Cheap New Jersey Auto Insurance in 2025 (Top 10 Companies for Savings)

The top providers for cheap New Jersey auto insurance are Geico, Progressive, and State Farm, with rates starting at $47 per month. These top providers stand out for affordability, coverage options, and customer service, making them the best choices for New Jersey drivers. Compare rates to save.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Min. Coverage in New Jersey

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage in New Jersey

A.M. Best Rating

Complaint Level

Pros & Cons

The best cheap New Jersey auto insurance top providers are Geico, Progressive, and State Farm, with rates starting at $47 per month.

- Cheap New Jersey Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $47 | A++ | Competitive Rates | Geico | |

| #2 | $60 | A+ | Name Tool | Progressive | |

| #3 | $73 | B | Wide Discounts | State Farm | |

| #4 | $74 | A | Competitive Rates | American Family | |

| #5 | $76 | A+ | Discount Variety | Nationwide |

| #6 | $87 | A++ | Discount Range | Travelers | |

| #7 | $101 | A+ | Coverage Options | Allstate | |

| #8 | $125 | A+ | Strong Discounts | The Hartford |

| #9 | $148 | A | Customizable Coverage | Farmers | |

| #10 | $178 | A | Custom Options | Liberty Mutual |

State Farm offers a wide range of discounts, making it an appealing option for those looking to save on auto insurance premiums in New Jersey. Explore further details in our article titled, “Understanding Auto Insurance Work.” Enter your ZIP code above to compare rates now.

- Strategies for cheap New Jersey auto insurance and savings

- Compare providers for the best auto insurance deals

- Geico starts at $47 per month for top coverage

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

Pros

- Competitive Rates: Geico offers some of the lowest rates in New Jersey, with an average monthly rate of $47, making it a highly cost-effective option for New Jersey drivers.

- Strong Financial Stability: Geico’s A++ rating from A.M. Best assures New Jersey policyholders of its financial reliability and long-term stability.

- Wide Availability: Geico provides coverage in all 50 states, including New Jersey, ensuring consistent service and support for New Jersey owners. Please read our Geico auto insurance review for more information.

- User-Friendly Tools: Geico’s easy-to-use website and mobile app simplify managing your New Jersey auto insurance, enhancing convenience for New Jersey policyholders.

Cons

- Limited Discounts: Geico offers fewer discount options for New Jersey drivers compared to some competitors, which might limit potential savings.

- Customer Service Concerns: Some New Jersey policyholders report mixed experiences with customer service, which could impact overall satisfaction.

- Less Personalization: Coverage options may be less tailored to individual needs, potentially offering less customized policies for New Jersey enthusiasts.

#2 – Progressive: Best for Customizable Coverage

Pros

Pros

- Name Your Price Tool: Progressive’s tool allows you to customize coverage based on your budget, with an average monthly rate of $60 for New Jersey drivers, offering flexible policy choices.

- Good Financial Stability: With an A+ rating from A.M. Best, Progressive provides confidence in its financial stability for New Jersey owners.

- Variety of Discounts: Progressive offers numerous discount options for New Jersey policyholders, helping to lower overall insurance costs.

- Flexible Coverage Options: Extensive customization of coverage is available for New Jersey drivers, ensuring policies meet specific needs and preferences.

Cons

- Higher Rates for Some Drivers: Rates can be higher for certain demographics in New Jersey, affecting affordability for specific groups.

- Mixed Customer Reviews: Customer service experiences vary, which may impact overall satisfaction for New Jersey policyholders.

- Complex Policy Terms: Progressive’s policies can be complex, requiring careful review by New Jersey enthusiasts. Check out our Progressive auto insurance review for more details.

#3 – State Farm: Best for Wide Range of Discounts

Pros

Pros

- Wide Range of Discounts: State Farm offers a variety of discounts, with an average monthly rate of $73 for New Jersey drivers, maximizing potential savings on premiums.

- Strong Local Presence: Extensive network of local agents in New Jersey provides personalized service and support tailored to New Jersey policyholders.

- Comprehensive Coverage Options: A broad range of coverage types is available for New Jersey owners, ensuring that diverse protection needs are met.

- Established Reputation: State Farm has a long-standing reputation in the insurance industry, giving New Jersey drivers confidence in the reliability of their coverage.

Cons

- Higher Average Rates: State Farm’s rates can be more expensive compared to some competitors, affecting overall affordability for New Jersey drivers.

- Inconsistent Customer Service: Service quality can vary by location, leading to inconsistent experiences for New Jersey policyholders. Explore our State Farm auto insurance review for additional insights.

- Limited Online Tools: State Farm’s online management tools are less advanced, potentially impacting convenience for New Jersey enthusiasts.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#4 – American Family: Best for Strong Customer Support

Pros

Pros

- Competitive Rates: American Family offers affordable pricing with an average monthly rate of $74 for New Jersey drivers, making it a budget-friendly option.

- Good Financial Stability: American Family’s A rating from A.M. Best provides confidence in its reliability for New Jersey policyholders.

- Multiple Coverage Options: Offers a range of coverage types and add-ons suitable for New Jersey owners, allowing for tailored protection.

- Strong Customer Support: Positive customer service reviews from New Jersey policyholders indicate high levels of satisfaction and effective support.

Cons

- Limited Discounts: Fewer discount options available for New Jersey drivers compared to some competitors, which may limit savings opportunities.

- Regional Availability: American Family is not available in all states, which can restrict accessibility for some New Jersey policyholders.

- Higher Rates for Some Drivers: Rates can be higher for certain profiles in New Jersey, affecting overall affordability. For more information, please refer to our American Family insurance auto insurance review.

#5 – Nationwide: Best for Discount Variety

Pros

Pros

- Discount Variety: Nationwide offers a wide range of discounts, with an average monthly rate of $76 for New Jersey policyholders, providing ample opportunities to reduce costs.

- Good Financial Rating: Nationwide’s A+ rating from A.M. Best ensures reliability and trust for New Jersey drivers.

- Comprehensive Coverage Options: Offers various coverage types and add-ons for New Jersey owners, addressing diverse insurance needs.

- User-Friendly Online Tools: Effective online management and quote tools for New Jersey policyholders enhance ease of use and accessibility.

Cons

- Higher Rates for Some Drivers: Nationwide’s rates can be higher for certain demographics, which might impact affordability for New Jersey drivers.

- Customer Service Variability: Mixed reviews on customer service may affect satisfaction among New Jersey policyholders.

- Complex Policy Terms: Policies can be complex, requiring careful review by New Jersey enthusiasts to understand all the details. Find out more through our Nationwide insurance review.

#6 – Travelers: Best for Discount Range

Pros

Pros

- Discount Range: Travelers offers numerous discounts, with an average monthly rate of $87 for New Jersey policyholders, allowing for significant savings on premiums.

- Excellent Financial Stability: Travelers’ A++ rating from A.M. Best provides assurance of its financial reliability for New Jersey drivers.

- Customizable Coverage: High degree of policy customization available for New Jersey owners, ensuring tailored coverage to meet individual needs.

- Strong Online Tools: Effective website and mobile app for managing policies enhance convenience for New Jersey policyholders. Check out our Travelers auto insurance review for additional details.

Cons

- Higher Average Premiums: Travelers’ rates can be higher compared to some competitors, which might affect affordability for New Jersey drivers.

- Customer Service Issues: Some customers report issues with claims handling and support, which could impact New Jersey policyholders’ experiences.

- Complex Policies: Policies may be complex, requiring detailed review by New Jersey enthusiasts to fully understand coverage options.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#7 – Allstate: Best for Coverage Options

Pros

Pros

- Diverse Coverage Options: Allstate provides a wide range of coverage options with an average monthly rate of $101 for New Jersey drivers, allowing for tailored protection plans.

- Strong Financial Stability: An A+ rating from A.M. Best ensures reliability and financial stability for New Jersey policyholders.

- Local Agents: Extensive network of local agents in New Jersey offers personalized support and service tailored to individual needs.

- Numerous Discounts: Offers a variety of discount opportunities for New Jersey owners, helping to reduce insurance costs.

Cons

- Higher Premiums: Allstate’s rates are generally higher, which could impact affordability for New Jersey drivers. Discover what lies beyond with our “Allstate Auto Insurance Review.”

- Customer Service Complaints: Mixed reviews on customer service and claims handling may affect overall satisfaction for New Jersey policyholders.

- Complex Policy Options: The variety of coverage options can be overwhelming and complex, requiring careful consideration by New Jersey enthusiasts.

#8 – The Hartford: Best for Strong Discounts

Pros

Pros

- Strong Discounts: The Hartford offers robust discount opportunities with an average monthly rate of $125 for New Jersey policyholders, maximizing potential savings.

- Good Financial Stability: With an A+ rating from A.M. Best, The Hartford provides reassurance of its financial health for New Jersey drivers.

- Senior Discounts: Offers special discounts for senior drivers, which can be beneficial for older New Jersey policyholders. Obtain further insights from our “How can I cancel my auto insurance policy with The Hartford?“

- Comprehensive Coverage: Provides a range of comprehensive coverage options for New Jersey owners, addressing diverse insurance needs.

Cons

- Higher Premiums: The Hartford’s average monthly rate can be higher, which may affect affordability for some New Jersey drivers.

- Customer Service Issues: Reports of inconsistent customer service may impact overall satisfaction for New Jersey policyholders.

- Limited Availability: Coverage options might be less extensive in certain regions of New Jersey, potentially affecting service accessibility.

#9 – Farmers: Best for Customizable Coverage

Pros

Pros

- Customizable Coverage: Farmers provides a range of customizable coverage options with an average monthly rate of $148 for New Jersey drivers, allowing for tailored protection plans.

- Good Financial Stability: An A rating from A.M. Best ensures reliability and stability for New Jersey policyholders. Explore our Farmers auto insurance review for more insights.

- Variety of Discounts: Offers a variety of discount opportunities for New Jersey owners, helping to lower overall insurance costs.

- Flexible Policy Terms: High degree of policy customization is available, ensuring coverage meets individual needs for New Jersey enthusiasts.

Cons

- Higher Premiums: Farmers’ rates can be among the more expensive options, which might impact affordability for New Jersey drivers.

- Customer Service Complaints: Mixed reviews on customer service could affect overall satisfaction for New Jersey policyholders.

- Complex Policy Options: Policies can be complex, requiring careful review and understanding by New Jersey enthusiasts.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Custom Options

Pros

Pros

- Custom Options: Offers a range of customizable coverage options with an average monthly rate of $178 for New Jersey drivers, providing extensive flexibility to suit diverse needs.

- Good Financial Stability: A rating from A.M. Best ensures reliability and stability for New Jersey policyholders, offering peace of mind about the insurer’s financial health.

- Multiple Discounts: Provides a variety of discount opportunities for New Jersey owners, helping to lower overall insurance costs.

- Flexible Coverage: Liberty Mutual provides a range of customizable coverage options, allowing New Jersey drivers to tailor their policies according to specific needs and budgets.

Cons

- Higher Premiums: Liberty Mutual’s rates are among the highest, which might impact affordability for New Jersey drivers. For further information, read our Liberty Mutual auto insurance review.

- Mixed Customer Service Reviews: Reports of inconsistent customer service could affect overall satisfaction for New Jersey policyholders.

- Limited Availability of Local Agents: Access to local agents may be limited in certain areas, posing a challenge for New Jersey owners who prefer face-to-face assistance.

New Jersey Auto Insurance Rates

Auto insurance rates in New Jersey are among the highest in the country. On average, drivers in the state pay about $2,400, or roughly $200 each month. This is significantly higher than the national average of $1,440. In major cities like Newark, the average cost can climb to around $3,100, translating to over $250 monthly. Several factors contribute to these elevated costs.

New Jersey’s legal system for handling accidents and the state’s high accident rates are major contributors. Recent statistics show a consistent number of auto crashes—301,000 one month, 303,000 the next, and 307,000 in the following month.

New Jersey Auto Insurance Monthly Rates by Coverage Level & Provider| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $101 | $157 |

| American Family | $74 | $115 |

| Farmers | $148 | $231 |

| Geico | $47 | $74 |

| Liberty Mutual | $178 | $279 |

| Nationwide | $76 | $119 |

| Progressive | $60 | $93 |

| State Farm | $73 | $113 |

| The Hartford | $125 | $340 |

| Travelers | $87 | $136 |

Although injuries from crashes decreased slightly from nearly 71,000 in 2006 to 67,500 in 2009, the consistently high volume of accidents keeps auto insurance monthly rates by state elevated.

The state’s extensive network of highways and heavy traffic, especially on the New Jersey Turnpike, heightens the risk of accidents. Additionally, factors such as age and gender affect insurance rates, with males typically facing higher premiums than females.

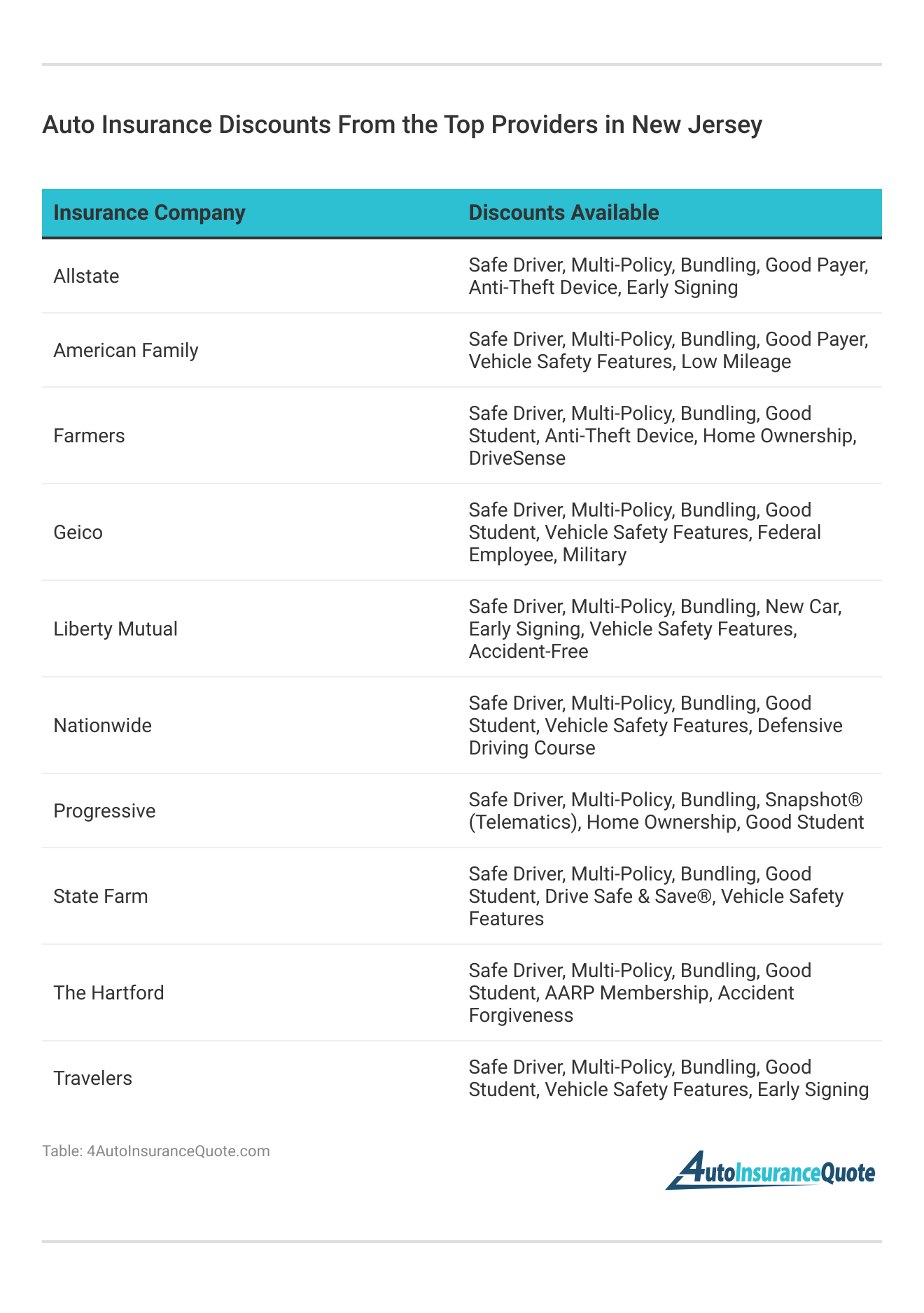

To manage these costs, New Jersey drivers should work with their insurance agents to explore auto insurance discounts for affordable coverage and adjust their plans to fit their needs. Enter your ZIP code below to compare rates from the top providers near you.

Related Driving Statistics in New Jersey

New Jersey has experienced a significant reduction in vehicle thefts, with recent data showing a sharp decline from previous years. This notable drop in thefts highlights the success of intensified law enforcement efforts aimed at combating vehicle crime.

Although auto insurance rates in New Jersey tend to be higher than in many other states, the state’s low vehicle theft rates and moderate accident risk provide some relief. Drivers can manage their insurance expenses by comparing rates and seeking out available discounts.

Geico offers the best overall value in New Jersey auto insurance with competitive rates starting at $47 per month, thanks to their extensive discounts and strong coverage options.Tracey L. Wells Licensed Insurance Agent

Even though insurance costs may seem high, they are still considerably lower than the potential costs associated with an accident. For a comprehensive understanding, consult our article titled “What are the different types of auto insurance coverage?“

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Best Auto Insurance Agents in New Jersey

If you’re looking for top-notch auto insurance in New Jersey, you’re in the right place. The leading auto insurance agents in the state are renowned for their exceptional service and tailored coverage options. They offer competitive rates that cater to a variety of needs, ensuring you get the best protection for your vehicle.

Whether you’re seeking basic coverage or more extensive protection, these experts have the knowledge and experience to guide you through your options. Explore further in our article titled “How to I Know if I Chose the Right Coverage?“

New Jersey Auto Insurance Rates by Company

Auto insurance rates in New Jersey are notably high, making it crucial to compare various providers to find those offering rates below the state average. To simplify this process, examining the 10 best auto insurance companies in the region can provide valuable insights into which providers offer the most competitive rates and the best coverage options.

These top companies often have the resources and experience to deliver both affordability and quality service. Identifying the largest and most influential companies in the New Jersey auto insurance market can significantly impact your decision-making process.

View this post on Instagram

By focusing on these major players, you can uncover opportunities for lower premiums and more comprehensive coverage tailored to your specific needs.

Evaluating their market share and comparing their offerings will help ensure you choose a provider that not only meets your budget but also delivers reliable and effective insurance solutions. You can also enter your ZIP code below into our free comparison tool to start comparing rates now.

New Jersey Auto Insurance Minimum Requirements and Laws

In New Jersey, understanding auto insurance requirements is crucial for compliance and adequate protection. The state’s regulations mandate specific coverage levels to ensure that drivers are financially protected in the event of an accident.

Here’s a detailed breakdown of the minimum insurance requirements and optional coverage options, including affordable full coverage auto insurance and cheap auto insurance New Jersey, available to New Jersey drivers.

- Minimum Liability Coverage: In New Jersey, drivers must carry bodily injury liability insurance with minimums of $15,000 per person and $30,000 per accident. Property damage liability coverage must be at least $5,000 per accident.

- Uninsured/Underinsured Motorist Coverage: This coverage is required with minimums of $15,000 per person and $30,000 per accident for bodily injury, and $5,000 for property damage.

- Personal Injury Protection (PIP): Drivers must have PIP coverage with a minimum of $15,000 per person, which covers medical expenses and lost wages regardless of who is at fault.

- Optional Coverage Options: In addition to the mandatory coverage, drivers can choose to add comprehensive coverage, collision coverage, rental car reimbursement, and roadside assistance/towing and labor.

- Regulatory System: New Jersey’s “Choice No-Fault” system lets drivers choose between no-fault insurance or a traditional tort system. While the state’s minimum coverage may be low, drivers should consider affordable full coverage auto insurance and cheap auto insurance New Jersey to ensure adequate protection.

Understanding these requirements will help ensure you have the right coverage and are compliant with New Jersey’s insurance laws. It’s important to review your policy regularly and consider additional coverage options to protect yourself fully on the road.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Summary: Cheap New Jersey Auto Insurance

New Jersey auto insurance rates average $200 per month, higher than the national average due to the state’s no-fault system, high population density, and accident rates. Minimum coverage requirements include bodily injury liability of $15,000 per person and $30,000 per accident, property damage liability of $5,000, and personal injury protection of $15,000.

To find affordable liability auto insurance coverage, compare quotes from top companies like Geico, Progressive, and State Farm for the best rates and discounts. Use our free quote comparison tool below to find the cheapest coverage in your area.

Frequently Asked Questions

What are the minimum auto insurance requirements in New Jersey?

New Jersey requires a minimum of $15,000 per person for bodily injury, $30,000 per accident, and $5,000 for property damage to meet basic insurance needs. Explore further in our article titled “Affordable No-Down-Payment Auto Insurance.”

What are the average auto insurance rates in New Jersey?

The average cost of auto insurance in New Jersey is about $200 per month, which is higher than the national average. Get fast and cheap auto insurance coverage today with our quote comparison tool below.

Why are auto insurance rates so high in New Jersey?

High rates are due to the state’s no-fault system, high accident rates, and dense traffic conditions.

How can I find cheap auto insurance in New Jersey?

To find cheap auto insurance, compare quotes from various providers and look for discounts offered by companies like Geico, Progressive, and State Farm. Delve into the specifics in our article called “Disabled Driver Auto Insurance Discount: Save on Auto Insurance.“

Which companies offer the most affordable auto insurance in New Jersey?

Geico, Progressive, and State Farm are known for offering affordable auto insurance options in New Jersey.

What optional coverage can help reduce auto insurance costs in New Jersey?

Opting for basic coverage and avoiding unnecessary add-ons can help keep costs lower, while exploring discounts can further reduce expenses.

How can I lower my auto insurance premium in New Jersey?

Comparing quotes from different companies and applying for available discounts can help lower your auto insurance premium. Enhance your knowledge by reading our “Can you negotiate lower auto insurance rates?“

What are the average rates for auto insurance in major New Jersey cities?

In cities like Newark, auto insurance rates can be as high as $3,100 monthly, reflecting the state’s higher average rates.

Are there any specific discounts for New Jersey auto insurance?

Yes, discounts such as safe driver discounts, multi-policy discounts, and good student discounts can make auto insurance more affordable.

How frequently should I compare auto insurance rates in New Jersey?

Regularly comparing auto insurance rates helps ensure you are getting the best deal and taking advantage of any new discounts or promotions. Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

What should I consider when choosing an auto insurance policy in New Jersey?

Consider coverage options, available discounts, and the overall cost to ensure you select an affordable policy that meets your needs. For additional insights, refer to our “Does auto insurance cover lost wages because of an accident?“

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros