auto insurance quotes

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Affordable Rates: Geico offers some of the most competitive rates for cheap Honda auto insurance, often leading the market with low monthly premiums. For additional details, explore our comprehensive resource titled “Geico Auto Insurance Review.”

- Comprehensive Online Tools: Their user-friendly app and website simplify managing policies and filing claims, making it easy to find and maintain cheap Honda auto insurance.

- Good Customer Service: Geico consistently receives high marks for customer support, ensuring that you get the assistance you need for cheap Honda auto insurance claims.

Cons

- Limited Local Agents: Geico’s emphasis on online service may not appeal to those who prefer face-to-face interactions with agents for their cheap Honda auto insurance needs.

- Higher Rates for Some Drivers: For those with less-than-perfect driving records, Geico’s rates for cheap Honda auto insurance might not be the lowest available.

#2 – Auto-Owners: Best for Competitive Rates

Pros

- Personalized Service: With a strong reputation for local agent service, Auto-Owners offers personalized care to help you secure affordable cheap Honda auto insurance.

- Flexible Coverage Options: Their range of coverage options allows you to tailor your policy, making it easier to find cheap Honda auto insurance that fits your needs. Read more on Auto-Owners auto insurance review.

- Strong Financial Stability: Known for high financial strength, Auto-Owners ensures reliability for your cheap Honda auto insurance coverage.

Cons

- Limited Availability: Auto-Owners isn’t available in all states, which may limit options for those seeking cheap Honda auto insurance in some regions.

- Potential for Higher Costs: Drivers with poor credit or a history of claims might find Auto-Owners’ premiums for cheap Honda auto insurance to be higher than expected.

#3 – Erie: Best for Customer Satisfaction

Pros

- High Customer Satisfaction: Erie is praised for exceptional customer service, making it a reliable choice for cheap Honda auto insurance with excellent support.

- Comprehensive Coverage Options: Erie offers a variety of coverage options, including unique add-ons, which can enhance your cheap Honda auto insurance policy. Learn more about Erie auto insurance review.

- Local Agents: Erie’s network of local agents provides personalized service, helping you find the best cheap Honda auto insurance for your specific needs.

Cons

- Higher Premiums in Some Areas: Depending on your location, Erie’s rates for cheap Honda auto insurance might be higher compared to other providers.

- Limited National Presence: Erie’s limited availability in some states could restrict your options for finding cheap Honda auto insurance if you live in those areas.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – State Farm: Best for Extensive Discounts

Pros

- Strong Customer Service: Known for reliable customer support, State Farm helps you navigate your cheap Honda auto insurance policy with ease.

- Nationwide Availability: With presence in all 50 states, State Farm provides access to cheap Honda auto insurance for a broad range of drivers.

- Flexible Coverage Options: Their customizable policies allow you to tailor your cheap Honda auto insurance to fit your individual needs. Read more on State Farm auto insurance review.

Cons

- Potentially Higher Rates for High-Risk Drivers: State Farm may offer higher premiums for drivers with a poor driving history, which can affect the affordability of cheap Honda auto insurance.

- Inconsistent Rates: Premiums and service quality may vary depending on the region and individual agent, impacting the overall value of cheap Honda auto insurance.

#5 – Farmers: Best for Reliable Service

Pros

- Reliable Service: Farmers is known for dependable customer service, ensuring you get the support you need for cheap Honda auto insurance. Read more on Farmers auto insurance review.

- Customizable Policies: They offer a range of options to tailor your coverage, making it easier to find cheap Honda auto insurance that meets your specific requirements.

- Strong Financial Stability: Their high financial stability ratings ensure that your cheap Honda auto insurance is backed by a reliable provider.

Cons

- Higher Premiums for Some Drivers: Farmers may have higher rates for drivers with higher risk profiles, which could affect the affordability of cheap Honda auto insurance.

- Complex Policy Terms: Understanding Farmers’ policy details might be challenging, potentially complicating your search for cheap Honda auto insurance.

#6 – Nationwide: Best for Innovative Programs

Pros

- Innovative Programs: Nationwide offers unique programs like the Vanishing Deductible and SmartRide, which can help reduce your cheap Honda auto insurance costs.

- Good Customer Service: Positive feedback for customer support ensures a smooth experience with your cheap Honda auto insurance policy.

- Discounts for Safe Driving: Safe driving discounts can lower your premiums, making it easier to secure cheap Honda auto insurance. Learn more about Nationwide auto insurance review.

Cons

- Higher Premiums for Certain Drivers: Drivers with a less-than-ideal record might find Nationwide’s rates for cheap Honda auto insurance to be higher.

- Limited Local Agents: Their focus on online and phone service might not appeal to those who prefer in-person interactions with agents.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – Travelers: Best for Customizable Policies

Pros

- Customizable Policies: Travelers offers a wide range of options to tailor your policy, making it easier to secure cheap Honda auto insurance that fits your needs.

- Strong Financial Ratings: High financial stability ratings ensure that Travelers provides reliable coverage for your cheap Honda auto insurance. Read more on Travelers auto insurance review.

- Innovative Coverage Options: Unique options like gadget protection enhance your cheap Honda auto insurance policy.

Cons

- Higher Rates for High-Risk Drivers: Premiums may be higher for drivers with poor credit or claims history, impacting the affordability of cheap Honda auto insurance.

- Complex Policy Details: The detailed terms and conditions of Travelers’ policies can be difficult to understand, potentially complicating your search for cheap Honda auto insurance.

#8 – Progressive: Best for Technology Integration

Pros

- Advanced Technology Integration: Progressive’s user-friendly app and online tools streamline the process of managing your cheap Honda auto insurance.

- Competitive Rates: Known for its competitive pricing and frequent promotions, Progressive helps you find affordable cheap Honda auto insurance. Read more on Progressive auto insurance review.

- Wide Range of Discounts: Various discounts, including for bundling and multi-vehicle policies, make it easier to secure cheap Honda auto insurance.

Cons

- Mixed Customer Service Reviews: Customer service quality can vary, which may affect your experience with cheap Honda auto insurance.

- Limited Personalized Service: Progressive’s focus on online service might not suit those who prefer in-person interactions with agents.

#9 – American Family: Best for Loyalty Rewards

Pros

- Loyalty Rewards: American Family’s rewards and discounts for long-term customers can help you save on cheap Honda auto insurance. Learn more about American Family auto insurance review.

- Good Customer Service: Known for strong customer support, American Family makes managing your cheap Honda auto insurance policy easier.

- Flexible Coverage Options: A variety of coverage choices allow you to tailor your cheap Honda auto insurance to your specific needs.

Cons

- Higher Premiums for Some: Rates may be higher for drivers with high-risk profiles, impacting the affordability of cheap Honda auto insurance.

- Limited Availability: American Family’s coverage is not available in all states, which may limit options for cheap Honda auto insurance in some regions.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Diverse Options

Pros

- Diverse Coverage Options: Liberty Mutual offers a wide range of coverage choices and add-ons to enhance your cheap Honda auto insurance policy.

- Good Customer Service: Positive feedback for customer service ensures a smooth experience with your cheap Honda auto insurance.

- Innovative Tools: Useful tools and resources for managing your policy help you maintain affordable cheap Honda auto insurance. Read more on Liberty Mutual auto insurance review.

Cons

- Higher Premiums for Some Drivers: Rates may be higher depending on your risk profile, which could affect the cost of cheap Honda auto insurance.

- Complex Policy Terms: Understanding Liberty Mutual’s policy details can be challenging, potentially complicating your search for cheap Honda auto insurance.

Different Auto Insurance Coverages for Hondas

Keeping an auto insurance policy with the bare minimum will help keep your rates low, although two coverages we highly recommend paying extra for are collision and comprehensive insurance.

These insurance coverages will pay for your Honda’s repairs after accidents or mishaps and are actually required coverages if you have a lease or loan on your Honda. Take a look below at what each coverage does to see the difference between comprehensive and collision insurance.

Honda Auto Insurance Monthly Rates by Coverage Level & Provider| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| American Family | $52 | $140 |

| Auto-Owners | $42 | $125 |

| Erie | $44 | $127 |

| Farmers | $46 | $135 |

| Geico | $40 | $120 |

| Liberty Mutual | $55 | $145 |

| Nationwide | $47 | $135 |

| Progressive | $50 | $140 |

| State Farm | $45 | $130 |

| Travelers | $48 | $138 |

Collision insurance covers repairs after hitting an object or car, while comprehensive insurance covers damage from animals, weather, vandalism, or falling objects.

If you don’t have a lease or loan, then you can choose not to carry collision and comprehensive coverage, but your Honda’s repairs won’t be covered in a variety of situations. The other important coverages we want to talk about for Hondas are those required by the majority of states.

If you don’t follow the auto insurance requirements of your state, then you aren’t driving legally and will face fines, suspended licenses, and more.

Most states in the U.S. will require some combination of liability insurance, medical payments insurance or personal injury protection insurance, and either uninsured or underinsured motorist insurance. A quick description of the different types of auto insurance coverage.

Liability insurance covers others’ damages, medical payments insurance covers in-car injuries, personal injury protection covers injuries and lost wages, and uninsured/underinsured motorist insurance covers your bills if the other driver lacks sufficient coverage.

Average Auto Insurance Rates for Hondas

The difference between the most and least expensive Honda models to insure is less than $50, so it’s not a huge price discrepancy. While a Honda Civic is the most expensive on average to insure, you won’t be paying hundreds of dollars more for insurance than the cheapest model to insure, the Honda Fit.

Your Honda insurance rates will also depend on your demographics, as the Honda Civic insurance cost for a 16-year-old driver will be different than for a 35-year-old driver. Take a look at the rates below to see how the cost of auto insurance for a Honda can change based on a driver’s driving record and age.

Learn how to get auto insurance here.

If you are a younger driver, your rates will decrease significantly as you age if you are a safe driver and don’t get into any accidents, making it easier to find cheap Honda auto insurance. Enter your ZIP code now to begin.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

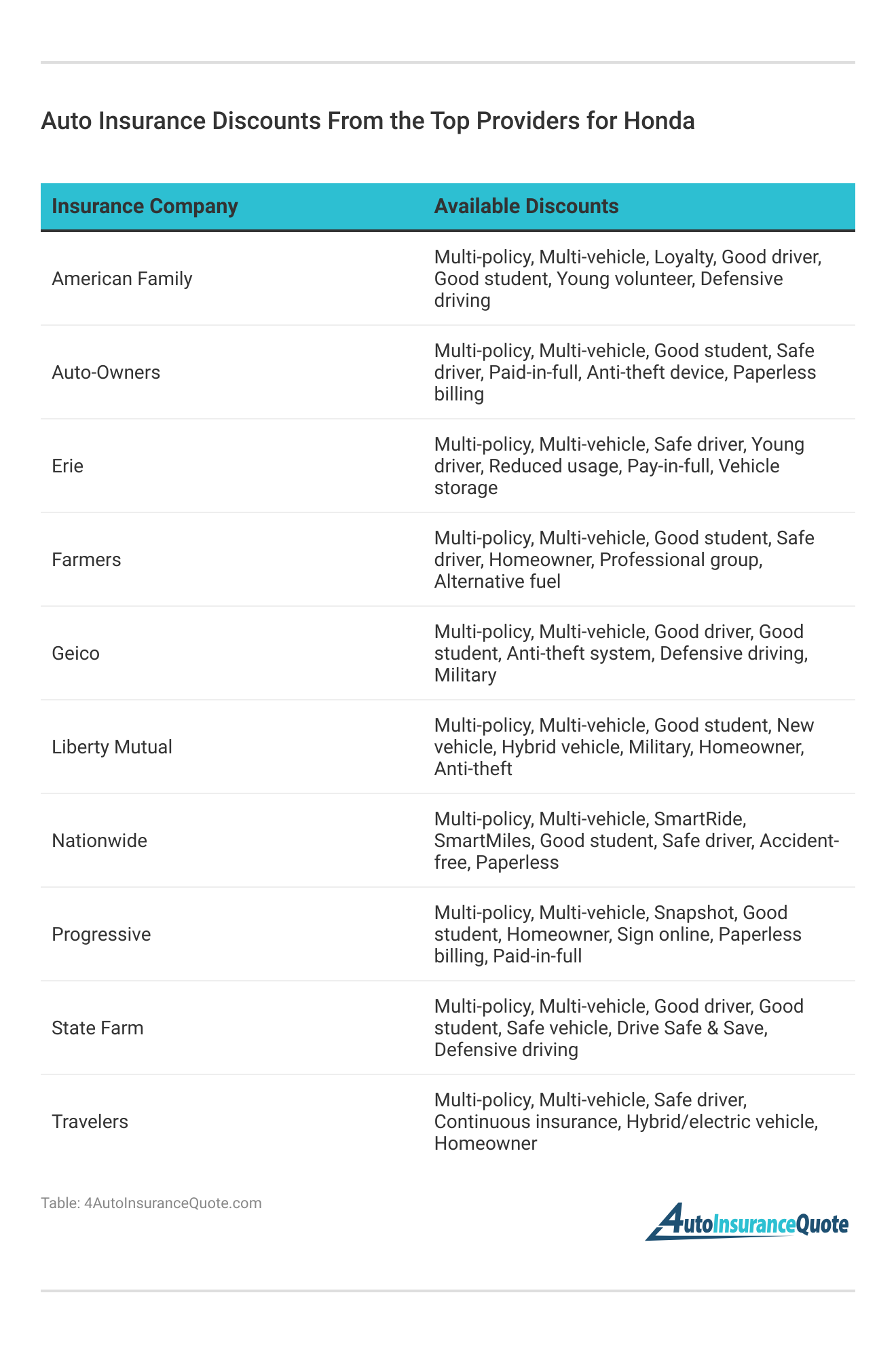

Saving on Honda Auto Insurance

If you are asking yourself why the price of Honda Civic insurance is so high, it may not have anything to do with the model of the car you own but rather other factors. If you have a clean driving record, you may be with the wrong auto insurance company.

We recommend getting plenty of auto insurance quotes to make sure you are getting the best price on insurance for your Honda.

You can also apply for auto insurance discounts to lower your rates, such as a bundling discount or a defensive driver discount. Make sure to check your insurance company’s list of available discounts to ensure that you are getting as much off your policy’s rate as possible.

Finally, if you have a low car insurance deductible, raising it will decrease your auto insurance rates. Just ensure that the amount you raise your deductible to is still an amount you would be able to afford comfortably.

The last thing you want is not to be able to get your Honda repaired because you raised your auto insurance deductible too high.

The Ultimate Take on Cheap Honda Auto Insurance

For Honda owners seeking cheap auto insurance, it’s generally possible to find affordable rates regardless of the model you drive. Insurance premiums for Hondas often fluctuate depending on factors such as your driving record, age, and the specific insurance provider you select.

To secure the cheapest Honda auto insurance, consider using our free quote comparison tool to quickly pinpoint which local insurance companies provide the most competitive rates for your area. This tool simplifies the process, allowing you to compare options and make an informed decision on the best deal available.

A company that was the cheapest for you a year ago may no longer be the cheapest company.Ty Stewart Licensed Insurance Agent

Most Honda owners can find affordable auto insurance rates for their vehicles, regardless of the specific model. Insurance premiums for Hondas typically vary based on factors such as your driving history, age, and the insurance provider you choose.

To secure the most affordable Honda auto insurance, start by comparing quotes from different providers. Enter your ZIP code now to get started with your insurance quote.

Frequently Asked Questions

How much does it cost to insure a Honda Accord?

The average insurance cost for a Honda Accord for a full coverage auto insurance policy is $131 per month.

Are Hondas expensive to insure?

Most Hondas have affordable insurance rates. Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

Is insurance expensive for Honda Accords?

Insurance for Honda Accords is slightly higher than for other models. For a thorough understanding, refer to our detailed analysis titled affordable full coverage auto insurance.

Can Honda insurance rates vary?

Yes, insurance rates can vary based on factors such as location, driving record, and coverage options.

Is auto insurance for a Honda Civic more expensive?

Auto insurance for Honda Civics is slightly more expensive but still affordable. Enter your ZIP code now.

Are Hondas good cars for insurance?

Yes, Honda auto insurance rates tend to be low. To gain profound insights, consult our extensive guide titled, “Affordable Full Coverage Auto Insurance.”

How can I find the best deals on cheap Honda auto insurance?

Compare quotes from different insurers, look for discounts, and adjust coverage to suit your needs.

What coverage is included in a cheap Honda auto insurance policy?

Typically includes basic liability coverage and may have limited collision and comprehensive coverage. Enter your ZIP code to begin.

What are common exclusions in cheap Honda auto insurance policies?

Common exclusions include high-risk activities, vehicle modifications, and certain types of damage. For a comprehensive overview, explore our detailed resource on self-insured auto insurance.

Can I lower the cost of my Honda auto insurance further?

Yes, by increasing deductibles, choosing fewer coverage options, maintaining a clean driving record, and using discounts.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.