Cheap Land Rover Auto Insurance in 2025 (Cash Savings With These 10 Companies!)

Geico, American Family, and State Farm offer cheap Land Rover auto insurance, starting at just $78 per month. These companies stand out for their affordability, comprehensive coverage options, and exceptional customer service, making them top choices for Land Rover auto insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Min. Coverage for Land Rover

A.M. Best Rating

Complaint Level

Company Facts

Min. Coverage for Land Rover

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for cheap Land Rover auto insurance are Geico, American Family, and State Farm, renowned for their competitive pricing and reliable coverage.

These providers excel by offering tailored policies that cater to the unique needs of Land Rover owners, ensuring optimal protection and value. See more details in our guide titled “Affordable Auto Insurance.”

Our Top 10 Company Picks: Cheap Land Rover Auto Insurance| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $78 | A++ | Overall Coverage | Geico | |

| #2 | $87 | A | Loyalty Rewards | American Family | |

| #3 | $88 | B | Customer Service | State Farm | |

| #4 | $92 | A+ | Additional Benefits | Nationwide |

| #5 | $96 | A+ | Online Tools | Progressive | |

| #6 | $101 | A++ | Financial Stability | Travelers | |

| #7 | $103 | A+ | Coverage Options | Allstate | |

| #8 | $106 | A+ | Roadside Assistance | AAA |

| #9 | $109 | A | Personalized Service | Farmers | |

| #10 | $115 | A | Customizable Policies | Liberty Mutual |

By comparing these companies, Land Rover drivers can secure affordable rates without compromising on quality. Explore your options to find the best fit for your auto insurance needs and enjoy peace of mind on the road.

- Geico is the top pick for cheap Land Rover auto insurance

- Tailored policies meet the specific needs of Land Rover owners

- Offers to combine affordability with comprehensive coverage

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Affordable Rates: Geico offers the lowest monthly rate at $78. See more details on our Geico auto insurance review.

- High Rating: It boasts an A++ rating from A.M. Best, indicating superior financial health.

- Comprehensive Plans: Geico provides a wide range of coverage options that cater to diverse needs.

Cons

- Policy Upselling: Customers may experience frequent upselling of additional coverages.

- Claim Process: Some users report a complex claim submission process.

#2 – American Family: Best for Loyalty Rewards

Pros

- Loyalty Benefits: American Family rewards long-term customers with significant loyalty discounts.

- Diverse Discounts: Offers a variety of discounts, including for safe driving and good students.

- Solid Rating: Holds an ‘A’ rating from A.M. Best, ensuring good financial health. Delve into our evaluation of American Family Insurance auto insurance review.

Cons

- Higher Rates for New Customers: New clients might face higher initial rates.

- Limited Availability: Coverage options can vary significantly by state.

#3 – State Farm: Best for Customer Service

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: State Farm provides a substantial discount for low-mileage usage.

- Wide Coverage: Offers various coverage options tailored to different needs. Learn more in our State Farm auto insurance review.

Cons

- Limited Multi-Policy Discount: The multi-policy discount is not as competitive as others.

- Premium Costs: Despite discounts, premiums might still be higher for certain coverage levels.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Additional Benefits

Pros

- Unique Benefits: Nationwide provides unique add-ons like vanishing deductibles and accident forgiveness.

- Customer Rewards: Offers a rewards program for safe drivers. Learn more on how do I file an auto insurance claim with Nationwide.

- Good Financial Standing: Maintains an A+ rating from A.M. Best.

Cons

- Higher Starting Rates: Slightly higher rates starting at $92 monthly.

- Coverage Limitations: Some desired coverages may be unavailable in certain areas.

#5 – Progressive: Best for Online Tools

Pros

- User-Friendly Online Interface: Progressive is renowned for its digital tools that simplify managing policies and claims.

- Customizable Coverage: Offers highly customizable policy options. Read up on the Progressive auto insurance review for more information.

- Discounts for Technology Use: Incentives for using their mobile app or online services.

Cons

- Variable Customer Service: The quality of customer support can vary significantly.

- Higher Premiums: Rates are on the higher side, starting at $96.

#6 – Travelers: Best for Financial Stability

Pros

- Strong Financial Backbone: Holds an A++ rating, indicating excellent financial stability.

- Wide Range of Options: Offers a diverse portfolio of insurance products. Access comprehensive insights into our Travelers auto insurance review.

- Risk Management Solutions: Provides advanced risk assessment tools for better protection.

Cons

- Costly Policies: Generally more expensive, with rates starting at $101.

- Complex Policies: The wide range of options can be overwhelming and complex to navigate.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – Allstate: Best for Coverage Options

Pros

- Extensive Coverage Choices: Allstate offers a variety of coverage options, allowing for highly tailored policies.

- Innovative Tools: Provides digital tools for policy management and claims.

- Reward Programs: Offers rewards and discounts for safe driving. More information is available about this provider in our “Allstate vs. USAA: Which Offers More Affordable Auto Insurance Quotes.”

Cons

- Higher End Pricing: Rates start at $103, which can be steep for some budgets.

- Customer Service Variability: Customer service quality can vary by region.

#8 – AAA: Best for Roadside Assistance

Pros

- Superior Roadside Assistance: AAA is highly regarded for its comprehensive roadside support.

- Member Benefits: Offers extensive benefits and discounts to its members.

- Strong Financial Rating: Maintains an A+ rating from A.M. Best. Check out insurance savings in our complete “AAA Auto Insurance Review: Can you get affordable quotes?“

Cons

- Membership Required: Requires a membership fee, adding to the overall cost.

- Higher Rates: Monthly premiums start at $106, higher than some competitors.

#9 – Farmers: Best for Personalized Service

Pros

- Personalized Attention: Farmers excels in providing personalized customer service.

- Customizable Policies: Offers flexibility in policy customization to meet individual needs.

- Dedicated Agents: Provides dedicated agents to assist with policy management. Discover more about offerings in our Farmers auto insurance review.

Cons

- Higher Costs: Starting rates are at $109, making it less competitive.

- Inconsistent Agent Experience: The quality of service can vary depending on the agent.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Customizable Policies

Pros

- Highly Customizable Policies: Liberty Mutual offers extensive options for policy customization.

- Discounts Available: Provides a range of discounts, including for multi-policy bundles.

- Good Financial Health: Holds an ‘A’ rating from A.M. Best. Check out insurance savings in our complete Liberty Mutual auto insurance review.

Cons

- Premium Pricing: Premiums are among the highest, starting at $115.

- Customer Service Complaints: Some customers report dissatisfaction with the service received.

Land Rover Insurance Cost: Detailed Breakdown

Navigating auto insurance rates for Land Rovers can be complex given the variability in coverage options. The table below simplifies this by showcasing monthly rates from various providers for both minimum and full coverage.

Land Rover Auto Insurance Monthly Rates by Coverage Level & Provider| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $106 | $171 |

| Allstate | $103 | $168 |

| American Family | $87 | $152 |

| Farmers | $109 | $173 |

| Geico | $78 | $143 |

| Liberty Mutual | $115 | $179 |

| Nationwide | $92 | $157 |

| Progressive | $96 | $162 |

| State Farm | $88 | $149 |

| Travelers | $101 | $161 |

The table presents a clear comparison of monthly auto insurance rates for Land Rovers, segmented by insurance company and type of coverage. For minimum coverage, rates start as low as $78 with Geico and go up to $115 with Liberty Mutual.

On the other hand, full coverage rates range from $143 at Geico to $179 at Liberty Mutual, reflecting a broader scope of protection.

This data is essential for Land Rover owners looking to balance cost with coverage needs, offering insights into potential premiums they might expect based on their chosen insurance provider and coverage level. See more details in our guide titled “Affordable Full Coverage Auto Insurance.”

Auto Insurance Coverages for Land Rovers

Some drivers may be tempted to do away with as much auto insurance coverage as possible to save on their policies, but this could leave them open to large bills after an accident.

Generally, similar to Land Rover Discover Sport car insurance, you should maintain both comprehensive and collision policies in addition to the legally required state coverages. Unless your vehicle is an older model that has significantly depreciated, these insurance policies will protect you in numerous situations.

If you have a lease or loan on your Land Rover, your lender will require you to carry these coverages. Collision coverage covers your Land Rover’s repairs if you crash into an object or vehicle. Comprehensive auto insurance coverage covers your Land Rover’s repairs if you crash into an animal. It also covers damages from vandalism and weather.

As for state-required auto insurance (read our “Auto Insurance Requirements by State” for more information) coverages on your Land Rover, you will likely have to carry liability insurance, medical insurance, and uninsured/underinsured motorist coverage.

However, it depends on your state, as not all states require medical insurance or uninsured/underinsured motorist coverage. Below is a quick overview of the different types of auto insurance coverage for your Land Rover:

- Medical Payments (MedPay) Insurance: Medpay helps pay medical bills if you or your passengers are injured in a car crash.

- Liability Auto Insurance Coverage: If you cause a car crash that injures other people or damages their property, liability insurance pays their bills.

- Personal Injury Protection (PIP) Auto Insurance: PIP helps pay medical bills if you or your passengers are injured in a car crash. It also covers related costs like lost wages.

- Uninsured/Underinsured Motorist Insurance: This insurance coverage helps pay your accident bills if you are hit by a driver who doesn’t have enough insurance coverage to pay all of your costs.

Generally, a combination of the above coverages will be the only coverages you are required by law to carry on your Land Rover. All other coverages are up to you unless you have a lease or loan agreement. Learn how to get auto insurance here.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

How Much Is Range Rover Insurance

Now that you know what coverages you’ll need on your Land Rover, let’s take a look at some of the average rates you’ll pay for basic coverages on different Land Rover models:

Land Rover Auto Insurance Monthly Rates by Coverage Type & Provider| Vehicle Model | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Land Rover Defender 110 | $39 | $75 | $44 | $217 |

| Land Rover Defender 90 | $38 | $72 | $44 | $220 |

| Land Rover Discovery | $37 | $70 | $43 | $210 |

| Land Rover Discovery Sport | $37 | $67 | $42 | $161 |

| Land Rover Range Rover | $45 | $87 | $42 | $190 |

| Land Rover Range Rover Evoque | $36 | $64 | $42 | $157 |

| Land Rover Range Rover Sport | $43 | $81 | $42 | $182 |

| Land Rover Range Rover Velar | $41 | $78 | $43 | $209 |

The Land Rover Range Rover is expensive to insure, costing well over $100,000. Models with lower retail prices, like the Land Rover Range Evoque, will have cheaper auto insurance rates on average.

Choosing Geico ensures comprehensive coverage at a fraction of the cost compared to other providers.Scott W. Johnson Licensed Insurance Agent

The cost of replacement parts and repairs is always less for cheaper models, so insurance companies don’t have to pay out as large of a claim. So the less your Land Rover costs to buy, the less your Land Rover insurance will cost.

Two other factors that will impact your auto insurance rates, besides the cost of your Land Rover, are your age and driving record.

Land Rover Auto Insurance Monthly Rates by Model, Driving Record & Age| Vehicle Model | High-Risk Driver | Age: 20 | Age: 30 | Age: 40 | Age: 50 | Age: 60 |

|---|---|---|---|---|---|---|

| Land Rover Defender 110 | $446 | $484 | $231 | $217 | $197 | $190 |

| Land Rover Defender 90 | $450 | $487 | $234 | $220 | $200 | $193 |

| Land Rover Discovery | $408 | $452 | $217 | $210 | $191 | $185 |

| Land Rover Discovery Sport | $343 | $365 | $168 | $161 | $147 | $144 |

| Land Rover Range Rover | $405 | $431 | $198 | $190 | $173 | $170 |

| Land Rover Range Rover Evoque | $334 | $356 | $164 | $157 | $143 | $140 |

| Land Rover Range Rover Sport | $387 | $412 | $190 | $182 | $166 | $162 |

| Land Rover Range Rover Velar | $419 | $462 | $224 | $209 | $191 | $185 |

If you are a younger driver, driving safely to keep a clean driving record is important. This will help lower your rates as you age. You can also see if your auto insurance company offers any discounts for young drivers, such as a good student discount.

Read more: Affordable Land Rover Auto Insurance Quotes

Ways to Save on Land Rover Auto Insurance

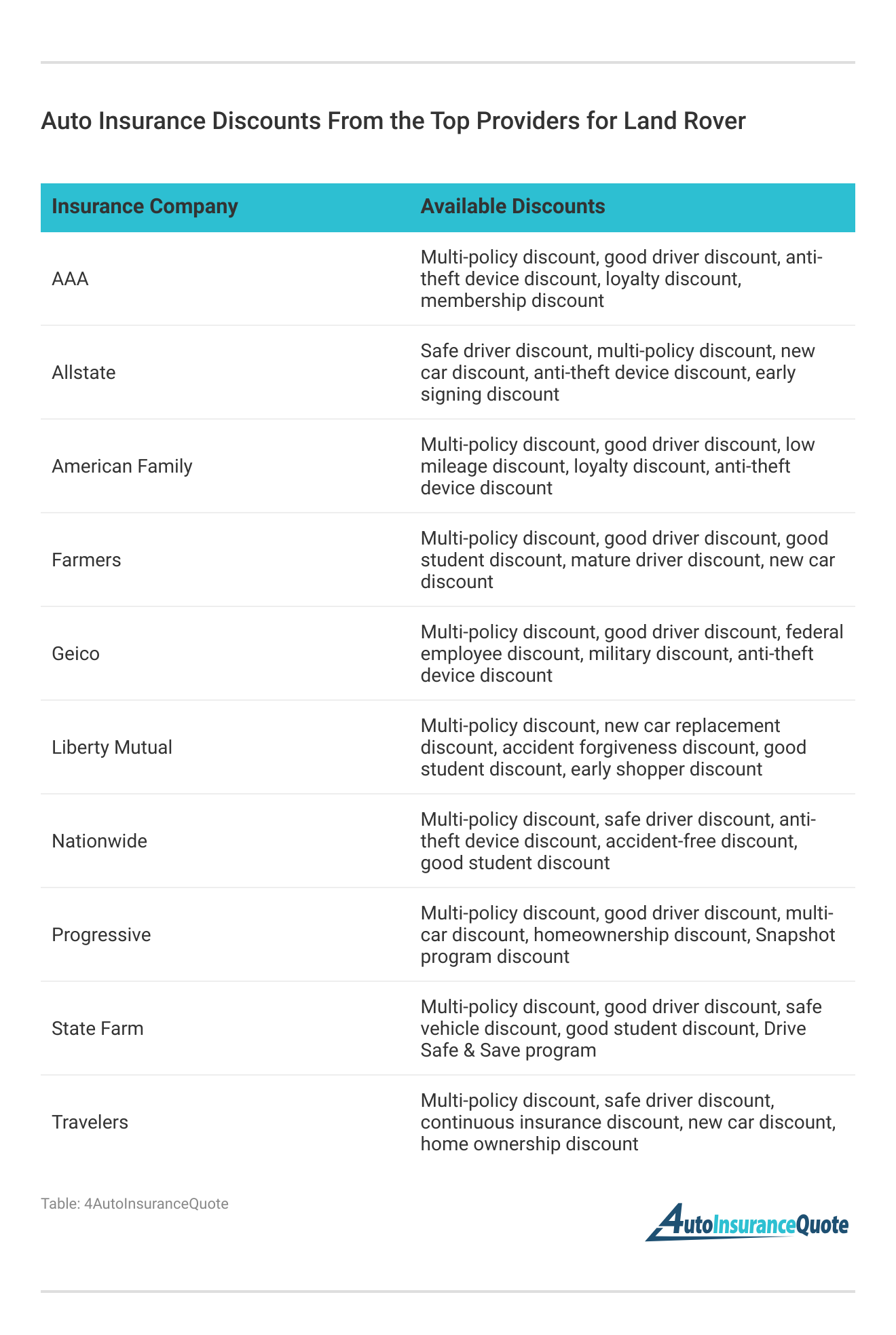

You can do a few things to reduce your Land Rover insurance rates. First, you should check if your insurance company has any additional auto insurance discounts you can qualify for.

There may be a safe driving program you can participate in for a discount or a good student discount you didn’t know about. A big discount to look for is a bundling discount, where you buy more than one type of insurance from the company, such as renters and auto insurance.

Besides discounts, you can also increase your auto insurance deductible to lower your Land Rover rates. The only thing we caution with this is to make sure you don’t raise it too high. You want your deductible to be an amount you could comfortably pay out-of-pocket after an accident.

Finally, our last tip is to make sure you shop around and compare rates from different companies. Otherwise, you can’t be sure you are getting the best deal on your Land Rover insurance, especially if you’ve recently had changes to your policy, like moving to a new address.

Find the Most Affordable Land Rover Auto Insurance Today

While Land Rovers can be more expensive to insure because they are luxury cars, this doesn’t mean you can’t find ways to save. Most drivers can reduce their auto insurance rates through discounts and quotes. They can also raise their insurance deductible to reduce their rates. Learn more in our complete “Auto Insurance Deductible: Simply Explained.”

If you want to shop around for affordable Land Rover insurance rates, check out our free quote comparison tool. It makes finding a cheap Land Rover insurance rate easy, as it compares rates from companies in your area for you.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Frequently Asked Questions

Are Land Rovers expensive to insure?

Indeed, insuring Land Rovers may be costlier due to their status as luxury vehicles. The greater the retail price of your Land Rover, the higher the insurance costs will be. This makes finding the best insurance for Range Rover an important consideration for owners.

To find out more, explore our guide titled “Can I buy auto insurance online?“

Is Range Rover insurance high?

The average Range Rover insurance cost for a full coverage policy is $190 per month or $2,280 per year. Your rates may be higher or lower depending on factors like your driving record.

How much is an oil change for a Range Rover?

An oil change can range anywhere from $100 to $300, depending on what shop you choose or if there are any discounts.

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area.

Can modifications to a Land Rover affect insurance premiums?

Yes, modifications to a Land Rover can affect insurance premiums. Any alterations made to the vehicle’s engine, body, or suspension may increase its value or performance, which can lead to higher insurance costs. It’s crucial to inform your insurance provider about any modifications to ensure you have appropriate coverage.

Are there any insurance discounts specifically available for Land Rover owners?

Some insurance companies offer specific discounts for Land Rover owners. These may include loyalty discounts, affinity discounts, or specialized discounts for safety features unique to Land Rover vehicles. It’s recommended to inquire about such discounts when obtaining Land Rover quotes.

Access comprehensive insights into our guide titled “Auto Insurance Discounts for Affordable Coverage.”

Are Land Rovers expensive to insure?

Yes, due to their luxurious nature and high repair costs, Land Rovers are generally more expensive to insure.

What is the average insurance cost for Range Rover?

The average insurance cost for a Range Rover is typically around $190 per month for full coverage.

How much does the average insurance cost for Range Rover Evoque?

On average, the insurance cost for Range Rover Evoque is about $160 per month for comprehensive coverage.

What’s the average insurance cost for Range Rover Sport?

For the Range Rover Sport, the average monthly insurance cost tends to be approximately $180.

Access comprehensive insights into our guide titled “Average Cost of Auto Insurance: Find Affordable Quotes.”

Which company offers the best auto insurance for BMW?

Companies like Geico and State Farm are frequently recommended for offering the best auto insurance rates for BMW models.

Where can I find cheap car insurance for Range Rover?

To find the cheapest Range Rover insurance, explore rate options from insurers such as Geico and American Family, known for their cost-effective policies.

Who provides the cheapest Range Rover Evoque insurance?

American Family and State Farm are known for providing some of the cheapest insurance options for the Range Rover Evoque.

Can I get a classic Land Rover insurance online quote?

Yes, you can obtain a classic Land Rover insurance online quote by visiting websites of insurers that specialize in classic vehicles, such as Hagerty or Grundy.

For additional details, explore our comprehensive resource titled “Finding Auto Insurance Quotes Online.”

Is Range Rover insurance considered expensive?

Range Rover insurance is considered expensive due to the high cost of the vehicles, their desirability, and the potential high cost of repairs.

What are the best Land Rover insurance options for young drivers?

Young drivers should seek Land Rover insurance providers that offer good student discounts or telematics-based discounts to help mitigate high costs.

How can I get a Land Rover insurance quote?

You can easily get Land Rover insurance quotes by using online comparison tools or directly contacting insurers for a personalized quote.

What do Land Rover insurance reviews typically say?

Land Rover insurance reviews often praise the comprehensive coverage and customer service, though they may note higher premiums as a downside.

To learn more, explore our comprehensive resource on “Affordable Comprehensive Auto Insurance Coverage.”

What should I know about modified Land Rover insurance?

For modified Land Rover insurance, it’s important to look for insurers that specialize in customized vehicles to ensure proper coverage.

Why is rover liability insurance important?

Rover liability insurance is crucial as it covers potential damages or injuries your vehicle might cause to other parties.

Why is Range Rover insurance so expensive?

The luxury status, potential for expensive repairs, and higher risk of theft contribute to the high cost of Range Rover insurance.

If you’re just looking for coverage to drive legally, enter your ZIP code below to compare cheap auto insurance quotes near you.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.