Cheap Volvo Auto Insurance in 2025 (Get Low-Cost Coverage With These 10 Companies)

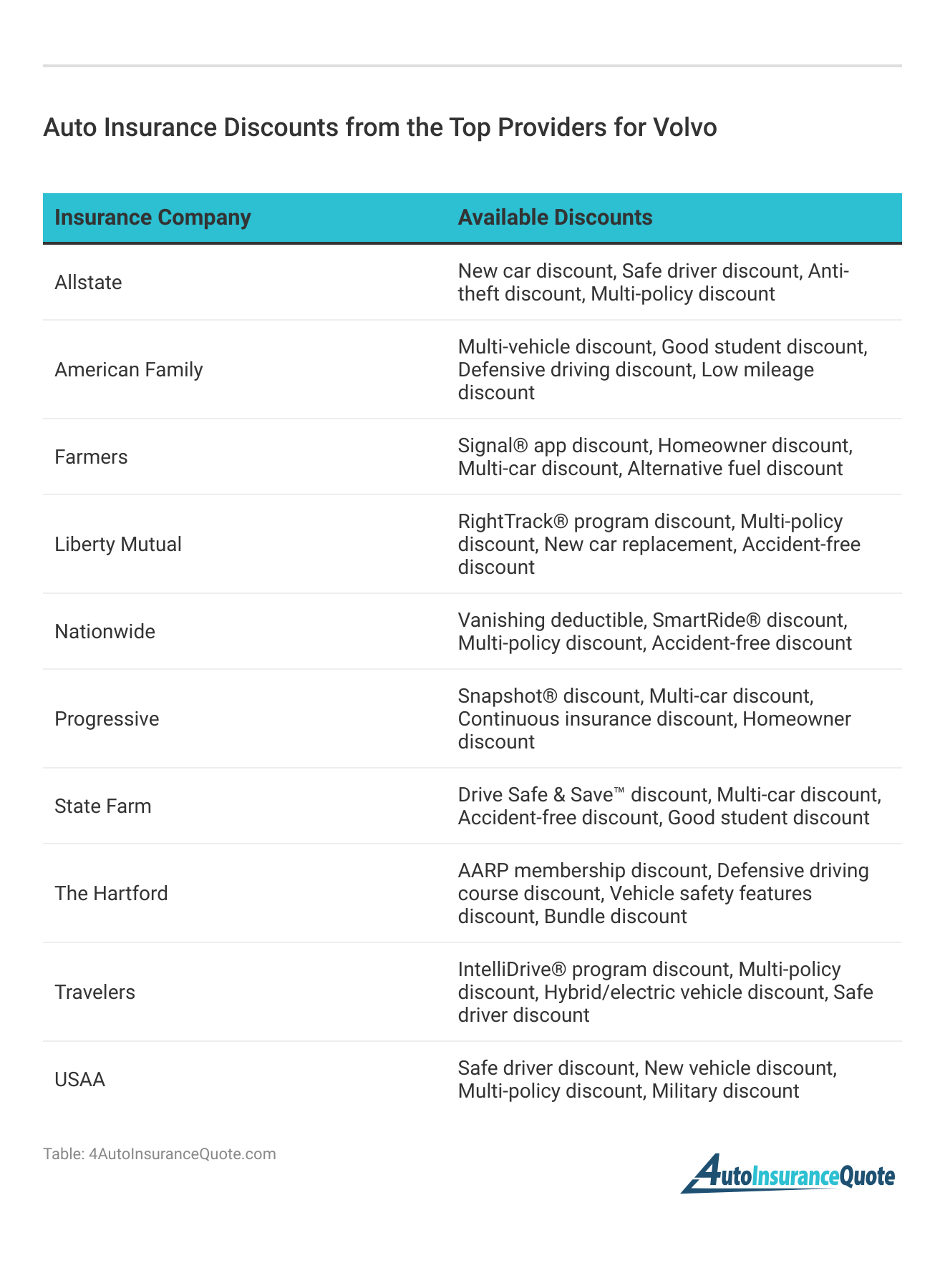

The best providers for cheap Volvo auto insurance are USAA, State Farm, and Progressive, with rates starting at $52 per month. USAA stands out for low rates and military discounts, State Farm excels in customer service, and Progressive offers comprehensive coverage options tailored to Volvo drivers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage for Volvo

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage for Volvo

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe top pick overall for cheap Volvo auto insurance is USAA, offering unbeatable rates at $52 per month.

For those looking for affordable options, State Farm and Progressive also stand out, with competitive prices of $61 and $64 per month respectively. USAA provides exceptional value with its low premiums and military-specific discounts, while State Farm excels in customer service and Progressive offers robust full coverage options.

Our Top 10 Company Picks: Cheap Volvo Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $52 | A++ | Military Members | USAA | |

| #2 | $61 | B | Customer Service | State Farm | |

| #3 | $64 | A+ | Qualifying Coverage | Progressive | |

| #4 | $66 | A | Costco Members | American Family | |

| #5 | $68 | A+ | Infrequent Drivers | Allstate | |

| #6 | $69 | A+ | Vanishing Deductible | Nationwide |

| #7 | $70 | A++ | Bundling Policies | Travelers | |

| #8 | $71 | A+ | Tailored Policies | The Hartford |

| #9 | $74 | A | Occupational Discount | Liberty Mutual |

| #10 | $78 | A | Safe Drivers | Farmers |

- Affordable Volvo Auto Insurance Quotes

This guide will help you navigate the best choices for budget-friendly Volvo insurance while considering various coverage needs and benefits. Explore further with our article entitled, “Auto Insurance Discounts.” Start saving on your auto insurance by entering your ZIP code above and comparing quotes.

- USAA offers the lowest Volvo insurance at $52/month

- State Farm and Progressive are affordable alternatives

- Compare quotes and discounts to find the best deal

Understanding Different Volvo Coverage Options

How high your Volvo rates will be will depend partly on what types of auto insurance coverage you have. The more coverage you carry, the higher your auto insurance rates will be.

While you may be tempted to do away with as much coverage as possible, carrying standard coverages will save you from high bills after an accident. You are also legally required to carry state-mandated coverages, such as the following:

- Liability Auto Insurance: Required in most states and covers others’ accident bills if you cause a crash that injures other people or damages their property.

- Medical Payments Insurance: Required in some states and helps to cover medical bills if you or your passengers are injured in a car accident.

- Personal Injury Protection (PIP) insurance: Required in some states and helps to cover medical bills and related injury costs like lost wages if you or your passengers are injured in a car accident.

- Underinsured Motorist Insurance: Required in some states and helps cover your car crash bills if the driver who hit you has poor insurance that doesn’t cover all of your bills.

- Uninsured Motorist Insurance: Required in some states and helps cover your car crash bills if the driver who hit you does not have auto insurance coverage.

In addition to carrying the minimum auto insurance required by your state, you might want to consider carrying collision and comprehensive auto insurance for a full coverage auto insurance policy. In fact, if you have a lease or loan on your Volvo, you will be required to carry these coverages regardless.

Both collision and comprehensive insurance protect your assets by covering repair costs for your car. Collision insurance pays for repairs if you hit another vehicle or an object like a tree or mailbox. Comprehensive insurance covers repairs if your car is damaged by external factors like weather, vandalism, or hitting an animal.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Summary: Best Auto Insurance Options for Volvo Owners

Finding affordable auto insurance for your Volvo can be tough, but some companies offer competitive rates. USAA has the lowest rate at $52 per month, but it’s for military families only. State Farm costs $61 per month and is known for good customer service and discounts. Progressive offers comprehensive coverage for $64 per month with customizable options.

Your credit score and auto insurance quotes are crucial factors in determining your premiums, so comparing quotes and considering coverage needs, discounts, and credit impact will help you secure the best deal. Get fast and cheap auto insurance coverage today with our quote comparison tool below.

Frequently Asked Questions

Which company offers the cheapest auto insurance for a Volvo?

USAA provides the cheapest auto insurance for a Volvo at $52 per month, making it a top choice for budget-conscious drivers. However, availability is limited to military members and their families. Uncover more by delving into our article entitled, “Affordable Volvo Auto Insurance Quotes.“

What are the main advantages of USAA auto insurance for Volvo owners?

USAA offers the lowest rates, top-rated coverage, and military discounts for Volvo owners, ensuring both affordability and quality. Keep in mind that basic coverage may require add-ons for comprehensive protection. Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

How does State Farm compare in terms of cost for Volvo insurance?

State Farm is the second cheapest option for Volvo insurance, with rates at $61 per month, offering a balance between cost and customer service. However, its lower A.M. Best rating might affect financial stability.

What is Progressive’s advantage for Volvo insurance?

Progressive offers competitive full coverage rates at $64 per month for Volvo owners, along with customizable policy options. Their Snapshot program can further lower premiums for safe drivers. For additional insights, refer to our article entitled, “Is auto insurance paid in advance?“

Why might State Farm’s insurance not be the best choice for some Volvo owners?

State Farm’s lower A.M. Best rating and potentially higher premiums for high-risk drivers could be drawbacks, making it less favorable for those with poor driving records.

How can Progressive’s Snapshot benefit Volvo drivers?

The Snapshot program can offer discounts for safe driving, helping to lower overall premiums for Volvo insurance. This makes Progressive a strong contender for drivers with good driving habits.

How does American Family benefit Volvo insurance for Costco members?

American Family provides competitive rates and additional savings for Costco members, making it a good option for cheap Volvo insurance. They also offer a range of comprehensive coverage options. Find out more by reading our article titled, “What documentation do I need to file an auto insurance claim with American Family?“

What’s a downside of Allstate for Volvo insurance if you want the lowest rates?

Allstate has higher premiums compared to other providers for Volvo insurance, especially for high-mileage drivers. This could be a disadvantage if you drive frequently and are seeking the lowest rates.

How does Nationwide’s Vanishing Deductible affect Volvo insurance costs?

The Vanishing Deductible program can reduce out-of-pocket costs over time, making Volvo insurance more affordable in the long run. However, the program’s availability may vary by state. Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

What should Volvo owners consider with Farmers insurance?

Farmers offers competitive rates for safe drivers but may not be the cheapest option, particularly for high-risk drivers. They also provide extensive discount options that can benefit those with a clean driving record. Explore further with our article entitled, “What information do I need to file an auto insurance claim with Farmers?“

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Shopping around for quotes from different insurers can help you find the best rates. Start with a free quote comparison tool to get personalized quotes from various companies and identify the most competitive rates. This tool may also connect you with an auto insurance adjuster if needed.

Shopping around for quotes from different insurers can help you find the best rates. Start with a free quote comparison tool to get personalized quotes from various companies and identify the most competitive rates. This tool may also connect you with an auto insurance adjuster if needed.