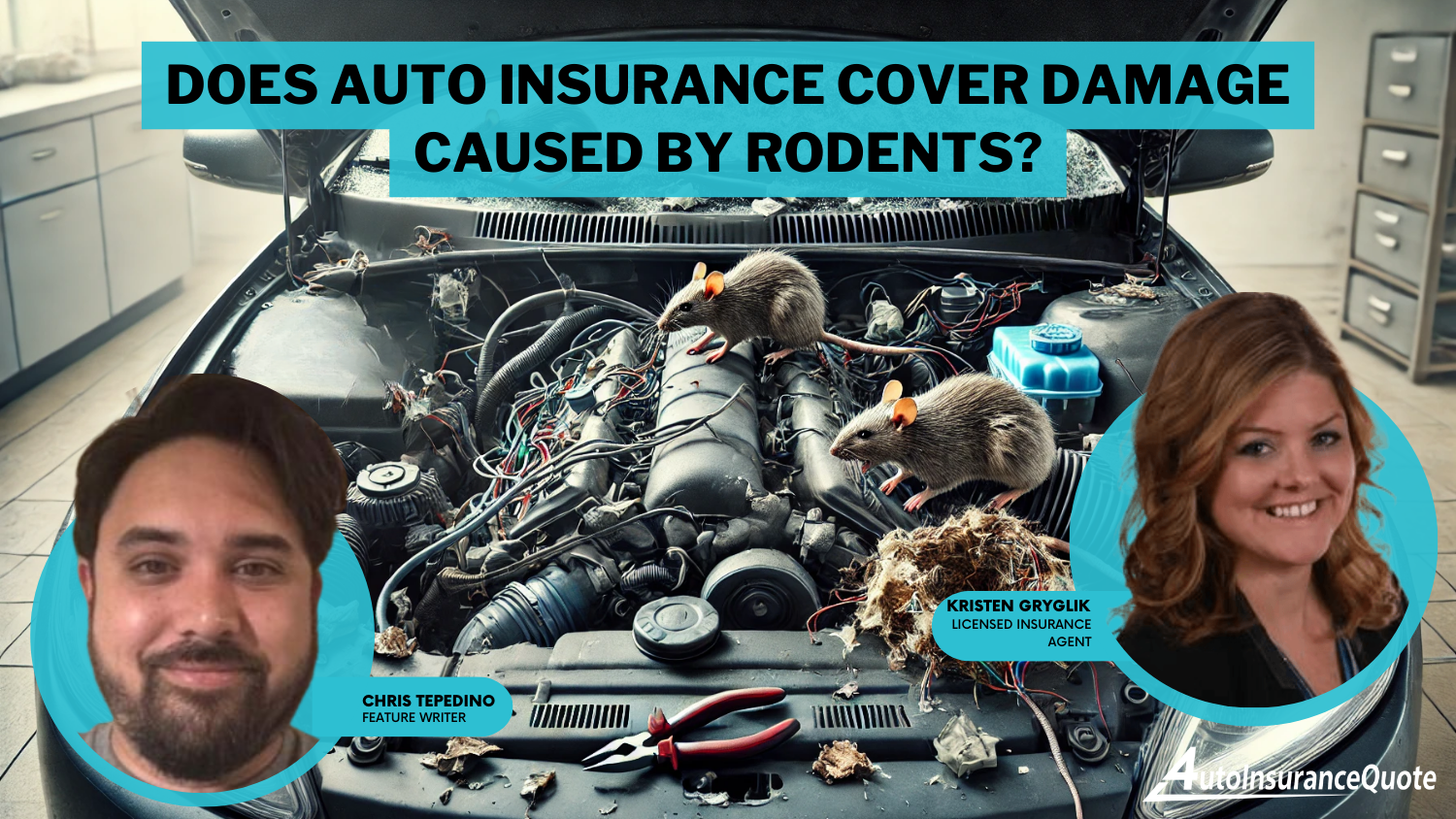

Does auto insurance cover rodent damage?

Comprehensive auto insurance will cover mice damage, and you can speed up the claims process by taking photos of the damage caused by mice and squirrels. If you don't have a comprehensive auto insurance policy, you will probably not be covered for mice damage.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Feb 25, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 25, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Mice and other animals can wreak havoc on a vehicle. When mice, squirrels, and other animals chew through wires in your car, can you expect car insurance to cover the damage? Or are you required to pay for this pest damage out of pocket?

Today, we’re explaining everything you need to know about car insurance covering mice damage and similar pest damage.

How Mice and Squirrels Can Damage a Vehicle

If damage is caused by a rodent infestation, then you might have to check the terms of your comprehensive insurance coverage. Mice, rats, and squirrels can cause significant damage to a vehicle. These animals may take shelter by climbing up inside a vehicle – say, under the hood. Once nested, they can start chewing through wires or damaging other components.(For more information, read our “Does my auto insurance cover damage caused by a collision with an animal if I only have liability coverage?“).

Squirrels can be particularly nasty to your vehicle. A squirrel’s teeth never stop growing, which means they constantly gnaw on things to prevent their teeth from getting too long. When nesting in a vehicle, they might gnaw on wires, creating electrical problems in your car.

The nests themselves can also be an issue: rodents collect all types of junk to store in their nests. We’ve heard stories from mechanics finding 15 pounds of dog food and hair inside engines, choking up the engine.

Plus, if the rodents have built a nest near your air filter, then you could be hit with a blast of rat poop and dander every time you turn on your air, spreading harmful bacteria throughout your vehicle.

This problem is particularly common on cars that have been stowed for a long period of time. You may have left your car stored in the garage over the winter, for example, only to come back and find rodent problems under the hood.

Unfortunately, these problems can be tricky for mechanics to fix – especially if the rodents have chewed through a wire.

Read more: Does auto insurance cover engine or electrical fires?

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

How to Tell If You Have a Mouse or Squirrel Problem

Part of the problem with mice and rodent problems is that the damage isn’t always obvious: mice and squirrels will run away as soon as they hear someone approach the car. Or, they may have nested in your vehicle over the winter, only to leave the nest in the spring with the warm weather.

For many drivers, the first sign of a mouse or squirrel problem is when one of the two problems occurs:

- Your check engine light comes on

- Your car does not start

If you suspect mouse or squirrel problems with your car, then we recommend contacting a mechanic. In many cases, your repairs will be covered under your comprehensive insurance policy.

Comprehensive Coverage Should Cover Mouse and Squirrel Damage

Are rodents covered by insurance? Rodent damage car insurance is comprehensive coverage. If you have comprehensive on your auto insurance policy, this damage should be covered.

Comprehensive insurance coverage covers unexpected damage that occurs outside of an accident – like when a tree falls on your car or when your car gets vandalized. It can also cover animal-related damage.

Comprehensive coverage is optional in every state. However, if you are leasing or financing your vehicle, then you may be required to maintain comprehensive coverage. Additionally, anyone with full coverage car insurance will have comprehensive coverage.

If you just maintain basic liability insurance on your vehicle, however, then your mouse and squirrel damage is unlikely to be covered. Drivers who maintain only the minimum required car insurance policy will not be able to make a claim for mouse and squirrel damage.

How to Make an Insurance Claim for Mouse Damage

The first step is to contact your insurer or insurance agent. An insurance agent will walk you through the claim process.

You’ll want to take as many photos of the affected area as possible. Take photos that clearly show the visible vermin damage caused by the rodents. The more information and photos you can show your insurance provider, the easier your claim will be.

Alternatively, you may want to visit a mechanic first to determine the source of your problem. In some cases, your car simply needs a new battery, for example, and you don’t need to make an auto insurance policy claim.

In other cases, the mouse or squirrel damages may only cost a few hundred dollars to repair, which means it may not be worth making an insurance claim (the cost of repairing the problem may be less than your deductible).

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Some Insurance Companies Deny Mouse Damage Claims

An insurance company may deny a mouse damage claim if the coverage is not specifically mentioned on your policy.

Generally, car insurance policies are “stated policies”, which means that only listed perils are covered. If the peril is listed, then it’s covered. If it’s not listed, then it’s not covered.

If your car insurance policy does not specifically mention damage from rodents eating the wiring, then you may be out of luck. Other insurance companies, however, are more generous and will cover all such situations even when not specifically listed. Your experience will vary depending on your insurance company.

Most Homeowners Insurance Policies Exclude Rodent-Related Damages

If you have a mouse problem with your car, then you may have a mouse problem with your home.

However, most claims for rodent-related damages in the home will be denied: most home insurance policies specifically exclude any losses related to vermin, rodents, birds, insects, or domestic animals unless you have added coverage to your policy that covers this damage.

Final Word

Mice, squirrels, and other animals can cause significant damage to vehicles. If a mouse or squirrel chews through your vehicle’s wiring, then the damage should be covered under your comprehensive coverage.

If you only have liability insurance, however, or if your policy excludes certain damages, then your mouse-related damage may not be covered. We recommend contacting your insurance company to verify mice, rat, and squirrel damage is covered.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Frequently Asked Questions

Will my comprehensive insurance cover the cost of repairing chewed wires and other electrical components?

Yes, if the damage is a result of rodent activity and covered under your comprehensive insurance, it should cover the cost of repairing chewed wires and other electrical components.

Are there any deductibles associated with filing a claim for rodent damage?

Yes, most comprehensive insurance policies have a deductible, which is the amount you are responsible for paying before the insurance coverage kicks in. Check your policy to determine your specific deductible amount.

Can I purchase comprehensive coverage specifically for rodent damage?

Comprehensive coverage typically encompasses various types of non-collision damages, including rodent damage. It is not usually offered as a separate coverage option.

Are there any preventive measures I can take to deter rodents from damaging my car?

Yes, there are several preventive measures you can take, such as parking in well-lit areas, using rodent repellents or deterrents, and keeping your vehicle clean and free of food debris.

Can I use my comprehensive coverage for rodent damage if the vehicle is not operational?

Yes, if your vehicle is not operational due to rodent damage, your comprehensive coverage should still apply. Contact your insurance provider to discuss the situation and initiate the claims process.

Does rodent damage affect the resale value of my vehicle?

Rodent damage can potentially affect the resale value of your vehicle, especially if the repairs were not done properly or the damage is extensive. It’s advisable to keep documentation of repairs and consult with a mechanic for an accurate assessment.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.