Cheap Arkansas Auto Insurance in 2025 (Save Big With These 10 Companies!)

USAA, State Farm, and Geico are recognized for offering cheap Arkansas auto insurance, with rates beginning at $19 per month. Arkansas auto insurance is reasonably priced due to a lot of reasons, such as its dense population and low coverage requirements, but it's crucial to compare quotes to get the best deals.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage in Arkansas

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in Arkansas

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsUSAA, State Farm, and Geico are the finest alternatives for cheap Arkansas auto insurance, with monthly rates starting at about $19.

Most drivers want to find cheap Arkansas auto insurance that meets the state’s minimum requirements.

- Cheap Arkansas Auto Insurance

- Get Affordable Yellville, AR Auto Insurance Quotes (2025)

- Get Affordable Siloam Springs, AR Auto Insurance Quotes (2025)

- Get Affordable Searcy, AR Auto Insurance Quotes (2025)

- Get Affordable Pine Bluff, AR Auto Insurance Quotes (2025)

- Get Affordable Keo, AR Auto Insurance Quotes (2025)

- Get Affordable Hughes, AR Auto Insurance Quotes (2025)

- Get Affordable Hot Springs, AR Auto Insurance Quotes (2025)

- Get Affordable Greenwood, AR Auto Insurance Quotes (2025)

- Get Affordable Gosnell, AR Auto Insurance Quotes (2025)

- Get Affordable Foreman, AR Auto Insurance Quotes (2025)

From coverage requirements to the best auto insurance companies in Arkansas, we have everything you need to know right here.

Our Top 10 Company Picks: Cheap Arkansas Auto Insurance| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $19 | A++ | Military Focus | USAA | |

| #2 | $28 | B | Extensive Network | State Farm | |

| #3 | $31 | A++ | Competitive Rates | Geico | |

| #4 | $34 | A | Customizable Policies | Liberty Mutual |

| #5 | $38 | A++ | Long-standing Reputation | Travelers | |

| #6 | $44 | A+ | Personalized Coverage | Nationwide |

| #7 | $45 | A+ | Technology Driven | Progressive | |

| #8 | $47 | A | Family Oriented | American Family | |

| #9 | $56 | A+ | Comprehensive Options | Allstate | |

| #10 | $57 | A | Customer Service | Farmers |

Before you get the details, you can find affordable auto insurance right now. Enter your ZIP code now to compare cheap Arkansas auto insurance quotes for free.

- Arkansas auto insurance averages $19/month, slightly below average

- Cheapest options: State Farm, Geico, USAA

- Compare rates to find cheap Arkansas auto insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#1 – USAA: Top Overall Pick

Pros

- Excellent Customer Service: USAA provides top-notch customer service, contributing to its reputation as a leading provider of cheap Arkansas auto insurance. Their A++ A.M. Best rating further underscores their reliability and financial strength.

- Competitive Rates: With premiums starting at $19 per month, USAA offers some of the most affordable rates for cheap Arkansas auto insurance, making it an excellent choice for budget-conscious drivers.

- Comprehensive Coverage Options: USAA includes unique coverage options like rental reimbursement and roadside assistance, enhancing its appeal as a provider of cheap Arkansas auto insurance. Find out more through our USAA auto insurance review.

Cons

- Membership Requirement: USAA’s services are limited to military members, veterans, and their families, which excludes those seeking cheap Arkansas auto insurance who don’t qualify for membership.

- Limited Availability: USAA is not available in all states, which might be a drawback for those seeking cheap Arkansas auto insurance but relocating or traveling outside of its coverage areas.

#2 – State Farm: Best for Extensive Network

Pros

- Extensive Network: State Farm’s broad network of local agents makes it easy to access support and manage policies, enhancing its appeal as a provider of cheap Arkansas auto insurance.

- Discount Opportunities: With discounts like multi-policy and safe driving rewards, State Farm helps customers save on cheap Arkansas auto insurance, making it a cost-effective choice.

- User-Friendly App: The well-rated mobile app simplifies policy management and claims processing, adding convenience for users of cheap Arkansas auto insurance.

Cons

- Higher Rates for Young Drivers: Young or inexperienced drivers might face higher premiums, which can negate the benefits of cheap Arkansas auto insurance if not adequately managed.

- Claims Process Variability: The claims process can vary by location, potentially affecting the experience of those seeking cheap Arkansas auto insurance. Discover more through our State Farm insurance review.

#3 – Geico: Best for Competitive Rates

Pros

- Affordable Rates: Geico is known for its low premiums starting at $31 per month, making it a strong contender for cheap Arkansas auto insurance and budget-conscious drivers.

- Easy Online Access: The streamlined online tools for quotes and policy management enhance convenience, particularly for those seeking cheap Arkansas auto insurance. Read more through our Geico insurance review.

- Wide Range of Discounts: Geico offers numerous discounts, such as those for military members, making it a cost-effective option for cheap Arkansas auto insurance.

Cons

- Limited Local Agents: Geico’s focus on online and phone-based services might not appeal to those preferring in-person interactions while searching for cheap Arkansas auto insurance.

- Customer Service Issues: Reports of dissatisfaction with customer service could impact the overall experience of those relying on Geico for cheap Arkansas auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual provides a variety of coverage options that can be tailored to individual needs, enhancing its appeal as a source of cheap Arkansas auto insurance.

- Useful Online Tools: Their online tools make it easier to manage policies and compare quotes, which is beneficial for those looking for cheap Arkansas auto insurance.

- Multiple Discounts: Offers various discounts that can help lower costs, making Liberty Mutual a viable option for cheap Arkansas auto insurance.

Cons

- Higher Premiums: Premiums can be higher than some competitors, which might detract from its appeal as a source of cheap Arkansas auto insurance for some customers. Gain further insights with our Liberty Mutual auto insurance review.

- Complex Policy Options: The range of customizable options can be overwhelming, potentially complicating the search for cheap Arkansas auto insurance.

#5 – Travelers: Best for Long-standing Reputation

Pros

- Strong Reputation: Travelers’ long-standing industry presence and A++ A.M. Best rating contribute to its reliability as a provider of cheap Arkansas auto insurance. Look for more details through our Travelers insurance review.

- Diverse Coverage Options: Offers a wide array of coverage options and add-ons, catering to various needs while providing affordable cheap Arkansas auto insurance.

- Discounts for Multiple Policies: Savings for bundling home and auto insurance make Travelers a cost-effective choice for cheap Arkansas auto insurance.

Cons

- Rates May Vary: Premiums can vary based on individual factors, which may affect the affordability of cheap Arkansas auto insurance for some drivers.

- Claims Process: Some customers report slower claims processing, which could impact satisfaction with Travelers as a provider of cheap Arkansas auto insurance.

#6 – Nationwide: Best for Personalized Coverage

Pros

- Personalized Coverage: Nationwide’s tailored coverage options suit specific needs, enhancing its appeal as a provider of cheap Arkansas auto insurance.

- Strong Customer Support: Positive reviews for customer support contribute to its reputation as a reliable source of cheap Arkansas auto insurance.

- Variety of Discounts: Offers discounts for safe driving and multi-policy bundles, making Nationwide a competitive option for cheap Arkansas auto insurance. Expand your knowledge through our Nationwide insurance review.

Cons

- Average Rates: Premiums might not be as competitive as some other options, which could impact its status as a top choice for cheap Arkansas auto insurance.

- Mixed Reviews: Variability in customer reviews, especially concerning claims handling, might affect overall satisfaction with Nationwide’s cheap Arkansas auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – Progressive: Best for Technology Driven

Pros

- Technology-Driven: Progressive’s innovative tools like the Snapshot program support potential savings on cheap Arkansas auto insurance by monitoring driving habits.

- Competitive Rates: Known for offering competitive pricing and discounts, Progressive provides affordable options for cheap Arkansas auto insurance.

- Flexible Coverage Options: Provides a range of coverage options, catering to diverse needs and ensuring access to cheap Arkansas auto insurance.

Cons

- Complexity of Policies: The broad range of options can be confusing, which might complicate finding the best cheap Arkansas auto insurance coverage.

- Customer Service: Reports of less satisfactory customer service could impact the overall experience for those using Progressive for cheap Arkansas auto insurance. Learn more through our Progressive insurance review.

#8 – American Family: Best for Family Oriented

Pros

- Family-Oriented Coverage: American Family’s policies are tailored for families, offering comprehensive protection that can be found within cheap Arkansas auto insurance plans.

- Multiple Discounts: Offers various discounts that can help reduce costs, making it a viable option for affordable cheap Arkansas auto insurance. Uncover more by reviewing our American Family auto insurance review.

- Good Customer Service: Positive feedback on customer service supports its reputation as a provider of cheap Arkansas auto insurance.

Cons

- Higher Rates for Some: Premiums might be higher compared to other providers, which could affect the affordability of cheap Arkansas auto insurance.

- Limited Availability: Not available in all states, which could limit options for those seeking cheap Arkansas auto insurance in areas where American Family does not operate.

#9 – Allstate: Best for Comprehensive Options

Pros

- Comprehensive Coverage Options: Allstate offers a range of coverage options and add-ons, providing flexibility for those seeking cheap Arkansas auto insurance.

- Good Customer Service: Known for strong customer service and support, contributing to overall satisfaction with their cheap Arkansas auto insurance offerings.

- Multiple Discounts: Offers various discounts, such as bundling and safe driving, which can help make their coverage more affordable for cheap Arkansas auto insurance.

Cons

- Premiums May Be Higher: Rates can be higher compared to some competitors, which might reduce its appeal for those seeking the cheapest Arkansas auto insurance. Learn more information through our Allstate insurance review.

- Complex Pricing Structure: The complexity of pricing and discount structures may make it difficult to find the best deal on cheap Arkansas auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – Farmers: Best for Customer Service

Pros

- Excellent Customer Service: Farmers is known for high-quality customer service, which enhances its reputation as a reliable provider of cheap Arkansas auto insurance. Read more through our Farmers auto insurance review.

- Comprehensive Coverage: Offers a broad range of coverage options and customizable policies, ensuring access to cheap Arkansas auto insurance that meets various needs.

- Discount Opportunities: Provides discounts for bundling and safe driving, helping to lower premiums for cheap Arkansas auto insurance.

Cons

- Higher Premiums: Premiums can be higher compared to some other providers, which might impact the cost-effectiveness of Farmers’ cheap Arkansas auto insurance.

- Mixed Claims Reviews: Customer reviews on the claims process can vary, which might affect overall satisfaction with Farmers as a provider of cheap Arkansas auto insurance.

Requirements for Arkansas Auto Insurance

Arkansas requires every driver to carry a minimum amount of car insurance. This ensures that drivers can be financially responsible if they’re at fault in an accident.

Arkansas Auto Insurance Monthly Rates by Coverage Level & Provider| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $56 | $162 |

| American Family | $47 | $137 |

| Farmers | $57 | $165 |

| Geico | $31 | $91 |

| Liberty Mutual | $34 | $99 |

| Nationwide | $44 | $128 |

| Progressive | $45 | $131 |

| State Farm | $28 | $80 |

| Travelers | $38 | $111 |

| USAA | $19 | $55 |

Drivers in Arkansas participate in what is known as the tort system of auto insurance. When an accident or crash happens, a driver is considered to be “at fault” for causing it, and both the driver and their insurance company are subject to legal action.

If you’re coming to Arkansas from another state, know that this is probably the same system that you used, but as with all state-to-state transitions, there may be minor tweaks. Ask your auto insurance agent for further details.

To ensure that drivers have at least a minimum amount of auto insurance when driving the roads, the Government of Arkansas has instituted mandatory minimums in a couple of different areas that all drivers must purchase to legally drive.

If you’re ready to buy Arkansas auto insurance online, we can help. Enter your ZIP code below to compare cheap Arkansas auto insurance rates today.

Estimated Auto Insurance Costs in Arkansas

Arkansas drivers have 116 insurers, so shopping around is key to finding the best rates. On average, auto insurance in Arkansas costs about $105 monthly, below the national average of $120. Rates vary by location, with Little Rock averaging $119 and Fort Smith as low as $93.

Moreover, age significantly affects insurance rates—young drivers often pay higher premiums due to inexperience, while older, more experienced drivers generally see lower rates. As a result, it’s crucial for drivers, especially younger ones, to compare quotes from multiple providers to find affordable coverage.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

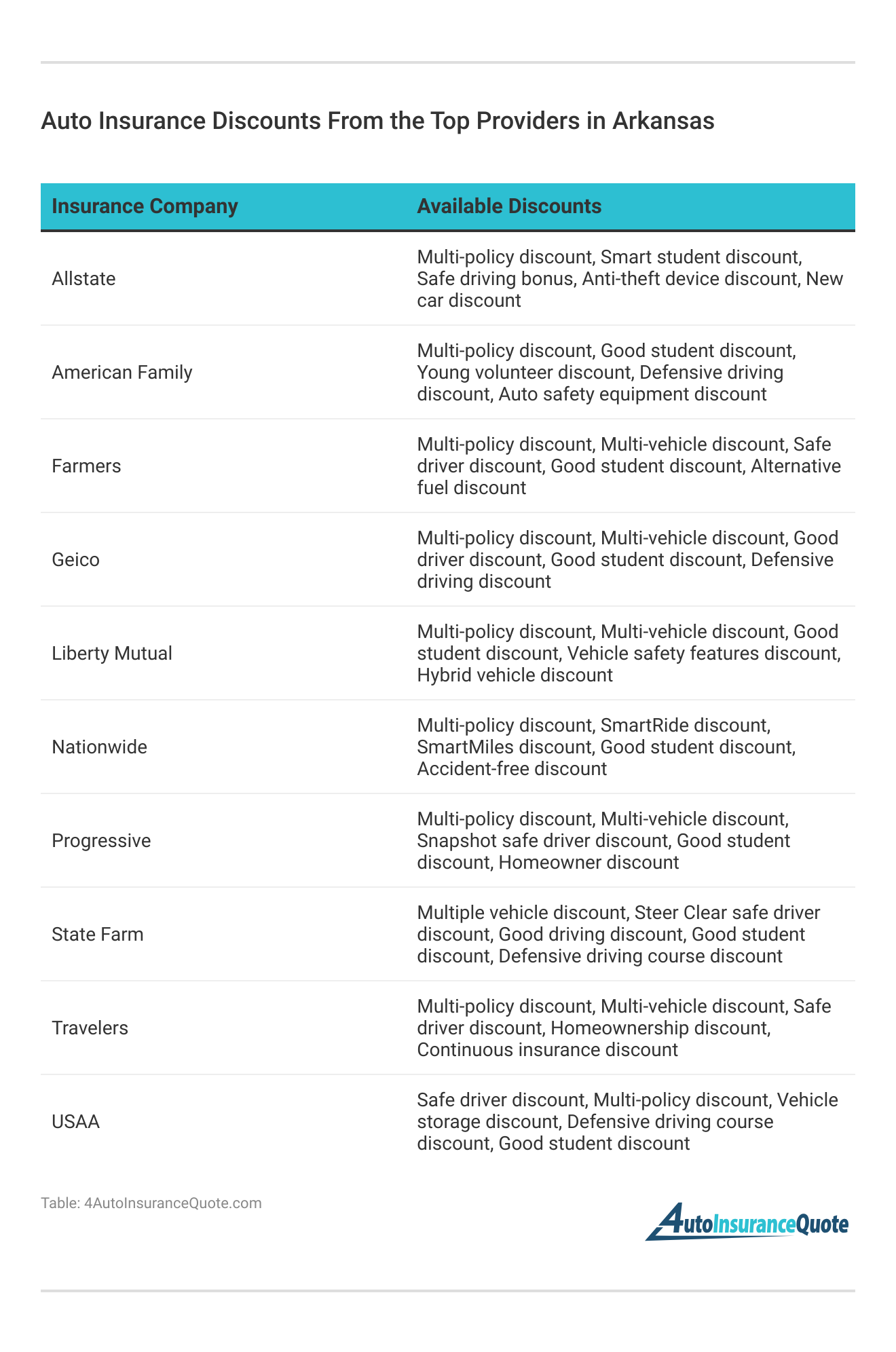

Find Cheap Arkansas Auto Insurance Rates by Company

Finding affordable auto insurance in Arkansas is easier when you compare rates among various companies, as some offer more competitive prices than others. While overall insurance rates in the state are relatively low, the costs can vary significantly between providers.

It’s important to explore how rates differ among major companies to find the best deal. Key players in the Arkansas market, such as State Farm, Geico, and USAA, hold substantial market share and often offer competitive pricing. View our summary of how car insurance rates are calculated.

By examining the rates from these leading insurers and comparing them, you can identify the most cost-effective options for your needs. Enter your ZIP code below to begin comparing rates.

Records on Theft and Accidents in Arkansas

Auto theft rates in Arkansas have declined significantly due to enhanced law enforcement, increased vigilance by residents, and the wider use of anti-theft recovery systems. In 2009, there were 6,100 reported vehicle thefts, down from 6,500 in 2008 and 7,010 in 2007.

Tim Bain Licensed Insurance Agent

Crash statistics also show improvement. In 2009, there were 62,808 vehicle crashes, down from 63,137 in 2008, marking a 12% drop since the start of the decade. Traffic fatalities have decreased as well, with 592 fatalities in 2009.

These trends not only suggest safer roads but also point to potential savings on auto insurance for Arkansas drivers, as insurers often adjust rates based on overall risk in the state.

Continued traffic law enforcement and driver education efforts could further enhance these positive outcomes, leading to even more favorable insurance rates.

How to Secure Cheap Arkansas Auto Insurance

Finding cheap Arkansas auto insurance requires a careful comparison of rates and types of auto insurance coverage from various providers. While USAA, State Farm, and Geico stand out for their competitive pricing and comprehensive policies, it’s essential to consider your specific needs and driving history when choosing the best insurance.

Arkansas drivers benefit from relatively low average insurance costs, but rates can vary significantly depending on factors like age, location, and vehicle type. By leveraging online comparison tools and exploring discounts, you can secure affordable coverage that meets both the state’s minimum requirements and your personal financial goals.

Remember, the key to getting the best deal on cheap Arkansas auto insurance is to compare multiple quotes and choose the policy that offers the most value for your situation.

We can assist you with purchasing cheap Arkansas auto insurance online. To compare cheap Arkansas auto insurance quotes, enter your ZIP code below.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Frequently Asked Questions

How can I compare Arkansas auto insurance quotes?

You can compare Arkansas auto insurance quotes by using online comparison tools or by contacting insurance companies directly to request quotes.

Where can I find auto insurance agents in Arkansas?

You can find auto insurance agents in Arkansas by referring to local directories, searching online, or contacting the Arkansas Insurance Department for a list of licensed agents. Enter your ZIP code below to see some of the best quotes on Arkansas auto insurance.

How much insurance does Arkansas require?

Arkansas auto insurance requirements are a 25/50/25 plan. Although they’re not required, most insurance experts recommend Arkansas drivers also purchase uninsured/underinsured motorist and personal injury protection coverage.

Which auto insurance companies are popular in Arkansas?

Some of the largest auto insurance companies in Arkansas include State Farm, Farm Bureau Insurance, Shelter Insurance, Progressive, and Allstate. However, there are many other companies to choose from.

How much does auto insurance cost in Arkansas?

On average, drivers in Arkansas pay around $1,266 per year for auto insurance. Rates can vary based on factors such as your location, driving record, age, and gender. To start, enter your ZIP code below right now.

How does the tort system work in Arkansas?

Arkansas follows the tort system, which means that in an accident, the at-fault driver and their insurance are responsible for the financial claims and lawsuits resulting from the accident.

What are the key benefits of choosing USAA for cheap Arkansas auto insurance?

USAA offers highly competitive rates starting at $19 per month and provides excellent customer service backed by an A++ A.M. Best rating. Their unique coverage options, such as rental reimbursement and roadside assistance, enhance their appeal for those seeking affordable insurance.

How does State Farm’s extensive network enhance its appeal for cheap Arkansas auto insurance?

State Farm’s broad network of local agents ensures easy access to support and personalized service, which is valuable for managing cheap Arkansas auto insurance policies. Their numerous discount opportunities, such as multi-policy discounts, help further reduce insurance costs.

To start, enter your ZIP code below right now.

What discounts does Geico offer that make it a competitive option for cheap Arkansas auto insurance?

Geico provides a variety of auto insurance discounts, including those for military members and safe drivers, which significantly lower premiums. Their competitive rates and robust online tools make it an attractive option for cheap Arkansas auto insurance.

In what ways do Liberty Mutual’s customizable policies provide value for cheap Arkansas auto insurance?

Liberty Mutual’s range of customizable coverage options allows policyholders to tailor their insurance to specific needs, enhancing their value for cheap Arkansas auto insurance. Additionally, their various discounts can help lower overall premiums, making them a flexible choice.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.