Cheap Wyoming Auto Insurance in 2025 (Save Big With These 10 Companies!)

USAA, Liberty Mutual, and State Farm are the best choices for the cheap Wyoming auto insurance. With USAA offering rates as low as $13 per month, these providers deliver great value. Known for their extensive coverage and competitive pricing, they are ideal for Wyoming drivers seeking reliable insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Min. Coverage in Wyoming

A.M. Best Rating

Complaint Level

Company Facts

Min. Coverage in Wyoming

A.M. Best Rating

Complaint Level

Pros & Cons

When seeking for the cheap Wyoming auto insurance, our top pick overall is USAA, known for its comprehensive coverage and competitive rates.

Drivers on Wyoming roads and highways need the required Wyoming auto insurance, but it doesn’t have to be expensive. Opting for minimum auto liability insurance coverage can fulfill legal requirements while keeping costs down.

Our Top 10 Company Picks: Cheap Wyoming Auto Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $13 A+ Member Benefits USAA

#2 $17 A Custom Coverage Liberty Mutual

#3 $19 B Network Discounts State Farm

#4 $23 A++ Policy Bundles Travelers

#5 $24 A+ Snapshot Program Progressive

#6 $25 A Loyalty Rewards American Family

#7 $26 A++ Online Convenience Geico

#8 $27 A+ SmartRide Program Nationwide

#9 $30 A Policy Options Farmers

#10 $36 A++ Safe Driving Allstate

Understanding auto insurance and the rates you should be paying will help you confidently buy the best Wyoming auto insurance.

We’ll cover cheap Wyoming auto insurance rates, laws, and coverage options. Enter your ZIP code now to begin.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#1 – USAA: Top Overall Pick

Pros

- Competitive Premiums: Offers some of the lowest premiums in Wyoming, starting as low as $13 per month, crowning it highly affordable for eligible members. It ensures substantial savings for those who qualify.

- Full Coverage: Includes coverage options and additional benefits tailored to military families, such as roadside assistance and rental reimbursement. This means members can get robust protection without sacrificing affordability.

- Outstanding Customer Support: High satisfaction from members for customer, with an A+ rating from A.M. Best indicating strong reliability. This adds value to the low-cost insurance by ensuring reliable service. Compare details through our Allstate vs. USAA insurance review.

Cons

- Membership Requirements: Coverage is only available to some family members and veterans, which excludes many potential customers. This limitation means that those outside this group might not benefit from the competitive rates.

- Limited Availability: Restricted in some states, potentially leaving some customers without access to their services. In Wyoming, this could mean fewer options for affordable insurance if you’re not eligible for USAA.

#2 – Liberty Mutual: Best for Custom Coverage

Pros

- Tailored Coverage: Allows for extensive customization to meet individual needs, with options for added protection like new car replacement and better car replacement. This ensures that even those seeking budget-friendly options can tailor their coverage to their needs without overspending.

- Various Premiums: Offers multiple deductions, including those for bundling home and auto insurance, and accident forgiveness, which significantly lower premiums. These discounts can make Liberty Mutual a competitive choice for cheap Wyoming auto insurance.

- Flexible Payment Options: Provides a range of payment plans, including monthly and quarterly options, to fit different budgets and financial situations. This flexibility can help manage the cost of insurance more effectively. Dive in more through our Liberty Mutual auto insurance review.

Cons

- Increased Rates for Some: May have higher premiums for drivers with less-than-perfect records or those who do not take advantage of available discounts. This can impact affordability for high-risk drivers looking for cheap Wyoming auto insurance.

- Complexity in Policies: Policy details and available discounts can be complex and difficult to understand, requiring thorough review to maximize benefits. This complexity might make it harder to find the best rates for affordable coverage.

#3 – State Farm: Best for Network Discounts

Pros

- Network Discounts: Offers numerous discounts for using a network of approved repair shops, which can lead to savings on repairs and maintenance. This can lower the overall cost of insurance, making it more affordable in Wyoming.

- Wide Range of Coverage: Provides various coverage options including liability, collision, and comprehensive, tailored to meet diverse needs. This variety allows for choosing budget-friendly options without sacrificing essential coverage.

- Strong Customer Support: Known for responsive and helpful customer service, with a solid B rating from A.M. Best, indicating reliable support. Good service can enhance the value of inexpensive auto insurance by providing reliable assistance. Delve more through our State Farm insurance review.

Cons

- Higher Prices for Certain Drivers: May have higher rates for drivers with poor credit or driving history, which can lead to less competitive pricing for high-risk individuals. This may impact the affordability of cheap Wyoming auto insurance for some drivers.

- Limited Online Tools: Less advanced online tools compared to competitors, which may affect the ease of managing policies and claims. This can be a drawback for those seeking a cost-effective and user-friendly insurance experience.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Travelers: Best for Policy Bundles

Pros

- Policy Bundles: Offers significant savings for bundling auto insurance with other policies like home or renters insurance, which can result in overall lower costs. This bundling can make Travelers a cost-effective choice for cheap Wyoming auto insurance.

- Extensive Coverage Options: Provides a broad range of coverage options and add-ons, including specialized policies for high-value vehicles. This allows for customization within a budget, maintaining affordability while meeting specific needs.

- Flexible Payment Plans: Offers various payment plans, including monthly, quarterly, and annual options, to accommodate different financial situations. This flexibility ensures that cheap Wyoming auto insurance can fit into various budgets. Look for more details through our Travelers insurance review.

Cons

- Customer Service Variability: Customer service experiences can vary by region, with some areas reporting slower response times or less satisfactory service. This variability can affect the overall value of cheap Wyoming auto insurance if customer support is inconsistent.

- Higher Premiums for Some: May have higher rates for drivers with high-risk profiles, which can make it less competitive for those with poor driving records. This can be a limitation for finding affordable coverage in Wyoming for high-risk drivers.

#5 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: Offers discounts based on driving behavior through the Snapshot program, which can lead to lower premiums for safe drivers. This program can significantly reduce the cost of insurance, making it a good option for cheap Wyoming auto insurance.

- Wide Range of Discounts: Includes discounts for safe driving, bundling multiple policies, and paying in full, helping to reduce overall insurance costs. These savings opportunities make Progressive a strong contender for affordable auto insurance.

- Flexible Coverage Options: Provides various coverage and add-on options, including roadside assistance and rental car reimbursement. This flexibility allows customers to tailor their coverage to their needs without overspending. Find out more through our Progressive insurance review.

Cons

- Variable Premiums: Rates can vary significantly based on driving history and behavior, which can result in less predictable pricing. This variability might impact those looking for consistently low rates in Wyoming.

- Complex Policies: Can be challenging to navigate the wide range of policy options and discounts, requiring careful review to ensure optimal coverage. This complexity might affect the ability to find the best cheap auto insurance options easily.

#6 – American Family: Best for Loyalty Rewards

Pros

- Loyalty Rewards: Offers rewards for long-term customers and those with multiple policies, including discounts and special perks. This rewards system can enhance the affordability of auto insurance over time.

- Comprehensive Coverage Options: Provides extensive coverage options and additional features, such as accident forgiveness and new car replacement. This comprehensive approach ensures that affordable coverage doesn’t compromise on protection.

- Strong Local Presence: Good network of local agents who provide personalized service and support, enhancing the customer experience. This local presence helps residents find affordable coverage tailored to their needs. Discover more through our American Family insurance review.

Cons

- Higher Costs for Some Drivers: Premiums can be higher for drivers with less-than-ideal records, making it less competitive for high-risk individuals. This may impact affordability for those seeking cheap auto insurance in Wyoming.

- Limited Online Tools: Fewer online management tools compared to some competitors, which may impact convenience and ease of access. This limitation can affect the efficiency of managing low-cost insurance policies.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – Geico: Best for Online Convenience

Pros

- Competitive Rates: Often provides some of the lowest rates in the industry, with premiums starting at $26 per month, which makes it a cost-effective option for those seeking cheap Wyoming auto insurance.

- Excellent Online Tools: Highly rated for its user-friendly website and mobile app, which simplify policy management and claims filing. This convenience can enhance the experience of managing affordable auto insurance.

- Quick Quotes: Fast and easy quote process online, allowing customers to get coverage information quickly and conveniently. This rapid process helps in finding the best deals for cheap Wyoming auto insurance. Read more through our Geico insurance review.

Cons

- Customer Service Issues: Some customers report mixed experiences with customer service, including issues with claims handling and support. This inconsistency can affect the overall value of cheap Wyoming auto insurance if service quality is poor.

- Limited Local Agent Network: Fewer local agents available for in-person support, which may affect those who prefer face-to-face interactions. This limitation can be a drawback for those seeking personalized assistance with affordable insurance.

#8 – Nationwide: Best for SmartRide Program

Pros

- SmartRide Program: Offers discounts for safe driving through the SmartRide program, which can lead to lower premiums based on driving behavior. This program helps reduce the cost of insurance, making it a good choice for cheap Wyoming auto insurance.

- Comprehensive Coverage Options: Provides a wide range of coverage options and additional features, including rental car reimbursement and roadside assistance. This allows for customization while maintaining affordability.

- Good Customer Service: Known for solid customer service and support, with an A+ rating from A.M. Best indicating strong reliability. Reliable service supports the value of affordable auto insurance by ensuring quality assistance. Find out more through our Nationwide insurance review.

Cons

- Higher Rates for Some: Premiums can be higher for high-risk drivers, which may make it less competitive for those with poor driving records. This can impact the affordability of cheap Wyoming auto insurance.

- Complex Policy Details: Policies and discounts can be complex and difficult to understand, requiring careful review to ensure the best coverage. This complexity might make it harder to find the best rates for cheap auto insurance.

#9 – Farmers: Best for Policy Options

Pros

- Customizable Policies: Offers a range of customizable policy options, allowing customers to tailor coverage to their specific needs and preferences. This flexibility helps in finding affordable coverage without overspending.

- Broad Coverage Options: Includes a variety of coverage types and add-ons, such as rental car coverage and accident forgiveness. This variety ensures that customers can secure affordable coverage while still getting essential protections.

- Good Customer Service: Known for responsive and helpful customer service, with an A rating from A.M. Best indicating reliable support. Good service enhances the value of cheap Wyoming auto insurance by providing effective assistance. Read more through our Farmers auto insurance review.

Cons

- Higher Premiums for Some: May have higher rates for drivers with poor credit or driving records, making it less affordable for high-risk individuals. This can impact the affordability of cheap Wyoming auto insurance for those with less favorable profiles.

- Complex Policy Structure: Can be challenging to navigate the various policy options and discounts, requiring careful consideration. This complexity might hinder finding the best deals for cheap auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – Allstate: Best for Safe Driving

Pros

- Safe Driving Discounts: Offers discounts for safe driving and low-mileage drivers, which can help reduce premiums for responsible drivers. This can make Allstate a competitive choice for cheap Wyoming auto insurance.

- Comprehensive Coverage: Provides extensive coverage options and additional features, including accident forgiveness and new car replacement. This ensures that affordable coverage includes important protections.

- Good Agent Network: Strong network of local agents who offer personalized service and support, enhancing the customer experience. This local presence can help in finding affordable coverage tailored to individual needs. Read more through our Allstate insurance review.

Cons

- Higher Rates: Premiums can be higher compared to some competitors, particularly for drivers with higher risk profiles. This might make it less competitive for those seeking cheap auto insurance in Wyoming.

- Mixed Customer Service: Customer service experiences can vary, with some reports of slower response times or less satisfactory support. This variability might affect the overall value of affordable auto insurance.

Wyoming Auto Insurance Requirements

Optional coverage in Wyoming (varies by carrier) includes Comprehensive Coverage, Collision Coverage, Medical Payments Coverage, Rental Car Reimbursement Coverage, and Roadside Assistance/Towing and Labor Coverage.

The minimum amount of auto liability coverage for a single person in an automobile accident is $25,000. This means that your insurance policy will pay out a maximum of $25,000 for each individual injured in an accident. Wyoming requires that $50,000 to cover all people injured in a single accident.

Drivers also must carry $20,000 in property damage liability insurance. Property damage liability insurance pays for damage to the personal property of another person as a result of an automobile accident.

Wyoming Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $36 155

American Family $25 111

Farmers $30 130

Geico $26 111

Liberty Mutual $17 75

Nationwide $27 114

Progressive $24 106

State Farm $19 82

Travelers $23 98

USAA $13 57

It should be noted that 25/50/20 is the minimum amount of coverage that drivers must have. Drivers can choose to have far more coverage and should purchase as much coverage as they can afford. Wyoming uses a tort system of auto insurance, which means that drivers are able to take each other to court to seek damages resulting from an accident.

Drivers in the state of Wyoming must produce proof of automobile insurance when they register their vehicles. Drivers cannot register a vehicle in Wyoming without valid proof of insurance. Drivers who choose to drive without valid insurance may be convicted of a misdemeanor. A fine ranging from $250 to $750 as well as jail time may be assigned by a judge.

Although auto insurance is required, many Wyoming drivers still try to test their luck on the road without it. Because of this, uninsured/underinsured motorist coverage is required in the state. It must have the same limits as your liability coverage.

Ty Stewart

Licensed Insurance Agent

Drivers are encouraged to purchase this insurance to protect against potential monetary losses. Uninsured/underinsured motorist coverage only adds a few extra dollars to a monthly premium but can save a motorist hundreds of thousands of dollars in the future.

Drivers in Wyoming are not required to have collision coverage. Wyoming drivers should strongly consider purchasing collision coverage as Wyoming is a tort state. Collision coverage protects a driver’s vehicle from colliding with another vehicle or object. This will pay for repairs to your vehicle.

Body shop repairs can easily cost thousands of dollars for vehicles that need several parts replaced, painted, and mounted onto the vehicle. Drivers who are still paying off their loan or have a lease vehicle may be required to have collision coverage.

Wyoming drivers are not required to have comprehensive coverage. The ability for Wyoming drivers to sue each other means that Wyoming drivers should strongly consider comprehensive coverage.

Comprehensive coverage will pay for theft, vandalism, and acts of God. Drivers will be able to recover the cost of their vehicle if it is stolen. Drivers who have a vehicle that is still under a loan or is being leased should strongly consider comprehensive coverage.

The statewide average for auto insurance is just under $13 per month. Compared to the national average, this rate is more than $36 less. What’s even better is that the rate doesn’t change much when going from an average rural area to a big city.

While many of these factors are simply based on your own driving record, two things that affect even the safest of drivers are age and gender. As with most states, males typically pay higher auto insurance rates than females.

Wyoming Driving Laws and Statistics

Teenage drivers in Wyoming must participate in the Graduated Drivers License program or GDL. This means that a teenage driver must first apply for the instruction permit. Drivers must spend at least six months at this level as well as complete 50 total hours of driving experience. 10 hours must be at night.

The intermediate permit phase requires that drivers pass a road skills test, vision screening and meet all requirements set by the state of Wyoming. Drivers who have held this license for six months and have not been ticketed/convicted of any offense may apply for a full license.

Wyoming drivers have one of the lowest DUI rates in the country. This is partially due to the low population of the state as well as a strict enforcement program. Adult drivers are not allowed to drive once their BAC reaches 0.08. Any driver who is found with 0.08 BAC or higher may be found guilty of DUI.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Wyoming Auto Insurance Rates by Company

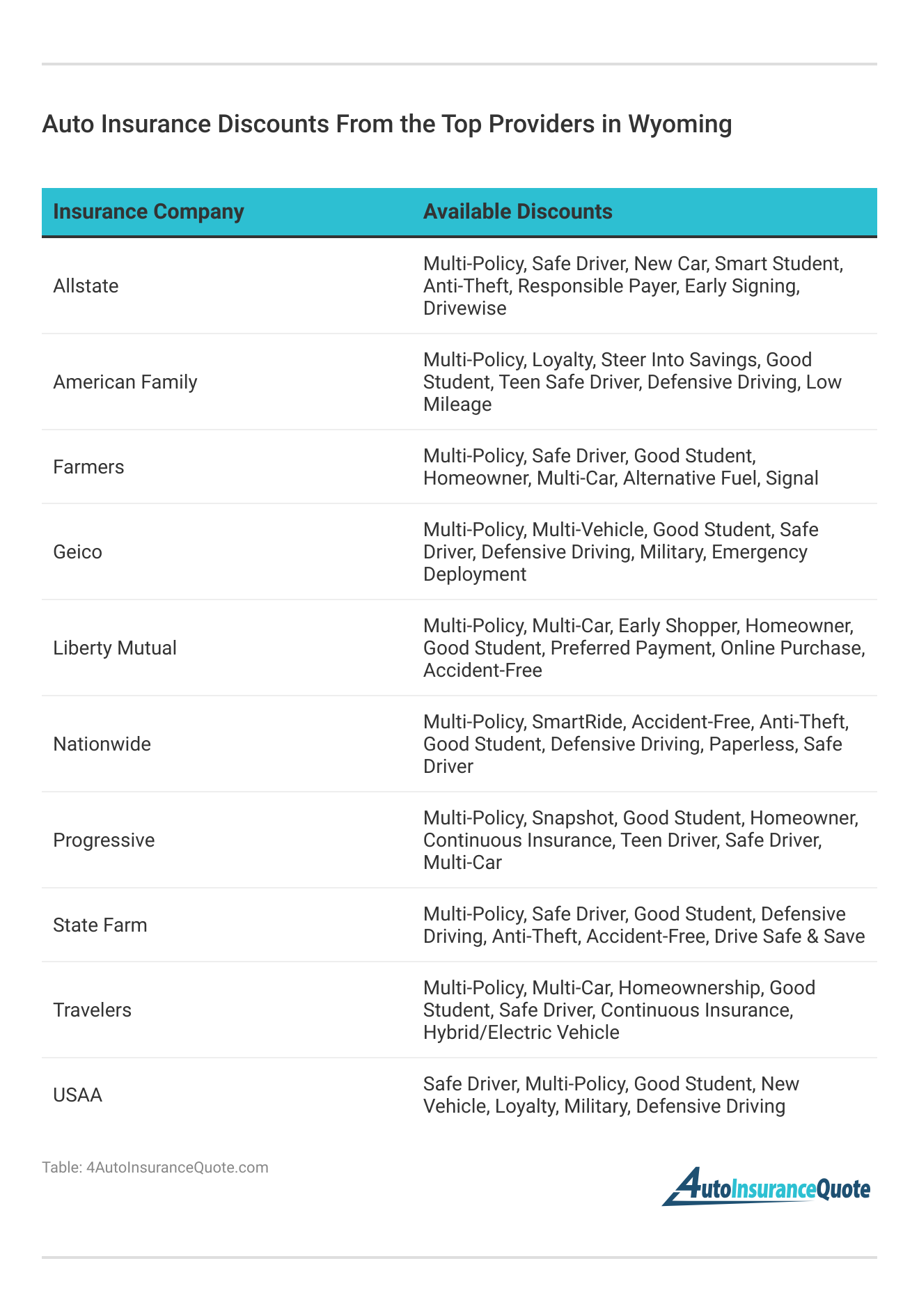

Though Wyoming boasts very cheap auto insurance rates overall, it’s important to understand how rates vary among some of the largest companies. State Farm is known for its competitive rates and excellent customer service, while Geico often provides some of the lowest rates, especially for drivers with a clean record.

Progressive offers various discounts and flexible coverage options, making it a popular choice among residents. Allstate’s rates may be slightly higher, but they are known for their comprehensive coverage options and extensive agent network. Farmers provides competitive rates and a range of customizable policy options, catering to the diverse needs of Wyoming drivers.

Understanding the different types of auto insurance coverage offered by these providers can help ensure you get the best rate for your needed protection.

Wyoming Auto Insurance – Additional Resources

Compare cheap Wyoming auto insurance quotes from top companies today. Just enter your ZIP code below for free quotes from the best Wyoming auto insurance companies.

Frequently Asked Questions

What are the minimum auto insurance requirements in Wyoming?

Minimum coverage is 25/50/20 (bodily injury per person/bodily injury per accident/property damage per accident).

Can I get additional coverage in Wyoming?

Yes, you can add optional coverage like uninsured/underinsured motorist, collision, and comprehensive. Enter your ZIP code now to begin comparing.

What happens if I drive without insurance in Wyoming?

Driving without insurance is illegal and can lead to significant consequences such as fines, jail time, and issues with vehicle registration. To avoid these problems, it’s crucial to understand auto insurance thoroughly.

By grasping the fundamentals of auto insurance, you can ensure you meet legal requirements and avoid costly penalties.

Are there special requirements for teenage drivers in Wyoming?

Yes, teenage drivers must go through the Graduated Drivers License (GDL) program.

Is Wyoming auto insurance cheaper?

Average yearly premium is around $1,100, which is on the lower side, but rates can vary based on factors like location and driving history. Enter your ZIP code now to begin comparing.

Do drivers need auto insurance in Wyoming?

Yes, all drivers must carry auto insurance coverage in Wyoming. If you’re involved in an accident, you’ll need to file an auto insurance claim to cover damages or injuries.

Ensuring you have the right coverage can make a significant difference in the outcome of your claim.

Is Wyoming a no-fault state?

No, Wyoming is an at-fault state.

Which insurance provider offers the lowest monthly rates in Wyoming, according to the article?

USAA offers the lowest monthly rates in Wyoming, starting at $13. This makes it an excellent choice for affordable coverage. Enter your ZIP code now to begin comparing.

What discount programs does Progressive offer that can help reduce the cost of auto insurance?

Progressive offers the Snapshot program, which tracks driving behavior to potentially lower premiums based on safe driving habits. By participating in this program, drivers can qualify for auto insurance discounts, leading to significant savings for those who maintain cautious driving habits.

How does the Snapshot program from Progressive contribute to lowering auto insurance premiums?

The Snapshot program monitors driving habits through a mobile app or device, offering discounts based on safe driving patterns. Drivers who demonstrate responsible behavior can receive reduced premiums as a result.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.