Best Auto Insurance for Rebuilt Titles in 2025 (Our Top 8 Picks)

Geico, Allstate, and State Farm provide the best auto insurance for rebuilt titles, with rates starting as low as $40 per month. These companies stand out by offering significant discounts and comprehensive coverage, ensuring owners of rebuilt titles can secure affordable and dependable insurance solutions.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Sep 21, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Sep 21, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Rebuilt Titles

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Rebuilt Titles

A.M. Best Rating

Complaint Level

Pros & Cons

Geico, Allstate, and State Farm are the top picks for the best auto insurance for rebuilt titles, offering competitive rates and robust coverage options. Explore how these insurers cater to drivers with rebuilt vehicles, focusing on affordability and comprehensive policy features.

It outlines the benefits of selecting providers that specialize in rebuilt titles, offering superior customer support and flexible terms. We also detail the discounts that can reduce monthly premiums.

Our Top 8 Company Picks: Best Auto Insurance for Rebuilt Titles

Company Rank Good Driver Discount A.M. Best Best For Jump to Pros/Cons

#1 12% A++ Budget-Friendly Geico

#2 20% A+ Wide Availability Allstate

#3 10% A++ Reliable Coverage State Farm

#4 10% A Safe Drivers Mercury

#5 10% A+ Comprehensive Care Progressive

#6 15% A+ Usage-Based Savings Nationwide

#7 10% A++ Affordable Options Kemper

#8 15% NR Tech-Savvy Users Root

Comparing these providers to find the best match based on individual needs and vehicle status is crucial. Understanding these factors enables consumers to make informed decisions about securing cost-effective auto insurance.

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

- Geico offers the best rates for rebuilt titles, up to 20% off

- Rebuilt titles require specialized insurance coverage

- Policies for rebuilt titles often include specific discounts

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Competitive Rates: For more details on their offerings, check out our Geico auto insurance review, which highlights their affordable insurance options for rebuilt titles.

- User-Friendly App: Geico’s app makes managing policies and filing claims straightforward.

- Strong Financial Stability: Geico has a solid financial rating, ensuring reliable claim payouts.

Cons

- Limited Availability: Not all Geico agents may be willing to insure rebuilt title vehicles.

- Higher Premiums: Insurance costs for rebuilt titles can be higher compared to clean titles.

#2 – Allstate: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage Options: Offers a variety of coverage options, including full coverage for rebuilt titles.

- Local Agents: Allstate’s network of local agents provides personalized service and support.

- Strong Customer Service: Learn about their processing times in our article, How long does it typically take for Allstate to process an auto insurance claim, highlighting their customer service.

Cons

- Higher Rates: Allstate tends to have higher premiums compared to other insurers.

- Strict Underwriting: May have stringent requirements for insuring rebuilt titles.

#3 – State Farm: Best for Nationwide Availability

Pros

- Nationwide Availability: State Farm has extensive coverage across the U.S., making it accessible for most drivers.

- Good Customer Service: Read our detailed State Farm auto insurance review to learn why it’s highly rated for customer service and claim satisfaction.

- Discount Opportunities: Offers multiple discounts that can help lower insurance costs.

Cons

- Limited Online Tools: State Farm’s online tools and mobile app are not as advanced as competitors.

- Higher Premiums: Insurance for rebuilt titles can be more expensive.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Mercury: Best for Affordable Rates

Pros

- Affordable Rates: For drivers seeking cost-effective options, consider checking out our article on affordable Mercury auto insurance quotes, known for offering competitive rates.

- Good Customer Reviews: Generally positive feedback on customer service and claim handling.

- Variety of Coverage Options: Provides a range of coverage options, including for rebuilt titles.

Cons

- Limited Availability: Not available in all states, which can limit accessibility.

- Higher Rates: May charge higher premiums for rebuilt titles compared to other vehicles.

#5 – Progressive: Best for Robust Online Tools

Pros

- Snapshot Program: To learn more about their offerings, read our detailed Progressive auto insurance review which covers their usage-based insurance program that can help lower rates.

- Comprehensive Online Tools: Offers robust online tools and a user-friendly app.

- Wide Range of Discounts: Various discounts available, including multi-policy and safe driver discounts.

Cons

- Higher Rates for Rebuilt Titles: Rebuilt title vehicles may face higher premiums.

- Variable Customer Service: Customer service experiences can vary widely.

#6 – Nationwide: Best for Financial Stability

Pros

- Strong Financial Stability: Our guide on how to file an auto insurance claim explains the importance of solid financial ratings for reliable claim handling.

- Vanishing Deductible Program: Deductibles decrease over time with safe driving.

- Comprehensive Coverage Options: Offers a broad range of coverage, including for rebuilt titles.

Cons

- Higher Premiums: Known for higher premiums compared to some competitors.

- Strict Underwriting: May have stringent requirements for insuring rebuilt vehicles.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – Kemper: Best for Competitive Pricing

Pros

- Affordable Options: Known for competitive pricing, even for rebuilt title vehicles.

- Good Customer Service: Our Kemper auto insurance review highlights the company’s generally positive reviews for customer support.

- Flexible Coverage: Offers various coverage options tailored to different needs.

Cons

- Limited Online Tools: Less robust online presence compared to larger insurers.

- Higher Rates: Insurance for rebuilt titles can be more expensive.

#8 – Root: Best for Usage-Based Insurance

Pros

- Usage-Based Insurance: Our review of good driver auto insurance discount rates shows that driving behavior can lead to lower premiums.

- Innovative App: User-friendly app for policy management and claims.

- Competitive Rates: Often offers lower rates due to the usage-based model.

Cons

- Limited Availability: Not available in all states.

- Strict Qualification: Only accepts drivers with good driving behavior, which can limit eligibility.

Understanding Total Loss, Salvage, and Rebuilt Titles

Cars can be declared a total loss due to accidents, weather damage, vandalism, and theft. Insurance companies typically declare a car totaled when damage reaches between 75 and 90 percent of its value. You can negotiate a total loss insurance settlement if you believe your totaled vehicle is worth more than the insurance company’s offer.

Usually, the insurance company sells a totaled car to recoup losses, but you can keep it to repair yourself. After repairs, a salvaged car may be eligible for a rebuilt title if it passes a state examination.

Geico leads the market in offering the most cost-effective and comprehensive auto insurance for vehicles with rebuilt titles.Melanie Musson Published Insurance Expert

Salvage and rebuilt titles, often confused, have distinct meanings indicated by the paper color: green for clean, blue for salvaged, and orange for rebuilt. If you’re unsure, an insurance agent can help decipher your title and the necessary coverage.

Auto Insurance for Rebuilt Titles: Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $45 $105

Geico $52 $120

Kemper $55 $125

Mercury $50 $115

Nationwide $62 $135

Progressive $51 $118

Root Insurance $48 $110

State Farm $40 $100

The table provides a comparison of monthly auto insurance rates for rebuilt titles, detailing both minimum and full coverage options from eight prominent insurance providers. Allstate offers rates at $45 for minimum coverage and $105 for full coverage. Geico’s rates are set at $52 and $120, respectively. Kemper lists its rates at $55 for minimum and $125 for full coverage.

Mercury offers slightly lower rates at $50 and $115. Nationwide charges $62 for minimum coverage and $135 for full, the highest among the listed companies. Progressive has rates of $51 and $118, while Root Insurance offers $48 and $110. State Farm provides the most economical options, at $40 for minimum coverage and $100 for full coverage.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Securing Insurance for Rebuilt Title Vehicles: Challenges and Possibilities

Cars with rebuilt titles are legal to drive and require insurance like any other vehicle, although not all insurance companies will cover them. Typically, insurers offer only liability coverage for these cars, meeting most state requirements.

However, owning a rebuilt title can be more expensive in terms of insurance; providers charge higher monthly rates due to the perceived risk and offer smaller payouts in claims. While obtaining full coverage auto insurance on a rebuilt title is challenging due to the difficulty in assessing the car’s pre-existing condition and true value, it is still possible.

This coverage complexity arises because the car may harbor undetected damages that pose potential dangers and complicate claims, making insurers hesitant to offer substantial payouts. Rebuilt cars are generally valued 20% to 40% less than comparable models with clean titles, further complicating insurance dealings.

Optimal Insurance Options for Rebuilt Title Vehicles

Rebuilt cars are legal to drive, but not all auto insurance companies will cover them. If you already have insurance for another vehicle or your car has been repaired after being totaled, inquire with your current agent about insuring your rebuilt vehicle.

For those without existing coverage, State Farm, Allstate, Geico (which requires additional inspections for approval), Farmers, and Progressive (offering full coverage on specific vehicle models) are recommended starting points. Most insurers impose specific requirements and policy limitations for insuring rebuilt cars, making it essential to compare insurance quotes to secure the best deal.

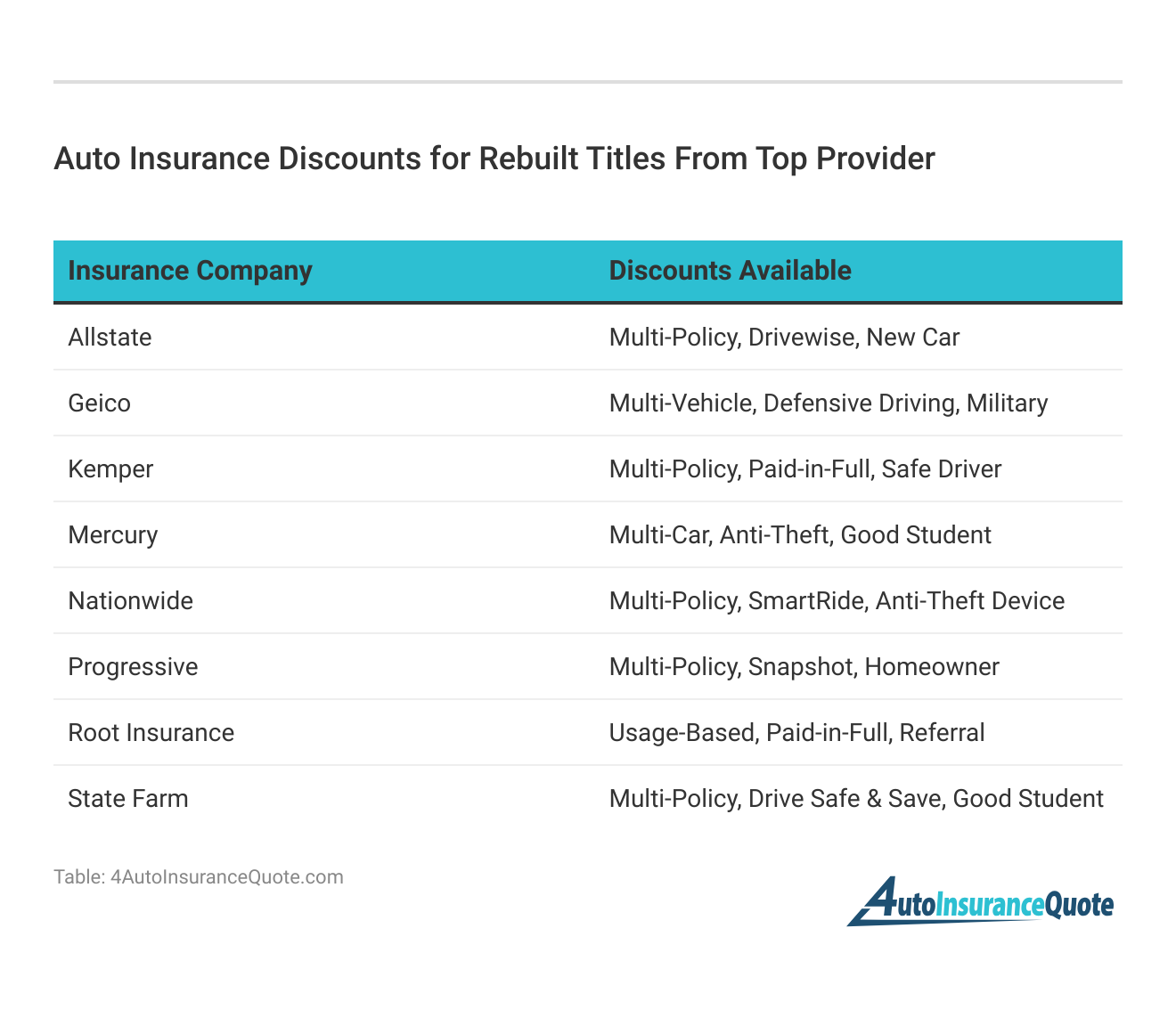

This table presents a comparison of auto insurance discounts offered by eight leading insurance providers for vehicles with rebuilt titles. Each company offers a range of discounts targeting different aspects of the driver’s profile and vehicle features.

The information provided outlines the variety of discount options available across different insurers, helping customers make informed choices based on their specific needs and circumstances. Whether you are a student, a safe driver, or a homeowner, these companies offer a range of incentives that could significantly lower your insurance costs.

Guide to Insuring Vehicles With Rebuilt Titles

Securing insurance for a rebuilt vehicle involves a few critical steps, even though it might seem daunting at first. Initially, ensure you hold a rebuilt title, as insurance cannot be issued for cars with salvage titles. Obtain a statement from a certified mechanic verifying that the vehicle is safe to drive, which will help convince insurers of its insurability.

Begin shopping for coverage, keeping in mind that not every company insures rebuilt vehicles and finding more than liability coverage can be tough. Since insurance for a rebuilt title can cost up to 20% more than for a clean title, comparing quotes from multiple providers is essential to finding the best rate.

Using an online tool to gather and compare these quotes can streamline the process, helping you make an informed choice and better understand how auto insurance works.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Real-World Insights on Insuring Rebuilt Titles

These case studies illustrate obtaining insurance for rebuilt title vehicles, emphasizing thorough inspections, online policy management, and provider accessibility. Each scenario highlights varied insurance strategies and requirements for significantly repaired vehicles.

- Case Study #1 – Comprehensive Coverage Seeker: John, a rebuilt vehicle owner, sought comprehensive auto insurance coverage from Geico after his car underwent major repairs. Geico issued a policy following additional safety inspections, illustrating that extensive coverage is attainable for rebuilt titles with thorough evaluations.

- Case Study #2 – Online Tools User: Sarah chose Progressive for its online tools, which simplified managing her policy and claims digitally. She secured full coverage for her rebuilt title car through Progressive’s user-friendly platform, demonstrating its flexibility and ease of use.

- Case Study #3 – Nationwide Availability Benefactor: Living in a rural area with limited options, Tom obtained a policy for his rebuilt title car from State Farm, benefiting from its nationwide coverage and readiness to insure such vehicles, showcasing the company’s accessibility and reliability.

These case studies demonstrate various aspects of obtaining insurance for rebuilt titles, from the need for additional inspections and comprehensive coverage to the advantages of robust online services and broad availability.

Geico excels with a customer review rating of 95%, setting the standard for superior auto insurance for rebuilt titles.Chris Abrams Licensed Insurance Agent

Ultimately, they underscore the importance of choosing insurers that tailor their services to meet the unique needs of rebuilt title vehicle owners.

Find the Best Insurance for Rebuilt Titles

Cars with rebuilt titles can be a great value, and there’s no reason why you shouldn’t buy one. While rebuilt title insurance quotes aren’t as cheap as insurance for cars with clean titles, you shouldn’t let that get in the way of owning a car.

To insure rebuilt title vehicles effectively, find auto insurance quotes online, determine if comprehensive or full coverage is necessary based on the vehicle’s condition, and complete all required inspections and documentation. These steps streamline the process of navigating insurance for rebuilt titles.

You can find the most affordable rebuilt title insurance rates by shopping around. If you’re ready to see what quotes might look like for you, enter your ZIP code into our free tool today.

Frequently Asked Questions

What is the average rebuilt title insurance cost?

The cost of rebuilt title insurance can vary widely, but it generally tends to be higher than standard insurance due to the perceived increased risk associated with rebuilt titles.

For more details, refer to our guide on “Affordable High-Risk Auto Insurance” for a complete overview.

Can you get full coverage on a rebuilt title?

Yes, you can obtain full coverage on a rebuilt title, although not all insurers provide this option. It’s important to confirm with insurers if they extend full coverage to rebuilt titles.

See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.

Which insurance companies cover rebuilt titles with full coverage?

Companies like Geico and Progressive are known for offering full coverage on rebuilt title vehicles, accommodating owners who seek comprehensive protection.

Explore our comprehensive resource titled “Affordable Full Coverage Auto Insurance” for more information on cost-effective comprehensive policies.

What are the cheapest insurance options for a rebuilt title?

While rates can vary, companies like State Farm and Progressive often offer the cheapest insurance for rebuilt titles, blending affordability with substantial coverage.

Who insures rebuilt titles?

Insurance companies such as State Farm, Geico, and Progressive are among those that provide policies for vehicles with rebuilt titles.

Which insurance companies offer full coverage on a rebuilt title?

Major providers like Geico and Allstate offer full coverage options for vehicles with rebuilt titles, addressing both liability and damage.

Discover our guide titled “Affordable Liability Auto Insurance Coverage” to deepen your understanding of cost-effective options.

What companies insure rebuilt titles?

Companies that insure rebuilt titles include Allstate, Progressive, and Geico, known for their flexible policies for such vehicles.

What are the best insurance companies for a rebuilt title?

The best insurance companies for a rebuilt title often include Geico, Progressive, and Allstate, known for their comprehensive coverage and competitive pricing.

Find the best comprehensive car insurance quotes by entering your ZIP code below into our free comparison tool today.

Can you put full coverage on a rebuilt title?

Yes, full coverage can be placed on a rebuilt title, though availability might depend on the insurer’s policy regarding rebuilt or salvaged vehicles.

Explore our detailed report on “Affordable Salvage Title Auto Insurance” to understand cost-effective options for insuring previously damaged vehicles.

How does insuring a rebuilt title differ from standard vehicle insurance?

Insuring a rebuilt title often involves higher premiums and more scrutiny during the underwriting process compared to standard vehicle insurance due to the previous damage and repairs the vehicle has undergone.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.