Cheap Louisiana Auto Insurance in 2025 (Get Low-Cost Coverage With These 10 Companies)

State Farm, Geico, and Travelers are leading choices for cheap Louisiana auto insurance. These companies provide some of the most competitive rates, starting at $33 per month. This article examines the pros and cons of each insurer to assist Louisiana drivers in making an informed decision.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage in Louisiana

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsState Farm, Geico, and Travelers are top provider for cheap Louisiana auto insurance, offering cheaper rates starting at $33/mo. and comprehensive coverage options.

Louisiana auto insurance law requires all drivers to carry a minimum amount of coverage to provide financial protection in the event of a car accident.

- Cheap Louisiana Auto Insurance

- Get Affordable Kinder, LA Auto Insurance Quotes (2025)

- Get Affordable Grayson, LA Auto Insurance Quotes (2025)

- Get Affordable Estherwood, LA Auto Insurance Quotes (2025)

- Get Affordable Castor, LA Auto Insurance Quotes (2025)

- Get Affordable Boutte, LA Auto Insurance Quotes (2025)

- Get Affordable Baton Rouge, LA Auto Insurance Quotes (2025)

Understanding auto insurance requirements can be confusing, but finding cheap Louisiana auto insurance can help you meet these requirements affordably. We have all the information you need to make the process easier.

Our Top 10 Company Picks: Cheap Louisiana Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $33 | B | Local Agents | State Farm | |

| #2 | $38 | A++ | Good Drivers | Geico | |

| #3 | $42 | A++ | Bundling Policies | Travelers | |

| #4 | $43 | A+ | Online Management | Progressive | |

| #5 | $47 | A | Claims Service | American Family | |

| #6 | $55 | A+ | UBI Discount | Allstate | |

| #7 | $56 | A | Roadside Assistance | AAA |

| #8 | $57 | A | Customizable Policies | Farmers | |

| #9 | $73 | A | Policy Options | Liberty Mutual |

| #10 | $80 | A+ | Organization Discount | The Hartford |

Find affordable Louisiana auto insurance quotes quickly. Just enter your ZIP code above for fast, free Louisana auto insurance quotes.

- Louisiana auto insurance averages $33/mo

- Louisiana laws require 15/30/25 coverage

- Compare rates from top Louisiana insurers to save

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Nationwide Coverage: Offers extensive coverage options across the country while providing cheap Louisiana auto insurance.

- Discounts: Multiple discount options, including safe driver, good student, and multi-policy discounts, making it easier to find cheap Louisiana auto insurance. Delve more through our “State Farm Insurance Review.”

- Customer Service: Excellent customer service with 24/7 support to assist with any cheap Louisiana auto insurance queries.

Cons

- Higher Premiums: Can be more expensive compared to some competitors, making it challenging to find cheap Louisiana auto insurance.

- Digital Experience: The mobile app and online platform can be less user-friendly, impacting the ease of managing your cheap Louisiana auto insurance. Best for those who prefer working with local agents.

#2 – Geico: Best for Good Drivers

Pros

- Affordable Rates: Known for offering some of the most competitive rates in the industry, ideal for those seeking cheap Louisiana auto insurance.

- User-Friendly App: Excellent mobile app for managing policies and claims related to cheap Louisiana auto insurance.

- Discounts: Wide range of discounts available to help secure cheap Louisiana auto insurance. Read more through our “Geico Insurance Review.”

Cons

- Limited Local Agents: Mostly operates online with fewer local agents available, which may be a downside for those looking for personalized help with cheap Louisiana auto insurance.

- Coverage Options: Fewer specialized coverage options compared to some competitors, which might affect the availability of tailored cheap Louisiana auto insurance. Best for good drivers.

#3 – Travelers: Best for Bundling Policies

Pros

- Comprehensive Coverage: Offers a wide range of coverage options to meet the needs of those looking for cheap Louisiana auto insurance. Look for more details through our “Travelers insurance review.”

- Discounts: Multiple discounts available for safe driving, homeownership, and more, helping to secure cheap Louisiana auto insurance.

- Customer Service: Reliable customer service to assist with cheap Louisiana auto insurance policies.

Cons

- Rates: Premiums can be higher than some other insurers, affecting the overall affordability of cheap Louisiana auto insurance.

- Digital Tools: Online tools and mobile app are not as advanced as competitors, which may impact the management of cheap Louisiana auto insurance. Best for bundling policies.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Progressive: Best for Online Management

Pros

- Competitive Pricing: Known for competitive pricing and discounts, making it a good choice for cheap Louisiana auto insurance.

- Snapshot Program: Usage-based insurance program for additional savings, aiding in the search for cheap Louisiana auto insurance. Find out more through our “Progressive Insurance Review.”

- Online Tools: Robust online tools and mobile app for managing cheap Louisiana auto insurance.

Cons

- Customer Service: Mixed reviews on customer service experiences, which could affect the satisfaction of cheap Louisiana auto insurance customers.

- Claims Process: Claims process can be slow, potentially impacting the experience for those with cheap Louisiana auto insurance. Best for online management.

#5 – American Family: Best for Claims Service

Pros

- Comprehensive Coverage: Offers a variety of coverage options to meet different needs, including cheap Louisiana auto insurance.

- Discounts: Multiple discount options available to help lower the cost of cheap Louisiana auto insurance.

- Local Agents: Access to local agents for personalized assistance with cheap Louisiana auto insurance. Learn more through our “American Family Auto Insurance Review.”

Cons

- Premium Costs: Can be higher than some other providers, impacting the affordability of cheap Louisiana auto insurance.

- Digital Experience: Online tools and app could be more user-friendly, affecting the management of cheap Louisiana auto insurance. Best for claims service.

#6 – Allstate: UBI Discount

Pros

- Extensive Coverage Options: Offers a variety of coverage options, including cheap Louisiana auto insurance. Read more through on Allstate insurance review.

- Discounts: Numerous discounts available to help secure cheap Louisiana auto insurance.

- Local Agents: Access to a large network of local agents for assistance with cheap Louisiana auto insurance.

Cons

- Premium Costs: Can be more expensive than other providers, affecting the search for cheap Louisiana auto insurance.

- Mixed Reviews: Mixed customer reviews regarding claims handling, which could impact the experience with cheap Louisiana auto insurance. Best for UBI discount.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – AAA Insurance: Best for Roadside Assistance

Pros

- Roadside Assistance: Excellent roadside assistance coverage, complementing cheap Louisiana auto insurance.

- Membership Benefits: Offers numerous membership benefits that enhance cheap Louisiana auto insurance. Read more on AAA auto insurance review.

- Discounts: Various discounts available to help secure cheap Louisiana auto insurance.

Cons

- Premium Costs: Higher premiums compared to some other providers, impacting the affordability of cheap Louisiana auto insurance.

- Coverage Options: Limited compared to some competitors, which might affect the customization of cheap Louisiana auto insurance. Best for roadside assistance.

#8 – Farmers: Best for Customizable Policies

Pros

- Coverage Options: Broad range of coverage options to suit various needs, including cheap Louisiana auto insurance.

- Discounts: Various discounts available to help lower the cost of cheap Louisiana auto insurance. Read more through on Farmers auto insurance review.

- Local Agents: Large network of local agents for personalized assistance with cheap Louisiana auto insurance.

Cons

- Premiums: Higher premiums compared to some other insurers, affecting the affordability of cheap Louisiana auto insurance.

- Claims Process: Mixed reviews on claims process efficiency, which could impact the experience with cheap Louisiana auto insurance. Best for customizable policies.

#9 – Liberty Mutual: Best for Policy Options

Pros

- Flexible Coverage: Offers customizable coverage options, including cheap Louisiana auto insurance. Read more through on Liberty Mutual auto insurance review.

- Discounts: Many discounts available to help secure cheap Louisiana auto insurance.

- Online Tools: User-friendly online tools and mobile app for managing cheap Louisiana auto insurance.

Cons

- Rates: Can be expensive, impacting the search for cheap Louisiana auto insurance.

- Claims Handling: Mixed reviews on claims handling, which could affect the satisfaction of cheap Louisiana auto insurance customers. Best for policy options.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – The Hartford: Best for Organization Discount

Pros

- Organization Discounts: Offers discounts for AARP members, making it easier to find cheap Louisiana auto insurance.

- Customer Service: Excellent customer service to assist with cheap Louisiana auto insurance needs.

- Financial Stability: Strong financial backing for peace of mind with cheap Louisiana auto insurance. Learn more on auto insurance policy with The Hartford.

Cons

- Premium Costs: Higher premiums compared to some other providers, impacting the affordability of cheap Louisiana auto insurance.

- Eligibility: Some discounts only available to certain organizations, which might limit options for cheap Louisiana auto insurance. Best for organization discounts.

Louisiana Auto Insurance Laws And Minimum Requirements

When legislators in Louisiana put together the state’s auto insurance laws, they chose to stick with the standard tort system of auto insurance in use in most other states around the country. Under this system, when an accident occurs one of the drivers will be deemed to be the driver at fault for causing the accident.

Louisiana Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $56 | $120 |

| Allstate | $55 | $108 |

| American Family | $47 | $84 |

| Farmers | $57 | $117 |

| Geico | $38 | $37 |

| Liberty Mutual | $73 | $120 |

| Progressive | $43 | $94 |

| State Farm | $33 | $59 |

| The Hartford | $80 | $146 |

| Travelers | $42 | $61 |

This driver’s insurance company will then be responsible for paying out claims for injuries and damages, and this driver will be the one who is targeted with any lawsuits that result from the accident itself.

State law requires that all drivers purchase auto insurance to be allowed to legally drive their automobiles on the state’s roads. There are two main coverages that drivers are required to purchase; all of the other coverage offered by auto insurance companies are optional.

The first coverage required is known as bodily injury liability insurance. This policy pays out claims for medical treatment expenses, rehabilitation costs, lost wages, and the like for injuries stemming from an accident where you are the party at fault.

For instance, if you rear-ended a car stopped at a traffic light, causing the driver ahead to get whiplash, their injury claims would be made against this policy and your insurance company would pay up to the maximum of your coverage. The minimum required coverage in Louisiana is $15,000 per person, per accident, and $30,000 for all parties per accident.

These amounts are somewhat low, so it’s recommended that drivers in Louisiana consider bumping this up with supplemental coverage if it can be afforded.

For instance, if you veer into the other lane and hit a car, the costs of making repairs to the car you’ve hit will be claimed against your property damage liability insurance. The minimum required coverage in Louisiana is $25,000.

Louisiana Auto Insurance Rates

Insurance rates for drivers in Louisiana have always been a bit higher than those in most other states, and this trend has continued into 2011. The current statewide monthly cost worth of auto insurance is $149 which is higher than the $119.

Those who live in major cities in Louisiana, however, tend to have it much worse. For those residing in Baton Rouge, you’re looking at about $179 to insure the starting automobile for a month, and drivers in New Orleans can expect an monthly bill of $189, which is close to $200 per month.

While many of these factors are simply based on your own driving record, there are two factors that impact even the safest of drivers: how age affects your auto insurance rates, as does gender. As with most states, males typically pay higher auto insurance rates than females. Teenage males can easily expect to pay $100 more for their coverage than females. Enter your ZIP code to compare rates.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Louisiana Driving Statistics

The news is positive for Louisiana’s drivers, as crash rates have continued to trend downward since peaking earlier in the decade. In 2009, there were 155,100 total vehicle crashes and 824 fatalities. This trend could help stabilize or even reduce car insurance premiums, benefiting drivers across the state.

Both of these figures were decreases from 2008, which saw 157,200 crashes and 915 fatalities. These decreases come as the state saw an increase of nearly 1% in the total number of vehicle miles traveled, which means that although Louisiana’s drivers are taking to the roads more often, they are becoming better, safer drivers.

If this trend should continue, it will help decrease the statewide average cost of auto insurance.

Auto theft figures throughout the state continue to decline as well. In 2009 there were 11,717 reported instances of vehicle theft, which was a decrease of almost 2,000 vehicles from the 2008 numbers.

Since the decade began, auto theft rates in Louisiana are down over forty percent, wiping out the minor increases that were seen in the New Orleans area following Hurricane Katrina.

As Louisiana’s car owners continue to protect their vehicles with anti-theft devices, and law enforcement initiatives become more and more efficient at getting criminals off of the streets, these numbers will drop even further.

Additional Automobile Insurance Resources in the State of Louisiana

Additional automobile insurance resources in the State of Louisiana can be invaluable when searching for cheap Louisiana auto insurance. Understanding the mandatory requirements, such as property damage liability insurance, is crucial.

It's important to know that your insurance company will handle claims for injuries and damages from an accident.Ty Stewart Licensed Insurance Agent

This coverage ensures that in the event of an accident where you are at fault, the insurance pays for the damage to the other party’s vehicle, property, and related expenses.

Utilizing these resources can help you find the most affordable options that still meet Louisiana’s legal requirements, providing peace of mind while driving on the state’s roads. Ready to compare auto insurance rates and find car insurance in Louisiana? Enter your ZIP code below now.

Frequently Asked Questions

What are the minimum auto insurance requirements in Louisiana?

Louisiana requires 15/30/25 coverage for bodily injury and property damage.

Are there any optional coverage options in Louisiana?

Yes, optional coverage includes comprehensive, collision, uninsured/underinsured motorist, and medical payments. Enter you ZIP code now.

How does Louisiana’s auto insurance system work?

Louisiana follows the tort system, where the at-fault driver is responsible for damages. This means that in the event of an accident, the at-fault driver’s best auto insurance companies will be responsible for covering the costs of any injuries and property damage resulting from the accident.

What is the average cost of auto insurance in Louisiana?

The average rate is $149 per month.

How can I find affordable auto insurance in Louisiana?

Compare quotes from multiple companies to find the best rates. Use our free quote comparison tool. Just enter your ZIP code to get started.

What types of auto insurance are required in Louisiana?

Louisiana law mandates a minimum coverage of 15/30/25 for bodily injury and property damage. To help meet these requirements while staying within your budget, look for auto insurance discounts for affordable coverage that can reduce your monthly premiums.

How can I find cheap Louisiana auto insurance?

To find cheap Louisiana auto insurance, it’s advisable to compare quotes from various top insurance providers in the state.

What factors affect the cost of auto insurance in Louisiana?

Factors such as your driving record, age, vehicle type, and location within the state can impact the cost of your auto insurance. Enter your ZIP code now to compare rates.

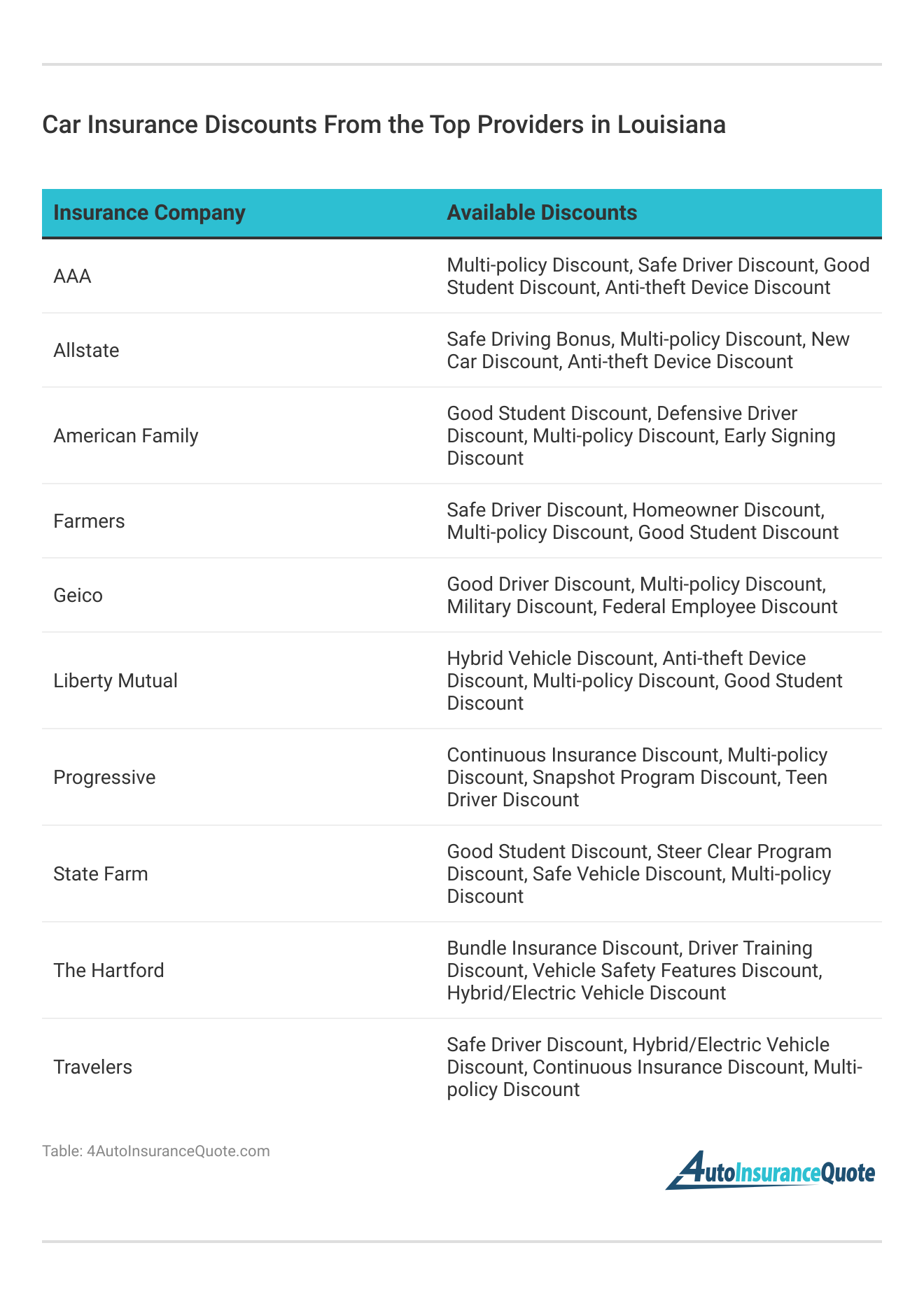

Are there discounts available for Louisiana auto insurance?

Yes, many insurance companies offer discounts for good drivers, bundling policies, having safety features in your car, and more. Additionally, some providers offer discounts on full coverage auto insurance to help you save even more while ensuring you have robust protection.

How do I file a claim with my Louisiana auto insurance provider?

Contact your insurance company’s claims department either online, through their app, or by phone to start the claims process.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.