Cheap Washington Auto Insurance in 2025 (Big Savings With These 10 Providers!)

USAA, Progressive, and State Farm are recognized for offering cheap Washington auto insurance, with rates beginning at around $20 per month. These highly-rated insurers provide an excellent balance of affordability and comprehensive coverage for Washington drivers in search of quality insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Min. Coverage in Washington

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage in Washington

A.M. Best Rating

Complaint Level

Pros & Cons

Top choices for cheap Washington auto insurance are USAA, Progressive, and State Farm. Seeking budget-friendly coverage? Use our complimentary comparison tool above to begin your search.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#1 – USAA: Top Overall Pick

Pros

- Competitive Rates: USAA is known for offering some of the most competitive rates, which is ideal for those seeking cheap Washington auto insurance. Their rates are often lower than the industry average, making them a top choice for cost-effective coverage.

- Comprehensive Coverage Options: They provide a wide range of coverage options tailored to the needs of military families, which can be useful for those looking for specific benefits in cheap Washington auto insurance policies. Find out more through our Allstate vs. USAA insurance review.

- Strong Financial Stability: With high A.M. Best ratings, USAA ensures reliable financial support in case of claims. This financial stability is crucial when choosing cheap Washington auto insurance to ensure the company can handle claims effectively.

Cons

- Eligibility Restrictions: USAA’s services are limited to military members and their families, which means those outside this group will need to look elsewhere for cheap Washington auto insurance. This exclusivity can be a significant limitation for many drivers.

- Limited Availability: USAA is not available in all states or for all types of insurance, so finding cheap Washington auto insurance might require exploring other options if you are not eligible for USAA coverage.

#2 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: Progressive’s Snapshot program can lead to substantial savings for safe drivers, making it an attractive option for cheap Washington auto insurance if you have good driving habits. This program tracks your driving behavior and rewards you with discounts based on your safety.

- Multiple Discounts: Progressive offers various discounts, including multi-policy and multi-car discounts, which can significantly reduce the cost of your cheap Washington auto insurance. This flexibility allows you to bundle policies and save money.

- User-Friendly Online Tools: Their website and mobile app are designed for ease of use, helping you manage your policy and claims effectively. This can be particularly useful for those seeking a hassle-free way to find cheap Washington auto insurance and manage it online.

Cons

- Customer Service Complaints: Some users report challenges with Progressive’s customer service, which might affect your experience when handling issues related to your cheap Washington auto insurance. Effective support is crucial for resolving any concerns.

- Higher Rates for Some Drivers: Drivers with poor credit or a history of claims might find that Progressive’s rates are higher. This can be a drawback if you’re searching for cheap Washington auto insurance and fall into a higher-risk category. Find out more through our Progressive insurance review.

#3 – State Farm: Best for Drive Safe

Pros

- Drive Safe & Save Program: State Farm’s Drive Safe program offers discounts based on your driving habits, which can be a great way to find cheap Washington auto insurance if you are a safe driver. This program uses technology to track your driving and reward safe behavior.

- Extensive Network: With a large network of agents and offices, State Farm provides personalized service, which can be beneficial when navigating the complexities of cheap Washington auto insurance. Local agents can help tailor coverage to your specific needs.

- Good Customer Satisfaction: State Farm generally receives positive feedback from customers, reflecting well on their service quality. This customer satisfaction is important when selecting a provider for cheap Washington auto insurance. Delve more through our State Farm insurance review.

Cons

- Higher Rates in Some Areas: Depending on your location, State Farm’s rates might be higher, which could impact your search for cheap Washington auto insurance. It’s essential to compare rates to ensure you’re getting the best deal.

- Limited Online Discounts: State Farm offers fewer online discounts compared to some competitors, which might affect your ability to find cheap Washington auto insurance through digital channels.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – Nationwide: Best for SmartRide Discount

Pros

- SmartRide Discount: Nationwide’s SmartRide program offers savings based on your driving habits, which can help you secure cheap Washington auto insurance if you drive safely. This program rewards good driving behavior with discounts.

- Comprehensive Coverage Options: Nationwide provides a variety of coverage types and add-ons, allowing you to customize your policy. This flexibility is useful for finding cheap Washington auto insurance that meets all your coverage needs.

- Great Customer Service: Nationwide is known for its excellent customer service, which can make dealing with claims and policy management smoother when seeking cheap Washington auto insurance. Find out more through our Nationwide insurance review.

Cons

- Price Increases: Premiums might rise after a claim or policy renewal, which could impact the affordability of cheap Washington auto insurance over time. It’s important to review your rates regularly.

- Average Rates: Nationwide’s premiums may be average compared to other providers, which means you might need to compare different insurers to find the cheapest Washington auto insurance.

#5 – Geico: Best for Low Overheads

Pros

- Low Overheads: Geico’s efficient operations contribute to lower rates, making it a strong contender for cheap Washington auto insurance. Their streamlined processes help keep costs down for policyholders. Read more through our Geico insurance review.

- Easy Online Quotes: Geico offers a quick and straightforward online quote process, which can help you find and compare cheap Washington auto insurance efficiently. Their digital tools make managing your policy convenient.

- Wide Range of Discounts: Geico provides various discounts, such as for good driving and multiple policies, which can help lower your costs for cheap Washington auto insurance. Exploring these discounts can lead to significant savings.

Cons

- Customer Service Issues: Some customers report difficulties with Geico’s claims processing and service, which might affect your experience with cheap Washington auto insurance. Efficient customer support is key for resolving issues.

- Limited Local Agent Access: Geico’s focus on online services means fewer local agents, which might be less ideal for those preferring face-to-face interactions when managing their cheap Washington auto insurance.

#6 – Travelers: Best for IntelliDrive program

Pros

- IntelliDrive Program: Travelers’ IntelliDrive program offers potential discounts based on driving habits, which can be advantageous for finding cheap Washington auto insurance if you practice safe driving. This program helps you earn rewards for your driving behavior.

- Flexible Coverage Options: Travelers provides a wide array of coverage options and add-ons, making it easier to find customized cheap Washington auto insurance. You can tailor your policy to suit your specific needs.

- Strong Financial Ratings: With solid A.M. Best ratings, Travelers ensures stability and reliability, crucial for handling claims effectively when you opt for cheap Washington auto insurance. Look for more details through our Travelers insurance review.

Cons

- Higher Rates for Some Drivers: Travelers might charge higher rates for drivers with poor credit or a history of claims, potentially impacting your search for cheap Washington auto insurance. It’s important to assess your risk profile.

- Complex Policies: Some users find Travelers’ policy options and discounts complex, which might complicate your search for straightforward cheap Washington auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – American Family: Best for Loyalty Benefits

Pros

- Loyalty Benefits: American Family offers benefits for long-term customers, which can be beneficial if you’re looking for consistent cheap Washington auto insurance. Their loyalty programs reward ongoing relationships.

- Comprehensive Coverage Options: They offer a broad range of coverage options, including unique policies like umbrella insurance, helping you find suitable cheap Washington auto insurance for diverse needs.

- Strong Customer Service: American Family is known for responsive and helpful customer service, which can make managing your cheap Washington auto insurance more pleasant and efficient. Learn more through our American Family auto insurance review.

Cons

- Higher Premiums: American Family’s rates might be higher compared to some competitors, which could impact the affordability of your cheap Washington auto insurance. Comparing rates with other providers is essential.

- Limited Online Tools: Their online tools might be less intuitive, which can be a drawback if you prefer digital management for your cheap Washington auto insurance.

#8 – Liberty Mutual: Best for RightTrack Savings

Pros

- RightTrack Savings: Liberty Mutual’s RightTrack program offers potential discounts based on driving behavior, which can be beneficial for securing cheap Washington auto insurance if you have a safe driving record. This rewards you with lower rates for being a cautious driver.

- Variety of Coverage Options: Liberty Mutual provides a wide range of coverage types and add-ons, allowing you to tailor your policy to meet specific needs. This flexibility can help you find affordable coverage that fits your requirements for cheap Washington auto insurance.

- Strong Financial Ratings: Liberty Mutual’s solid financial stability ratings provide reassurance that they can handle claims effectively. This is crucial when choosing cheap Washington auto insurance to ensure your provider can cover you when needed. Read more through our Liberty Mutual auto insurance review.

Cons

- Potentially Higher Premiums: Liberty Mutual’s rates can be higher compared to some competitors, which might affect your ability to find the cheapest Washington auto insurance. It’s important to compare their rates with other insurers to ensure you’re getting the best deal.

- Mixed Customer Service Reviews: Some customers report mixed experiences with Liberty Mutual’s customer service, which could impact your experience managing your cheap Washington auto insurance. Effective support is essential for resolving any issues that arise.

#9 – Farmers: Best for Signal Discount

Pros

- Signal Discount: Farmers’ Signal program offers discounts based on your driving habits, which can help you save on cheap Washington auto insurance if you demonstrate safe driving practices. This rewards you for being a responsible driver. Read more through our Farmers auto insurance review.

- Comprehensive Coverage Options: Farmers provides a wide array of coverage types and additional options, allowing for a customized policy that can meet diverse needs. This flexibility is advantageous for finding affordable cheap Washington auto insurance.

- Local Agent Network: With a strong network of local agents, Farmers offers personalized service that can help you navigate your options and secure the best cheap Washington auto insurance. Local agents can provide tailored advice and support.

Cons

- Premium Variability: Farmers’ rates can vary significantly based on individual factors, which might impact your search for the cheapest Washington auto insurance. It’s crucial to compare quotes to ensure you’re getting the best possible rate.

- Customer Service Concerns: Some customers have reported issues with Farmers’ customer service, which could affect your experience when managing your cheap Washington auto insurance. Effective customer support is key for a positive experience.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – Allstate: Best for Drivewise Program

Pros

- Drivewise Program: Allstate’s Drivewise program offers discounts based on your driving behavior, which can lead to lower rates for cheap Washington auto insurance if you drive safely. This program helps you save by monitoring and rewarding safe driving habits.

- Wide Range of Discounts: Allstate provides numerous discounts, including ones for bundling policies and safe driving, which can make it easier to find cheap Washington auto insurance. Exploring these discounts can result in significant savings.

- Customizable Coverage: They offer a variety of coverage options and add-ons, allowing you to tailor your policy to meet specific needs. This customization can help you find affordable and suitable cheap Washington auto insurance. Read more through our Allstate insurance review.

Cons

- Higher Rates for Some Drivers: Allstate’s rates may be higher for drivers with less favorable profiles, such as those with poor credit or a history of claims. This could impact your search for the cheapest Washington auto insurance if you fall into a higher-risk category.

- Complex Policy Options: Allstate’s extensive range of coverage options and discounts can be overwhelming, potentially making it harder to find the most straightforward and cheapest Washington auto insurance. Simplifying choices may require more effort.

Washington Auto Insurance Requirements

Similar to the majority of states around the country, Washington’s state insurance laws are based around the tort system. This means that when an accident occurs, one of the drivers will be determined as the at-fault party, and their insurance will pay out claims accordingly. This also means that the driver can be sued for damages when things are a bit more severe than a typical accident.

Washington Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $50 $114

American Family $40 $91

Farmers $44 $102

Geico $32 $75

Liberty Mutual $41 $92

Nationwide $31 $70

Progressive $26 $60

State Farm $30 $69

Travelers $35 $81

USAA $20 $46

Washington state law is a bit more lenient than some states when it comes to minimum coverage amounts that are required on the mandatory types of auto insurance coverage to be considered fully insured. Washington has just two areas of coverage that are legally mandated: bodily injury liability insurance and property damage liability insurance.

Bodily injury liability coverage kicks in to cover injury treatment costs for another party when you are considered to be the at-fault party in an accident. Bodily injury liability doesn’t cover the insured driver or anyone else in their car – it’s strictly for covering costs related to injuries that you cause.

Bodily injury liability insurance will cover medical treatment, rehabilitation, lost wages due to work loss, and any other related costs stemming from the injuries sustained in the accident. Washington state law requires that drivers have a minimum coverage of $25,000 per person, per accident, and $50,000 for all parties in a single accident.

Property damage liability insurance covers the damage that you cause to another person’s automobile or property when you are at fault for an accident. For instance, if you swerved to avoid an obstacle and hit a parked car and a fence, your PDL coverage would pay out both the damage to the car and the damage to the fence.

Again, property damage liability insurance isn’t for any damage to the insured driver’s car but just for damage that they cause to other property. The minimum coverage required by state law is $10,000.

Washington Auto Insurance Rates And Statistics

When you consider the median rates statewide, drivers in Washington will end up paying right around the national average for automobile insurance. In 2010 the average auto insurance premium in Washington was $1,476, which comes out to about $123 per month, slightly higher than the national annual rate of $1,439.

Things get a bit worse for those who live in the Seattle area, as the metropolitan area median auto insurance rate was just north of $1,600 per year. On the plus side, things have trended down a bit in the first few months of 2011, and look to be staying that way for the near future.

Washington drivers appear to be taking road safety to heart as crash rates have been coming down over the past few years. In 2009, the state saw a total of 102,859 crashes, with 453 fatalities resulting from these accidents. Compared to 2005’s numbers, this is a drop of almost 25 percent in just five years! Fatalities also dropped over 20 percent in that time frame as well.

As Washington’s drivers continue to take more care while on the roads, and law enforcement initiatives increase, these numbers will drop even further.

News is also positive for Washington’s automobile owners regarding auto theft rates. Between 2005 and 2009, statewide vehicle thefts dropped by over 50 percent, from 49,287 to 23,680.

This significant reduction is largely attributed to increased law enforcement efforts and the adoption of anti-theft recovery systems, making it one of the largest declines in auto theft reported in any state. To start, enter your ZIP code below right now.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Additional Washington Auto Insurance Resources

For those seeking comprehensive information on auto insurance in Washington State, there are several valuable resources available. These resources will assist you in understanding and meeting the auto insurance requirements in Washington State.

Here are some additional resources for Washington auto insurance, providing valuable information and guidelines.

- Washington State Department Of Licensing: Official website of the Washington State DMV.

- Washington State Insurance Department: Washington state office of the insurance commissioner.

- Insurance.wa.gov Auto Insurance Guide: Information from the Washington insurance department.

- Mandatory Insurance: Auto insurance requirements from the Washington DMV.

- Washington State Highway Safety Laws: Information from the GHSA.

These resources will help you navigate the requirements and options for auto insurance in Washington State.

Cheap Auto Insurance In Washington

It’s worth it to spend a bit of time researching auto insurance rates among the various companies that offer insurance in Washington to ensure you’re getting the best deal. Take a look at our overview of how car insurance rates are calculated.

Most drivers qualify for a range of discounts that require some digging to find out about, so put in a bit of work, and you’re sure to come out paying the lowest Washinton auto insurance rates possible for your coverage!

Schimri Yoyo

Licensed Agent & Financial Advisor

To get some of the best Washington auto insurance quotes available, enter your ZIP code below right now.

Frequently Asked Questions

What insurance coverage is required in Washington?

In Washington, drivers are required to have bodily injury liability insurance with minimum limits of $25,000 per person and $50,000 per accident, as well as property damage liability insurance with a minimum limit of $10,000. These requirements ensure coverage for injuries and damages caused to others in the event of an accident.

Are there optional coverage options?

Yes, there are optional coverage options available with most auto insurance providers in Washington. These can include comprehensive coverage, collision coverage, and various add-ons such as rental car reimbursement or roadside assistance, which can be tailored to individual needs. To get some of the best Washington auto insurance quotes available, enter your ZIP code below right now.

How does Washington’s insurance system work in accidents?

Washington follows a tort system, meaning the driver determined to be at fault in an accident is responsible for paying out claims through their insurance. This system also allows for legal action against the at-fault driver for damages beyond what their insurance covers and it’s worth exploring options for affordable guaranteed auto protection (gap) insurance.

What are the average auto insurance rates in Washington?

The average auto insurance rates in Washington are approximately $1,100 per year, which equates to around $123 per month. This rate is slightly higher than the national average but varies depending on factors such as location and driving history.

How much is Washington auto insurance per month?

The average cost of auto insurance in Washington is approximately $123 per month. This figure is close to the national average, making Washington’s rates relatively typical compared to other states. To start, enter your ZIP code below right now.

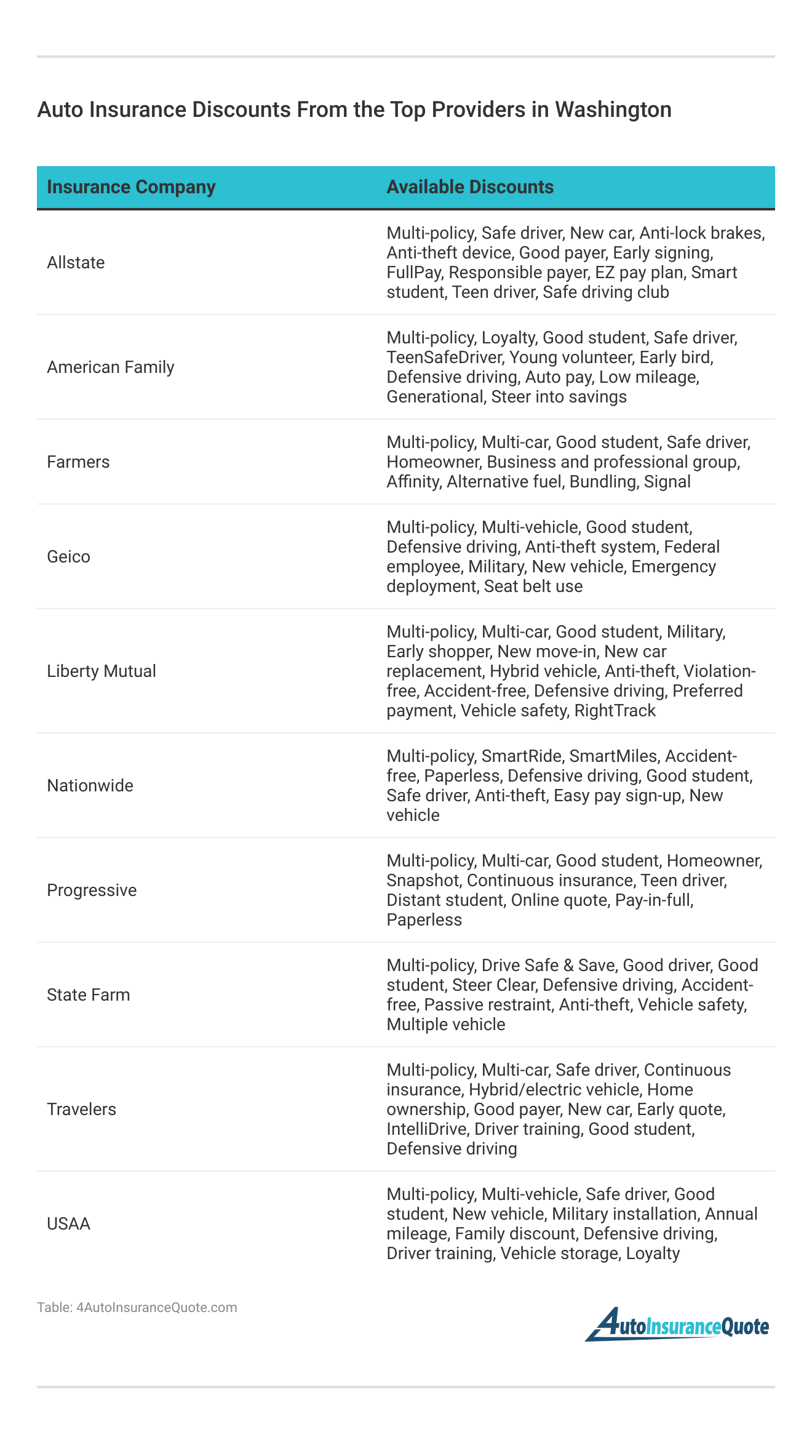

Are there any discounts available?

Yes, many insurers offer discounts on Washington auto insurance, including those based on driving behavior, bundling policies, and safe driving records. To secure the most affordable instant auto insurance quotes, it’s crucial to compare quotes from different providers to find the best available discounts.

Which provider is highlighted for offering the best loyalty benefits in Washington auto insurance?

American Family is highlighted for its strong loyalty benefits in Washington auto insurance. Their loyalty program rewards long-term customers with discounts and additional perks.

What discount program does Farmers offer based on driving behavior?

Farmers offers the Signal discount program, which provides savings based on safe driving habits. This program tracks your driving behavior and rewards you with lower rates for good driving practices. To get some of the best Washington auto insurance quotes available, enter your ZIP code below right now.

How do Washington’s auto insurance rates compare to the national average?

Washington’s auto insurance rates are generally around the national average, with a median rate of approximately $1,100 per year. Rates in metropolitan areas like Seattle can be slightly higher than the state average, and your choice of auto insurance deductibles can also impact these rates.

What is a key factor in finding the cheapest Washington auto insurance according to the article?

A key factor in finding the cheapest Washington auto insurance is comparing quotes from multiple providers. This helps you identify the best rates and discounts available for your specific situation.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.