Best Auto Insurance for Undocumented Immigrants in 2025 (Your Guide to the Top 10 Companies)

State Farm, Progressive, and Liberty Mutual offer the best auto insurance for undocumented immigrants, starting at just $40 a month. These companies are recognized for their competitive pricing, comprehensive coverage options, and excellent customer service, making them top choices for undocumented immigrants.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Undocumented Immigrants

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 3,792 reviews

3,792 reviewsCompany Facts

Full Coverage for Undocumented Immigrants

A.M. Best Rating

Complaint Level

3,792 reviews

3,792 reviewsThe top picks for the best auto insurance for undocumented immigrants are State Farm, Progressive, and Liberty Mutual.

These companies stand out for their exceptional coverage options, tailored to meet the specific needs of undocumented immigrants, ensuring compliance with U.S. driving laws while providing essential financial protection. See more details in our “Can I use out-of-state auto insurance?”

Our Top 10 Company Picks: Best Auto Insurance for Undocumented Immigrants

| Company | Rank | Safe Driver Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | B | Inclusive Policies | State Farm | |

| #2 | 15% | A+ | Flexible Payments | Progressive | |

| #3 | 10% | A | Safe Driving | Liberty Mutual |

| #4 | 10% | A+ | Resident Coverage | Allstate | |

| #5 | 10% | A+ | Easy Application | Nationwide |

| #6 | 10% | A+ | Comprehensive Support | Amica | |

| #7 | 10% | A++ | Tailored Plans | Travelers | |

| #8 | 10% | A | Multilingual Services | MetLife | |

| #9 | 5% | A | Accessible Rates | The General | |

| #10 | 10% | A++ | Military Family | USAA |

They are recognized for their robust customer service and the ability to cater to a diverse clientele. With these providers, undocumented immigrants can find reliable and comprehensive auto insurance solutions that fit their unique circumstances.

Want to start shopping for quotes to reduce undocumented immigrants’ auto insurance rates? Enter your ZIP code in our free tool above.

- State Farm is the top pick for auto insurance for undocumented immigrants

- Tailored policies meet the specific legal needs of undocumented drivers

- Coverage ensures compliance with U.S. driving and insurance laws

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: State Farm provides a substantial discount for low-mileage usage.

- Wide Coverage: State Farm offers various coverage options tailored to different business needs. Learn more in our State Farm auto insurance review.

Cons

- Limited Multi-Policy Discount: The multi-policy discount of State Farm is not as high compared to some competitors.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels.

#2 – Progressive: Best for Flexible Payments

Pros

- Loyalty Rewards: Progressive rewards long-term customers with decreasing deductibles. Read up on the Progressive auto insurance review for more information.

- Customizable Policies: Allows extensive customization of policies to match individual needs.

- Technology Integration: Progressive uses technology like mobile apps for easier policy management.

Cons

- Customer Service Variability: Customer service quality can vary significantly depending on the region.

- Rate Increases: Some customers report frequent rate increases after filing claims.

#3 – Liberty Mutual: Best for Safe Driving

Pros

- Accident Forgiveness: Liberty Mutual won’t hike your premiums after your first accident if you’re eligible.

- Safe Driver Discounts: Additional discounts for drivers with clean records. Check out insurance savings in our complete Liberty Mutual auto insurance review.

- Wide Range of Add-ons: Offers numerous add-ons like roadside assistance and new car replacements.

Cons

- Higher Rates for High-Risk Drivers: Premiums can be significantly higher for drivers with past incidents.

- Policy Upselling: Some customers report aggressive upselling of additional features.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Allstate: Best for Resident Coverage

Pros

- Local Agents: Provides personalized service through a network of local agents.

- Discounts for Homeowners: Special rates for customers who own homes. More information is available about this provider in our “How do I file an auto insurance claim with Allstate?”

- Innovative Tools: Access to tools like Drivewise to monitor driving and save on premiums.

Cons

- Pricing Inconsistency: Pricing can vary widely between states and individual circumstances.

- Claims Process Issues: Some users report delays and complications in the claims process.

#5 – Nationwide: Best for Easy Application

Pros

- Streamlined Application Process: Easy and quick online application process. Learn more on how to file an auto insurance claim with Nationwide.

- Accident Forgiveness: Similar to Liberty Mutual, Nationwide also offers accident forgiveness.

- Wide Range of Products: Offers a broad array of insurance products that can be bundled for discounts.

Cons

- Customer Service: Customer service can be inconsistent, with some areas reporting poor experiences.

- Premium Fluctuations: Customers might experience unexpected premium increases.

#6 – Amica: Best for Comprehensive Support

Pros

- High Customer Satisfaction: Known for excellent customer service and satisfaction.

- Dividend Policies: Offers policies that can return a dividend, reducing overall cost. See more details on our “Finding Auto Insurance Quotes Online.”

- Full Replacement Coverage: Full replacement cost coverage is available without depreciation.

Cons

- Higher Initial Costs: Premiums can be higher initially compared to other insurers.

- Limited Availability: Services might not be available in all regions.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – Travelers: Best for Tailored Plans

Pros

- Customization Options: Wide range of options to tailor coverage extensively.

- Discounts for Multiple Policies: Offers discounts when you bundle different types of policies.

- Green Home Discount: Discounts for eco-friendly home practices. Access comprehensive insights into our Travelers auto insurance review.

Cons

- Complex Policy Options: The vast array of options can be confusing for new insurance buyers.

- Higher Rates for Riskier Profiles: Higher premiums for those with riskier profiles or poor credit.

#8 – MetLife: Best for Multilingual Services

Pros

- Multilingual Support: Offers services in multiple languages, beneficial for a diverse clientele.

- Broad Coverage Options: Comprehensive coverage options for a variety of vehicle types. Unlock details in our “Compare Auto Insurance Coverage Types.”

- Employee Benefits: Attractive discounts and benefits for employees of partner companies.

Cons

- Complex Claims Process: Some customers find the claims process to be overly complicated.

- Limited Personalized Service: Less focus on personalized service compared to some competitors.

#9 – The General: Best for Accessible Rates

Pros

- High Acceptance Rate: Welcomes drivers with less-than-perfect driving records.

- Flexible Payment Options: Offers various payment options to suit different financial situations.

- Immediate Coverage: Quick and easy process to start coverage almost immediately. Discover insights in our “Affordable Full Coverage Auto Insurance.”

Cons

- Quality of Coverage: Basic coverage options might not offer the depth that some drivers need.

- Customer Service Concerns: Reports of unsatisfactory customer service experiences.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – USAA: Best for Military Family

Pros

- Military Specialization: Tailored services specifically for military members and their families.

- Competitive Rates: Generally lower rates for insurance compared to the broader market.

- Extensive Support: Offers wide-ranging support both online and through local offices. See more details on what information I need to provide when filing an auto insurance claim with USAA.

Cons

- Limited Eligibility: Services are only available to military members, veterans, and their families.

- Less Flexibility for Non-Military: Non-military individuals have reported less flexibility and higher rates.

Specific Coverage Rates for Undocumented Immigrants

States That Allow Undocumented Immigrants to Obtain a License

You may be asking, “Which states allow illegal immigrants to get driver’s licenses?” Slugly, California, Colorado, Connecticut, Delaware, Hawaii, Illinois, Maryland, Nevada, New Jersey, New Mexico, New York, Oregon, Utah, Vermont, and Washington all have laws in place that allow them to obtain driver’s licenses. Discover insights in our “Auto Insurance Requirements by State.”

This leads you to your next question: “Can illegal immigrants get auto insurance?” Several states have laws regarding the driving rights of undocumented immigrants. The main purpose of these laws is safety. If more drivers are required to go through the necessary testing to be able to drive and buy insurance, the roads will be safer.

Each of the programs in these states requires applicants to pass both a written and driving test before they are issued a license. They are also required to obtain auto insurance before they are allowed to drive. So in these states, the answer to “Can unauthorized immigrants get auto insurance?” is yes. However, each state has different rules that must be met before the driver’s license will be granted.

What Are the Average Auto Insurance Rates by Companies

Once you obtain a license, you can look into getting auto insurance for undocumented immigrants. Take a look at the table below to see average prices for low, medium, and high auto insurance coverage. Rates will also depend upon your driving history, age, credit history, and vehicle.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

California Driving Laws

Can an illegal immigrant get auto insurance in California? The state of California is one of the more recent states to offer driver’s licenses to undocumented immigrants, so immigrants can get California auto insurance. State officials are hoping that allowing immigrants to obtain a driver’s license will also get them to purchase auto coverage.

State Farm offers the most competitive rates for both minimum and full coverage, making it a top choice for undocumented immigrants seeking value and reliability.Kristen Gryglik Licensed Insurance Agent

To encourage undocumented immigrants to purchase auto insurance, the state’s Department of Insurance has been marketing a low-cost auto insurance policy (public auto insurance) available to immigrants who are projected to obtain their licenses under the state’s new laws.

Since about 90% of the applicants are expected to be Spanish-speaking, the marketing has been geared towards this population. The low-cost insurance program is extremely basic. Immigrants who can afford a better policy should consider joining a private plan that offers more coverage.

Read more: How To Pass Your Driving Test

Rules for Undocumented Immigrants While Driving

As an undocumented immigrant with a driver’s license, you will be required to follow all the same rules of the road as U.S. citizens. Once you have obtained your license, it is important to make sure that you obtain an insurance policy as well, as this is required in every state. Unlock details in our “Understanding How Auto Insurance Works.”

Any driver on the road, undocumented immigrant or not, will need to be able to show proof of insurance after an accident or during a traffic stop. Once you have your driver’s license, it is important to keep your proof of insurance card with you whenever you are driving your vehicle.

How to Get Insurance in States That Do Not Allow Immigrant Licenses

Now you may be asking, “How do undocumented immigrants get auto insurance in states that don’t allow them to get a driver’s license?” This can be much more difficult. Even if you can purchase auto insurance, the policy may essentially be worthless. There are several reports of insurers selling a policy to an undocumented immigrant and then refusing to pay any claims made on the policy.

The majority of states in the country do not currently have laws regarding undocumented immigrants obtaining driver’s licenses. If you are an undocumented immigrant who lives in one of these states, it is important to not drive without legal driving privileges, even if you can obtain a car insurance policy.

If you pay for an insurance policy and are involved in an accident, chances are the insurance company is not going to pay for any damages that you may have caused. When making a claim, the insurance company will state that they will not pay it because you are not a licensed driver. Delve into our evaluation of “Auto Insurance Quotes by State.”

Overall, if you live in a state that allows you to obtain a driver’s license as an undocumented immigrant, you will easily be able to find an auto insurance policy from a company that provides insurance for your state. if you cannot obtain a driver’s license legally in the state that you live in, you should not try to obtain an auto insurance policy either.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Frequently Asked Questions

Which states allow undocumented immigrants to obtain a driver’s license?

Currently, 15 states allow undocumented immigrants to obtain driver’s licenses. These states are California, Colorado, Connecticut, Delaware, Hawaii, Illinois, Maryland, Nevada, New Jersey, New Mexico, New York, Oregon, Utah, Vermont, and Washington.

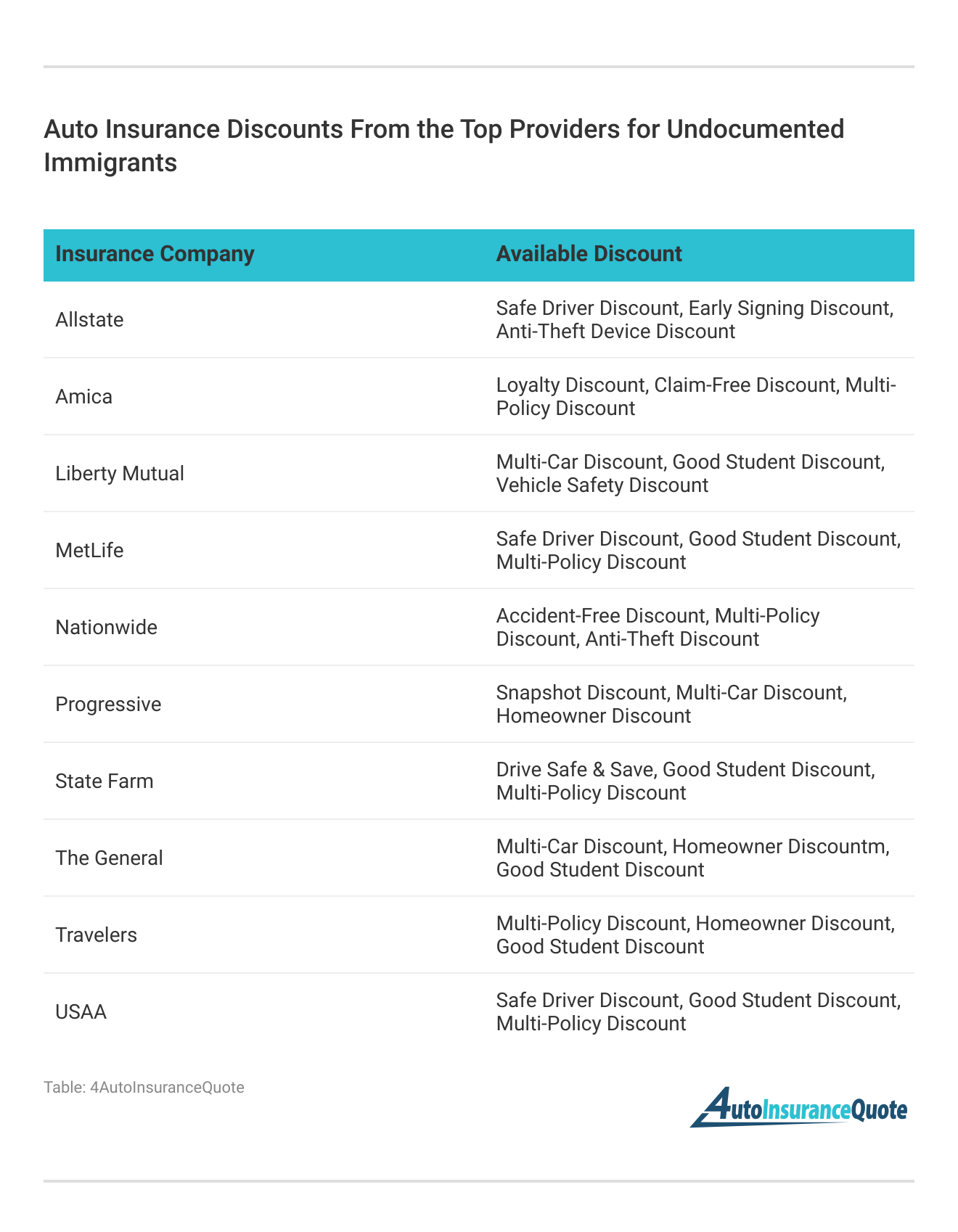

For additional details, explore our comprehensive resource titled “Auto Insurance Discounts for Affordable Coverage.”

Can undocumented immigrants get auto insurance?

In states that permit undocumented immigrants to secure driver’s licenses, they are also eligible to buy auto insurance. It is essential for every driver, no matter their immigration status, to possess auto insurance to adhere to state regulations, including car insurance for new immigrants in the US.

Can undocumented immigrants get roadside assistance coverage with their auto insurance?

Undocumented immigrants can typically include roadside assistance coverage in their auto insurance policy for extra protection and help during breakdowns or road emergencies, ensuring comprehensive insurance for undocumented immigrants.

Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

Will having an auto insurance policy help me establish a driving record in the United States?

Indeed, maintaining a clean driving record while holding an auto insurance policy can contribute to a favorable driving history in the United States. This can be advantageous for securing more affordable auto insurance and managing future driving-related issues.

Can undocumented immigrants obtain commercial auto insurance for business purposes?

Some automobile insurance companies may offer commercial auto insurance policies for undocumented immigrants who need coverage for business purposes. It’s best to inquire with insurance providers directly to determine the options available.

To find out more, explore our guide titled “Auto Insurance Quotes by Vehicle.”

What is car insurance for immigrants?

Car insurance for immigrants provides coverage tailored to meet the needs of individuals who have recently moved to a new country.

Which companies offer the best car insurance for undocumented immigrants?

State Farm, Progressive, and Liberty Mutual are noted for offering the best car insurance for immigrants due to their competitive rates and inclusive policies.

What makes the best car insurance for immigrants?

The best car insurance for immigrants offers affordable rates, and comprehensive coverage options, and is sensitive to the unique needs of immigrants.

Can undocumented immigrants get car insurance?

Yes, in certain states, undocumented immigrants can obtain car insurance once they have a valid driver’s license from that state.

To learn more, explore our comprehensive resource on “How Vehicle Make and Model Affects Your Auto Insurance Rates.”

How does auto insurance for immigrants differ from standard policies?

Auto insurance for immigrants may offer more flexible documentation requirements and multilingual support to accommodate non-native speakers.

What should undocumented immigrants know about car insurance?

Undocumented immigrants should seek car insurance providers that offer policies explicitly designed for non-citizens, ensuring legal driving and financial protection.

What are the considerations for auto insurance for new immigrants?

New immigrants should consider insurers that offer international driver’s license acceptance, translation services, and personalized customer support.

Is auto insurance for undocumented immigrants widely available?

Availability varies by state, but in regions where it’s allowed, several insurers provide tailored auto insurance for undocumented immigrants.

Access comprehensive insights into our guide titled “Average Cost of Auto Insurance: Find Affordable Quotes.”

Can car insurance for illegal immigrants be obtained easily?

Obtaining car insurance for illegal immigrants can be challenging and depends largely on the state’s laws regarding driver’s licenses for non-citizens.

What is the best car insurance for immigrants looking for high coverage?

Amica and State Farm are often recommended for offering extensive coverage at competitive rates, making them ideal for immigrants seeking robust policies.

How do illegal immigrants get car insurance?

Illegal immigrants can obtain car insurance in states that issue driver’s licenses to undocumented individuals by providing the necessary state-approved documentation.

What options exist for car insurance for non-US citizens?

Non-US citizens can access car insurance through providers that accept international or foreign driver’s licenses and offer policies designed for international residents.

Access comprehensive insights into our guide titled “Affordable Auto Insurance Quotes for Foreigners.”

How does car insurance for undocumented immigrants differ from other policies?

This insurance typically requires no SSN and may accept foreign or specially issued state driver’s licenses, catering specifically to the undocumented community.

Can illegal immigrants get car insurance without a U.S. driver’s license?

Generally, illegal immigrants need a valid driver’s license from the state they reside in to obtain car insurance, which some states do issue to undocumented residents.

Which provider offers the best car insurance for undocumented immigrants seeking comprehensive coverage?

Progressive is highly regarded for providing comprehensive coverage that meets the needs of undocumented immigrants at competitive pricing.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.