Cheap Porsche Auto Insurance in 2025 (Get Low-Cost Coverage With These 10 Companies)

Finding cheap Porsche auto insurance can be challenging, but USAA, Geico, and State Farm stand out as the top choices for affordable coverage with monthly rates starting at $85. These providers offer competitive pricing and strong customer service, making them ideal for insuring your Porsche.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Licensed Agent & Financial Advisor

UPDATED: Oct 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Porsche

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage for Porsche

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsThe best options for cheap Porsche auto insurance are USAA, Geico, and State Farm, with rates starting at $85 per month.

USAA leads with top rates and coverage for Porsche owners, plus extensive discounts and high customer satisfaction. Geico and State Farm also offer excellent value with competitive pricing and various discounts. Geico is known for its budget-friendly rates and efficient online tools, while State Farm excels with its extensive network of agents and personalized service.

Our Top 10 Company Picks: Cheap Porsche Auto Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $85 A++ Military Members USAA

#2 $90 A++ Cheap Rates Geico

#3 $95 B Many Discounts State Farm

#4 $100 A+ Tight Budgets Progressive

#5 $105 A+ Agent Network Allstate

#6 $110 A+ Budget Shopping Nationwide

#7 $115 A Unique Benefits Liberty Mutual

#8 $120 A Family Plans Farmers

#9 $125 A++ Industry Experience Travelers

#10 $130 A Loyalty Discounts American Family

Find out more by reading our “Quote Wizard Auto Insurance Review.” Start saving on your auto insurance by entering your ZIP code above and comparing quotes.

- Affordable Porsche Auto Insurance Quotes

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#1 – USAA: Top Overall Pick

Pros

Pros

- Affordable Rates: USAA offers Porsche auto insurance at a highly competitive monthly rate of $85, making it one of the most cost-effective options for military members who are Porsche owners.

- High Customer Satisfaction: Known for exceptional customer service, USAA consistently receives high marks in customer satisfaction surveys, a plus for Porsche policyholders.

- Comprehensive Coverage Options: USAA provides a wide range of coverage options to meet the specific needs of Porsche drivers. Elevate your knowledge with our “USAA Auto Insurance Review.”

- Strong Financial Stability: With an A++ rating from A.M. Best, USAA is highly financially stable, ensuring they can meet claims obligations for Porsche insurance.

Cons

- Eligibility Restrictions: USAA is only available to military members, veterans, and their families, limiting access for Porsche enthusiasts who are not affiliated with the military.

- Limited Local Agents: USAA operates primarily online, which might not appeal to Porsche owners who prefer in-person service.

- No Pay-Per-Mile Option: Unlike some competitors, USAA does not offer a pay-per-mile insurance plan, which could be a drawback for Porsche drivers who log fewer miles.

#2 – Geico: Best for Cheap Rates

Pros

Pros

- Competitive Rates: Geico offers Porsche auto insurance at a budget-friendly monthly rate of $90, making it a top choice for Porsche policyholders looking for affordability.

- Easy Online Quote Process: Geico’s user-friendly online platform makes it simple for Porsche drivers to get a quote and purchase coverage. Uncover additional insights in our article called, “Geico Auto Insurance Review.”

- Wide Range of Discounts: Geico offers numerous discounts, including those for good Porsche drivers, multi-policy holders, and military personnel.

- Strong Financial Backing: With an A++ rating from A.M. Best, Geico is a financially secure company, providing peace of mind for Porsche insurance policyholders.

Cons

- Limited Coverage Options: Geico may not offer as many specialized coverage options for Porsche owners as some competitors, which could be a drawback for those seeking customized policies.

- Average Customer Service: While Geico is known for affordability, its customer service ratings are more average compared to some other top providers, which might concern some Porsche policyholders.

- No Local Agents: Geico operates mostly online, which might not appeal to Porsche owners who prefer in-person service.

#3 – State Farm: Best for Many Discounts

Pros

Pros

- Numerous Discounts: State Farm offers a variety of discounts, helping Porsche owners save on their insurance with a monthly rate of $95. Discover what lies beyond with our “State Farm Auto Insurance Review.”

- Large Agent Network: State Farm has a vast network of local agents, providing personalized service and assistance for Porsche policyholders.

- Comprehensive Coverage Options: The company offers a wide range of coverage options to suit the needs of Porsche drivers.

- Reliable Track Record in Porsche Insurance: State Farm is recognized for its longstanding reputation and commitment to effectively serving Porsche insurance customers.

Cons

- Lower Financial Rating: State Farm’s B rating is lower compared to some competitors, which might be a concern for Porsche policyholders prioritizing financial strength.

- Higher Premiums for Some Drivers: Depending on factors like driving record and location, some Porsche drivers may find State Farm’s rates higher than competitors.

- Mixed Customer Service Reviews: While many Porsche owners are satisfied, there have been reports of issues with claim processing and customer service.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Progressive: Best for Tight Budgets

Pros

Pros

- Affordable Rates: Progressive offers Porsche auto insurance at a competitive monthly rate of $100, making it a strong choice for Porsche drivers on a tight budget.

- Name Your Price Tool: Progressive’s unique tool allows Porsche policyholders to find coverage that fits their budget by specifying how much they want to pay.

- Multiple Discount Options: Progressive provides several discounts for Porsche owners, including those for bundling, safe driving, and paying in full.

- Strong Financial Rating: Progressive holds an A+ rating from A.M. Best, indicating solid financial stability for Porsche insurance. Access the complete picture in our “Progressive Auto Insurance Review.”

Cons

- Potential Rate Increases: Some Porsche owners have reported significant rate increases after the first policy term with Progressive.

- Less Personalized Service: Progressive’s online-focused approach might not appeal to Porsche enthusiasts who prefer working with an agent in person.

- Limited Coverage Customization: Progressive may offer fewer options for customizing Porsche insurance coverage compared to some competitors.

#5 – Allstate: Best for Agent Network

Pros

Pros

- Extensive Agent Network: Allstate boasts a vast network of local agents, offering personalized service and support for Porsche insurance needs at a monthly rate of $105.

- Comprehensive Coverage: Allstate offers a wide range of coverage options, including some unique add-ons like accident forgiveness, which can benefit Porsche policyholders.

- Strong Financial Rating: With an A+ rating from A.M. Best, Allstate is financially secure, giving Porsche owners peace of mind.

- Discount Opportunities: Allstate provides various discounts for Porsche drivers, including safe driver, multi-policy, and new car discounts.

Cons

- Higher Rates: Allstate’s rates may be higher compared to some other providers, which could be a drawback for Porsche owners on a budget. Obtain a more nuanced perspective with our “Allstate Auto Insurance Review.”

- Mixed Customer Satisfaction: While many Porsche policyholders are happy with their service, others have reported dissatisfaction with claims handling.

- Potential for Rate Increases: Some Porsche drivers have experienced rate increases after their initial policy term, which could impact long-term affordability.

#6 – Nationwide: Best for Budget Shopping

Pros

Pros

- Affordable Monthly Rate: Nationwide offers Porsche auto insurance at a reasonable monthly rate of $110, making it a solid choice for budget-conscious Porsche owners.

- On Your Side Review: Nationwide provides annual reviews to ensure Porsche policyholders are getting the best possible coverage and rates. Gain a deeper understanding through our “Nationwide Auto Insurance Review.”

- Wide Range of Coverage Options: The company offers comprehensive coverage options, including vanishing deductible and accident forgiveness for Porsche insurance.

- Financial Stability: Nationwide holds an A+ rating from A.M. Best, indicating a strong financial position for Porsche policyholders.

Cons

- Higher Rates for High-Risk Drivers: Nationwide may not be the most affordable option for Porsche drivers with a history of accidents or violations.

- Mixed Customer Service Experiences: Customer service reviews are mixed, with some Porsche owners reporting issues with claims processing.

- Limited Local Agent Availability: Depending on your location, there may be fewer Nationwide agents available for in-person service for Porsche insurance needs.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Unique Benefits

Pros

Pros

- Unique Benefits: Liberty Mutual offers Porsche auto insurance with unique perks such as new car replacement and better car replacement at a monthly rate of $115, appealing to Porsche enthusiasts.

- Flexible Coverage Options: The company provides a variety of customizable coverage options to meet the needs of Porsche drivers. Expand your understanding with our article called, ” Liberty Mutual Auto Insurance.”

- Strong Financial Stability: With an A rating from A.M. Best, Liberty Mutual is financially secure, offering peace of mind to Porsche policyholders.

- Discount Programs: Liberty Mutual offers various discounts for Porsche owners, including those for safe driving, multi-car policies, and bundling.

Cons

- Higher Premiums: Liberty Mutual’s premiums may be higher than some competitors, which could be a drawback for budget-conscious Porsche owners.

- Mixed Customer Service Reviews: Some Porsche policyholders have reported issues with Liberty Mutual’s claims handling and customer service.

- Limited Availability of Certain Discounts: Depending on location, some Porsche drivers may not qualify for all the discounts Liberty Mutual offers.

#8 – Farmers: Best for Family Plans

Pros

Pros

- Family-Oriented Discounts: Farmers offers a variety of discounts for families, making it an attractive option for Porsche policyholders who want to insure multiple vehicles or family members, with a monthly rate of $120.

- Personalized Service: Farmers is known for its strong customer service, providing Porsche owners with personalized support and advice.

- Comprehensive Coverage Options: Farmers offers extensive coverage options, including specialized add-ons for Porsche insurance.

- Solid Financial Strength: With an A rating from A.M. Best, Farmers is a financially stable company, ensuring that claims for Porsche drivers are handled effectively.

Cons

- Higher Rates: Farmers’ monthly rates may be higher than some other providers, which could be a concern for Porsche enthusiasts looking for lower premiums.

- Limited Availability of Discounts: Some Porsche owners may find it challenging to qualify for certain discounts, especially if they do not meet specific criteria.

- Potential for Rate Increases: Some Porsche policyholders have reported that their premiums increased significantly after the initial policy term. Discover what lies beyond with our “Farmers Auto Insurance Review.“

#9 – Travelers: Best for Industry Experience

Pros

Pros

- Experienced Provider: Travelers has a long history in the insurance industry, providing reliable coverage for Porsche drivers at a monthly rate of $125.

- Comprehensive Coverage Options: Travelers offers a wide range of coverage options, allowing Porsche policyholders to tailor their policies to their needs.

- Strong Financial Stability: With an A++ rating from A.M. Best, Travelers is a financially strong company, ensuring it can meet its obligations to Porsche insurance policyholders.

- Discount Opportunities: Travelers provides several discount options for Porsche owners, including multi-policy and safe driver discounts. Obtain further insights from our “Travelers Auto Insurance Review.“

Cons

- Higher Premiums: Travelers’ rates may be higher than those of some competitors, which could be a drawback for budget-conscious Porsche enthusiasts.

- Less Personalized Service: Some Porsche drivers may find that Travelers’ service is less personalized compared to companies with a more localized agent network.

- Limited Availability of Certain Discounts: Depending on location, some Porsche policyholders may not qualify for all the discounts Travelers offers.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – American Family: Best for Loyalty Discounts

Pros

Pros

- Loyalty Rewards: American Family offers loyalty discounts to Porsche owners who stay with the company for extended periods, making it a cost-effective option at a monthly rate of $130.

- Comprehensive Coverage Options: The company provides a wide range of coverage choices, including specialized options for Porsche insurance.

- Personalized Service: American Family is known for its customer-focused approach, offering Porsche policyholders personalized service and attention.

- Solid Financial Strength: With an A rating from A.M. Best, American Family is a reliable and financially stable choice for Porsche drivers. Deepen your understanding with our article called, “American Family Insurance Auto Insurance Review.”

Cons

- Higher Monthly Premiums: American Family’s monthly rates are higher than some other providers, which could be a concern for budget-conscious Porsche policyholders.

- Limited Availability: American Family’s coverage may not be available in all areas, which could be a limitation for some Porsche enthusiasts.

- Potential for Limited Discounts: Depending on location and other factors, Porsche owners may not qualify for all available discounts, impacting overall affordability.

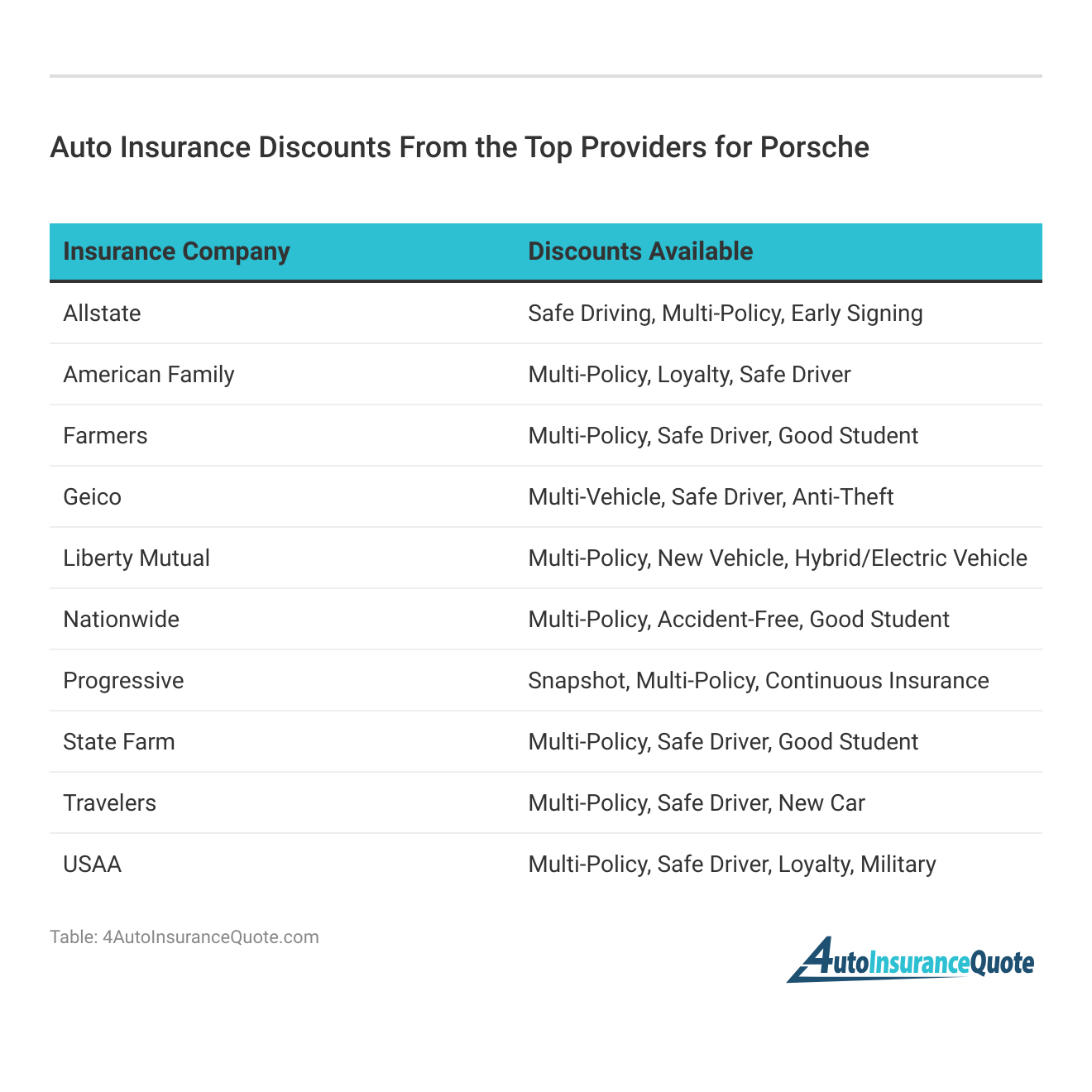

Porsche Auto Insurance Rates

Your Porsche auto insurance costs are influenced by several factors, including your choice of insurer, Porsche model, and age. The best insurance for Porsche often comes from companies like Geico and State Farm, known for providing lower average rates. USAA also offers competitive prices for military members. For the best Porsche insurance, it’s advisable to compare quotes from different providers and check Porsche auto insurance reviews.

The Porsche model you drive affects how much insurance on a Porsche will cost. More expensive models, such as the Porsche Panamera and Porsche 911, typically have higher premiums, whereas more affordable options like the Porsche 718 Boxster may offer cheaper Porsche insurance. For young drivers, such as those needing Porsche boxster insurance for 18 year old, costs are generally higher.

Porsche Auto Insurance Monthly Rates by Coverage Level & Provider| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $105 | $165 |

| American Family | $130 | $190 |

| Farmers | $120 | $180 |

| Geico | $90 | $150 |

| Liberty Mutual | $115 | $175 |

| Nationwide | $110 | $170 |

| Progressive | $100 | $160 |

| State Farm | $95 | $155 |

| Travelers | $125 | $185 |

| USAA | $85 | $140 |

Your age and driving history significantly influence how much is insurance on a Porsche. Younger drivers often face higher premiums due to inexperience. However, maintaining a clean driving record can help reduce costs, making it easier to find cheap Porsche insurance over time. For specific models, like the Porsche Panamera, your rates may vary based on these factors.

Porsche Auto Insurance Coverage

Porsche offers specialized auto insurance through its subsidiary, Mile Auto, providing both traditional and pay-per-mile insurance options. This allows Porsche owners to choose coverage that fits their driving habits. You can get quotes from Porsche auto insurance to compare rates with other providers.

Some of the advantages that Porsche boasts about its auto insurance policies are as follows:

- Agreed Value Coverage: Porsche lets you set the full value of your car, including any accessories or modifications, ensuring they’re covered in case of an accident.

- Genuine Parts: Repairs at Porsche-approved collision centers using genuine parts maintain your vehicle’s integrity.

- Pay-per-Mile: Ideal for infrequent drivers, this option charges a daily fee plus a few cents per mile, potentially saving you money if you drive less than 10,000 miles annually and allowing you to benefit from a low-mileage auto insurance discount.

Porsche’s pay-per-mile insurance is a significant perk, especially for those who drive less frequently. However, if you’re considering traditional auto insurance, it’s wise to compare Porsche’s quotes with other companies to ensure you’re getting the best deal.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Frequently Asked Questions

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Additionally, consider the coverage options available for your Porsche. Comprehensive and collision coverage, rental car reimbursement coverage, and any additional protections can significantly impact your insurance costs. Ensuring that you have the right coverage tailored to your specific Porsche model is essential.

Additionally, consider the coverage options available for your Porsche. Comprehensive and collision coverage, rental car reimbursement coverage, and any additional protections can significantly impact your insurance costs. Ensuring that you have the right coverage tailored to your specific Porsche model is essential.