Cheap South Dakota Auto Insurance in 2025 (Secure Low Rates With These 10 Companies)

Geico, USAA, and State Farm offer affordable and cheap South Dakota auto insurance. Our top recommendation, Geico, has rates for only $9/mo. Explore budget-friendly from South Dakota auto insurance options that provide comprehensive coverage and excellent benefits customized for your South Dakota auto insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Licensed Agent & Financial Advisor

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Min. Coverage in South Dakota

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage in South Dakota

A.M. Best Rating

Complaint Level

Pros & Cons

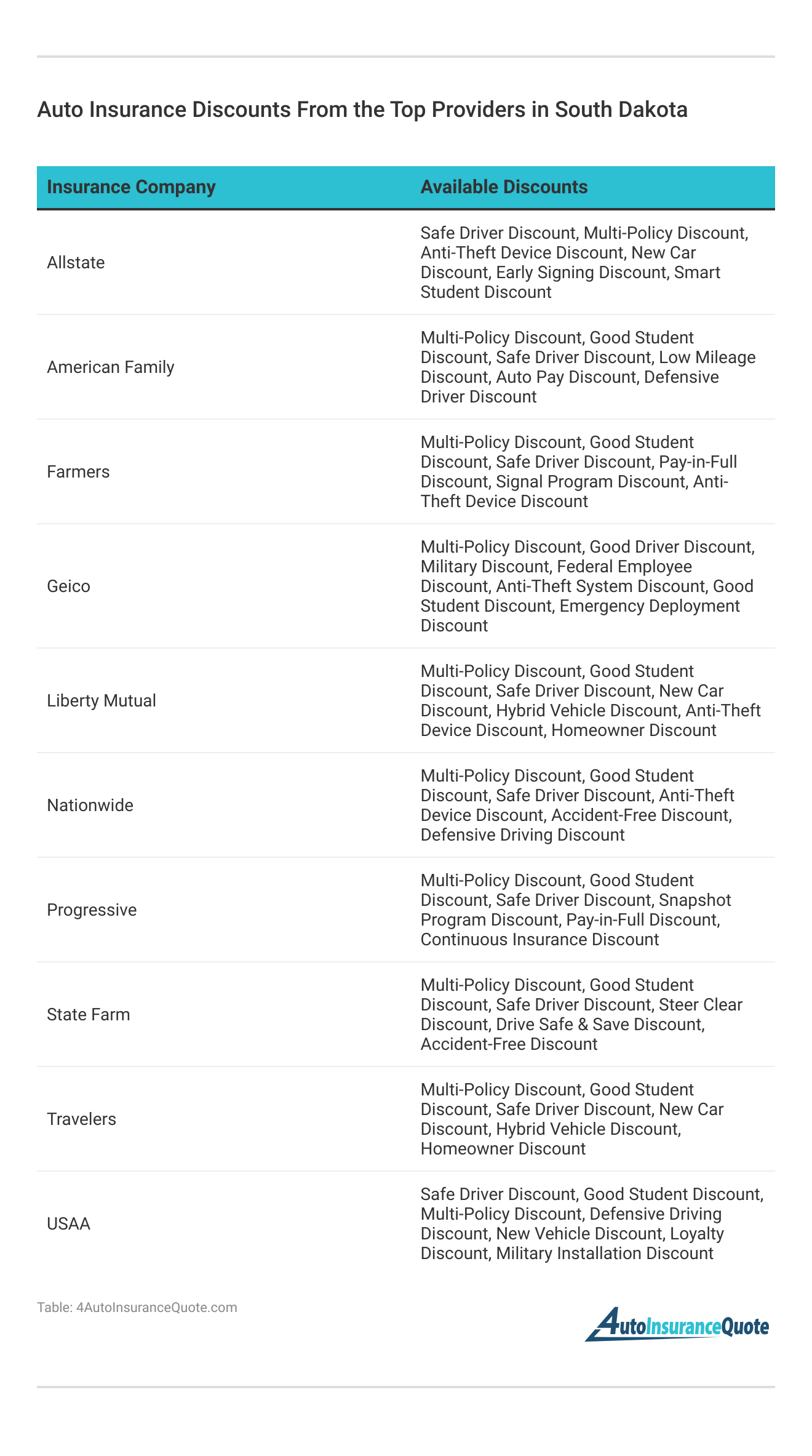

Geico, USAA, and State Farm offer cheap South Dakota auto insurance for comprehensive option, discount, and premium.

Understanding auto insurance in South Dakota, from its required coverages to company rates, will help you buy a cheap policy with ease. We have covered everything you need to know about South Dakota auto insurance rates, laws, and coverage here.

Our Top 10 Company Picks: Cheap South Dakota Auto Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $9 A++ Efficient Operations Geico

#2 $10 A+ Member Discounts USAA

#3 $11 B Volume Discounts State Farm

#4 $12 A+ Competitive Rates Nationwide

#5 $16 A++ Policy Bundling Travelers

#6 $17 A+ Snapshot Discounts Progressive

#7 $18 A Customer Loyalty Farmers

#8 $22 A++ Drivewise Program Allstate

#9 $24 A Safe Driving American Family

#10 $37 A Policy Customization Liberty Mutual

Before you buy South Dakota auto insurance, make sure to compare rates. Enter your ZIP code for free South Dakota auto insurance quotes now.

- South Dakota drivers must have 25/50/25 liability insurance

- Full coverage auto insurance in South Dakota costs $9 per month

- South Dakota auto insurance rates are below the national average

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Low Rates: Known for highly competitive pricing, with a monthly rate of just $9, making it an excellent option for cheap South Dakota auto insurance.

- Efficient Operations: Rated A++ by A.M. Best for its excellent financial stability and operational efficiency, ensuring reliable coverage at affordable rates.

- User-Friendly App: Offers a highly-rated mobile app for easy policy management and claims, helping you maintain cheap South Dakota auto insurance without hassle. Read more through our Geico auto insurance review.

Cons

- Limited Local Agents: May lack personalized service due to its focus on online and phone-based support, which could be a drawback if you prefer in-person assistance with cheap South Dakota auto insurance.

- Coverage Options: Fewer optional coverage choices compared to some competitors, which may limit the ability to tailor your policy for comprehensive cheap South Dakota auto insurance.

#2 – USAA: Best for Member Discounts

Pros

- Exceptional Service: Renowned for superior customer service and satisfaction, and ranked #2 with a $10 monthly rate, offering some of the best cheap South Dakota auto insurance for military families.

- Member Discounts: Offers significant discounts for military members and their families, enhancing affordability for cheap South Dakota auto insurance.

- Comprehensive Coverage: Includes extensive coverage options and benefits, ensuring you get reliable and affordable coverage for cheap South Dakota auto insurance.

Cons

- Eligibility Restrictions: Only available to military members and their families, limiting accessibility for those seeking cheap South Dakota auto insurance who do not qualify.

- Limited Local Offices: Fewer physical locations for face-to-face service, which could be inconvenient if you need personalized assistance with cheap South Dakota auto insurance. Learn more through our USAA Auto insurance review.

#3 – State Farm: Best for Volume Discounts

Pros

- Extensive Network: Large network of local agents providing personalized service, ranked #3 with an $11 monthly rate, making it a good choice for cheap South Dakota auto insurance with local support.

- Volume Discounts: Offers discounts for bundling multiple policies and maintaining good driving records, helping you save more on cheap South Dakota auto insurance.

- Variety of Coverage: Offers a wide range of coverage options and add-ons, allowing you to customize your policy for affordable and effective cheap South Dakota auto insurance. Find out in our State Farm Company Review.

Cons

- Higher Rates: Rates may be higher compared to some online-only insurers, potentially affecting the affordability of cheap South Dakota auto insurance.

- Inconsistent Service: Service quality can vary depending on the local agent, which may impact your experience with obtaining and managing cheap South Dakota auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Competitive Rates

Pros

- Competitive Rates: Ranked #4 with a monthly rate of $12, known for competitive pricing, making it a strong contender for cheap South Dakota auto insurance.

- Customizable Policies: Provides a variety of policy options and customization, allowing you to tailor cheap South Dakota auto insurance to fit your needs.

- Positive Customer Service: Generally positive reviews for customer service and claims handling, contributing to a positive experience with cheap South Dakota auto insurance.

Cons

- Average Pricing: Not always the lowest rate available, which may limit your options for the cheapest South Dakota auto insurance. Explore more discount options in our Nationwide auto insurance review.

- Claims Handling: Some customers report slower claims processing compared to competitors, which could be a concern for those relying on cheap South Dakota auto insurance during claims

#5 – Travelers: Best for Policy Bundling

Pros

- Policy Bundling: Ranked #5 with a monthly rate of $16, known for offering attractive policy bundling options that can further reduce the cost of cheap South Dakota auto insurance.

- Flexible Coverage: Provides a range of customizable coverage options, allowing you to create a cheap South Dakota auto insurance policy that meets your specific needs.

- Discounts: Offers various discounts for bundling policies and safe driving, helping to lower the cost of cheap South Dakota auto insurance even further.

Cons

- Higher Premiums: Premiums can be higher compared to some other insurers, which might impact the affordability of cheap South Dakota auto insurance.

- Customer Service: Some customers report issues with customer service responsiveness, which could affect your experience with cheap South Dakota auto insurance. Read more in our detailed Travelers auto insurance review.

#6 – Progressive: Best for Snapshot Discounts

Pros

- Snapshot Discounts: Ranked #6 with a $17 monthly rate, known for its Snapshot program that rewards safe driving with discounts, making it an option for cheap South Dakota auto insurance.

- Competitive Pricing: Often offers lower rates compared to many competitors, contributing to affordable options for cheap South Dakota auto insurance. Our complete Progressive auto insurance review goes over this in more detail.

- Wide Range of Coverage: Provides many types of coverage and optional add-ons, allowing you to secure comprehensive cheap South Dakota auto insurance.

Cons

- Inconsistent Pricing: Rates can vary widely based on location and personal factors, which might affect your ability to find the cheapest South Dakota auto insurance.

- Customer Service: Some customers report challenges with customer service and claims handling, which could impact your overall experience with cheap South Dakota auto insurance

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – Farmers: Best for Customer Loyalty

Pros

- Customer Loyalty: Ranked #7 with an $18 monthly rate, known for offering discounts to loyal customers, which can help make your cheap South Dakota auto insurance more affordable.

- Personalized Service: Strong emphasis on local agents providing personalized service, ensuring you get tailored advice for cheap South Dakota auto insurance.

- Variety of Discounts: Offers a broad range of discounts for various factors, helping you save on your cheap South Dakota auto insurance. Take a look at our Farmers auto insurance review to learn more.

Cons

- Higher Rates: Premiums may be higher compared to some other insurers, which could impact the overall cost of your cheap South Dakota auto insurance.

- Complex Policies: Some customers find the policy options and discounts confusing, which might complicate finding the best cheap South Dakota auto insurance.

#8 – Allstate: Best for Drivewise Program

Pros

- Drivewise Program: Ranked #8 with a $22 monthly rate, known for its Drivewise program that rewards safe driving with discounts, helping reduce the cost of cheap South Dakota auto insurance.

- Comprehensive Coverage: Extensive range of coverage options and add-ons, providing robust protection with your cheap South Dakota auto insurance.

- Strong Network: Large network of local agents providing personalized service, which can be beneficial for managing cheap South Dakota auto insurance.

Cons

- Higher Premiums: Rates can be on the higher side compared to some competitors, affecting the affordability of cheap South Dakota auto insurance. Read more in our detailed Allstate auto insurance review.

- Service Variability: Service quality can vary depending on the local agent, which may impact your experience with obtaining and maintaining cheap South Dakota auto insurance.

#9 – American Family: Best for Safe Driving

Pros

- Safe Driving Discounts: Ranked #9 with a $24 monthly rate, offers discounts for safe driving practices, which can help lower your cheap South Dakota auto insurance premiums.

- Customizable Policies: Provides a range of customizable coverage options, allowing you to tailor your cheap South Dakota auto insurance to fit your specific needs. Take a look at our Farmers auto insurance review to learn more.

- Positive Reputation: Generally positive reviews for customer service and claims handling, ensuring a good experience with your cheap South Dakota auto insurance.

Cons

- Higher Costs: Premiums can be higher compared to some other insurers, potentially impacting your ability to secure the cheapest South Dakota auto insurance.

- Limited Availability: Availability may be restricted in certain regions, which could affect your options for cheap South Dakota auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Policy Customization

Pros

- Policy Customization: Ranked #10 with a $37 monthly rate, known for offering extensive policy customization options, allowing you to tailor your cheap South Dakota auto insurance.

- Discounts: Attractive discounts for bundling policies and safety features can help reduce the overall cost of cheap South Dakota auto insurance. To see monthly premiums and honest rankings, read our Liberty Mutual auto insurance review.

- Strong Financial Ratings: Rated A by A.M. Best, indicating financial stability and reliability, ensuring your cheap South Dakota auto insurance is backed by a stable provider.

Cons

- Higher Premiums: Generally higher premiums compared to some other insurers, which may impact the affordability of cheap South Dakota auto insurance.

- Customer Service Issues: Some customers report challenges with customer service and claims processing, which could affect your experience with cheap South Dakota auto insurance.

South Dakota Auto Insurance Requirements

South Dakota drivers must have 25/50/25 coverage. This means that a driver must have a minimum of $25,000 in bodily injury liability insurance per party along with $50,000 total coverage per accident. $25,000 in coverage must also be included in the policy for property damage liability insurance.

South Dakota Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $22 $136

American Family $24 $151

Farmers $18 $113

Geico $9 $57

Liberty Mutual $37 $230

Nationwide $12 $76

Progressive $17 $105

State Farm $11 $67

Travelers $16 $97

USAA $10 $58

Drivers in South Dakota are also required to have coverage to protect against underinsured/uninsured motorists. Drivers are not required to have collision or comprehensive automobile insurance in South Dakota.

Bodily injury insurance protects drivers when they are involved in an accident and injure another person. South Dakota requires drivers to have this insurance to ensure financial responsibility when you are at fault in an accident.

Drivers should consider purchasing more than the state minimum for bodily injury insurance as it may cost the driver more money down the road in legal fees and court costs.

Property damage liability insurance covers the cost of the other party’s vehicle and any other property damaged in the accident where you are at fault. As an example of how this policy works, if you were to hit a vehicle as well as a house, the damage to both would be covered by your property damage coverage.

Comprehensive vs. Collision coverage, Collision coverage is another option for South Dakota auto insurance policies. While a collision policy is not required, drivers should strongly consider adding insurance coverage onto their vehicle if it is worth over $4,000.

Having a vehicle worth over $4,000 often means that a collision policy will pay for itself.

Collision coverage carries a deductible that you can select when you buy your policy. Individuals can decide which level of coverage is right for them. A lower deductible does mean a higher monthly insurance payment.

However, it means less money coming out of your pocket when you file a claim. Drivers should keep this in mind when deciding upon the deductible that is correct for them.

Personal injury protection insurance is another policy that is not required in South Dakota. However, drivers should strongly consider purchasing PIP protection. This policy protects a driver in case of personal injury during an auto accident.

A personal injury protection policy will pay costs such as lost wages, medical expenses, and other costs for you and your passengers regardless of fault in an accident.

PIP often costs a few dollars extra per month and can provide hundreds of thousands of dollars in extra coverage for individuals. Many auto insurance companies offer different levels of coverage and drivers should carefully consider which level of coverage is appropriate for their needs.

Comprehensive insurance, also known as full coverage auto insurance, is another optional insurance policy that many drivers choose to add to their policy.

Comprehensive auto insurance protects a vehicle if it were to be involved in a fire, natural disaster, or is broken into. Drivers should look at the cost of the additional premium monthly versus the cost of replacing their car.

A driver who does not have a comprehensive auto insurance policy and has a vehicle stolen may realize that the additional coverage was well worth it. Comprehensive auto insurance policies often have a deductible option.

Some drivers may choose a low deductible in order to be able to easily have their vehicle repaired. Other drivers choose to have a high deductible to lower their monthly premium.

Luckily the insurance rates in South Dakota are much cheaper in comparison to the other states in the nation. Enter your ZIP code now.

South Dakota Auto Insurance Rates by Company

South Dakota generally offers low auto insurance rates, but prices can vary significantly between providers. It’s important to compare different insurance companies to find the best rates and coverage for your needs.

Some providers offer competitive rates for good drivers, while others may provide discounts for bundling multiple policies, such as auto and home insurance.

There are also options for high-risk drivers, offering affordable plans even for those with a less-than-perfect driving history.

Additionally, some companies are known for their variety of coverage options and customizable plans, while others stand out for excellent customer service and quick claims processing, though they may come at a slightly higher price.

When shopping for auto insurance in South Dakota, consider not just the cost but also the coverage options, customer service, and available discounts to find the best policy for your budget and needs.

Learn about how age affects auto insurance rates.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Comparing Auto Insurance Quotes in South Dakota

Drivers in South Dakota should carefully review the different options available for cheap auto insurance, including full coverage car insurance. It’s important to consider a variety of policies to find the one that best suits their needs.

Schimri Yoyo Licensed Agent & Financial Advisor

Full coverage car insurance provides comprehensive protection, including liability, collision, and comprehensive coverage, making it a crucial option for those looking for extensive coverage.

If you are a South Dakota driver, enter your ZIP code below to compare quotes from top South Dakota auto insurance companies.

Frequently Asked Questions

What are the minimum auto insurance requirements in South Dakota?

In South Dakota, drivers are required to carry the 25/50/25 auto insurance coverage. This means a minimum of $25,000 in bodily injury liability insurance per person, $50,000 total coverage per accident, and $25,000 in property damage liability insurance.

Do South Dakota drivers need uninsured/underinsured motorist coverage?

Yes, South Dakota drivers are required to have uninsured/underinsured motorist coverage. This coverage protects you in case you are involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. Enter your ZIP code today.

What optional coverage choices are available in South Dakota?

While collision and comprehensive insurance are optional in South Dakota, it’s highly recommended to consider adding them to your policy. Collision coverage protects your vehicle in case of an accident, and comprehensive coverage covers damage from other incidents like theft or natural disasters.

To get a clearer picture of how these coverages will impact your premium, you can find auto insurance quotes online. This will help you compare different options and make an informed decision about the best coverage for your needs.

What is personal injury protection (PIP) coverage? Is it required in South Dakota?

Personal injury protection (PIP) coverage is not required in South Dakota, but it is strongly recommended. PIP covers medical expenses, lost wages, and other costs for you and your passengers, regardless of fault in an accident.

It provides additional coverage and financial protection in case of injury.

Are auto insurance rates in South Dakota affordable?

Yes, auto insurance rates in South Dakota are generally affordable compared to the national average. The statewide average for auto insurance is just under $1,100 per year, which is less than $100 per month.

However, rates may vary depending on factors such as your driving record, age, and the insurance company you choose. It’s important to compare quotes from multiple companies to find the best rate for your needs. Enter your ZIP code now.

What is the liability insurance limit in South Dakota?

In South Dakota, the liability insurance limit is 25/50/25, which means $25,000 for bodily injury per person, $50,000 for total bodily injury per accident, and $25,000 for property damage.

When it comes to understanding how auto insurance claims work in the state, these limits define the maximum amount your insurance company will pay out in the event of a claim. If damages exceed these limits, you could be responsible for the additional costs.

Is South Dakota a no-fault state?

No, South Dakota is an at-fault state for auto insurance.

Is it illegal to drive without auto insurance in South Dakota?

Yes, drivers must carry the required auto insurance coverages in South Dakota to drive legally. Enter your ZIP code now.

What is the minimum required auto insurance coverage for drivers in South Dakota?

Drivers in South Dakota are required to have 25/50/25 coverage, which includes $25,000 in bodily injury liability per person, $50,000 total per accident, and $25,000 in property damage liability.

This ensures basic protection in the event of an accident. To make sure you meet these requirements, it’s important to know your car’s make and model, as this information is often needed when purchasing or updating your insurance policy.

If you’re unsure how to find your car make and model, you can usually locate this information on your vehicle registration, insurance card, or the car’s dashboard.

Which South Dakota auto insurance provider is noted for offering the lowest average monthly rate?

Geico is noted for offering the lowest average monthly rate at $9. This makes it a highly competitive option for cheap South Dakota auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.