Cheap Cadillac Auto Insurance in 2025 (10 Best Companies for Savings)

Farmers, Geico, and American Family offer the best options for cheap Cadillac auto insurance. Farmers leads with the lowest rates at $85/month, while Geico and American Family provide competitive options. Explore these top providers for affordable Cadillac auto insurance and various savings opportunities.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Min. Coverage for Cadillac

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Cadillac

A.M. Best Rating

Complaint Level

Farmers leads as the top choice for cheap Cadillac auto insurance, offering the most competitive rates and comprehensive coverage. Geico providing significant discounts and American Family offering reliable protection at attractive prices.

For those seeking a blend of cost-effectiveness and comprehensive Cadillac auto insurance. Exploring and understanding how auto insurance works can meet your insurance needs while keeping your budget in check.

Our Top 10 Company Picks: Cheap Cadillac Auto Insurance| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $85 | A | Reliable Service | Farmers | |

| #2 | $86 | A++ | Competitive Rates | Geico | |

| #3 | $88 | A | Excellent Coverage | American Family | |

| #4 | $90 | A++ | Customer Satisfaction | Auto-Owners | |

| #5 | $92 | A | Member Benefits | AAA |

| #6 | $96 | B | Strong Reputation | State Farm | |

| #7 | $98 | A+ | Comprehensive Options | Erie |

| #8 | $100 | A+ | Innovative Features | Progressive | |

| #9 | $101 | A+ | Extensive Network | Nationwide |

| #10 | $102 | A | Affordable Premiums | Mercury |

Find your cheapest auto insurance quotes by entering your ZIP code above into our free comparison tool.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#1 – Farmers: Top Overall Pick

Pros

- Affordable Premiums: Farmers provides competitive rates for cheap Cadillac auto insurance, offering a cost-effective option for budget-conscious drivers.

- Reliable Coverage: Explore our Farmers auto insurance review to see how it is known for consistent and dependable coverage, ensuring Cadillac owners receive solid protection.

- Varied Coverage Plans: Offers a range of coverage options, from basic to extensive, allowing customization to meet diverse Cadillac insurance needs.

Cons

- Limited Discounts: Fewer discount opportunities compared to some competitors could limit overall savings on Cadillac insurance.

- Regional Variability: Service quality may vary by location, leading to inconsistent experiences for Cadillac policyholders.

#2 – Geico: Best for Competitive Rates

Pros

- Low-Cost Premiums: Geico is known for its highly competitive rates for cheap Cadillac auto insurance, making it a budget-friendly choice.

- Extensive Discounts: Offers a wide range of discounts, including those for safe driving, low mileage, and bundling, which can enhance savings on Cadillac coverage.

- Strong Financial Stability: Discover our Geico auto insurance review to learn how its solid financial health ensures reliable and consistent coverage for Cadillac drivers.

Cons

- Less Personalized Service: Geico’s reliance on automated systems may lack the personalized service that some Cadillac drivers prefer.

- Standard Coverage Options: Coverage flexibility may be limited compared to providers that offer more customizable policy options.

#3 – American Family: Best for Excellent Coverage

Pros

- Comprehensive Coverage Options: View our American Family auto insurance review to find out how it provides robust coverage choices for cheap Cadillac auto insurance, catering to various protection needs.

- Affordable Rates: Offers competitive pricing, delivering substantial value and making it a strong option for Cadillac insurance.

- High Customer Ratings: Generally receives positive feedback for service quality and support, contributing to a satisfying experience for Cadillac owners.

Cons

- Slightly Higher Premiums: Rates may be slightly higher compared to some other insurers, which could impact overall affordability.

- Regional Variability: Coverage options and service quality can differ depending on location, affecting consistency.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Auto-Owners: Best for Customer Satisfaction

Pros

- High Customer Satisfaction: Auto-Owners is recognized for its high satisfaction rates in cheap Cadillac auto insurance, reflecting strong service and reliability.

- Competitive Pricing: Offers good value with affordable rates, making it a cost-effective choice for Cadillac coverage.

- Dependable Coverage: Delve into our Auto-Owners auto insurance review for consistent and reliable protection that ensures peace of mind for Cadillac owners.

Cons

- Limited Discounts: Fewer discount options might reduce potential savings on Cadillac auto insurance.

- Regional Availability: Not available in all states, potentially limiting access for some Cadillac drivers.

#5 – AAA: Best for Member Benefits

Pros

- Exclusive Member Discounts: In our AAA auto insurance review, discover how members benefit from special discounts on cheap Cadillac auto insurance, adding significant value.

- Broad Coverage Options: Offers a comprehensive range of coverage choices tailored for Cadillac owners, ensuring extensive protection.

- Excellent Service: Known for high-quality customer service and support, enhancing the overall experience for Cadillac policyholders.

Cons

- Higher Costs: Premiums may be slightly higher than some competitors, which might affect affordability.

- Membership Requirement: Discounts and benefits are limited to AAA members, which may not be accessible to everyone.

#6 – State Farm: Best for Strong Reputation

Pros

- Trusted Industry Reputation: State Farm’s long-standing reputation for cheap Cadillac auto insurance reflects reliability and industry trustworthiness.

- Diverse Coverage Options: Provides a wide range of coverage plans, allowing Cadillac owners to select the best fit for their needs.

- Wide Availability: Based on our State Farm auto insurance review, find out why it is available in most states, making it a convenient option for Cadillac drivers across the country.

Cons

- Higher Premiums: Rates may be higher compared to some other insurers, potentially impacting overall affordability.

- Limited Customization: Coverage options might not be as flexible as those offered by more specialized providers.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – Erie: Best for Comprehensive Options

Pros

- Extensive Coverage Choices: Erie offers a variety of coverage options for cheap Cadillac auto insurance, ensuring thorough protection for Cadillac owners.

- Strong Financial Stability: See our Erie auto insurance review to understand how it is known for robust financial health, providing reliable and consistent coverage.

- Affordable Rates: Balances cost and coverage effectively, offering good value for Cadillac insurance.

Cons

- Geographic Limitations: Limited availability in certain regions may affect access for some Cadillac drivers.

- Traditional Features: May not provide the latest technological features found with more innovative insurers.

#8 – Progressive: Best for Innovative Features

Pros

- Advanced Tools and Features: Progressive is known for its innovative tools and features that enhance the management of cheap Cadillac auto insurance.

- Cost-Effective Rates: Offers competitive pricing that balances affordability with advanced coverage features.

- Customizable Coverage: With our Progressive auto insurance review, explore how it provides extensive customization options for Cadillac insurance, catering to specific needs.

Cons

- Complex Pricing Structure: Pricing can be complex, making it challenging to compare with other providers.

- Variable Service Quality: Customer service experiences may vary, leading to inconsistent satisfaction.

#9 – Nationwide: Best for Extensive Network

Pros

- Large Network: According to our Nationwide auto insurance review, learn how it offers a broad network and extensive coverage options for cheap Cadillac auto insurance, ensuring wide access.

- Reliable Service: Generally provides good customer service and support, enhancing the experience for Cadillac policyholders.

- Competitive Value: Balances quality coverage with affordability, offering good value for Cadillac insurance.

Cons

- Higher Premiums: Premiums might be higher compared to some other options, impacting overall affordability.

- Less Personalized Service: May lack the personalized approach found with smaller, local providers.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – Mercury: Best for Affordable Premiums

Pros

- Budget-Friendly Rates: Mercury offers some of the most affordable premiums for cheap Cadillac auto insurance, making it ideal for those on a budget.

- Solid Coverage Options: Provides a variety of coverage options to meet different needs and preferences for Cadillac owners.

- Positive Service Reviews: In our Mercury auto insurance review, discover why it generally receives favorable reviews for customer service and support.

Cons

- Higher Rates Compared to Some: Premiums might be slightly higher than other budget options, affecting overall cost.

- Limited Discounts: Fewer discount opportunities might limit potential savings on Cadillac insurance.

Comparing Cheap Cadillac Auto Insurance Rates

Choosing the right Cadillac auto insurance involves evaluating various options to ensure the best value for your money. Farmers offers competitive rates and cost-effective coverage with flexible auto insurance deductible options.

Cadillac Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $92 $162

American Family $88 $152

Auto-Owners $90 $160

Erie $98 $169

Farmers $85 $150

Geico $86 $155

Mercury $102 $180

Nationwide $101 $176

Progressive $100 $177

State Farm $96 $159

American Family provides robust coverage and discounts, especially for hybrid models like the Cadillac ELR. Geico is known for competitive rates and valuable discounts. State Farm delivers a balanced approach with reasonable rates and broad availability.

AAA offers excellent member benefits and discounts, while Auto-Owners is praised for customer satisfaction and cost-effective coverage. Progressive provides innovative features and competitive pricing.

Nationwide offers a large network and extensive coverage options, and Mercury presents affordable premiums and various coverage choices.

Make sure to thoroughly review each provider’s offerings to identify the most suitable and cost-effective insurance policy for your Cadillac. Consider factors such as the level of coverage, any available discounts, and additional benefits that may be offered.

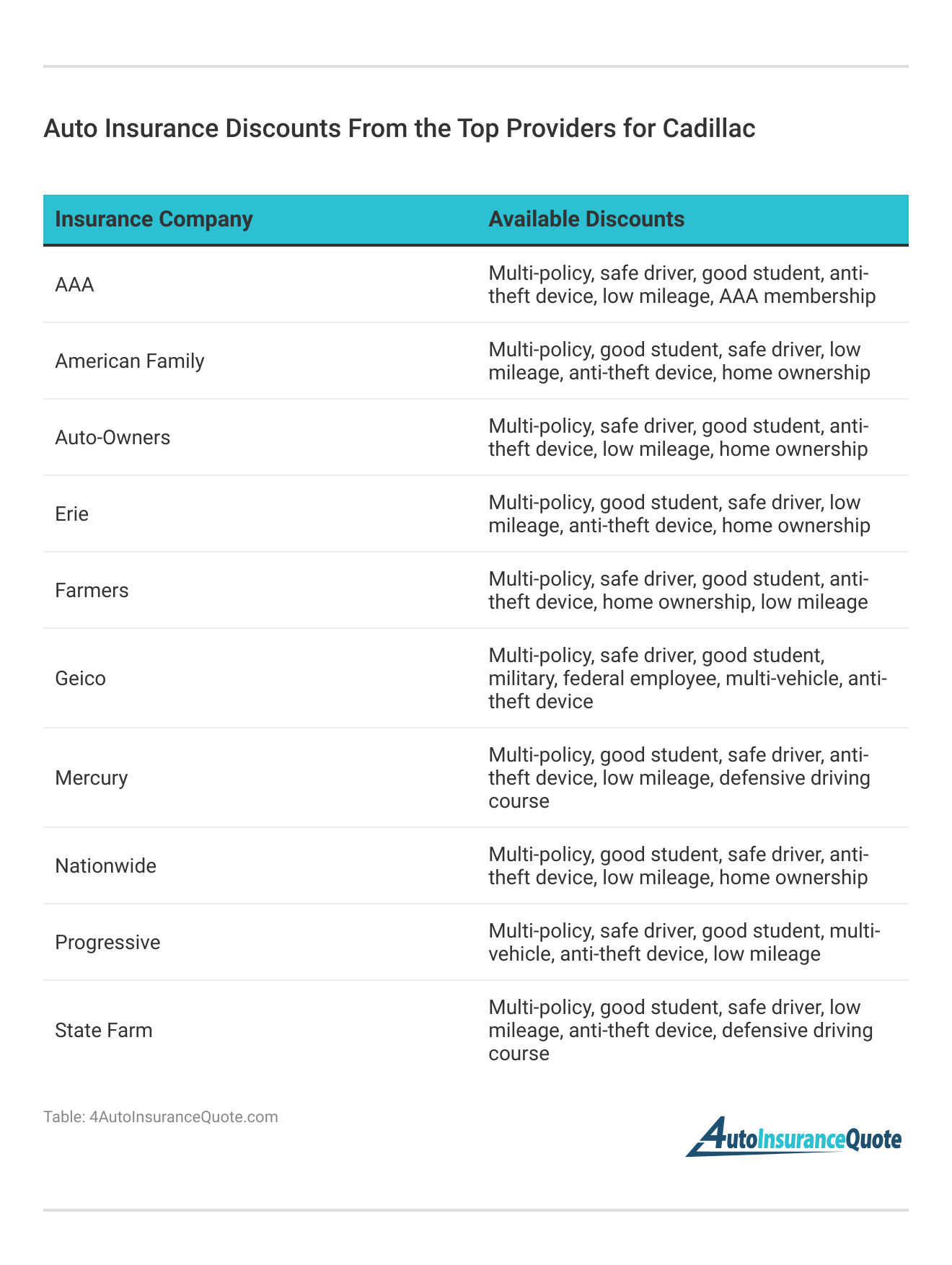

Save on Cheap Cadillac Auto Insurance

To secure cheap Cadillac auto insurance, maximizing discounts from top providers is essential. Farmers, our top pick, offers valuable discounts, including multi-policy, safe driver, and low mileage, which can significantly reduce your premiums.

AAA gives discounts for low mileage, anti-theft recovery systems, and AAA membership. Other providers like Erie and Nationwide offer similar discounts.

Farmers offers the best value for Cadillac insurance, delivering competitive rates and comprehensive coverage tailored to your needs.Eric Stauffer Licensed Auto Insurance Agent

By leveraging these discounts, along with those from other leading companies like Geico, State Farm, and Erie, you can find the most affordable coverage for your Cadillac.

To secure the most affordable deals on cheap Cadillac auto insurance, consider these strategies:

- Bundle Insurance Policies: Combining insurance policies with your Cadillac auto insurance with other types of coverage, like homeowners or renters insurance, can lead to substantial savings.

- Increase Your Deductible: Opting for a higher deductible can lower your monthly premiums, but make sure you can comfortably afford the deductible amount in case of a claim.

- Maintain a Clean Driving Record: Avoiding traffic violations and accidents helps keep your rates lower.

- Limit Annual Mileage: Driving fewer miles each year can help reduce your insurance premiums.

- Keep a Positive Credit Score: Insurance companies often use credit scores to determine rates, so maintaining a good credit score can help you secure cheaper rates.

If you’re struggling to find affordable rates for your Cadillac, comparing quotes from different insurers can reveal better options and potentially save you money

If you’re finding it hard to get affordable Cadillac rates, comparing quotes from different insurers can uncover better options and savings. Rates vary based on factors like vehicle model and driving history.

Farmers offers competitive rates and comprehensive coverage for Cadillac CTS. If you’re wondering how much is insurance for a Cadillac CTS, the Cadillac CTS insurance cost varies depending on the model, with the Cadillac CTS-V typically having higher premiums. Geico also provides competitive rates and potential discounts for these vehicles.

| Cadillac Auto Insurance Rates by Model |

|---|

| Cadillac CTS Sport Wagon |

| Cadillac CTS-V |

| Cadillac ELR |

| Cadillac XT5 |

For the Cadillac ELR, a hybrid model, checking with American Family might be beneficial. They offer special hybrid vehicle auto insurance discount, which can help reduce overall insurance costs.

The Cadillac XT5 usually has higher premiums due to its value and repair costs. State Farm is a solid choice for its balanced coverage and reasonable SUV rates. For Cadillac XTS car insurance, comparing quotes is key; AAA offers useful member benefits and discounts.

The Cadillac DTS Pro usually has lower insurance costs. Auto-Owners is recommended for its cost-effective coverage and customer satisfaction, ideal for Cadillac DTS Pro car insurance. For Cadillac DTS car insurance, Progressive offers competitive rates and innovative features.

By considering these providers and their offerings, you can find the most cost-effective insurance solution tailored to your specific Cadillac model.

Your Guide for the Cheap Cadillac Auto Insurance

To secure affordable Cadillac auto insurance, evaluate top providers for competitive rates and comprehensive coverage. Farmers excels with its competitive pricing, strong coverage, and flexible deductibles.

Farmers offers the most cost-effective Cadillac auto insurance, making it the top choice for budget-conscious drivers.Scott W. Johnson Licensed Auto Insurance Agent

Geico and American Family also offer attractive rates, valuable discounts, and deductible options tailored to your budget, making them solid alternatives for those seeking both savings and reliable protection.

To get the best deal for your Cadillac, explore discounts like multi-policy and low-mileage auto insurance discount, and assess each company’s benefits, including deductible options.

By comparing auto insurance quotes in Cadillac, leveraging discounts, and choosing the right deductible, you can secure affordable coverage tailored to your needs.

Get fast and cheap auto insurance coverage today with our quote comparison tool below.

Frequently Asked Questions

What is the best insurance company for securing cheap Cadillac auto insurance?

Farmers is often the best choice for cheap Cadillac auto insurance, with Geico and American Family also providing affordable comprehensive auto insurance coverage.

How much would cheap Cadillac auto insurance be for a Cadillac CTS?

For a Cadillac CTS, you can find insurance rates starting as low as $85 per month through Farmers, making it an affordable option for Cadillac owners.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Who typically offers the cheapest car insurance rates for Cadillac vehicles?

Farmers often provides the cheapest Cadillac car insurance rates, starting at $85 per month. Geico and American Family also offer competitive and affordable insurance options for Cadillacs.

Is comprehensive coverage the most expensive form of Cadillac auto insurance?

Comprehensive coverage can be costly, but you can still find affordable options through providers like Farmers and Geico, who offer lower rates for Cadillac owners.

Are Cadillacs expensive to insure, or can I find cheap Cadillac auto insurance?

While Cadillac insurance cost is generally higher, making Cadillacs among the most expensive cars to insure, you can still find affordable options with companies like Farmers, Geico, and American Family, which offer competitive rates

How much does cheap Cadillac auto insurance cost on average per month?

On average, you can expect to pay around $85 per month with Farmers for cheap Cadillac auto insurance. Geico and American Family also offer similarly competitive rates.

Are parts for Cadillacs more expensive, and how does that impact the cost of cheap Cadillac auto insurance?

Cadillac parts can be more expensive, which can increase insurance rates. However, Farmers, Geico, and American Family still offer competitive and affordable insurance options.

Does Cadillac qualify as a car brand with cheap insurance options?

Yes, despite their premium status, you can find cheap Cadillac auto insurance through providers like Farmers, Geico, and American Family, which offer competitive rates. If you’re wondering, “How does the auto insurance company determine my premium?” these providers take various factors into account to offer you the best rates.

What is the lowest level of coverage I can get with cheap Cadillac auto insurance?

The lowest level of coverage is typically liability insurance, which is the most affordable option. Farmers and Geico offer cheap Cadillac auto insurance with liability coverage.

Is Cadillac considered high maintenance, and how does that affect finding cheap Cadillac auto insurance?

Cadillacs are generally considered high-maintenance vehicles, but you can still find affordable insurance with companies like Farmers, Geico, and American Family, which specialize in offering competitive rates for luxury cars.

Get the best auto insurance rates possible by entering your ZIP code below into our free comparison tool today.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.