Cheap Mitsubishi Auto Insurance in 2025 (Save Big With These 10 Companies!)

Our top three best providers for cheap Mitsubishi auto insurance are Geico, AAA, and Farmers, with rates starts at $88 monthly. These leading insurers offer competitive rates and wide range of coverage options. Compare Mitsubishi auto insurance quotes to get the best deal.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,027 reviews

3,027 reviewsCompany Facts

Min. Coverage for Mitsubishi

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 3,072 reviews

3,072 reviewsCompany Facts

Min. Coverage for Mitsubishi

A.M. Best Rating

Complaint Level

3,072 reviews

3,072 reviewsGeico, AAA, and Farmers are best choices for cheap Mitsubishi auto insurance. These leading providers offers great value with low rates and comprehensive coverage, starting at $88 per month.

In most cases, Mitsubishi models will be fairly inexpensive to insure. However, you will see changes in rates among models, as well as rate changes for different driver factors.

- Affordable Mitsubishi Auto Insurance Quotes

Knowing how to lower rates and average costs helps you find cheaper Mitsubishi auto insurance quotes.

Our Top 10 Company Picks: Cheap Mitsubishi Auto Insurance| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $88 | A++ | Competitive Pricing | Geico | |

| #2 | $89 | A | Strong Discounts | AAA |

| #3 | $93 | A | Comprehensive Coverage | Farmers | |

| #4 | $95 | A++ | Broad Network | Travelers | |

| #5 | $98 | A+ | Excellent Service | Erie |

| #6 | $100 | A | Reliable Claims | American Family | |

| #7 | $102 | A+ | Extensive Options | Allstate | |

| #8 | $104 | A | Flexible Policies | Liberty Mutual |

| #9 | $105 | A+ | Innovative Tools | Progressive | |

| #10 | $110 | B | Nationwide Reach | State Farm |

Our guide goes over everything you need to know about Mistusbishi rates, from what coverages you’ll need to carry to our best tips on reducing your rates. You can also learn more about finding the cheapest auto insurance companies here. Enter your ZIP code to start.

- Affordable Mitsubishi Auto Insurance Quotes

- The Mitsubishi Lancer is pricier to insure

- The Mirage and Outlander Sport are cheaper to insure

- Rates increase with DUIs, accidents, or tickets

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Affordable Rates for Mitsubishi Drivers: Geico offers some of the cheapest Mitsubishi auto insurance with rates starting at $88 per month. Mitsubishi owners can benefit from these low premiums, making it a budget-friendly choice. Their competitive pricing is particularly advantageous for those driving the Mirage or other Mitsubishi models.

- Excellent Customer Satisfaction: Geico’s high customer satisfaction ratings reflect their commitment to providing quality service. Mitsubishi drivers appreciate the consistent and reliable support, which enhances the value of cheap Mitsubishi auto insurance. Explore our comprehensive resource titled “Geico Auto Insurance Review.”

- Extensive Discounts for Safe Drivers: Geico offers a variety of discounts, including those for safe driving, which can significantly lower premiums for Mitsubishi drivers with clean records. This makes their cheap Mitsubishi auto insurance an attractive option for safety-conscious Mitsubishi enthusiasts.

Cons

- Limited Local Agents: Geico’s focus on online services means fewer local agents, which may be inconvenient for Mitsubishi owners who prefer personal interaction. This can make accessing support for cheap Mitsubishi auto insurance less straightforward for some drivers.

- High Rates for High-Risk Drivers: Mitsubishi drivers with poor driving records may find Geico’s rates less competitive, as their premiums can increase significantly for high-risk individuals. This can impact those seeking cheap Mitsubishi auto insurance with a history of claims or violations.

#2 – AAA: Best for Strong Discounts

Pros

- Comprehensive Discount Programs: AAA provides a wide range of discounts, such as multi-car and loyalty discounts, which can greatly reduce premiums for Mitsubishi drivers. The strong discount programs make AAA’s cheap Mitsubishi auto insurance a top choice for those looking to maximize savings.

- Roadside Assistance: AAA’s renowned roadside assistance offers valuable support for Mitsubishi drivers, adding extra security with services like towing and lockout assistance. This added benefit enhances the appeal of their cheap Mitsubishi auto insurance. It’s important to know the liability auto insurance coverage.

- Bundle Savings: Bundling auto insurance with other AAA policies, like home or renters insurance, can lead to significant savings for Mitsubishi owners. This bundling option makes AAA’s cheap Mitsubishi auto insurance even more economical. Read more on AAA auto insurance review.

Cons

- Membership Requirement: To access AAA insurance, Mitsubishi drivers must be members, which involves an additional annual fee. This requirement might be a drawback for those only seeking cheap Mitsubishi auto insurance without additional costs.

- Average Online Experience: AAA’s online tools and mobile app are not as advanced as competitors’, potentially making it harder for tech-savvy Mitsubishi owners to manage their cheap Mitsubishi auto insurance digitally.

#3 – Farmers: Best for Comprehensive Coverage

Pros

- Wide Range of Coverage Options: Farmers offers extensive coverage options, such as glass repair, new car replacement, and customized parts coverage, perfect for Mitsubishi owners with unique needs. Their comprehensive coverage ensures that Mitsubishi drivers can fully protect their vehicles.

- Good Multi-Policy Discounts: Mitsubishi owners can enjoy substantial savings by bundling auto insurance with other Farmers policies, such as life or home insurance. This makes their cheap Mitsubishi auto insurance even more affordable. Read more through our Farmers auto insurance review.

- Accident Forgiveness Program: Farmers’ accident forgiveness helps Mitsubishi drivers avoid premium increases after their first at-fault accident. This feature adds value to their cheap Mitsubishi auto insurance by mitigating the impact of driving mishaps.

Cons

- Higher Premiums: Farmers’ premiums are generally higher compared to other providers, which might make it less attractive for those seeking the cheapest Mitsubishi auto insurance. Mitsubishi drivers on a tight budget may find this a significant drawback.

- Limited Availability of Discounts: While Farmers does offer discounts, they may not be as extensive or accessible as those from competitors, potentially limiting savings for Mitsubishi enthusiasts seeking cheap Mitsubishi auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Travelers: Best for Broad Network

Pros

- Extensive Nationwide Network: Travelers boasts a broad network of agents and coverage areas, making it a convenient choice for Mitsubishi drivers across the country. This extensive reach ensures that Mitsubishi owners can access cheap Mitsubishi auto insurance wherever they are.

- Flexible Coverage Options: Mitsubishi owners can customize their policies with add-ons like accident forgiveness, new car replacement, and gap insurance. This flexibility enhances the value of Travelers’ cheap Mitsubishi auto insurance. To broaden your understanding, explore our coverage titled “Combining Insurance Policies.”

- Multi-Car Discounts: Travelers offers significant discounts for insuring multiple Mitsubishi vehicles, making it a cost-effective option for families or enthusiasts with several cars. This discount helps make their cheap Mitsubishi auto insurance even more affordable.

Cons

- Average Customer Satisfaction: Travelers has mixed reviews on customer service, which might be a concern for Mitsubishi owners who value high-quality support. This could impact their overall experience with cheap Mitsubishi auto insurance.

- Higher Rates for Young Drivers: Travelers’ premiums can be higher for young Mitsubishi drivers, making it less competitive for this demographic seeking affordable coverage. Look for more details through our Travelers insurance review.

#5 – Erie: Best for Excellent Service

Pros

- Top-Ranked Customer Service: Erie is highly rated for customer service, providing Mitsubishi drivers with prompt and effective support. Their commitment to service enhances the appeal of their cheap Mitsubishi auto insurance. Read more through our Erie auto insurance review.

- Guaranteed Rate Lock: Erie offers a rate lock feature, which prevents premium increases for Mitsubishi owners unless they make policy changes. This stability is a key benefit of their cheap Mitsubishi auto insurance.

- Comprehensive Coverage Options: Erie provides a wide array of coverage options, including personal injury protection (PIP) and comprehensive coverage, which cater to the needs of Mitsubishi drivers. Their cheap Mitsubishi auto insurance ensures extensive protection.

Cons

- Limited Availability: Erie operates in only 12 states, which may be a limitation for Mitsubishi drivers outside its service areas. This could restrict access to their cheap Mitsubishi auto insurance for some.

- Few Online Tools: Erie’s digital tools and online services are not as advanced as those of larger competitors, which might be inconvenient for tech-savvy Mitsubishi drivers seeking to manage their cheap Mitsubishi auto insurance online.

#6 – American Family: Best for Reliable Claims

Pros

- Reliable Claims Process: American Family is known for its efficient claims handling, ensuring that Mitsubishi owners have a smooth experience during claims. This reliability adds value to their cheap Mitsubishi auto insurance.

- Good Student Discounts: Mitsubishi drivers with student drivers in the family can benefit from American Family’s good student discount, lowering premiums significantly. This makes their cheap Mitsubishi auto insurance especially appealing to families.

- Comprehensive Coverage for Customized Cars: American Family offers coverage for customized Mitsubishi vehicles, protecting aftermarket modifications and accessories. This ensures Mitsubishi enthusiasts can fully cover their customized rides with cheap Mitsubishi auto insurance.

Cons

- Limited Availability: American Family is not available in all states, which may limit access to their cheap Mitsubishi auto insurance for drivers outside its service areas. For additional details, explore our resource titled “American Family Insurance Auto Insurance Review.”

- Higher Premiums for Some Drivers: Some Mitsubishi owners may find American Family’s premiums higher compared to other providers, especially without discounts, impacting the affordability of their cheap Mitsubishi auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – Allstate: Best for Extensive Options

Pros

- Wide Range of Coverage Options: Allstate offers a broad array of coverage options, including accident forgiveness, new car replacement, and roadside assistance, catering to various needs of Mitsubishi owners. This variety allows Mitsubishi drivers to customize their policies and enjoy comprehensive protection, contributing to their cheap Mitsubishi auto insurance.

- Strong Discounts and Rewards Programs: Allstate provides numerous discounts, such as safe driver discounts and multi-policy savings. Additionally, their Drivewise program rewards safe driving habits with further discounts. Mitsubishi enthusiasts can benefit from these programs to lower their overall costs on cheap Mitsubishi auto insurance.

- Innovative Digital Tools: Allstate’s mobile app and online tools, including the Drivewise app for monitoring driving behavior, offer convenience and help Mitsubishi drivers manage their policies more effectively. These innovative tools make their cheap Mitsubishi auto insurance easier to manage and potentially more affordable.

Cons

- Higher Premiums for Some Drivers: Allstate’s premiums can be higher compared to some competitors, especially for those with a poor driving history. Mitsubishi drivers seeking the cheapest Mitsubishi auto insurance may find better rates with other providers if they have a less favorable driving record. Read more through our detailed guide titled “Allstate Auto Insurance Review.”

- Variable Customer Service Experiences: While generally strong, Allstate’s customer service can vary depending on location and individual agents. This inconsistency might be a drawback for Mitsubishi drivers who prioritize consistent, high-quality support as part of their cheap Mitsubishi auto insurance.

#8 – Liberty Mutual: Best for Flexible Policies

Pros

- Customizable Coverage Options: Liberty Mutual allows Mitsubishi drivers to tailor their coverage extensively, including add-ons like new car replacement and accident forgiveness. This customization ensures Mitsubishi owners can craft a policy that meets their specific needs, enhancing their cheap Mitsubishi auto insurance.

- Good Coverage for High-Risk Drivers: Liberty Mutual offers competitive rates for high-risk Mitsubishi drivers, such as those with past accidents or traffic violations. This feature makes their cheap Mitsubishi auto insurance more accessible for those with less-than-perfect driving records. To gain in-depth knowledge, consult our comprehensive resource titled “Liberty Mutual Auto Insurance Review.”

- Multi-Policy Discounts: Mitsubishi owners can benefit from significant savings by bundling auto insurance with other Liberty Mutual policies, like home or renters insurance. This bundling not only reduces premiums but also adds to the overall value of their cheap Mitsubishi auto insurance.

Cons

- Above-Average Premiums: Liberty Mutual’s premiums can be higher compared to other insurers, which may be a disadvantage for those seeking the cheapest Mitsubishi auto insurance. Mitsubishi drivers looking to minimize costs may find this a significant drawback.

- Limited Discounts: While Liberty Mutual does offer some discounts, they may not be as extensive as those provided by competitors, potentially limiting savings for Mitsubishi drivers seeking the most affordable cheap Mitsubishi auto insurance.

#9 – Progressive: Best for Innovative Tools

Pros

- Snapshot Program for Savings: Progressive’s Snapshot program offers personalized rates based on actual driving habits, which can result in significant savings for Mitsubishi drivers. This innovative tool helps make their cheap Mitsubishi auto insurance more economical for safe drivers.

- Comprehensive Coverage Options: Progressive provides a wide range of coverage options, including gap insurance and rental car reimbursement, catering to various needs of Mitsubishi owners. Their diverse offerings ensure that Mitsubishi enthusiasts can fully protect their vehicles with cheap Mitsubishi auto insurance.

- Multi-Car Discounts: Mitsubishi owners with multiple vehicles can enjoy substantial savings with Progressive’s multi-car discount. This discount helps make their cheap Mitsubishi auto insurance more affordable for families or those with several cars. To enhance your understanding, explore our resource titled “Progressive Auto Insurance Review.”

Cons

- Higher Rates for High-Risk Drivers: Progressive’s rates can be higher for Mitsubishi drivers with poor driving records, which may impact affordability for those seeking the cheapest Mitsubishi auto insurance. High-risk drivers might find better rates with other providers.

- Average Customer Service: While Progressive excels in digital tools, their customer service ratings are mixed. This can be a concern for Mitsubishi owners who prioritize excellent support along with cheap Mitsubishi auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – State Farm: Best for Innovative Reach

Pros

- Nationwide Coverage: State Farm’s extensive network of agents and coverage areas makes it a convenient option for Mitsubishi drivers throughout the country. Their broad reach ensures that Mitsubishi owners can access cheap Mitsubishi auto insurance regardless of location.

- Wide Range of Discounts: State Farm offers numerous discounts, including safe driving and multi-car discounts, which can help lower premiums for Mitsubishi owners. These discounts contribute to the overall affordability of their cheap Mitsubishi auto insurance.

- Customizable Coverage Options: State Farm allows Mitsubishi drivers to customize their policies with various add-ons, such as rental car coverage and roadside assistance. This flexibility enhances the value of their cheap Mitsubishi auto insurance. To gain in-depth knowledge, consult our comprehensive resource titled “State Farm Auto Insurance Review.”

Cons

- Higher Premiums for Certain Drivers: State Farm’s premiums can be higher for some drivers, particularly those with less-than-perfect records, which may be a disadvantage for those seeking the cheapest Mitsubishi auto insurance.

- Mixed Customer Service Ratings: State Farm’s customer service has received mixed reviews, which could affect Mitsubishi drivers who place a high value on support and service quality in their cheap Mitsubishi auto insurance.

Understanding Different Auto Insurance Coverages for Mitsubishis

With so many coverage options offered by providers, you are probably wondering what you need to buy for your Mitsubishi and what you can do away with.

To start, you are legally required to carry your state’s minimum auto insurance requirements, and this often means you must have a certain amount of liability coverage.

Mitsubishi Auto Insurance Monthly Rates by Coverage Level & Provider| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $89 | $230 |

| Allstate | $102 | $245 |

| American Family | $100 | $245 |

| Erie | $98 | $240 |

| Farmers | $93 | $235 |

| Geico | $88 | $233 |

| Liberty Mutual | $104 | $247 |

| Progressive | $105 | $250 |

| State Farm | $110 | $255 |

| Travelers | $95 | $238 |

However, each state will require different amounts of coverage, which is why it’s important to check before looking for quotes.

Generally, these requirements consist of some combination of the following insurance coverages:

- Liability Auto Insurance: Protects you if you cause a crash by paying for other parties’ accident bills. Some amount of auto liability insurance is often required in most states. This coverage prevents you from being financially responsible for the damages caused because of an accident.

- MedPay Auto Insurance: Protects you by helping pay your medical bills if you are injured in a crash, as well as helping pay for your passenger’s medical bills.

- Personal Injury Protection: Personal injury protection will cover you financially by helping pay your and your passenger’s medical bills and related costs like lost wages if you are injured in an accident.

- Underinsured/Uninsured Motorist Auto Insurance: Protects you by helping pay your accident costs if you are hit by a driver without adequate auto insurance coverage or no insurance at all.

The other two coverages that you may be required to carry on your Mitsubishi are collision and comprehensive insurance. You are only required to carry these coverages if you have a lease or loan on your Mitsubishi.

Both coverages provide great protection in a number of situations. It’s important to note that there are differences between comprehensive and collision coverage.

Collision insurance pays for your Mitsubishi to be repaired if you collide with another vehicle. It also covers repairs if you crash into a stationary object like fences or telephone poles, which means it will cover a number of different accident situations.

On the other hand, comprehensive insurance covers a variety of damages from accidents not involving other vehicles or stationary objects. Your Mitsubishi repairs will be covered if your Mitsubishi is damaged by weather, animal crashes, falling objects, theft, or vandalism.

Comparing Mitsubishi Auto Insurance Rates

What you’ll pay for basic auto insurance coverage partially depends on what model of Mitsubishi you own. Mitsubishi models with a higher retail price often cost more to insure, as insurance companies have to pay more for repairs in claims.

While Mitsubishi auto insurance rates will vary based on the model you own, you can also compare rates based on the amount of coverage you purchase.

Full coverage auto insurance policies will cost more than basic coverage. Below is a table showing a few different examples of what a full coverage auto insurance policy will cost versus just the minimum amount of coverage.

Auto Insurance Monthly Rates by Provider & Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $67 | $176 |

| American Family | $51 | $137 |

| Farmers | $64 | $167 |

| Geico | $32 | $87 |

| Liberty Mutual | $77 | $200 |

| Nationwide | $53 | $136 |

| Progressive | $50 | $136 |

| State Farm | $39 | $103 |

One of the most expensive Mitsubishi models to insure is the Mitsubishi Lancer, which is a compact car model. Models that will be cheaper to insure include the Mitsubishi Mirage and the Mitsubishi Outlander Sport.

Besides what model of Mitsubishi you own, insurance companies will also base rates on your age and driving record, as you can see in the average rates displayed below.

Average Monthly Full Coverage Auto Insurance Rates Based on Age & Driving Record| Driver Age & Driving Record | Average Monthly Full Coverage Auto Insurance Rates |

|---|---|

| 16-year-old male with a clean record | $618.49 |

| 16-year-old female with a clean record: | $566.05 |

| 18-year-old male with a clean record | $501.45 |

| 18-year-old female with a clean record | $416.15 |

| 30-year-old male with a clean record: | $138.81 |

| 30-year-old female with a clean record | $128.44 |

| 45-year-old male with a clean record | $119.27 |

| 45-year-old female with a clean record | $119.47 |

| 45-year-old male with a DUI | $208.94 |

| 45-year-old female with a DUI | $209.44 |

| 45-year-old male with an accident | $172.68 |

| 45-year-old female with an accident | $173.27 |

Drivers with poor driving records mean any driver with a DUI, at-fault accident, or a traffic ticket. The more incidents a driver has on their record, the higher their auto insurance rates will be for their Mitsubishi.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

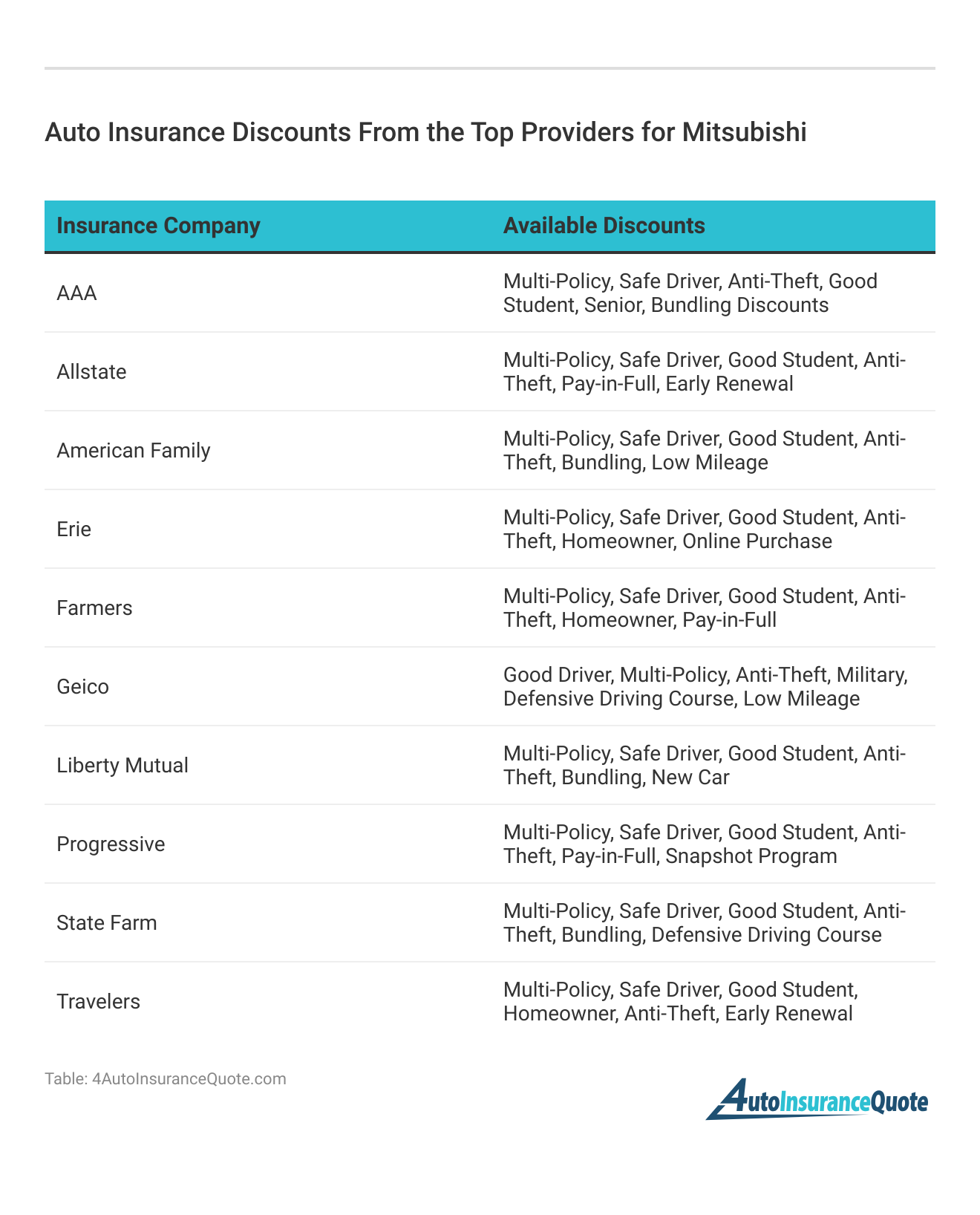

Ways to Save on Auto Insurance for Mitsubishis

If your Mitsubishi auto insurance rates are draining your wallet, there are a few things you can do to try and save on insurance. The first step to take is to see if you can reduce your rates at your auto insurance company.

Two ways to do this are checking for additional auto insurance discounts and raising your auto insurance deductible. Many insurance companies will offer discounts that aren’t automatically applied.

With the first tip, there may be auto insurance discounts that aren’t applied to your insurance policy because you have to participate in a program or submit proof of eligibility for a discount.

For example, you will have to submit proof of good grades to get a good student discount at insurance companies.

If you have already applied as many discounts as possible to your insurance policy, then you can consider raising your auto insurance deductible. Just don’t raise it to an amount you can’t pay out-of-pocket — otherwise, you will be stuck without a car until you can afford to pay for your car’s repairs.

If you don’t want to raise your auto insurance deductible, then you should shop around for quotes to see if a different company offers a better auto insurance rate. In fact, you should shop around for quotes anytime there is a change to your policy or your insurance company raises your rates.

Finding the Most Affordable Auto Insurance for Mitsubishis Today

Most drivers will be able to find affordable auto insurance rates for their Mitsubishi if they have what is considered a clean driving record. Even then, drivers can try to reduce their auto insurance rates by raising deductibles, applying for discounts, and getting quotes.

Shop around for quotes whenever your policy changes or rates increase.Brandon Frady Licensed Insurance Agent

If you want to dive right into looking for the cheapest rates for your Mitsubishi, use our free rate comparison tool to find the cheapest rate from companies in your area.

It will do the work of finding the best rate for you by comparing different quotes and coverage options, just enter your ZIP code here to start.

Frequently Asked Questions

Is Mitsubishi auto insurance expensive?

In general, the cost of insuring most Mitsubishi models is not that expensive. However, rates will be higher for drivers with risky driving profiles, such as drivers with poor driving records or young drivers.

How much is Mitsubishi Mirage auto insurance?

A Mitsubishi Mirage full coverage policy costs an average of $125 per month. Of course, rates depend on a driver’s record, age, location, and other factors, so the rates you pay may be higher or lower.

Getting auto insurance quotes will help you to determine how much you’ll pay for Mitsubishi Mirage auto insurance. Enter your ZIP code to start comparing your quote for free.

How can Mitsubishi drivers benefit from comparing auto insurance quotes across multiple providers?

Comparing auto insurance quotes allows Mitsubishi drivers to identify the most competitive rates and coverage options available, helping them secure the best deal.

This process not only ensures they get the most value from their cheap Mitsubishi auto insurance but also answers the question, “How do I know if I chose the right coverage?” by highlighting potential savings and better policies.

Is Mitsubishi Lancer auto insurance high?

The Mitsubishi Lancer is one of the most expensive Mitsubishi models to insure, but it is still not terribly expensive compared to rates for other car brands. The average monthly cost for a full coverage policy for a Mitsubishi Lancer is $152.

How often should I review my Mitsubishi auto insurance policy?

It’s a good practice to review your Mitsubishi auto insurance policy annually or whenever significant changes occur, such as adding a new driver, moving to a different location, or purchasing a new vehicle. Regular reviews can help ensure you have adequate coverage at the best possible rates. Enter your ZIP code to start.

Can I bundle my Mitsubishi auto insurance with other insurance policies for additional savings?

Yes, many insurance providers offer multi-policy discounts when you bundle your Mitsubishi auto insurance with other policies, such as home insurance or renters insurance. Bundling can often result in cost savings and provide you with affordable instant auto insurance options.

What should I do if I’m involved in an accident with my Mitsubishi?

If you’re involved in an accident with your Mitsubishi, follow the standard procedure: check for injuries, call emergency services if necessary, exchange insurance information with other parties involved, and notify your insurance provider to initiate the claims process.

What specific coverage options are essential for Mitsubishi owners when considering cheap auto insurance?

Mitsubishi owners should consider essential coverages such as collision and comprehensive insurance, which protect against various types of damage and accidents.

These coverages are crucial for ensuring comprehensive protection and maintaining affordable rates in their cheap Mitsubishi auto insurance. Enter your ZIP code now to start.

How do discounts and rewards programs impact the affordability of cheap Mitsubishi auto insurance?

Auto insurance discounts and rewards programs, such as safe driver discounts or multi-policy savings, significantly reduce the overall cost of auto insurance.

What are the key factors that influence the insurance rates for different Mitsubishi models, such as the Mirage versus the Lancer?

Insurance rates for Mitsubishi models vary based on factors such as the vehicle’s repair costs, safety features, and overall risk profile. For example, the Mitsubishi Lancer typically costs more to insure than the Mirage due to its higher repair expenses and risk factors, impacting the cost of cheap Mitsubishi auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.